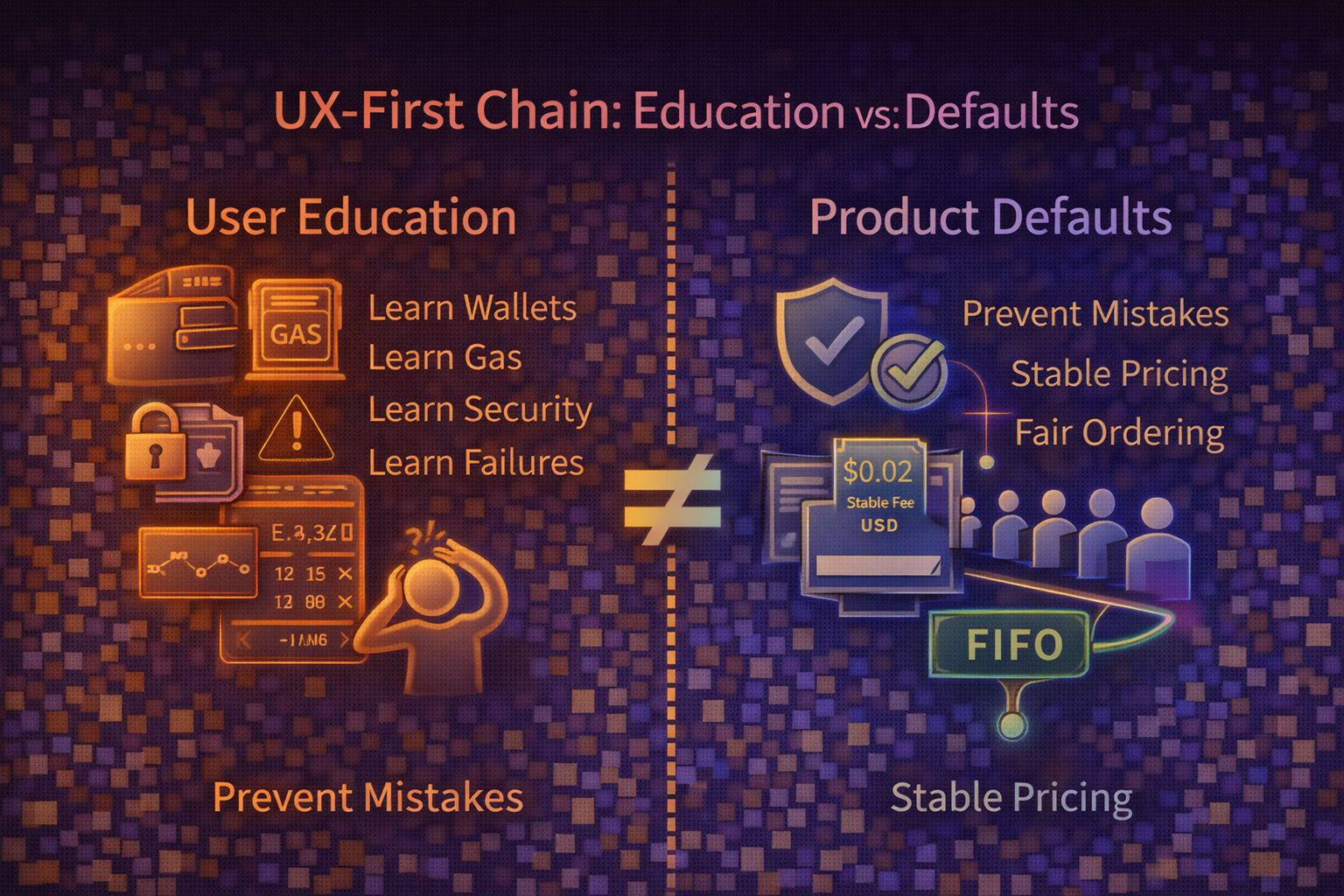

The crypto industry has spent years assuming that mainstream adoption is mostly a marketing problem. If the technology is fast enough, cheap enough, and promoted loudly enough, people will eventually show up. When adoption doesn’t happen, the default excuse is always the same: users need more education. They need to learn wallets, learn gas, learn security, learn bridges, learn why transactions fail, learn why fees spike, and learn why a simple click can become an irreversible financial decision.

