Every Trader Starts With Noise

Every Trader Starts With Noise

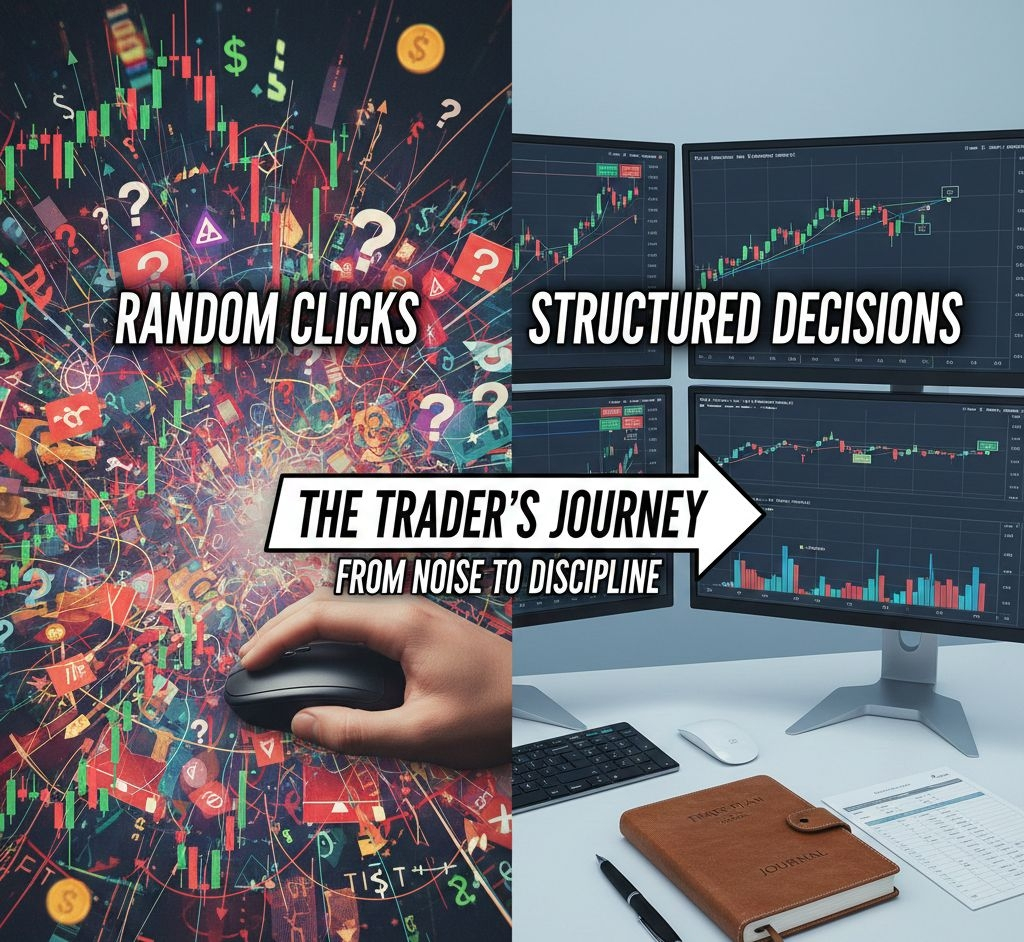

Almost every trader begins the same way — random clicks, emotional entries, chasing green candles, and closing trades based on fear rather than logic. At this stage, trading feels exciting, fast, and unpredictable. Wins feel like skill. Losses feel like bad luck.

But here’s the truth most people learn late:

➤ Random actions create random results.

➤ Consistency never comes from luck.

The real transformation in trading doesn’t happen when you find a “secret indicator.”

It happens when you shift from impulse-driven behavior to structured decision-making.

This is the real trader’s journey — and it’s uncomfortable, disciplined, and powerful.

Phase ①: The Random Click Era

This is where most traders live — and many never leave.

◆ Entering trades without a clear plan

◆ Switching strategies after every loss

◆ Overtrading during high emotions

◆ Risking more to “recover” losses

At this stage: ✔︎ Charts are confusing

✔︎ Indicators contradict each other

✔︎ Emotions dominate logic

Losses aren’t just financial — they drain confidence.

Phase ②: Awareness Before Improvement

A turning point arrives when a trader asks one honest question:

➜ “Why am I really losing?”

This phase introduces:

① Trade journaling

② Studying market structure

③ Understanding risk-to-reward

④ Realizing psychology matters more than predictions

You stop blaming the market.

You start analyzing your behavior.

This is where traders either quit — or evolve.

Phase ③: Building a Trading Framework

Structured traders don’t trade everything.

They trade specific conditions.

✔︎ Defined setups

✔︎ Clear entry & exit rules

✔︎ Fixed risk per trade

✔︎ Acceptance of losses as business expenses

Instead of asking: ➤ “Will this trade win?”

They ask: ➤ “Does this trade fit my system?”

This shift alone separates amateurs from professionals.

Phase ④: Emotional Control Becomes an Edge

At higher levels, technical skills matter less than emotional discipline.

◆ No revenge trading

◆ No FOMO entries

◆ No overconfidence after wins

Structured traders understand:

➜ Capital protection > Profit chasing

They don’t aim to win every trade.

They aim to survive long enough for probability to work.

Phase ⑤: Consistency Over Excitement

Trading becomes boring — and that’s a good sign.

✔︎ Fewer trades

✔︎ Better execution

✔︎ Smaller drawdowns

✔︎ Stable equity curve

At this stage, trading feels less like gambling and more like a business.

The journey ends where most beginners never start:

➜ Discipline over dopamine.

The Market Rewards Structure, Not Emotion

The crypto market doesn’t reward intelligence alone.

It rewards prepared minds, controlled emotions, and repeatable processes.

If you’re still clicking randomly, you’re not broken — you’re just early in the journey.

But if you want longevity, growth, and survival:

✔︎ Build structure

✔︎ Respect risk

✔︎ Trade less, think more

➤ Random clicks end accounts. Structured decisions build traders.

What phase of the trading journey are you currently in?

Share this with a trader who needs this reminder.

#WhenWillBTCRebound #WarshFedPolicyOutlook #ADPDataDisappoints #JPMorganSaysBTCOverGold #WhaleDeRiskETH