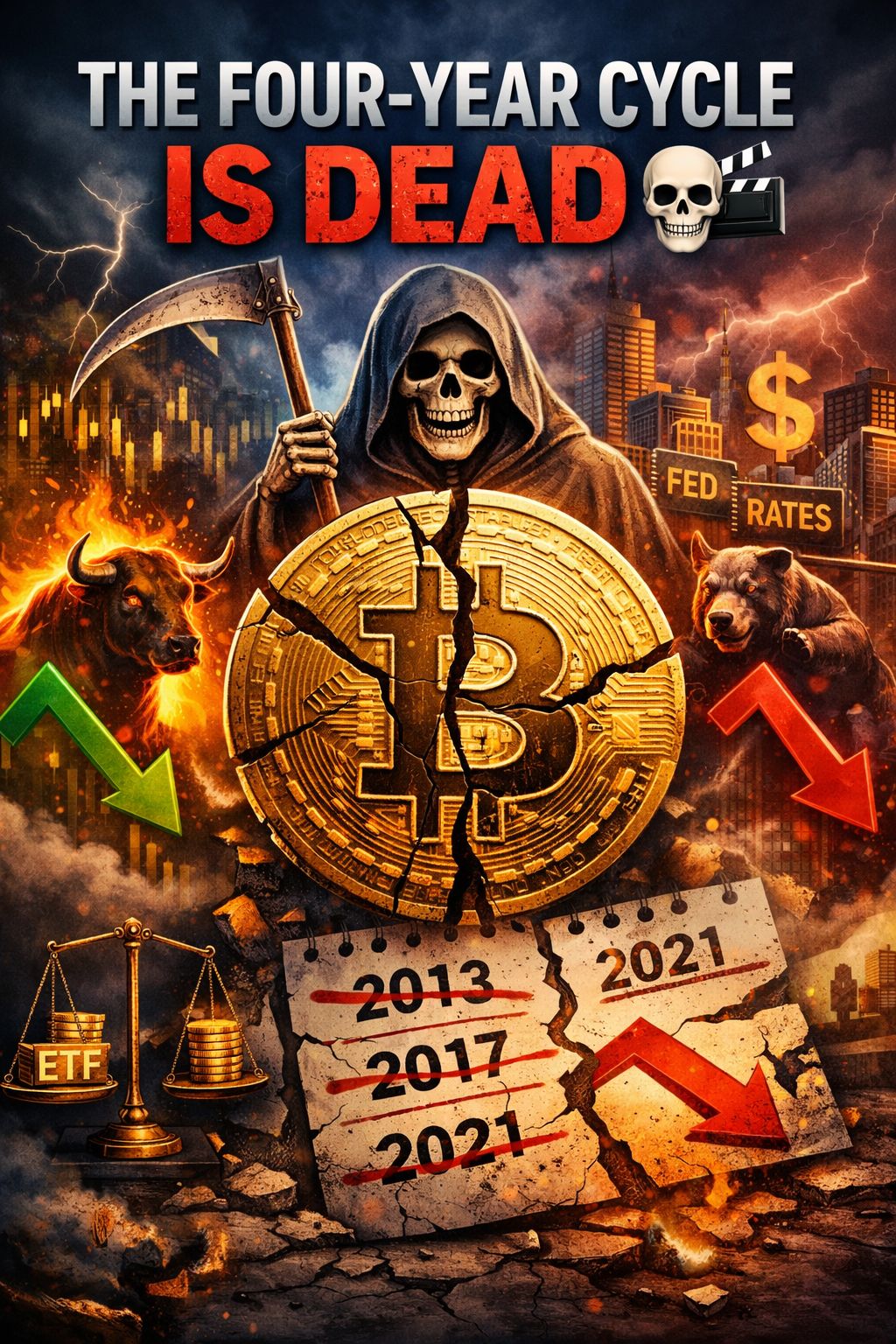

For years, Bitcoin investors followed one simple belief:

Halving → Pump → Blow-off Top → Bear Market → Repeat every 4 years.

But in today’s market… that model is breaking.

Why the Classic 4-Year Cycle Is Failing

1️⃣ Institutions Changed the Game

Bitcoin is no longer driven only by retail hype.

ETFs, funds, and corporations now buy $BTC strategically, not emotionally.

They don’t wait for halvings — they buy dips, hedge risk, and hold long-term.

2️⃣ Liquidity > Halving

Markets now move on:

Interest rates

Dollar liquidity

Macro data (inflation, jobs, policy)

Halving still matters — but it’s no longer the main trigger.

3️⃣ Cycles Are Getting Messy

Early tops

Shallow bear markets

Multiple mini-bulls and mini-crashes

Instead of one clean cycle, we now see overlapping waves.

4️⃣ Bitcoin Is Maturing

As markets mature:

Volatility compresses

Returns slow

Patterns break

Bitcoin is slowly behaving less like a meme asset and more like a macro asset.

So… Is the Cycle Really Dead?

Not completely.

The rhythm has changed, not disappeared.

👉 Halvings still affect supply

👉 Psychology still matters

👉 But timing is no longer predictable by a calendar

New Reality

❌ No guaranteed “post-halving moon”

❌ No perfect cycle top date

✅ More complex, macro-driven moves

✅ More opportunity for smart, patient investors

Final Take

The four-year cycle wasn’t wrong —

it just belonged to an earlier version of Bitcoin.

Welcome to the era of: Liquidity cycles, not halving cycles.

Adapt — or get left behind.