@Plasma is often discussed as a scaling or transaction framework, but its real power shows up when you look at it through an enterprise integration lens. Instead of just asking “How fast is it?” the smarter question becomes: How does Plasma plug into real-world financial and operational systems? That’s where its architecture starts to look less like a crypto experiment and more like serious financial infrastructure.

Enterprise Integration as the Real Use Case

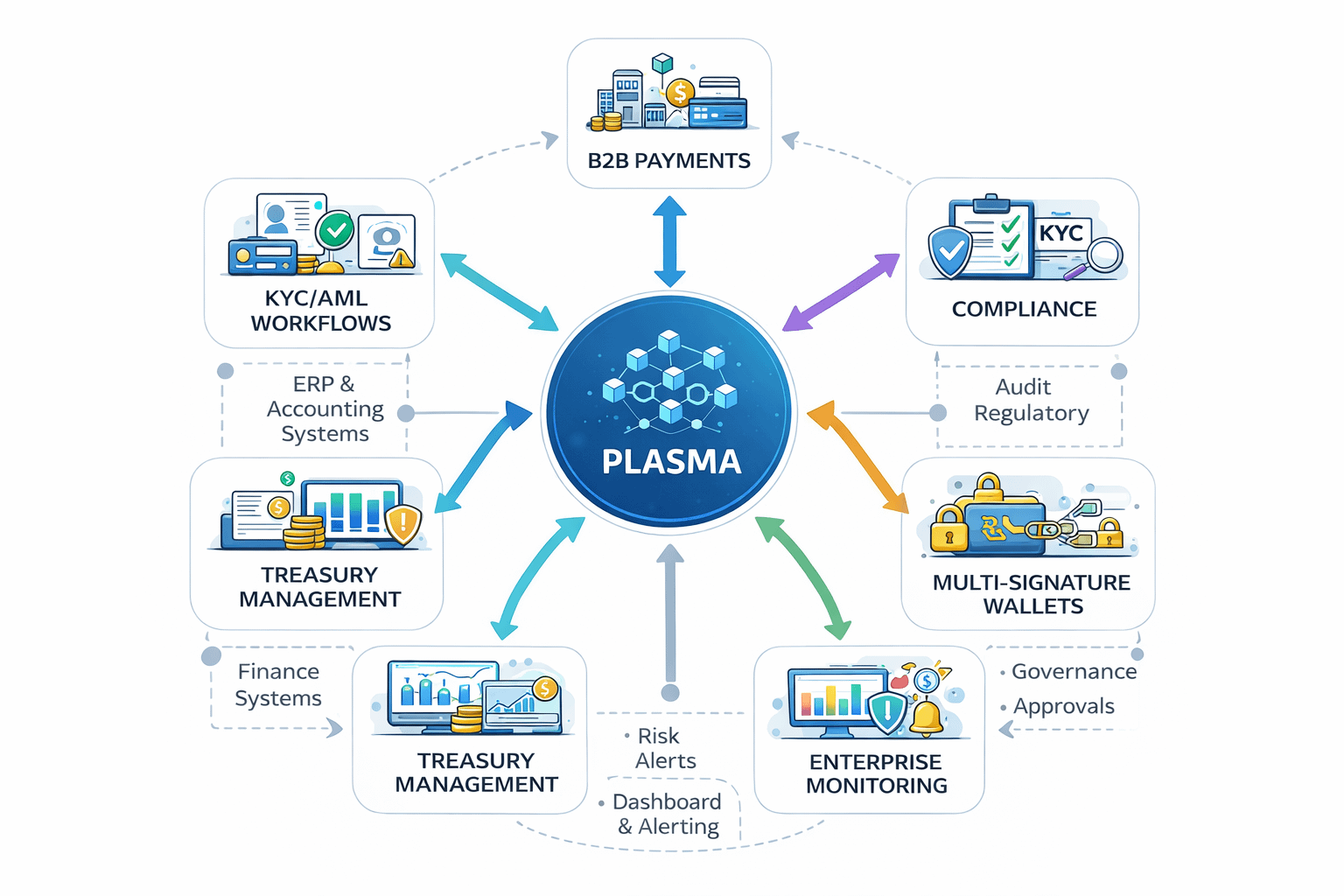

For businesses, Plasma is not just about moving tokens it’s about connecting digital value rails to existing corporate systems. Enterprises already run complex stacks: ERP tools, accounting platforms, compliance engines, treasury dashboards, and monitoring systems. Plasma’s layered structure makes it possible to slot blockchain-based settlement into these environments without forcing companies to rebuild everything from scratch.

