I keep coming back to one simple thought when I look at Dusk Network: most blockchains were built to escape the financial system, but Dusk feels like it was built to plug directly into it. Not in a loud, rebellious way, but in the quiet, slightly unglamorous way real infrastructure gets built.

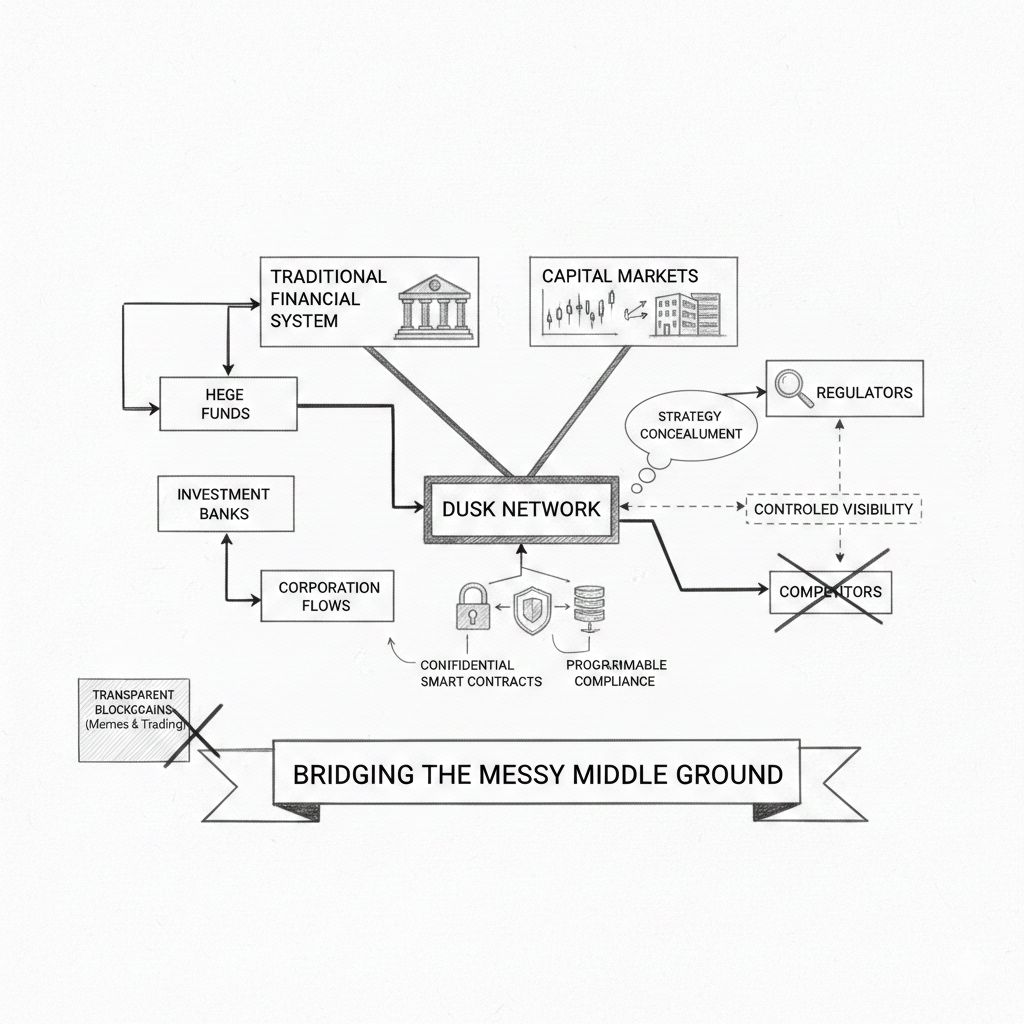

In crypto, we love the idea that everything should be transparent by default. Wallets, balances, transaction histories, all laid bare. That works for memes and trading games, but the second you step into actual capital markets, that model breaks down. Funds do not want their strategies visible in real time. Companies cannot expose sensitive financial flows to competitors. Regulators do not want total opacity either. They want controlled visibility. That messy middle ground is where Dusk seems most comfortable.

