In blockchain, speed is easy to promise. Security is easy to claim. What’s difficult — and rare — is building a system that delivers both simultaneously under real-world stress. This is especially true for payment-focused blockchains, where a single failure doesn’t just slow things down, it breaks trust, halts commerce, and risks irreversible financial damage.

Plasma (XPL) was built with this exact challenge in mind.

Unlike general-purpose blockchains that evolved organically from experimentation, Plasma launched in late 2025 with a sharply defined mission: become a high-performance settlement layer for stablecoins and real-world payments. That mission demanded a radically different approach to consensus, performance engineering, and economic security.

At the heart of Plasma lies PlasmaBFT — a custom implementation inspired by Fast HotStuff — designed from day one to survive Byzantine behavior, maintain sub-second finality, and remain live even under coordinated attacks or partial network failures.

This is a complete deep dive into how Plasma achieves that balance. We will explore the mathematics, the consensus mechanics, the economic incentives, and the real-world performance benchmarks that together form Plasma’s resilience-by-design philosophy.

Understanding the Enemy: Byzantine Nodes in Payment Networks

In distributed systems theory, a “Byzantine” node is any participant that behaves unpredictably. This unpredictability can come from many sources:

hardware or software failure

network outages

configuration errors

malicious intent

coordinated attacks by adversarial actors

In a social network, Byzantine behavior is annoying.

In a payment system, it’s existentially dangerous.

A Byzantine validator in a blockchain could attempt to:

sign conflicting blocks (double-spend attempts)

censor transactions

delay block production

send malformed or misleading messages

intentionally halt the network

Plasma assumes this hostile environment as the default, not the exception. PlasmaBFT is engineered with the assumption that up to one-third of the validator set may be faulty or malicious at any given time — and the network must still remain safe and live.

