When I look at Dusk Network, I don’t see a project trying to win a popularity contest, because the whole design reads like it was built for a world where finance is serious, rules exist, and privacy is not a preference but a requirement, which is exactly why Dusk keeps framing itself as regulated and decentralized finance and keeps pointing toward institutions, businesses, and everyday users who want self-custody without turning their financial activity into public information.

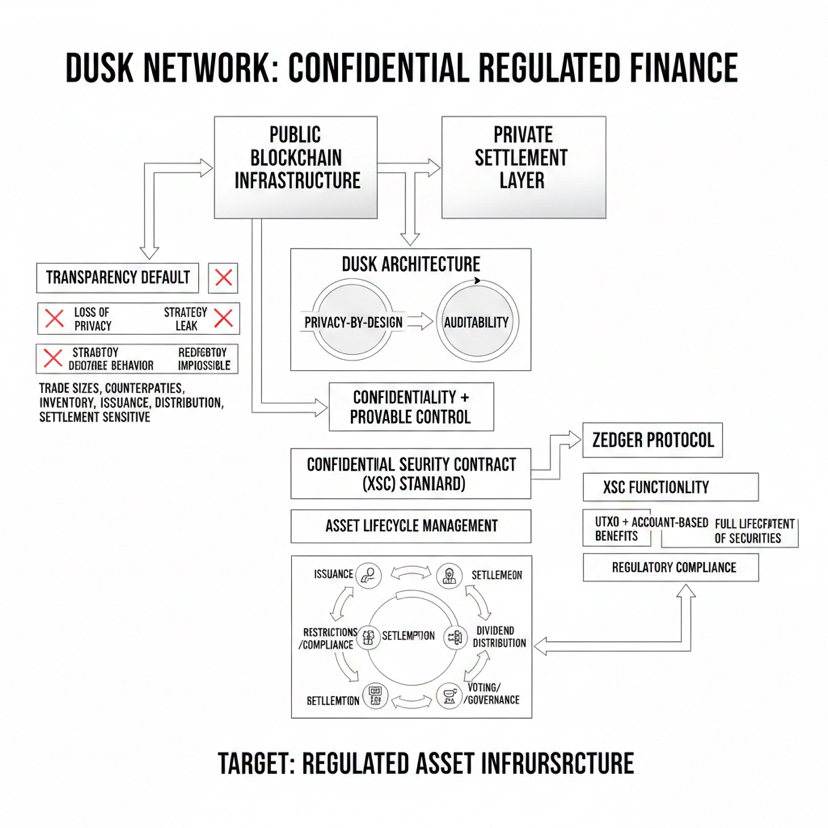

The real reason this matters is that public blockchains made transparency the default setting, but markets don’t function that way once you leave the retail sandbox, because exposure is not just uncomfortable, it is structurally harmful, since trade sizes, counterparties, inventory positions, issuance details, distribution logic, and settlement flows are all sensitive by nature, and when everything is visible by default you don’t just lose privacy, you lose fairness, you leak strategy, you invite predatory behavior, and you make regulated adoption practically impossible. Dusk’s positioning is basically an argument that finance can live on public infrastructure without sacrificing confidentiality, as long as privacy is designed into the settlement layer and paired with auditability in a controlled, provable way, rather than turning the chain into a surveillance machine.

The part that makes Dusk feel “built from the inside out” is how it treats privacy as more than hidden balances, because the project is centered around confidential smart contracts and a securities-focused standard called the Confidential Security Contract, usually referenced as XSC, and that matters because real financial instruments are not only about transferring value, they are about enforcing rules across an asset’s entire lifecycle, including issuance, restrictions, compliance checks, settlement, redemption logic, dividend distribution, and governance-style actions like voting. In Dusk’s documentation, Zedger is described as an asset protocol that combines UTXO and account-based benefits, and it is explicitly tied to providing XSC functionality and enabling full lifecycle management of securities with regulatory compliance baked in, while still preserving privacy, which is exactly the kind of design choice you make when the target isn’t “a cool demo,” but regulated asset infrastructure.

This is where the Phoenix and Zedger story becomes more than branding, because Phoenix is presented as the transaction model underpinning confidentiality on the network, while Zedger evolves the model into something that can carry securities-grade functionality without forcing issuers or investors to expose everything, and the key word in their own description is selective disclosure, meaning you can keep transactions anonymous to the general public while still enabling audits by the parties that legally need to verify activity, which is exactly the type of compromise regulated markets demand and most chains simply are not architected to support cleanly.

If you zoom out, Dusk is trying to build a single public network where confidentiality and compliance can coexist without splitting liquidity into isolated privacy pools, because in real markets, the same asset needs different visibility rules depending on who is interacting with it and why, and that is why the documentation keeps emphasizing that Zedger tokens can represent securities like stocks or bonds while maintaining privacy with a compliance path, and why the core components section goes deep into practical lifecycle operations like capped transfers and preventing certain account behaviors, which are details you only add when you expect regulated constraints to be part of normal chain usage.