What makes this interesting is that Dusk does not force one privacy setting on the entire network. It runs two transaction models on the same settlement layer. Moonlight handles public, account style transactions. Phoenix handles shielded transfers. Both flow through the same Transfer Contract on DuskDS. That sounds technical, but the practical meaning is very human. Different participants in a market need different levels of visibility, yet they still need to settle on the same shared ledger. Dusk’s design feels less like a philosophical stance on privacy and more like someone sat down and asked how real financial desks actually operate.

I like to think of it as a building with adjustable glass. Some rooms are clear because they need to be. Others are frosted because sensitive work is happening inside. But it is still one building, one structure, one foundation. The ability to selectively reveal information to authorized parties using zero knowledge proofs fits naturally into that picture. It is not about hiding everything. It is about showing the right things to the right people at the right time.

The modular structure reinforces that same mindset. DuskDS sits at the base handling consensus and settlement guarantees. On top of that, there are specialized execution environments like DuskEVM, which is EVM equivalent and built on the OP Stack, and a WASM based Dusk VM designed to be friendly to zero knowledge systems. This separation is not just for developer flexibility. It mirrors how traditional financial systems evolve. You keep a stable core ledger and build new products and rules around it, instead of rewriting the foundation every time the market invents a new instrument.

If everything is fully transparent, institutions struggle. If everything is fully private, regulators struggle. Dusk’s architecture suggests that settlement should be stable and neutral, while execution environments can adapt to the needs of specific financial workflows. That feels far closer to how exchanges, clearing houses, and custodians actually operate today.

