The Bitcoin market does not move randomly. Its price follows a repeating market cycle influenced by supply and demand, investor psychology, liquidity, and macroeconomic conditions. Understanding the Bitcoin market cycle — especially how corrections work — helps investors make smarter decisions and avoid emotional trading.

This guide explains the Bitcoin market cycle, why corrections happen, and how to interpret them at different stages of the trend.

What Is the Bitcoin Market Cycle?

The Bitcoin market cycle refers to the recurring phases Bitcoin goes through over time. These phases have repeated across multiple bull and bear markets and are driven largely by human behavior.

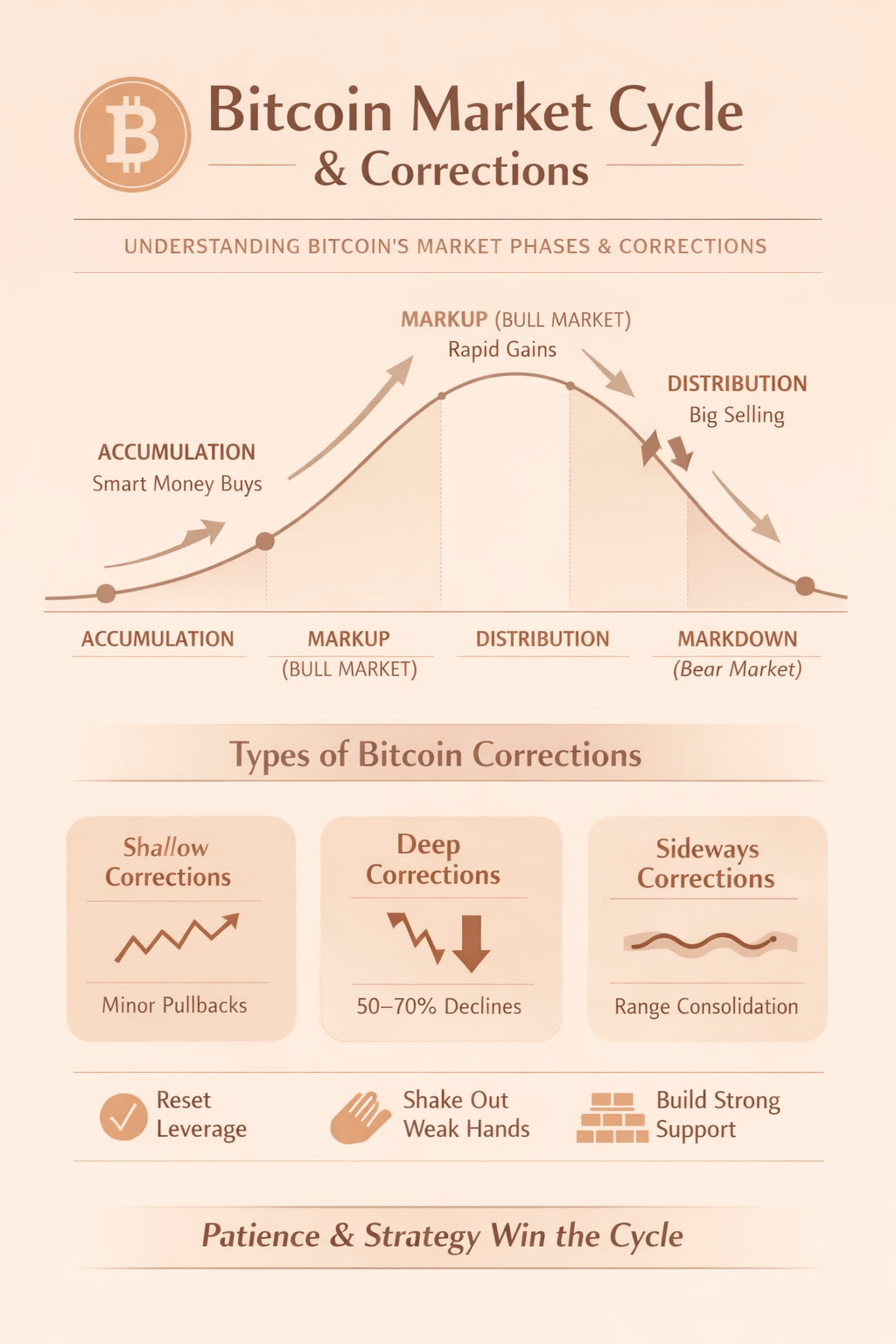

There are four main stages in the Bitcoin market cycle.

1. Accumulation Phase

The accumulation phase occurs after a major market crash or prolonged downtrend. Price trades sideways with low volatility, and market sentiment is extremely bearish.

Key characteristics:

Low trading volume

Negative news and poor sentiment

Long-term investors and institutions accumulate quietly

This phase often feels boring and uncertain, but it historically offers the best risk-reward opportunities.

2. Markup Phase (Bull Market)

The markup phase is when Bitcoin begins its bull run. Price starts making higher highs and higher lows as demand increases.

Key characteristics:

Strong upward trend

Rising volume and momentum

Increased media attention and retail participation

This phase can last months or even years and often includes multiple pullbacks along the way.

3. Distribution Phase

After a strong rally, Bitcoin enters the distribution phase. Price struggles to make new highs and becomes volatile as large players gradually sell into strength.

Key characteristics:

Choppy price action near all-time highs

Increasing volatility

Retail investors buying aggressively

This phase often appears bullish on the surface but signals growing market risk underneath.

4. Markdown Phase (Bear Market)

The markdown phase begins when key support levels break. Selling pressure increases, and Bitcoin enters a sustained downtrend.

Key characteristics:

Lower highs and lower lows

Panic selling and forced liquidations

Declining confidence and interest

This phase continues until sellers are exhausted, eventually transitioning back into accumulation.

Why Bitcoin Corrections Are Healthy

Bitcoin corrections are a normal and necessary part of market structure. Even during strong bull markets, Bitcoin regularly experiences sharp pullbacks.

Corrections help the market:

Remove excessive leverage

Shake out weak hands

Build strong support zones

Create better long-term entry points

In many bull cycles, Bitcoin has corrected 20–40% multiple times before reaching new highs.

Types of Bitcoin Market Corrections

Shallow Corrections

These occur in strong uptrends where buyers remain in control. Price pulls back briefly before continuing higher.

Deep Corrections

Deep pullbacks often follow parabolic rallies. While painful, they frequently offer high-quality long-term buying opportunities.

Sideways (Complex) Corrections

Price consolidates within a range for weeks or months. These periods reset momentum and prepare the market for its next major move.

How Corrections Differ Across Market Cycles

Understanding where a correction occurs is more important than the correction itself.

Early bull-market corrections often lead to trend continuation

Late-cycle corrections can signal distribution or trend exhaustion

Bear-market rallies are usually temporary relief moves

Context determines whether a correction is an opportunity or a warning.

Key Takeaways for Bitcoin Investors

The Bitcoin market cycle is deeply tied to human psychology. Fear and greed drive price extremes, while corrections restore balance.

Successful investors:

Respect market cycles

Manage risk during corrections

Avoid emotional decision-making

Focus on long-term structure, not short-term noise

Bitcoin rewards patience, discipline, and understanding of its cyclical nature.

Final Thoughts

Bitcoin corrections are not market failures — they are essential for sustainable growth. By understanding the Bitcoin market cycle and recognizing the role of corrections, investors can position themselves more confidently through both bull and bear markets.