But education is not a scaling strategy. It’s a confession that the product is still too fragile for normal people.That is why Vanar is worth taking seriously. Not because it promises to reinvent the blockchain world, but because it seems to recognize a reality most chains refuse to accept: the next billion users are not waiting to become crypto experts. They are waiting for software that doesn’t punish them for being normal.

Vanar’s most important innovation is not speed, not partnerships, and not branding. It is the attempt to replace “user education” with something far more powerful: product defaults that prevent mistakes before they happen.

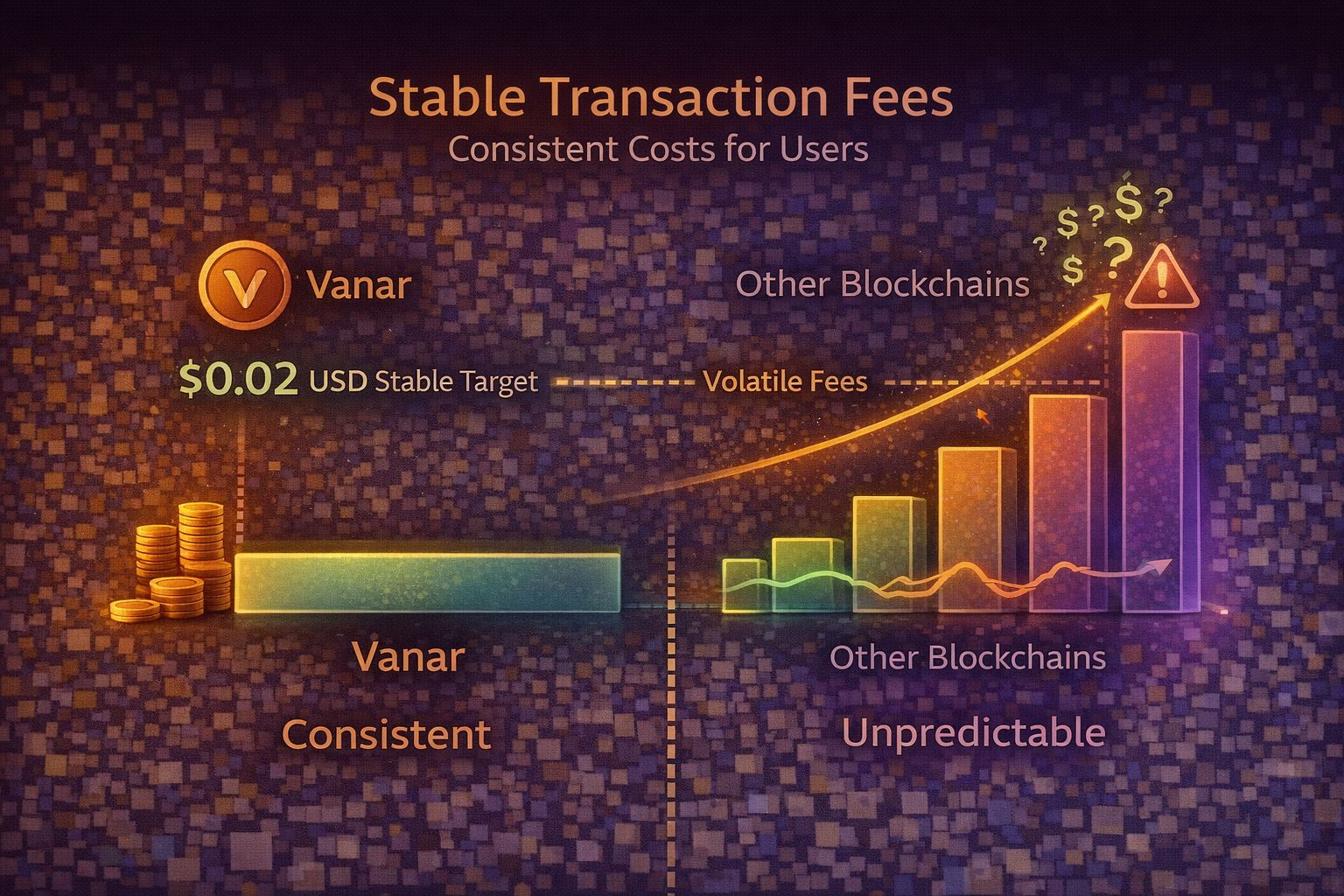

The clearest example is how Vanar approaches transaction fees. Most blockchains treat fees like weather. Sometimes it’s calm, sometimes it’s chaos, and users are expected to tolerate it as part of the ecosystem. This model works for traders who already treat blockchain usage as a financial activity. It fails immediately in consumer environments. Games cannot design stable economies if every action risks unpredictable cost. Loyalty programs cannot run campaigns if redemption suddenly becomes expensive. Marketplaces cannot build trust if checkout feels like roulette.

