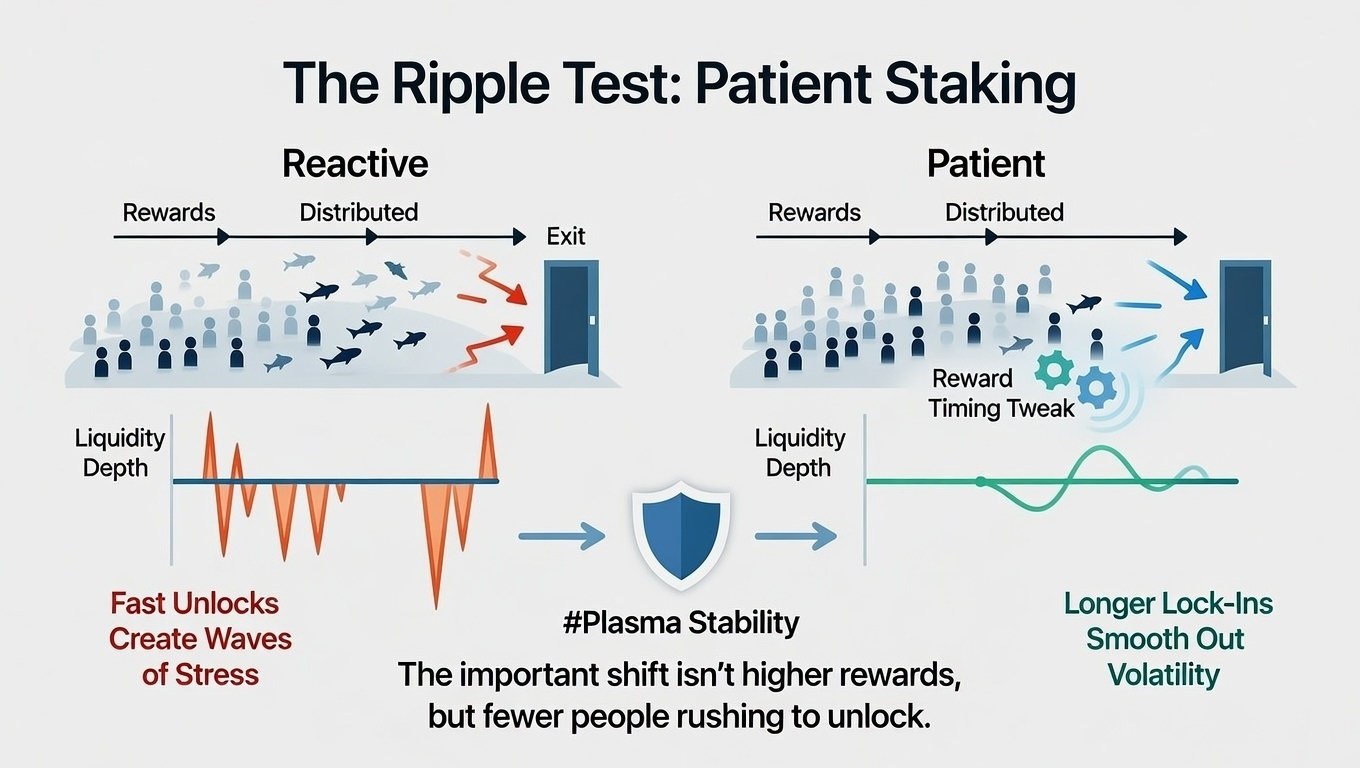

You start to notice it once you’ve watched enough cycles: when staking slows down, liquidity calms down too. Right now, the important shift isn’t higher rewards, but fewer people rushing to unlock. That matters because sudden exits are what turn small changes into big liquidity stress. Around @Plasma , the mood feels more patient, and liquidity usually follows that mood.

One detail made this clear. After a reward-timing tweak in early Q2, on-chain data showed longer average lock-ins and fewer same-day unlocks when rewards landed. That matters because fast unlocks create waves, while longer commitments smooth them out. Inside #plasma , validator participation also evened out across epochs, hinting that incentives are shaping behavior, not just attracting attention. Are you seeing fewer people sprint for the exit after rewards?