The blockchain industry keeps promising revolutions but rarely delivers the quiet transformations that actually matter. While countless projects shout about disrupting finance, a smaller number focus on building the technical foundations that could genuinely reshape how decentralized systems operate. Plasma stands among this latter group, approaching decentralized finance through meticulous engineering rather than marketing theatrics. Understanding where Plasma came from and where it’s heading requires looking beyond surface-level features into the architectural decisions that define its purpose.

The Genesis of a Technical Vision

Plasma didn’t emerge from a desire to create another token or replicate existing DeFi platforms. The project originated from developers who spent years observing the limitations of early blockchain systems, particularly Ethereum’s struggles with scalability and transaction costs. They recognized that Layer 2 solutions represented the future of practical blockchain applications, but existing implementations carried trade-offs that limited their real-world utility. High fees persisted even on some Layer 2 networks, while others sacrificed decentralization or security to achieve speed.

The founding team saw an opportunity to build a Layer 2 solution that balanced these competing demands differently. They weren’t interested in being the fastest or the cheapest in isolation. Instead, they aimed to create infrastructure where developers could build complex financial applications without constantly worrying about gas optimization or network congestion. This philosophy shaped every technical decision from the earliest architecture diagrams to the current production environment.

What sets Plasma apart from its inception is the commitment to being a genuine Layer 2 rather than a sidechain with looser security guarantees. The distinction matters because true Layer 2 solutions inherit security from Ethereum’s main chain while processing transactions off-chain for efficiency. Plasma achieves this through optimistic rollup technology, a method where transactions are assumed valid unless proven otherwise. This approach creates a system where users benefit from Ethereum’s security without paying Ethereum’s transaction fees for every action.

Building the Technical Foundation

Creating a functional Layer 2 network involves solving problems that aren’t immediately obvious to casual observers. The team had to develop mechanisms for batching transactions, submitting compressed data to Ethereum, handling fraud proofs, and managing the bridge between Layer 1 and Layer 2. Each component required careful engineering to ensure security without sacrificing performance.

The Plasma Virtual Machine represents one of the project’s core technical achievements. It’s fully compatible with the Ethereum Virtual Machine, which means developers can deploy existing Solidity smart contracts without modification. This compatibility eliminates one of the biggest barriers to adoption that alternative blockchains face. If you’ve built something on Ethereum, you can move it to Plasma without rewriting your code. The same tools, the same development environment, the same testing frameworks all work identically.

Transaction finality happens in seconds rather than minutes, and fees typically cost a fraction of what users pay on Ethereum mainnet. These aren’t theoretical improvements measured in laboratory conditions. They’re consistent performance characteristics that hold true under real network load. The bridge connecting Ethereum and Plasma allows assets to move between chains with security guarantees that prevent the exploit scenarios that have plagued other cross-chain solutions.

Behind these user-facing features sits the data availability layer, perhaps the least glamorous but most crucial component of any Layer 2 system. Plasma publishes transaction data in a way that allows anyone to reconstruct the chain’s state and verify its correctness. This transparency ensures that even if Plasma’s operators disappeared tomorrow, users could recover their assets by referencing the data posted to Ethereum. It’s a safety mechanism that most users will never need but that fundamentally enables the trust model underlying the entire system.

The Ecosystem Takes Shape

Technology means nothing without applications, and Plasma’s value proposition depends entirely on what people build using its infrastructure. The ecosystem started slowly, which is typical for new Layer 2 networks. Early projects were often experimental, small teams testing whether Plasma’s performance claims held up in production environments. These pioneers provided valuable feedback that shaped subsequent protocol improvements.

Decentralized exchanges arrived first, which makes sense given that trading applications benefit most immediately from low fees and fast execution. Users could swap tokens multiple times per day without worrying about transaction costs eroding their profits. Liquidity pools formed, attracting capital from users who appreciated the mathematical efficiency of automated market makers without the friction of high gas fees. These exchanges weren’t revolutionary in their design, but they demonstrated that familiar DeFi primitives could operate more smoothly on Plasma than on their native Ethereum.

Lending protocols followed, allowing users to deposit assets as collateral and borrow against them. The lower transaction costs made smaller loan positions economically viable, opening these financial tools to users who couldn’t justify the fees on Ethereum mainnet. Borrowers could adjust their collateral more frequently, and liquidation mechanisms could operate more efficiently without gas costs dominating every calculation. The result was a lending market that felt more responsive and accessible than its Layer 1 equivalents.

NFT platforms discovered that Plasma’s cost structure enabled new use cases. Minting collections with thousands of items became affordable. Trading small-value NFTs made economic sense when transaction fees didn’t exceed the asset’s worth. Gaming projects explored Plasma for in-game assets, where players might interact with smart contracts hundreds of times during a single session. These applications pushed the network in ways that financial protocols didn’t, testing throughput limits and revealing optimization opportunities.