Rather than acting as a standalone chain, Plasma can function as a settlement and verification layer that interoperates with traditional enterprise middleware. This is where enterprise integration patterns come in: message queues, API gateways, reconciliation systems, and automated workflows that bridge on-chain activity with off-chain records.

B2B Payment Infrastructure Setup

One of the strongest enterprise fits for Plasma is business-to-business payments. Traditional B2B payments are slow, opaque, and expensive due to correspondent banking layers. Plasma-based payment rails can introduce near-real-time settlement while still allowing companies to maintain internal approval hierarchies and accounting controls.

Instead of replacing internal finance systems, Plasma becomes the final settlement layer. Invoices originate in ERP software, approvals happen in existing finance tools, and once cleared, a Plasma transaction executes the transfer. The blockchain doesn’t disrupt operations it accelerates and verifies them.

Compliance and Regulatory Considerations

Enterprises cannot touch financial infrastructure without addressing regulation. Plasma integrations must be designed with auditability, traceability, and jurisdictional compliance in mind. That means transaction metadata, reporting hooks, and identity linkage systems must be built into the workflow layer surrounding Plasma, not treated as afterthoughts.

This flips the narrative: compliance isn’t a barrier to blockchain adoption it becomes an integration requirement. Properly structured Plasma systems can actually simplify audits by creating tamper-evident transaction histories that align with regulatory reporting needs.

KYC/AML Integration Workflows

Identity and risk screening are core to enterprise finance. Plasma on its own is neutral infrastructure, but when paired with KYC/AML service providers, it becomes enterprise-ready. Businesses can design onboarding pipelines where counterparties are verified before being whitelisted for Plasma-based transactions.

These workflows typically sit off-chain but interact directly with transaction permissions. A wallet address might only gain transaction rights after passing identity verification, sanctions screening, and risk scoring. This approach ensures Plasma networks operate inside the same risk frameworks as banks and payment processors.

Treasury Management Solutions

For corporations, crypto infrastructure is meaningless without treasury visibility and control. Plasma can feed transaction data into treasury management systems that track liquidity, exposure, and settlement timing. Instead of reconciling bank statements, finance teams reconcile on-chain settlement logs synchronized with internal ledgers.

This creates a hybrid treasury model where digital asset flows and fiat positions can be viewed within the same operational dashboards. The result is not just faster payments, but improved liquidity forecasting and capital efficiency.

Multi-Signature Wallet Configurations

Enterprises don’t rely on single-person authorization, and Plasma integrations reflect that. Multi-signature wallet structures allow organizations to mirror internal approval chains on-chain. Finance officers, compliance heads, and operations managers can each hold signing authority, ensuring no transaction executes without the required governance checks.

This transforms wallets from simple crypto tools into digital equivalents of corporate bank accounts with layered authorization controls.

Enterprise-Grade Monitoring and Alerting

Finally, Plasma in an enterprise context must be observable. Monitoring tools track transaction throughput, failed settlements, unusual activity patterns, and system health. Alerting systems can notify risk teams of anomalies in real time, much like fraud detection systems in traditional finance.

With proper monitoring, Plasma becomes not just decentralized infrastructure, but managed financial infrastructure that fits inside corporate risk and IT oversight models.

The Bigger Picture

When viewed through enterprise integration patterns, Plasma stops being just a scaling solution and starts looking like a programmable financial backbone. Its value lies not only in technical efficiency but in how smoothly it can embed into compliance frameworks, treasury operations, identity systems, and corporate governance structures.

That’s the shift enterprises care about: not replacing their systems, but connecting them to faster, more transparent settlement layers without losing control, oversight, or regulatory alignment.