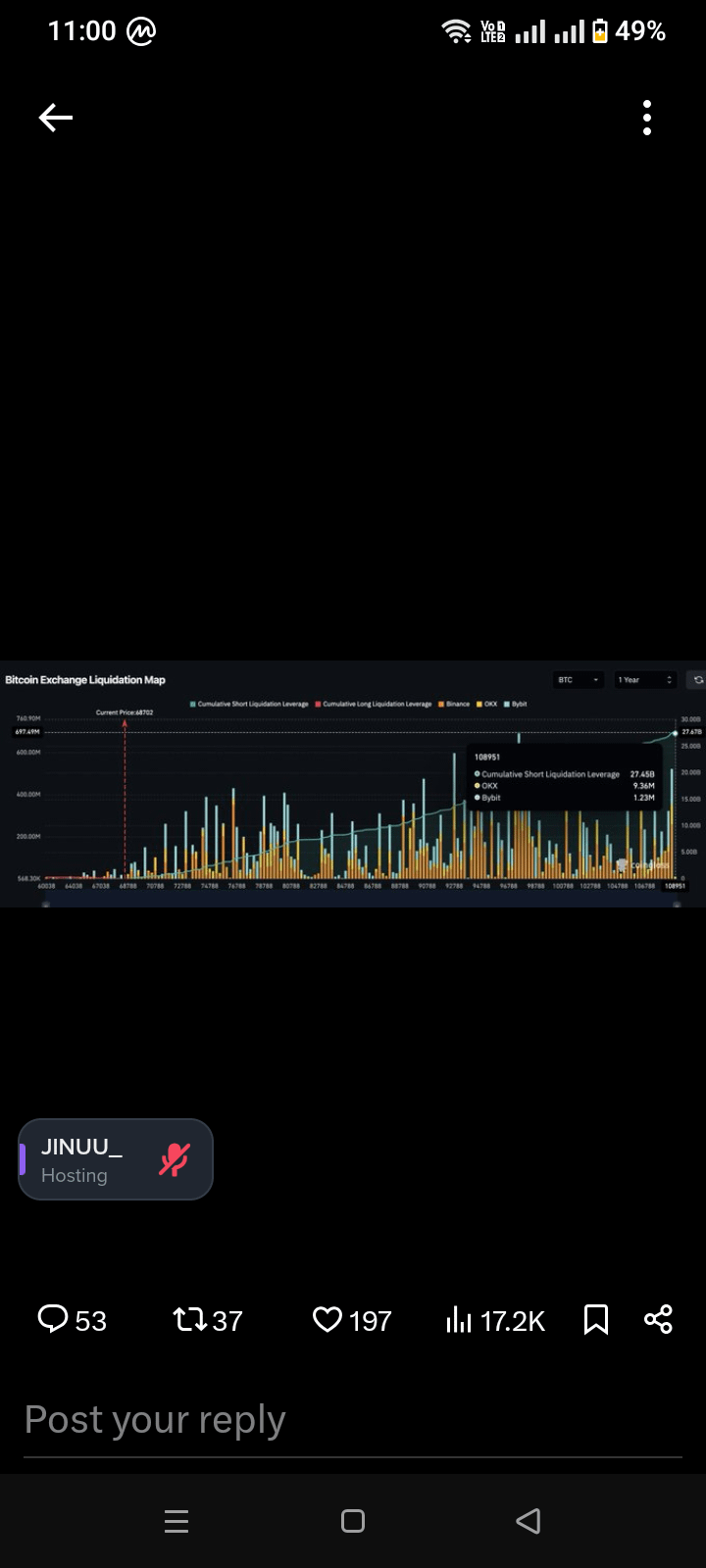

The Bitcoin liquidation heatmap is one of the most powerful tools for understanding short-term market behavior, especially during periods of high volatility. It visually shows where large clusters of leveraged positions are likely to be liquidated if price moves into certain zones.

Here’s what’s happening and why it matters.

A liquidation heatmap highlights price levels where traders have placed heavy leverage—both long and short. These areas appear as brighter or hotter zones on the chart. When price approaches these levels, forced liquidations can occur, creating rapid price movements in a very short time.

Currently, the heatmap shows dense liquidation clusters sitting both above and below the current Bitcoin price. This tells us something important: the market is highly leveraged, and liquidity is stacked on both sides. In simple terms, Bitcoin is surrounded by “fuel.”

If price moves upward, short positions get liquidated first. This forces buy orders, pushing price even higher in what’s known as a short squeeze. On the flip side, a move downward can trigger long liquidations, accelerating selling pressure through a long squeeze.

What makes this setup “insane” is the size and proximity of these liquidity zones. When liquidation levels are tightly packed, even a moderate price move can cascade into a much larger move. This is why Bitcoin often makes sharp, unexpected spikes instead of slow, clean trends.

Another key takeaway from the heatmap is market psychology. Retail traders often enter positions late, using high leverage near obvious support or resistance. Larger players and algorithms are aware of this behavior and tend to push price toward these crowded areas to access liquidity. Liquidations aren’t random—they’re part of how the market resets leverage.

It’s also important to understand that liquidation heatmaps do not predict direction. They show where price is likely to react strongly, not which way it will go. Direction usually comes from broader factors like trend structure, funding rates, spot demand, and macro sentiment.

In highly leveraged environments like this, risk management becomes critical. Wide stop losses, lower leverage, and patience often outperform aggressive entries. When the heatmap lights up on both sides, volatility is usually the only certainty.

In short, the current Bitcoin liquidation heatmap suggests one thing very clearly: a major move is loading. Whether up or down, the market is primed to hunt liquidity—and when it starts, it may move faster than most traders expect.

#follow Helena 💕