The first time I realized how broken crypto #Payments still are was not during a crash or a hack. It was during a simple transfer. I sent a stablecoin, then sat there watching the screen, checking gas, wondering if I missed something, refreshing the wallet, hoping it wouldn’t fail. Nothing dramatic happened. It worked. But it wasn’t calm. It never feels calm. And that’s when it hit me: money in crypto still asks for too much attention.

Most #blockchains seem to accept this as normal. They treat friction like a learning process. You’re supposed to understand gas, fees, confirmation times, bridges, retries, and networks. If you don’t, that’s “on you.” Over time, people get used to it. But getting used to something doesn’t mean it’s good. It just means you’re tired of fighting it.

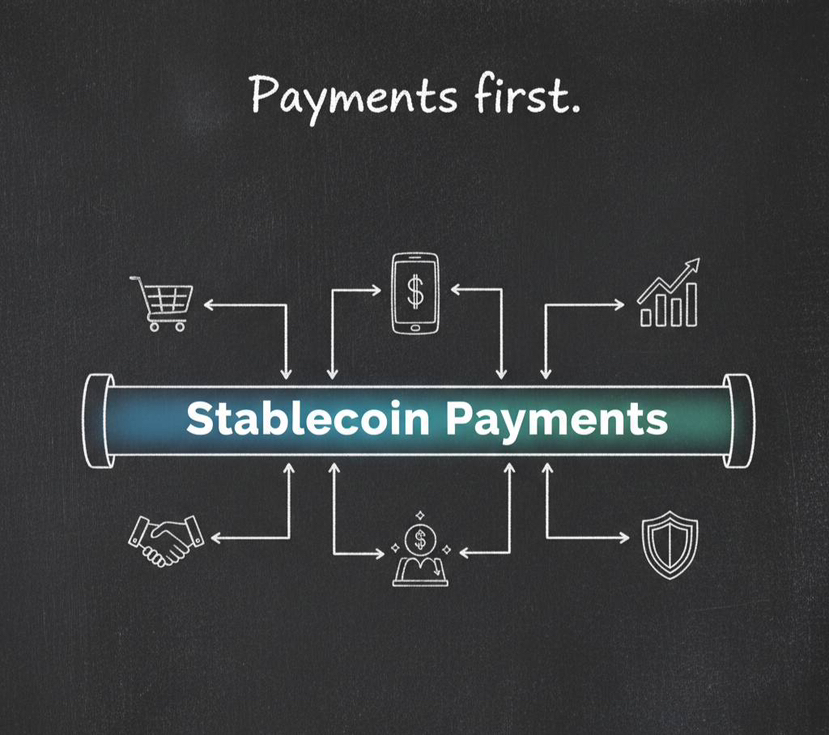

When I started looking more closely at Plasma, what stood out wasn’t some flashy feature or bold promise. It was the opposite. It felt like the whole system was built around one quiet idea: if someone is using stablecoins, they don’t want to think about infrastructure. They just want money to move. That’s it.

Plasma doesn’t treat payments as a side feature. It treats them as the main product. Everything else comes second. Instead of building a general-purpose chain and hoping payments work well on top of it, they built the chain around settlement from the beginning. That may sound boring, but boring is exactly what money is supposed to be.

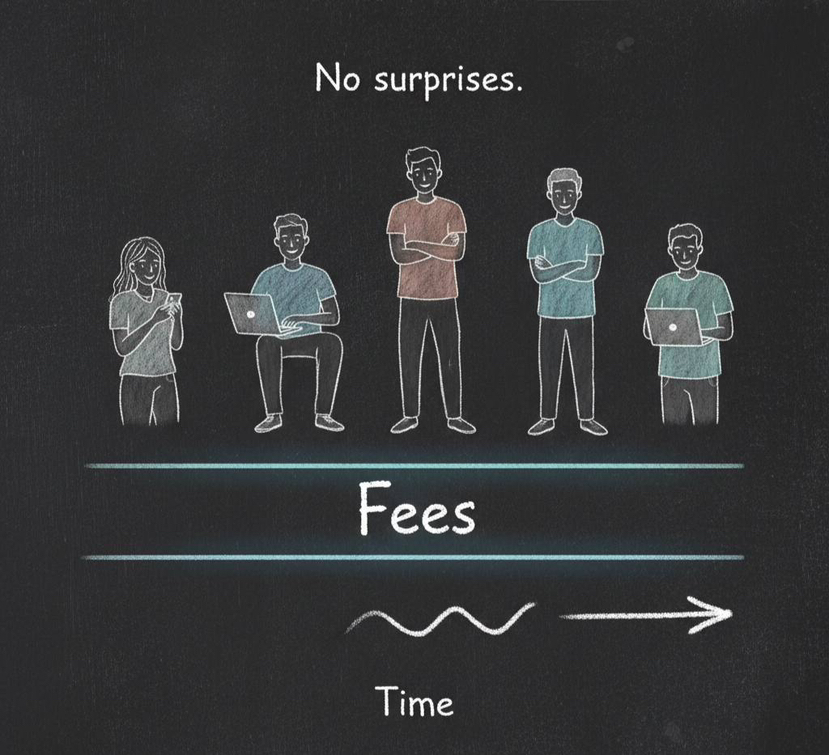

Take gas fees, for example. On most networks, fees feel like a surprise tax. Sometimes they’re tiny. Sometimes they’re painful. And you never really know which version you’ll get. Plasma’s approach is different. For stablecoin transfers, the system absorbs much of that friction. It’s not trying to make everything free. It’s trying to make the most common action sending value predictable.