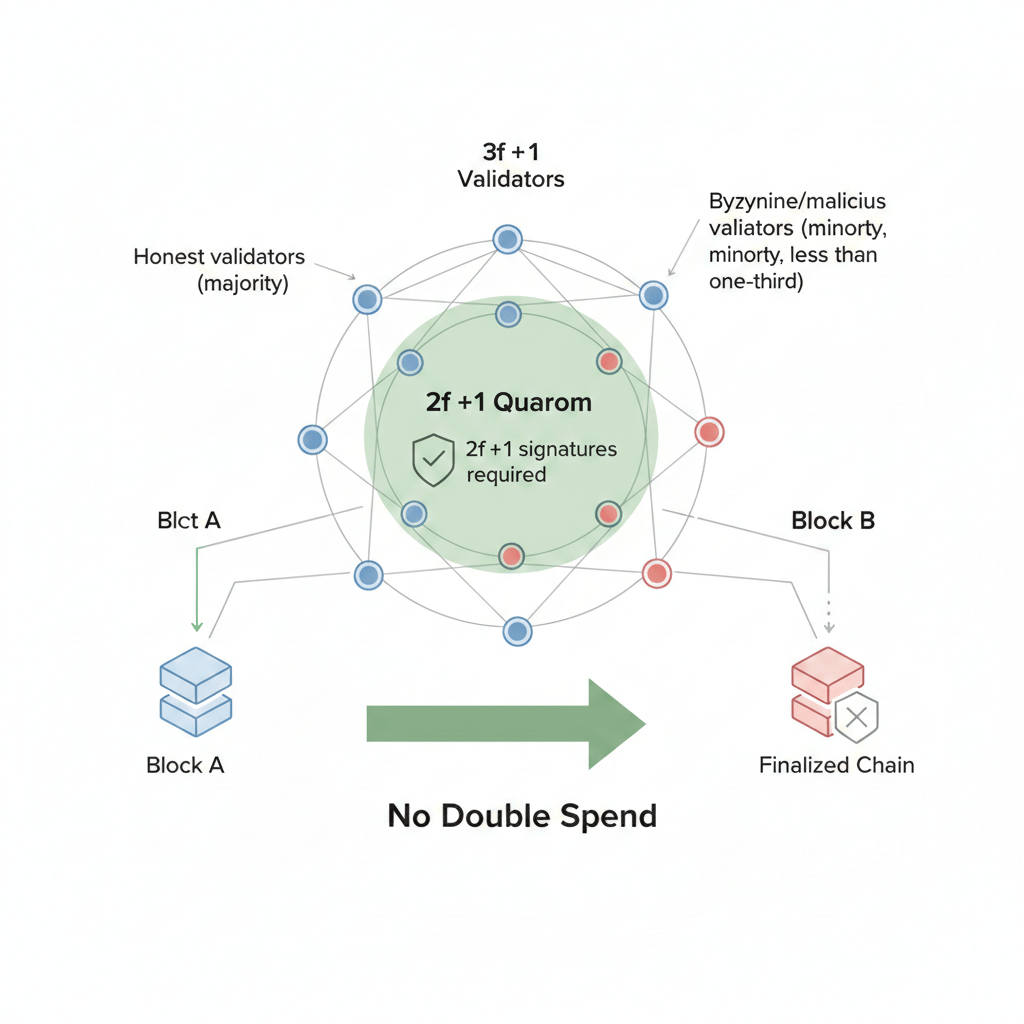

The Mathematical Fortress: Why 3f + 1 Is Non-Negotiable

Every serious Byzantine Fault Tolerant system rests on one fundamental equation:

n ≥ 3f + 1

Here:

n is the total number of validators

f is the maximum number of faulty or malicious validators the system can tolerate

This is not a design preference — it is a mathematical requirement.

If Plasma wants to tolerate up to f Byzantine validators, it must have at least 3f + 1 total validators. From this structure emerge two critical guarantees: safety and liveness.

Quorum Certificates and the Power of Overlap

PlasmaBFT requires a supermajority to finalize any block. Specifically:

A Quorum Certificate (QC) requires signatures from at least 2f + 1 validators

This rule creates a powerful property known as quorum intersection.

Any two groups of 2f + 1 validators must overlap by at least one honest node. That single honest validator prevents two conflicting blocks from ever being finalized at the same height.

Even if 33% of the network is actively malicious, the system cannot confirm two contradictory versions of history.

This is the foundation that prevents:

double spending

ledger divergence

chain splits

In payment systems, this guarantee is everything.

Safety First: Deterministic Finality Without Rollbacks

Unlike Proof-of-Work systems, Plasma does not rely on probabilistic finality.

In PoW chains, users wait for multiple confirmations, hoping that the chain with the most accumulated work remains dominant. Reorganizations are rare — but possible.

PlasmaBFT offers deterministic finality.

Once a block receives a valid Quorum Certificate and passes the commit rule, it is final. There is no reorg. No “wait six blocks.” No ambiguity.

For stablecoin settlement, merchant payments, and financial rails, this property is non-negotiable.

Leader -Based Consensus — Without Leader Risk

PlasmaBFT uses a leader-based consensus model. In each round, a designated leader proposes the next block.

This design improves performance, but introduces a new risk: what if the leader is Byzantine?

A malicious leader could:

censor transactions

send different blocks to different validators (equivocation)

go offline intentionally to halt progress

Plasma neutralizes this risk with timeouts, view changes, and deterministic leader rotation.

View Changes and the Blame Mechanism

Each consensus round operates on a strict time window.

If validators do not receive a valid proposal within that window, they broadcast timeout messages. Once 2f + 1 validators agree that the leader has failed, the protocol triggers a view change.

The leader role automatically rotates to the next validator in a deterministic sequence.

No governance vote.

No human intervention.

No discretion.

A malicious leader can delay the network only briefly — never indefinitely.

Censorship Resistance Through Rotation

Because leadership rotates continuously, no validator can maintain long-term control over transaction inclusion.

Even if a leader censors a transaction, the next leader can include it within seconds. Over time, censorship becomes statistically futile.

This is how Plasma preserves neutrality without sacrificing performance.

Liveness: Keeping the Chain Breathing Under Stress

Liveness means the network never gets stuck.

In PlasmaBFT, liveness depends on one simple condition:

at least 2f + 1 validators must remain honest and online

As long as this condition holds, the protocol guarantees that the system will eventually make progress.

Leader failures are temporary.