Your token link is also an important part of the story, because the contract you shared is the ERC-20 representation of DUSK on Ethereum at , and this matters from an accessibility standpoint since it allows tracking, distribution, and market participation through a widely used token format, while the deeper long-term value narrative still depends on whether the Dusk network becomes a place where confidential financial activity actually settles in volume. On-chain trackers for that contract show the constant flow of transfers and holder counts over time, and they present a quick reality check on how broad the token distribution looks on the ERC-20 side.

Now, for the “what are they doing behind the scenes” part that most people never talk about properly, the most telling signals are always in the boring places, because regulated infrastructure is not supposed to feel chaotic, it’s supposed to feel stable, and one of the most concrete recent official updates from Dusk was an incident notice around bridge services where they clearly stated the mainnet itself was not impacted, that there was no protocol-level issue, and that bridge services were temporarily paused while they performed a broader hardening pass, which reads like an operations-first mindset rather than a hype-first mindset, and it also tells you the team is treating the system like production infrastructure that needs controlled risk handling.

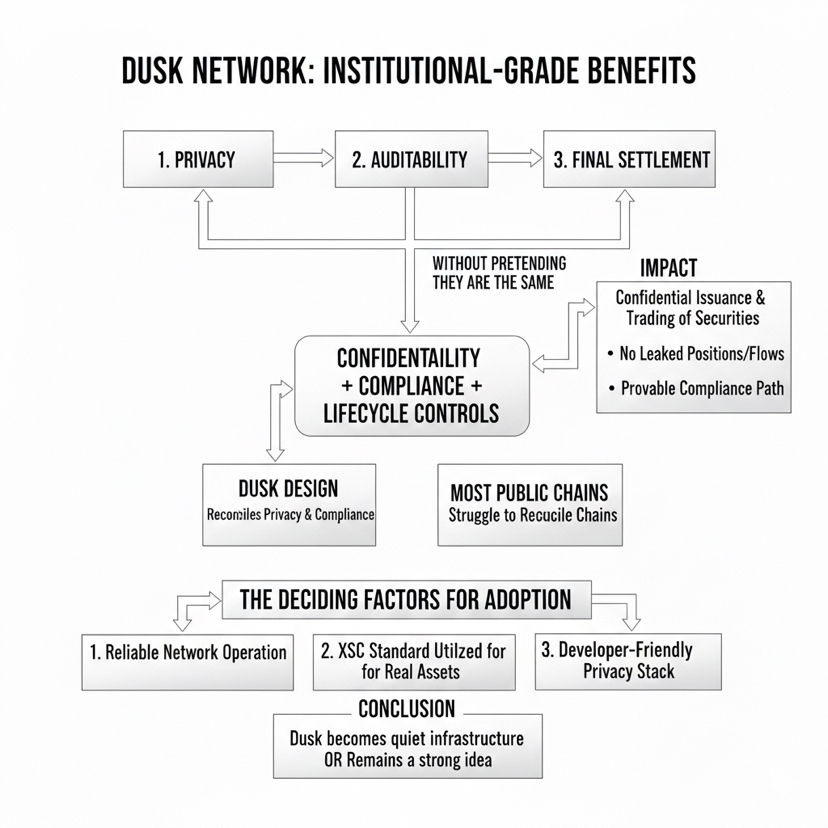

When you ask what’s next, I think the honest answer is that Dusk’s next phase is not about proving the concept of privacy, because the concept is clear, and the next phase is about proving reliability, tooling maturity, and real asset workflows in the open, because regulated finance doesn’t reward ideas, it rewards systems that behave consistently under stress, systems that developers can actually build on, and systems that issuers can integrate into without rewriting their compliance stack from scratch. That is why the parts of the docs that talk about moving privacy-preserving logic into easier developer access patterns are not minor details, because reducing friction is how standards actually spread, and if XSC-style assets and Zedger/Hedger models become easy enough for builders to adopt, then the network’s niche becomes durable instead of theoretical.

For benefits, the cleanest way to say it is that Dusk is trying to offer three things at once without pretending they are the same thing, because privacy is one thing, auditability is another thing, and final settlement is another thing, and the project is designing for all three in the context of regulated assets, which is why it keeps returning to confidentiality plus compliance plus lifecycle controls, and why it keeps speaking in terms of institutional-grade use cases rather than generic “DeFi” slogans. If this design works at scale, then confidential issuance and trading of tokenized securities becomes possible without leaking positions and flows to the public, while still keeping a provable compliance path available to the right parties, and that combination is exactly what most public chains struggle to reconcile cleanly.

My takeaway is simple and strict, because Dusk is either going to become quiet infrastructure that real financial products can sit on, or it is going to remain a strong idea that never crosses the adoption chasm, and the deciding factor will not be how good the narrative sounds, it will be whether the network keeps operating reliably, whether standards like XSC actually get used to issue and manage assets in real workflows, and whether developers find the privacy stack approachable enough to ship production applications without fighting the chain. The project’s own documentation reads like it understands that reality, because it is full of the kind of operational and lifecycle details that you do not add unless you expect real constraints and real users.

For the last 24 hours update, the most verifiable “new” signal is usually not a brand-new announcement, it is the live market and network activity, and right now price and volume trackers show DUSK moving with notable short-term volatility, including a marked 24-hour price change and a rolling 24-hour trading volume figure, which is the cleanest real-time snapshot you can reference when there is no fresh official blog post released in the same 24-hour window.