That difference matters more than people realize. Businesses don’t build systems on uncertainty. Freelancers don’t want to guess how much it will cost to get paid. Merchants don’t want checkout fees changing every hour. When fees behave consistently, money starts acting like money again.

Another small but important shift is how Plasma treats the native token. On many chains, you’re forced to care about the token before you can even use the network. You need to buy it, manage it, and monitor its price just to send something else. Plasma flips that. You can interact using the asset you already care about: stablecoins. The network works around that reality instead of fighting it.

Speed is another area where #Plasma feels more practical than promotional. Lots of chains advertise speed with big numbers. Thousands of transactions per second. Millisecond blocks. But in payments, speed isn’t about bragging rights. It’s about certainty. When a transaction finalizes quickly and reliably, systems can be automated. Accounting becomes easier. Risk drops. Planning improves. Plasma focuses on finality because finality is what businesses actually need.

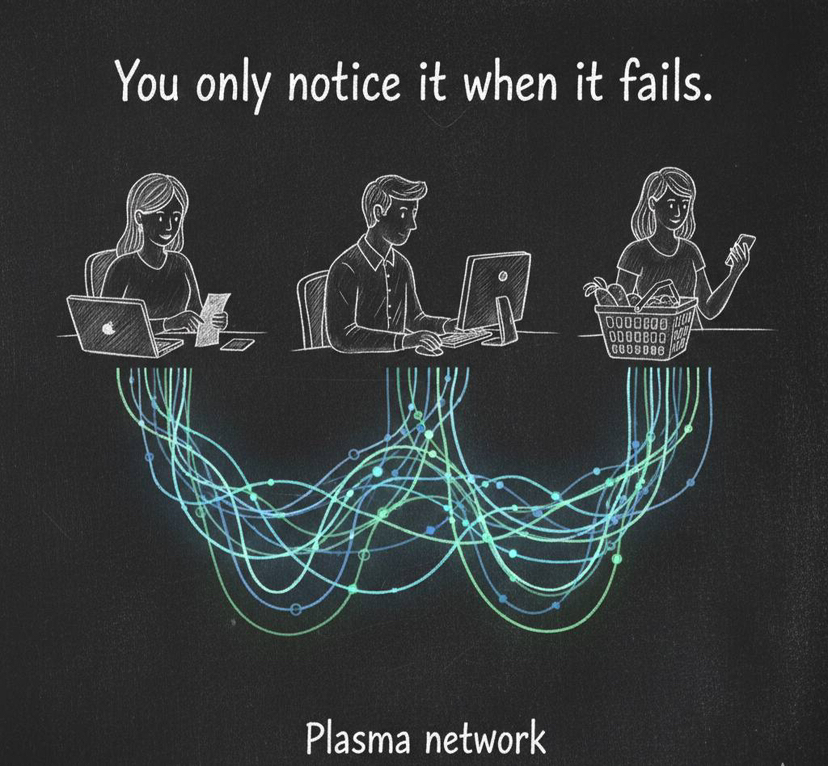

What’s interesting is that Plasma doesn’t pretend to eliminate complexity. It just moves it. Instead of dumping it on users, it puts it into protocol rules, validator incentives, and governance structures. That’s how real financial systems work. Your card payment feels simple, but behind it is a massive network of rules, checks, and institutions. Plasma is trying to recreate that balance on-chain.

Even the idea of anchoring parts of the system to Bitcoin fits this mindset. It’s not about marketing “Bitcoin security.” It’s about choosing an external, politically neutral reference point for long-term trust. Bitcoin is slow and conservative, but it’s hard to capture. By tying into that, Plasma is signaling that settlement matters more than speed races.

The role of XPL also reflects this philosophy. It’s there to secure the network and align validators. Not to dominate every interaction. Many users may barely notice it. That’s not a weakness. That’s what infrastructure looks like when it works. You don’t think about electricity while using your phone. You just expect it to be there.

it. That’s not a weakness. That’s what infrastructure looks like when it works. You don’t think about electricity while using your phone. You just expect it to be there.

If Plasma succeeds, people won’t argue about it every day on social media. They won’t build cults around it. They’ll just use it. Transfers will clear. Fees will make sense. Payments will feel boring. And boring is exactly what money should be.

The real question isn’t whether Plasma can make transfers cheaper or faster. Plenty of projects can do that for a while. The real test is whether a system that hides friction can stay honest, transparent, and accountable as it grows. Because when systems become invisible, power doesn’t disappear. It just becomes harder to see.

If Plasma can keep that power balanced while keeping payments simple, it won’t just be another blockchain. It will be something rarer in crypto: infrastructure people quietly rely on.