Network partitions are survivable.

Individual outages do not cascade into system-wide failure.

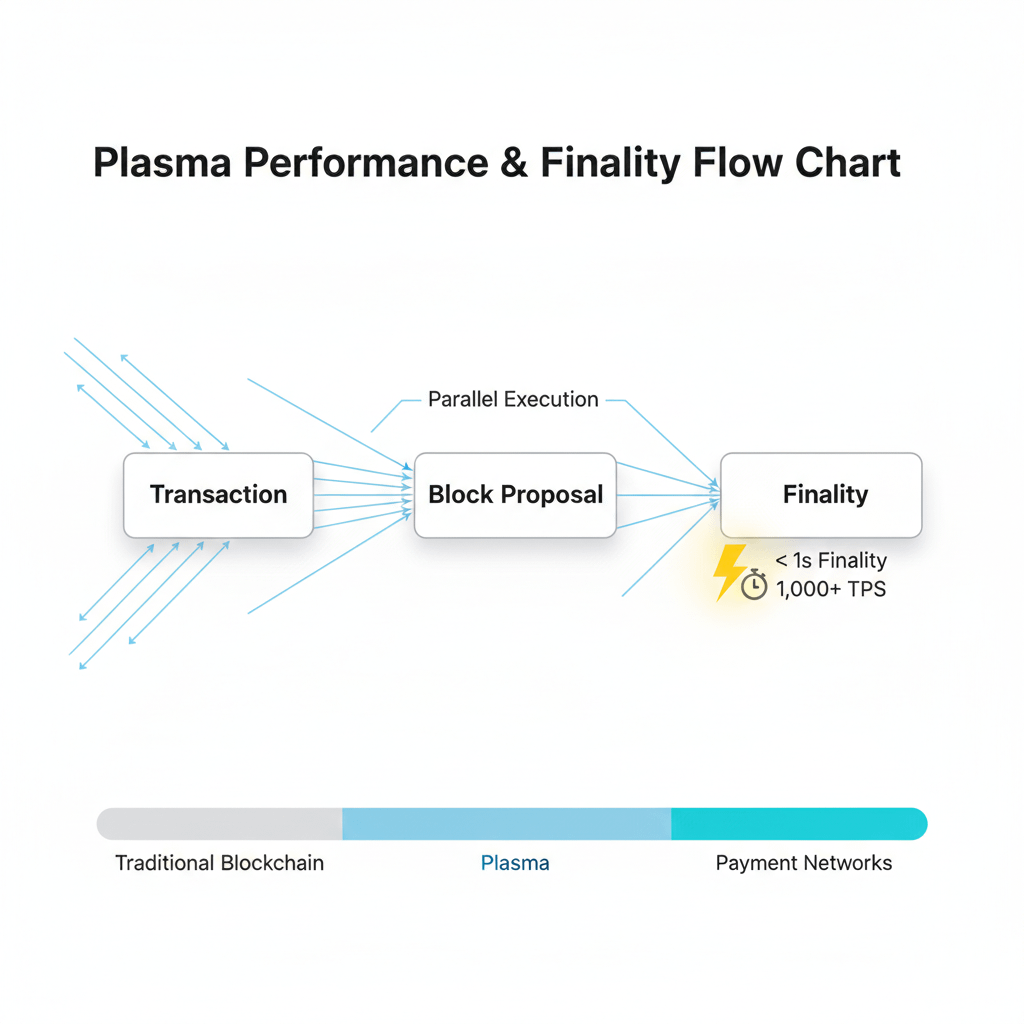

Why Supermajorities Matter for Pipelined Consensus

PlasmaBFT uses a pipelined consensus model, where validators are simultaneously:

voting on the current block

preparing the next block

executing transactions in parallel

This design dramatically increases throughput, but it also raises the bar for correctness.

Plasma uses a two-chain commit rule:

a block is finalized only after it is followed by another block, both backed by Quorum Certificates

This rule prevents forks and ensures strict ordering, but it also ties finality tightly to validator participation.

Without a supermajority, the pipeline stalls — which is why Plasma emphasizes validator reliability and distribution.

