@Plasma is a Layer 1 blockchain tailored for stablecoin settlement, which is a quietly different ambition than “general purpose smart contracts.” It’s built around the idea that most real economic activity people actually want on-chain is denominated in dollars, moves in predictable flows, and breaks when fees, liquidity gaps, or operational uncertainty show up at the wrong moment. Plasma’s mainnet beta framing made that explicit: zero-fee USD₮ transfers, a planned launch with roughly $2B in stablecoin liquidity active from day one, and a deliberate attempt to feel usable immediately rather than “promising future ecosystem growth.”

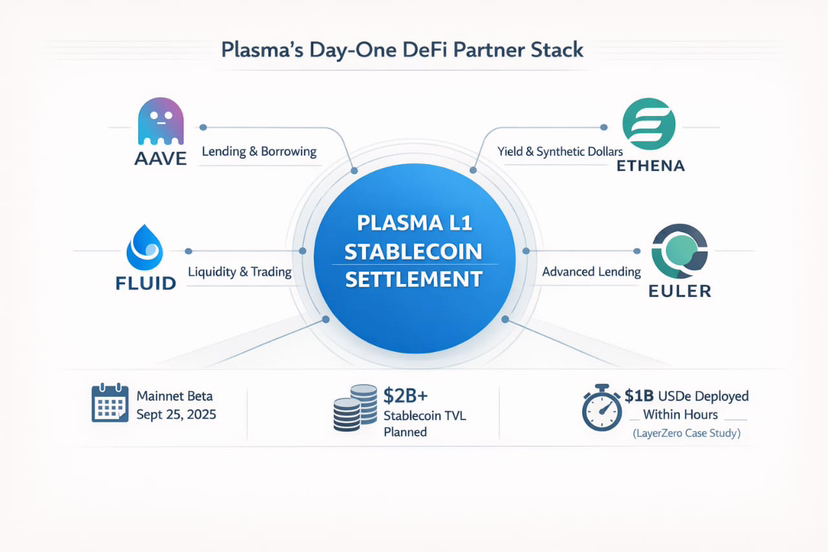

That’s the context that makes the “day-one DeFi partner stack” more than a marketing list. When Plasma highlighted that capital would be deployed across 100+ DeFi partners including Aave, Ethena, Fluid, and Euler, it was making a specific claim: this chain would not start life as an empty city. It would start as a functioning money market with recognizable venues for lending, borrowing, yield, and collateral loops—the kinds of venues that create habit and gravity for users who aren’t interested in pioneering.

This is trending now because the market’s definition of “launch” has changed. A chain can have great throughput and still fail if the first week feels like walking into a mall where the lights are on but the stores are closed. Plasma’s approach suggests it internalized that lesson. In 2025, it positioned the mainnet beta and XPL launch as a moment where liquidity and utility arrive together, not sequentially. That matters more in stablecoin land than in speculative-token land, because stablecoin users are often there to do a job: park cash, borrow against it, move it between counterparties, or build a payment flow that can’t afford surprises.

Aave is the most obvious piece of that stack, and not just because it’s big. Lending markets are where stablecoin ecosystems either become real financial infrastructure or remain a bridge-and-swap playground. Plasma later framed the Aave relationship in plain language: convert USD₮ deposits into predictable, “market-grade” credit, with risk calibration and incentives designed to keep borrow costs low enough to be usable. Even if you ignore the rhetoric, the underlying point is practical: if a chain is “for stablecoin settlement,” it needs deep, boring money markets where participants can be lenders or borrowers without feeling like they’re stepping onto thin ice.

Ethena is a different kind of signal. It represents the demand for yield-bearing dollars that don’t depend on a bank account, and it also represents complexity that can blow up if risk and liquidity aren’t treated with respect. The LayerZero case study on Plasma describes something worth sitting with: within hours of launch, more than $1B in USDe was deployed on Plasma, and it notes that demand emerged largely through usage patterns like looping collateral on venues such as Aave and Fluid rather than only pre-planned liquidity seeding. That’s not a minor anecdote. It implies Plasma’s “day-one stack” wasn’t just a set of logos; it created immediate pathways for capital behavior people already understand—deposit, borrow, loop, hedge—now transplanted onto a chain that is explicitly optimized around stablecoin movement.

Fluid and Euler, in that sense, are part of the same story: you don’t get a functioning credit economy from a single lending market alone. You get it from alternative venues, different risk appetites, different collateral preferences, and the presence of competition that keeps terms honest. Plasma’s own launch note grouped Aave, Ethena, Fluid, and Euler together as part of the “immediate utility” goal—savings behavior, deep USD₮ markets, and low borrow rates—because those are the first-order primitives that make stablecoins feel less like parked inventory and more like working capital.

There’s also a subtler reason this mattered: it changes the social psychology of adoption. When a chain launches without familiar financial venues, the first users are forced into a pioneer mindset. That attracts a specific personality type—early yield hunters, explorers, people who tolerate broken UX and half-finished risk parameters. But stablecoin settlement is not an explorer product. The users Plasma is implicitly courting—treasury teams, payment operators, DeFi funds running basis trades, even ordinary users who just want predictable dollar access—are often allergic to “first week chaos.” A day-one stack anchored by established markets reduces that emotional barrier. People don’t feel like they’re testing an experiment; they feel like they’re using a known pattern in a new place.

Of course, none of this works without price feeds and reliable on-chain data, because lending markets without robust oracles become brittle fast. Plasma’s move to integrate Chainlink as an official oracle provider, tied to ecosystem adoption “in collaboration with Aave,” is another piece of the same thesis: don’t just launch apps; launch the dependencies that keep them from failing in predictable ways.In a stablecoin-first environment, the failure mode isn’t always dramatic insolvency. Sometimes it’s smaller: a liquidation cascade because an oracle hiccupped, a borrow market that becomes unusable because parameters weren’t grounded in reality, or a liquidity venue that looks deep until volatility arrives.

The real progress here is measurable in the way the launch was described by multiple sources: mainnet beta going live on September 25, 2025, with a projected $2B+ in stablecoin TVL, 100+ DeFi partners, and explicit emphasis on zero-fee USD₮ transfers.Those are concrete claims, and they set a high bar because they invite immediate verification. If the chain says it’s launching as a top venue by stablecoin liquidity, the market will know quickly whether the liquidity is real, whether it’s sticky, and whether it actually produces tighter spreads and better borrow rates rather than just screenshots.

The more interesting question is what “why it mattered” looks like six months later, when the novelty wears off. A day-one partner stack matters if it creates repeatable routines: deposit dollars, earn yield, borrow when needed, pay counterparties, unwind safely. It matters if it reduces the cognitive load of moving serious money on-chain, because the venues feel familiar and the failure modes feel managed. It also matters if it prevents the ecosystem from being held hostage by one dominant venue; in any credit economy, concentration risk is real, and multiple credible markets can be the difference between resilience and a single-point shock.

There’s a final point that’s easy to miss. A “stablecoin settlement chain” is, in practice, a bet on the unglamorous middle layer of the crypto economy: payment flows, treasury flows, and the steady recycling of collateral. If Plasma can keep that layer calm—low friction transfers, credible money markets, and the basic infrastructure that lets institutions and ordinary users trust the plumbing—then the day-one stack will be remembered as more than a launch tactic. It will be remembered as a declaration that the chain wanted to start life behaving like a financial venue, not like a science project. And in stablecoins, that emotional difference—calm versus chaotic—is often the thing that decides where the dollars stay.