Vanar’s decision to anchor transaction costs to a stable USD-equivalent target is not just a technical choice. It is an empathy choice. It acknowledges that the user experience collapses the moment costs become uncertain. The goal isn’t to be the cheapest chain in ideal conditions. The goal is to be consistently affordable under real conditions, even when token price moves or network activity changes.That design philosophy matters because predictability is what allows products to exist without constantly explaining themselves. Normal software does not require users to understand pricing mechanics. It requires pricing to behave.

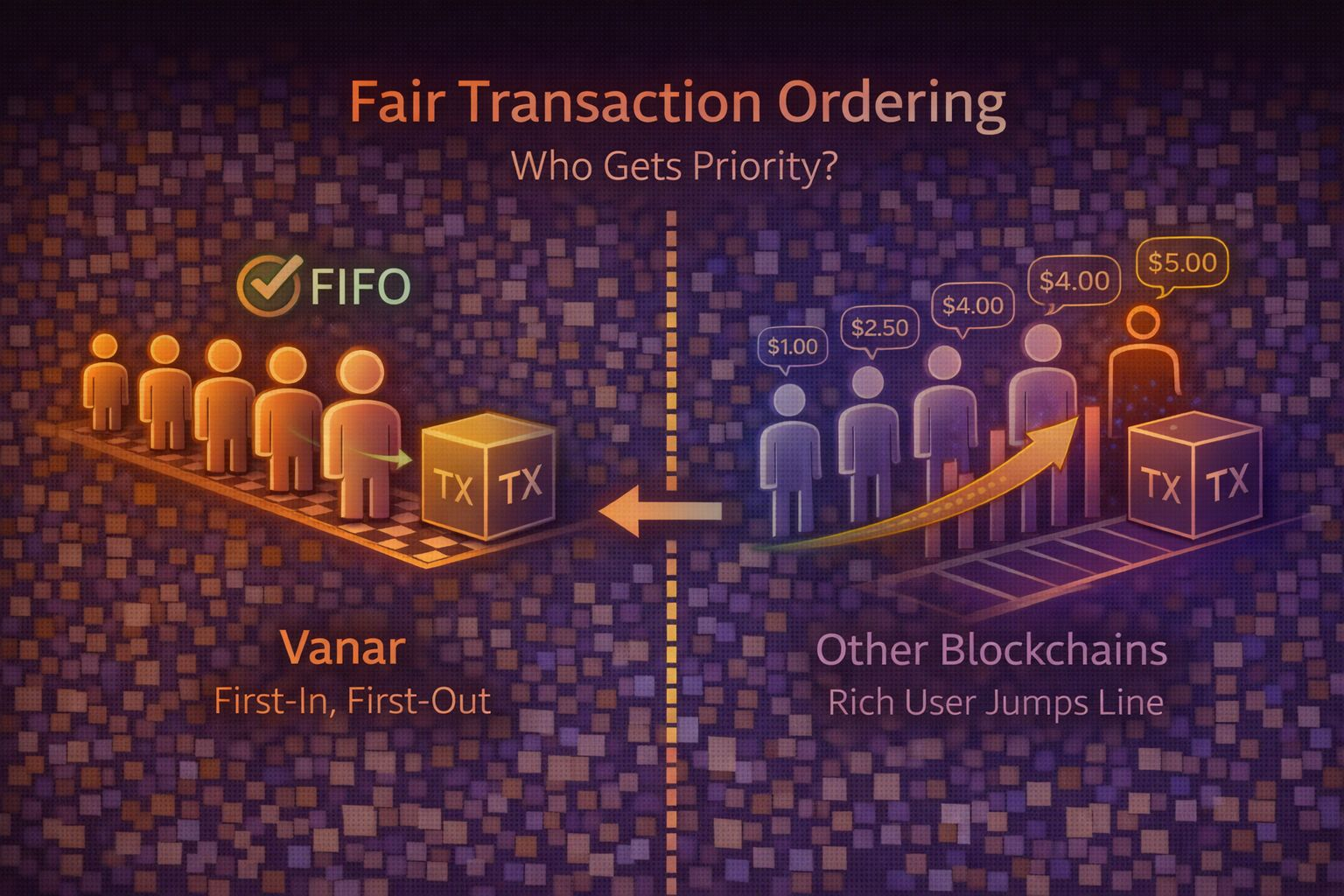

Vanar applies the same consumer logic to transaction ordering. Instead of turning blockspace into an auction where the richest user can always jump the line, Vanar’s first-in-first-out ordering model resembles something more familiar: a fair queue. Crypto insiders may argue about efficiency or theoretical market dynamics, but consumer products operate under a different standard. Users do not evaluate systems through economic theory. They evaluate them through fairness.If two people click at the same time, the expectation is simple: the person who acted first should not lose simply because someone else paid more. That expectation is not philosophical. It is psychological. Vanar appears to understand that fairness is not a feature; it is infrastructure for trust.

The chain’s activity metrics hundreds of millions of transactions, millions of blocks, and tens of millions of wallet addresses should not be interpreted as automatic proof of adoption. Automation can inflate numbers, and early activity can be mechanical. But the shape of those metrics is still revealing. Consumer systems generate constant low-value interactions, not occasional high-value transfers. The kind of chain that matters in gaming and entertainment is not one that settles rare large trades; it is one that survives relentless repetition.

This is where Vanar’s design intent becomes clearer. It appears to be tuned for everyday behavior rather than occasional speculation.