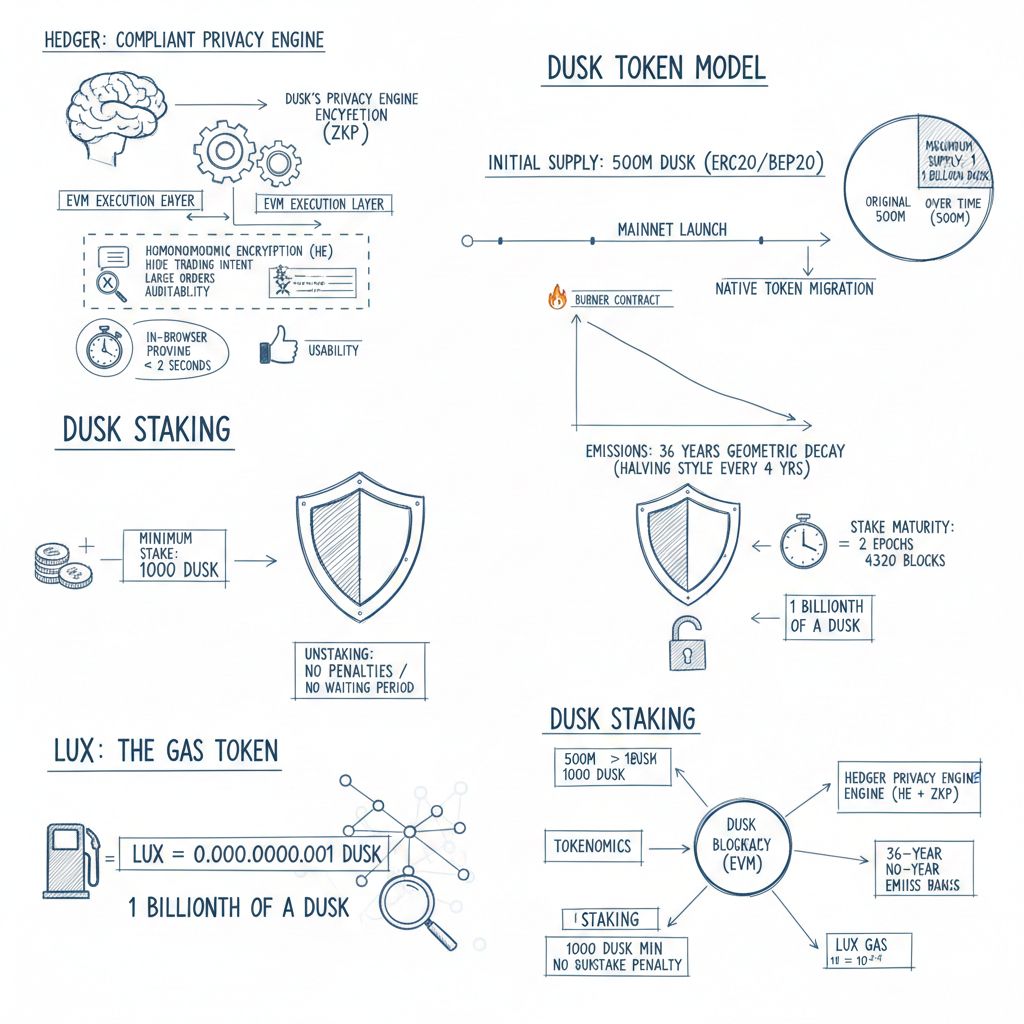

The idea of compliant privacy becomes more concrete when you look at Hedger. This is Dusk’s privacy engine built for the EVM execution layer. What stands out is that it combines homomorphic encryption with zero knowledge proofs and is aimed at use cases like obfuscated order books. In traditional markets, hiding trading intent is normal. Large orders are broken up, routed carefully, and shielded from public view to avoid market impact. Hedger is clearly designed with that kind of behavior in mind, while still keeping auditability in the picture. The mention of in browser proving times under two seconds is a small detail, but it tells you the team is thinking about usability. A system can be cryptographically beautiful, but if it slows down real workflows, desks simply will not use it.

Even the token model feels grounded in operational reality rather than hype cycles. The initial supply is 500 million DUSK on ERC20 and BEP20, with a native token migration through a burner contract now that mainnet is live. The maximum supply is 1 billion DUSK, made up of the original 500 million plus 500 million emitted over time. Emissions stretch across 36 years with a geometric decay that reduces every four years in a halving style pattern. Staking requires a minimum of 1000 DUSK, with stake maturity after two epochs or 4320 blocks, and unstaking is described as having no penalties or waiting period. Gas is denominated in LUX, where one LUX equals one billionth of a DUSK.

What this says to me is that the network is designed to survive long periods where transaction fees alone are not enough to secure it. Institutional adoption moves slowly. Integrations take years, not weeks. A long emission curve is an acknowledgment of that reality. It is less exciting than short term scarcity narratives, but it is far more aligned with the time horizons of regulated finance.