Economic Security: Turning Honesty Into the Rational Choice

Consensus rules explain how the system works.

Economics explain why participants behave.

Plasma uses a Delegated Proof of Stake (DPoS) model to align incentives with network health.

Validators stake XPL tokens and earn rewards for correct participation. Misbehavior is punished through slashing.

Reward Slashing: Handling Honest Failure Gracefully

Not all failures are malicious.

Hardware issues, software bugs, or temporary outages can cause validators to miss blocks.

For these cases, Plasma uses reward slashing:

the validator is temporarily removed from the active set

block rewards are forfeited for a fixed period

No stake is burned.

No permanent damage is done.

This keeps the validator set performant without being overly punitive.

Stake Slashing: The Nuclear Deterrent

For provable Byzantine behavior — especially equivocation — Plasma employs stake slashing.

If a validator signs two conflicting blocks at the same height:

cryptographic proof is submitted on-chain

a significant portion of the validator’s staked XPL is permanently burned

This makes attacks economically irrational.

The cost of misbehavior far exceeds any potential gain.

Cryptography as a Performance Weapon: BLS Signatures

Byzantine nodes often attempt to overwhelm networks with malformed or excessive messages.

Plasma counters this with BLS signature aggregation.

Instead of processing hundreds of individual signatures:

validators combine them into a single compact proof

This reduces:

bandwidth usage

verification time

attack surface for spam

Byzantine noise is compressed out of existence.

Pipelining: Speed Without Fragility

Plasma’s pipelined architecture allows multiple consensus stages to operate concurrently.

Validators don’t wait for full commitment before advancing. They vote on chains of blocks.

If a Byzantine node injects invalid data:

the chain of trust breaks immediately

honest nodes revert to the last valid Quorum Certificate

Progress continues without rollback or chaos.

Performance Benchmarks: Speed That Survives Reality

Plasma’s architecture isn’t theoretical — it’s been tested under live conditions.

Since mainnet launch on September 25, 2025, Plasma has demonstrated consistent real-world performance.

Throughput: Sustained High TPS

Launch-day throughput: 1,000+ TPS

Peak daily load (Nov 2025): 450,000 transactions

Sustained high-activity windows: 1,200+ TPS

The architecture is designed to scale toward 10,000+ TPS as the validator set grows and hardware improves.

Finality: Sub-Second Settlement

Average block finality: ~0.8 seconds

Deterministic and irreversible

For users and merchants, this feels instant — closer to card payments than traditional blockchain UX.

Execution Layer: Reth and Parallel Processing

Plasma’s execution layer is built on Reth, a high-performance Ethereum implementation written in Rust.

This allows:

efficient EVM execution

parallel transaction processing

lower memory overhead

Proposal, voting, and execution run on separate threads, maximizing CPU utilization without bottlenecks.

Zero-Fee Transfers: Performance Meets Accessibility

Plasma introduces a Paymaster system that subsidizes gas fees for stablecoin transfers.

up to 5 free USDT transfers per wallet per day

encourages microtransactions

removes friction for real-world adoption

This is only possible because of Plasma’s high throughput and low marginal cost per transaction.

Liveness by the Numbers

Total Validators Max Faulty (f) Min Active for Liveness

4 1 3

10 3 7

100 33 67

Plasma strongly favors larger validator sets to make coordinated failure statistically improbable.

The Bigger Picture: Why Plasma’s Design Matters

Plasma is not trying to be everything.

It is not a general-purpose experimentation sandbox.

It is not optimized for NFTs or meme tokens.

It is optimized for money.

By combining:

Byzantine-resilient consensus

deterministic finality

pipelined execution

cryptographic aggregation

strong economic deterrents

Plasma delivers something rare in crypto: speed without fragility.

Final Thoughts

In blockchain, resilience is not achieved by hope. It is achieved by math, cryptography, economics, and ruthless engineering discipline.

PlasmaBFT embodies this philosophy.

By assuming failure, expecting attacks, and designing for worst-case conditions, Plasma doesn’t just survive Byzantine behavior — it makes it irrelevant.

For stablecoins, payments, and the future of on-chain money, that design choice may prove to be its greatest strength.