The diversity of projects building on Plasma suggests that developers see it as general-purpose infrastructure rather than a specialized tool for specific applications. This versatility comes from the EVM compatibility decision made years earlier. When developers don’t need to learn new programming languages or adapt to unfamiliar paradigms, they’re more likely to experiment with deploying their projects on new platforms.

The Token Economics and Governance Model

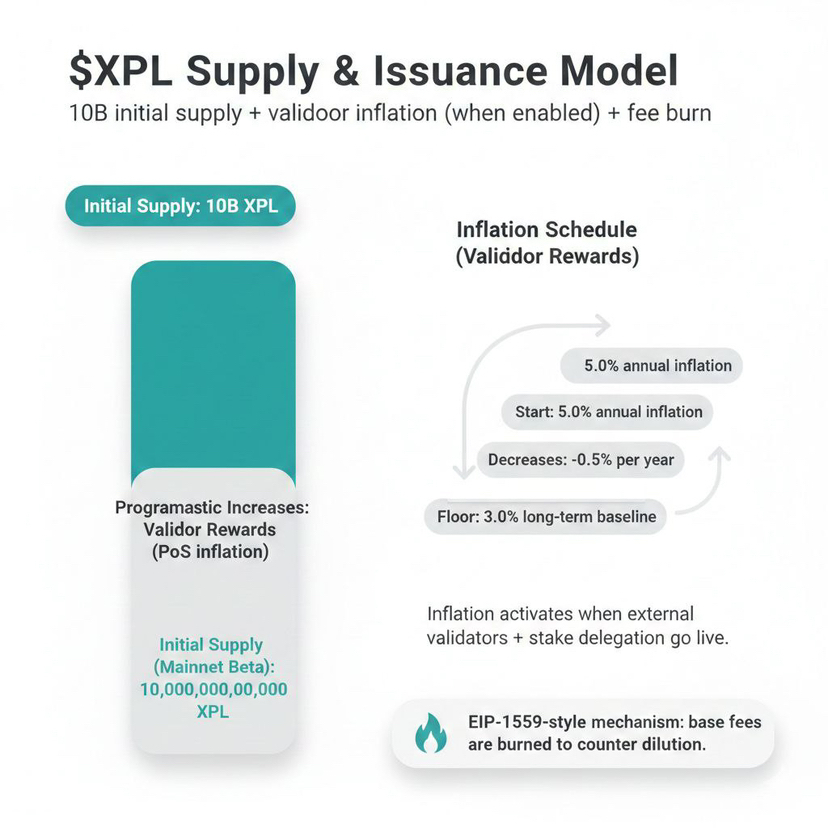

XPL functions as the network’s native token, serving multiple roles within the ecosystem. Users pay transaction fees in XPL, creating baseline demand that correlates with network activity. Validators stake XPL as collateral, aligning their economic incentives with the network’s security and reliability. This staking mechanism helps ensure that those responsible for processing transactions have skin in the game, facing financial penalties if they attempt malicious behavior.

The token also enables governance, allowing holders to vote on protocol upgrades and parameter changes. This governance structure reflects a belief that decentralized infrastructure should be controlled by its community rather than a central development team. Decisions about fee structures, bridge security thresholds, and network upgrades happen through transparent proposal and voting processes. While governance participation isn’t universal, the mechanism exists for stakeholders who want to influence the protocol’s direction.