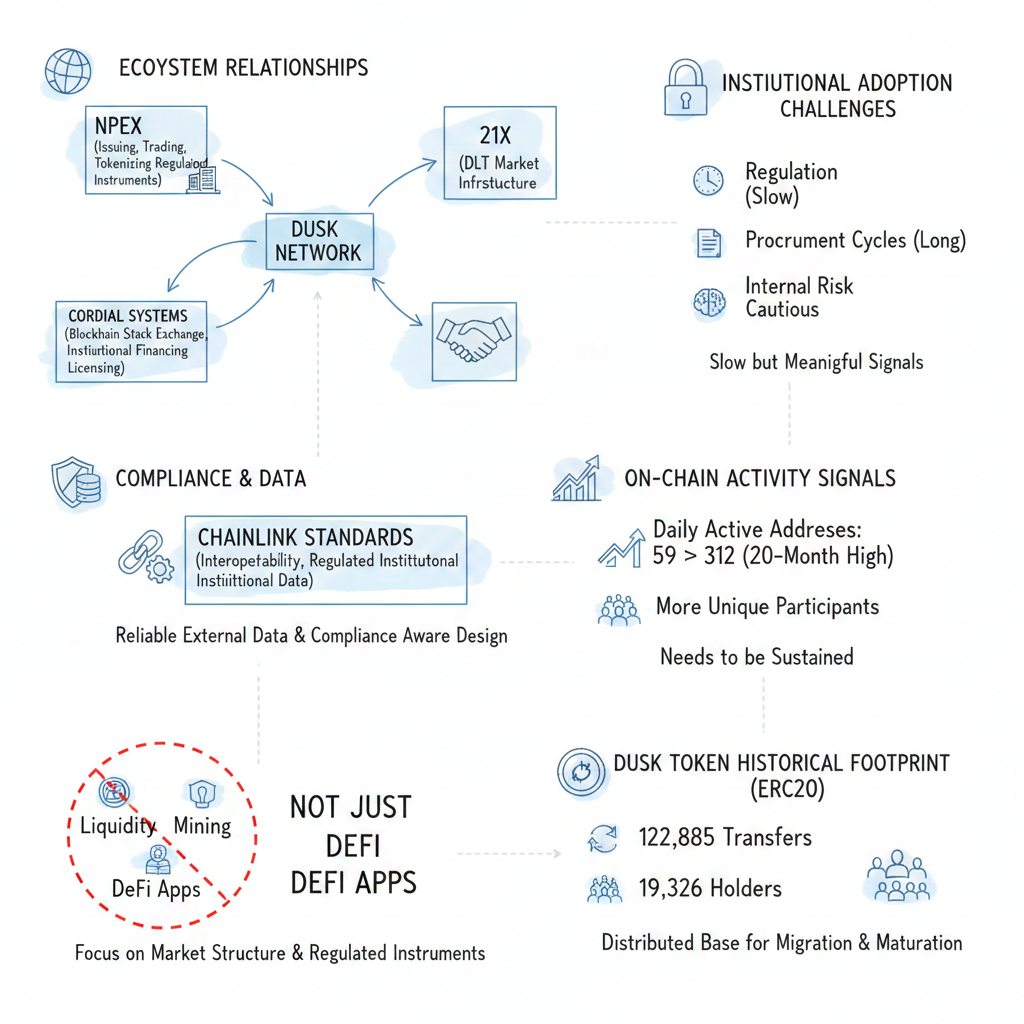

The ecosystem relationships also point in that direction. Work with NPEX around issuing, trading, and tokenizing regulated instruments shows a focus on actual market structure. Involvement from Cordial Systems in efforts tied to a blockchain powered stock exchange and institutional financing themes adds to that picture. The partnership with 21X connects Dusk to conversations around DLT based market infrastructure and licensing frameworks. The use of Chainlink standards for interoperability and data around regulated institutional assets further suggests that the goal is not just to run DeFi apps, but to support instruments that need reliable external data and compliance aware design.

None of this guarantees that large institutions will suddenly migrate on chain. Regulation moves slowly. Procurement cycles are long. Internal risk committees are cautious. But the type of partners and problems Dusk is engaging with look very different from the usual liquidity mining and yield farming loops.

On chain activity offers small but meaningful signals. There has been reporting that daily active addresses for DUSK moved from 59 to 312 in a short period, described as a roughly 20 month high compared to earlier levels. That kind of jump suggests more unique participants are interacting with the network, even if it needs to be sustained over time to mean anything lasting. On the ERC20 side, the DUSK token shows around 122885 transfers and 19326 holders. While the long term focus is on native usage, this historical footprint shows there is already a distributed base of holders and transaction history to build from during the migration and maturation phase.

For a network aiming at financial infrastructure, the goal is not explosive, noisy growth. It is steady, reliable participation that institutions can depend on. Boring can be a feature, not a flaw.

When I step back, the bet Dusk is making feels clear and very specific. Future on chain finance will not be won by the loudest claims of decentralization alone. It will be shaped by systems that can protect trading privacy, satisfy audit and regulatory requirements, and still give developers familiar tools to build with. Moonlight and Phoenix living side by side, modular execution on top of DuskDS, Hedger bringing confidentiality to an EVM compatible environment, and long horizon token economics all point in that direction.

The risk is obvious too. If institutional adoption takes longer than expected or chooses different technical paths, Dusk could end up being a highly sophisticated network waiting for a market that moves at its own pace. But that is also what makes the project interesting. It is not chasing every trend. It is trying to solve a very specific, very real problem set at the intersection of privacy, compliance, and market structure. That is a harder road, but if it works, it is the kind of infrastructure people end up using without even thinking about it.