Bitcoin has existed for more than a decade.

Web3 has promised to “change the world” for almost as long.

Yet one simple question remains unanswered:

Why can’t we easily buy a 10-yuan cup of coffee with crypto at the store downstairs?

The reason is uncomfortable but clear: the economics don’t work.

On most major chains today, confirming a tiny transaction can cost more than the coffee itself. Paying high gas fees for a low-value purchase is like deploying heavy machinery to crack a peanut. This design naturally pushes blockchains toward large transfers, speculation, and NFTs—while everyday payments remain impossible.

1. The Missing Layer: The “Ant Economy”

Real life isn’t made of million-dollar transactions.

It’s made of small, repetitive ones:

A drink

A charging session

A paid article

An in-game action

These high-frequency, low-value transactions are what power mass adoption. Without them, Web3 will never reach a billion users.

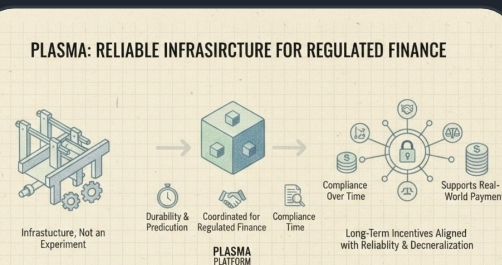

This is why the idea behind Plasma stands out. It’s not trying to compete in the “armored-truck” business of large transfers. It’s building infrastructure for the ant economy—precise, lightweight, and efficient.

By reducing transaction friction through mechanisms like gas abstraction, on-chain actions finally become cheaper than the value they move. When costs approach zero, Web3 stops selling assets and starts selling services.

2. $XPL and the Rise of Machine-to-Machine Payments

The future of payments won’t be limited to humans.

Cars will pay charging stations.

Appliances will reorder supplies.

Devices will transact with other devices—constantly.

This machine-to-machine world requires an entirely different payment structure: ultra-cheap, ultra-fast, and massively scalable. A system built on strong security with minimal friction is not optional—it’s mandatory.

In this environment, $XPL is no longer a “fee token.”

It becomes infrastructure: a digital lubricant that allows trillions of micro-transactions to flow smoothly. Each transaction consumes almost nothing—but at scale, demand compounds exponentially.

3. Real Investing Is About Seeing Demand Before It’s Obvious

The last cycle was driven by DeFi speculation and wealth narratives.

The next cycle will be driven by implementation: real usage, real payments, real-world assets, and real demand.

Markets reward solutions to actual problems. Plasma isn’t asking whether money can move on-chain. That’s already solved.

It’s asking whether money can move cheaply, frequently, and invisibly like it does in everyday life.

That small shift is what takes Web3 from theory to reality.

Final Thought

While attention stays locked on congested, high-cost chains, a quieter shift is happening elsewhere.

Micropayments are the blue ocean and Plasma is positioning itself early.

Sometimes the biggest revolutions don’t start with grand promises.

They start with something as simple as buying a cup of coffee.