Virtua is another meaningful signal because it represents something rare in Web3: an ecosystem partner moving real asset gravity onto the chain. When a platform migrates NFTs from Ethereum or Polygon to Vanar, it is not simply optimizing fees. It is relocating user habit. Users follow their assets. They return to the environment where their identity, collectibles, and progression live. This is how ecosystems become sticky. Not through narratives, but through gravitational pull.

In Web3, chains often compete on ideology. In consumer markets, chains compete on where users naturally spend time. Virtua moving its NFT layer onto Vanar is significant because it makes Vanar less like an optional network and more like a default home for recurring interaction.

The role of VANRY fits this broader “invisible infrastructure” model. It functions as gas and supports staking, but it is not positioned as the emotional centerpiece of the ecosystem. In consumer-first systems, that is exactly what you want. The token is not the product; it is the internal fuel that keeps the product consistent. If Vanar is serious about stable user costs, then VANRY becomes part of a balancing mechanism that protects experience from volatility.

The ERC-20 representation on Ethereum is equally pragmatic. It recognizes that liquidity, tooling, and familiarity still live heavily in Ethereum’s orbit. Cutting yourself off from that is not purity; it is self-sabotage. Vanar seems to be choosing integration over isolation, which is what consumer ecosystems require.

Vanar’s validator model reveals another deliberate trade-off. Validators are selected by the foundation, while the community participates through delegation. Purists will dislike this because it is not maximal permissionlessness. But consumer infrastructure is judged differently. Brands, studios, and mainstream platforms do not build on systems where accountability is abstract. They prefer known operators, predictable uptime, and governance that can respond to real incidents.

This is where Vanar’s design feels less like a crypto experiment and more like infrastructure built for enterprises that cannot afford chaos. The long-term question is not whether this model is “good” or “bad.” The question is whether it evolves toward greater decentralization without losing the reliability that made it attractive in the first place.

That balance will define its credibility.

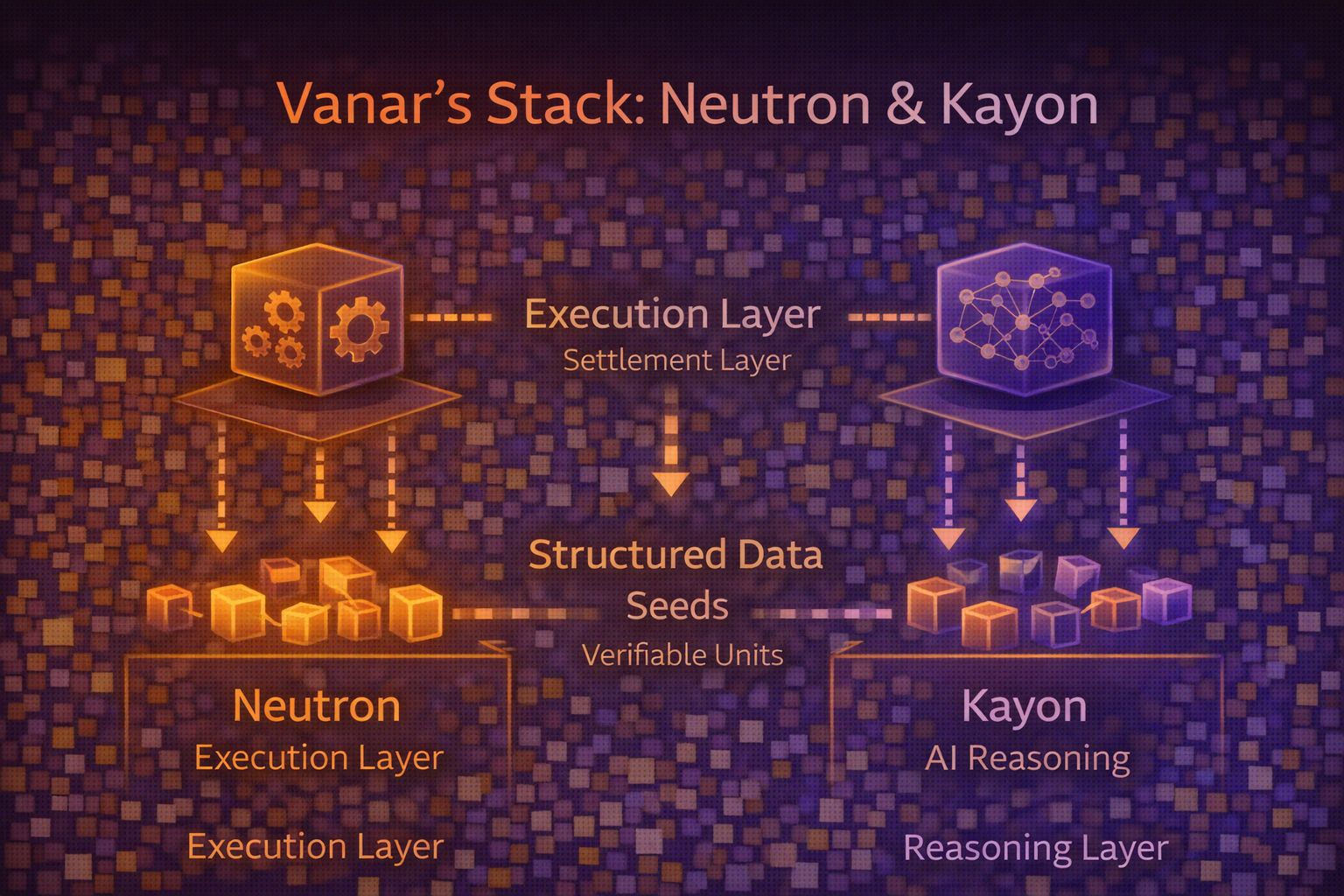

The most ambitious layer of Vanar’s stack is Neutron and Kayon. Under the surface marketing, the real goal appears to be simple: giving blockchain data a structure that preserves meaning rather than dumping raw records and hoping external indexers reconstruct context later. Neutron’s “Seeds” concept suggests a world where data is compressed into small, verifiable units that can be referenced and permissioned. Kayon positions itself as a reasoning layer that can query and interpret this structured information.If this works as intended, it pushes Vanar toward a rare category of blockchain design: not just a settlement layer, but a memory layer. That matters because the future of consumer Web3 will not be built on transaction history alone. It will be built on identity continuity, licensing rules, permissions, and evolving digital state.

The moment builders adopt it because it solves problems not because it sounds futuristic is the moment this vision becomes real.

Zooming out, Vanar feels like a protocol built around a rare thesis: the future is not “educating users” into crypto. The future is designing systems where users never have to learn crypto at all. Fixed-fee behavior, fair ordering, consumer-facing ecosystem design, pragmatic EVM alignment, and a push toward contextual data all point toward the same direction.

Vanar is not trying to convince people that blockchain is exciting. It is trying to make blockchain behave like normal software.

And if it succeeds, it will not win through hype. It will win through quiet reliability the kind of reliability that makes users stop asking questions. They won’t ask why fees changed. They won’t ask why a transaction failed. They won’t ask why the experience feels fragile. They will simply use the product and move on.

In crypto, that kind of invisibility is often mistaken for weakness. In consumer technology, it is usually what dominance looks like.