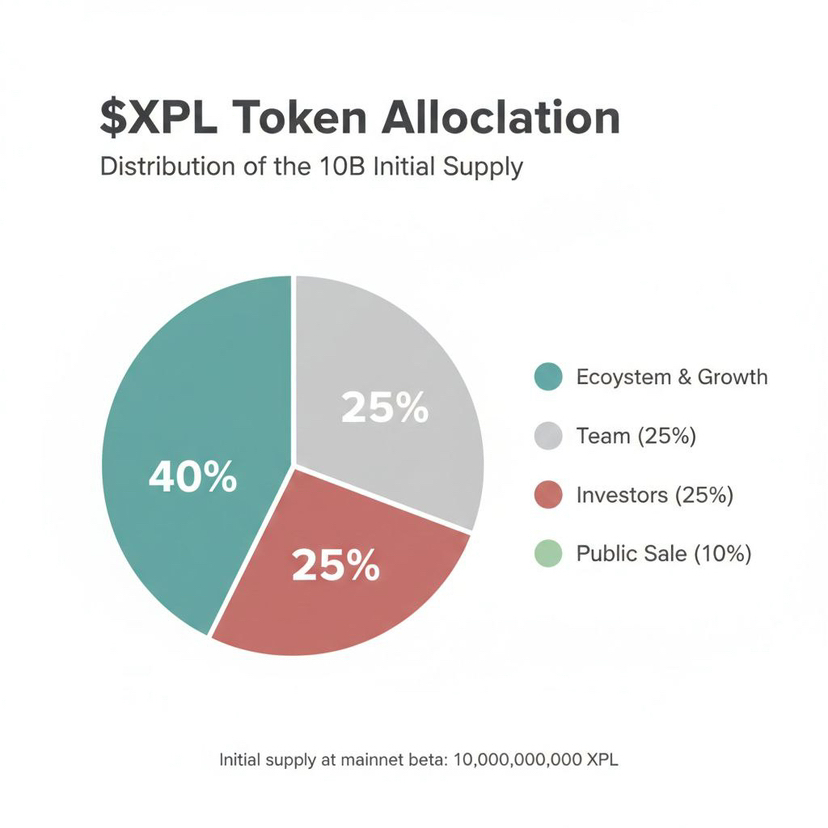

Token distribution happened through a combination of initial allocations to the development team, early investors, and community incentives. The vesting schedules for team and investor tokens extend over multiple years, reducing the risk of sudden supply shocks from early participants exiting their positions. Community incentives encourage liquidity provision, protocol usage, and ecosystem development through various reward programs.

Critics might point out that token economics in crypto often become self-referential, where value derives primarily from speculation rather than underlying utility. Plasma faces this challenge like every blockchain project. The team’s response has been focusing on building genuine utility, increasing network usage, and demonstrating that XPL demand stems from people actually using the platform rather than just trading the token.

Challenges and Growing Pains

No blockchain project evolves without encountering obstacles, and Plasma’s journey includes its share of challenges. Network congestion during periods of high demand revealed that Layer 2 solutions aren’t immune to scalability pressures. When multiple popular applications all experience usage spikes simultaneously, transaction throughput becomes a bottleneck. The team responded with optimizations and infrastructure improvements, but these episodes reminded everyone that scaling is an ongoing process rather than a solved problem.

Security audits uncovered vulnerabilities that required immediate patches, disrupting development roadmaps and forcing the team to reprioritize. While no exploits occurred in production, the discovery of potential attack vectors highlighted how complex blockchain security truly is. Every smart contract integration point, every bridge mechanism, every consensus rule creates potential vulnerabilities that must be identified and addressed before malicious actors discover them.

Liquidity fragmentation poses a persistent challenge for any blockchain ecosystem. When similar applications exist across multiple chains, liquidity splits among them, reducing efficiency for everyone. A lending protocol on Plasma might offer better technology than its Ethereum equivalent, but if the Ethereum version has ten times the liquidity, most users will tolerate higher fees for better trading conditions. Overcoming this fragmentation requires either building substantially superior applications or convincing major protocols to migrate, neither of which happens quickly.

The competitive landscape intensified as established Layer 2 networks matured and new solutions launched. Arbitrum and Optimism gained significant traction with generous incentive programs and ecosystem development support. Alternative approaches like zkSync promised superior technology through zero-knowledge proofs. Plasma had to differentiate itself not just through technical specifications but through community building and developer relations. Standing out in a crowded market requires more than good technology; it demands clear value propositions and sustained ecosystem momentum.

The Developer Experience and Community Building

Plasma’s long-term success depends on attracting developers who choose to build their projects on this infrastructure rather than alternatives. The team invested heavily in developer tools, documentation, and support systems. Comprehensive guides explain how to deploy contracts, interact with the bridge, and optimize for Plasma’s specific characteristics. Code examples demonstrate common patterns and best practices. Testing frameworks help developers catch issues before deploying to production.

Developer grants provided funding for teams building on Plasma, offsetting the opportunity cost of choosing a newer platform over established alternatives. These grants targeted projects that would expand the ecosystem’s capabilities, fill gaps in available applications, or demonstrate innovative use cases. The selection process balanced technical merit with strategic value, prioritizing projects likely to attract users and showcase Plasma’s strengths.

Hackathons and developer conferences created opportunities for the community to gather, share knowledge, and collaborate on new ideas. These events served multiple purposes beyond just generating new projects. They built social connections among developers, created content showcasing Plasma’s capabilities, and provided feedback channels for the core team to understand developer pain points. The most successful projects often emerged not from individuals working in isolation but from teams that formed at these community events.

Educational initiatives targeted developers new to blockchain technology, recognizing that ecosystem growth required expanding the talent pool rather than just competing for existing Ethereum developers. Tutorial series walked newcomers through smart contract development, explaining concepts from first principles. Mentorship programs paired experienced blockchain developers with those just starting their journey. These investments in education wouldn’t pay immediate dividends but represented long-term thinking about sustainable ecosystem growth.

Integration with the Broader DeFi Ecosystem

Plasma’s relationship with the wider cryptocurrency ecosystem evolved from isolated Layer 2 into an interconnected component of multi-chain DeFi. Cross-chain bridges enabled assets to flow between Plasma and other networks beyond just Ethereum. These bridges carried risks, as numerous high-profile exploits demonstrated across the industry, but they also created essential liquidity connections that users demanded.

Major DeFi protocols began deploying on Plasma as multi-chain strategies became standard practice. Rather than committing exclusively to one blockchain, successful projects maintained presences across multiple networks, allowing users to choose their preferred environment. When established protocols like Aave or Curve deployed on Plasma, they brought not just their technology but their brands and user bases, providing instant credibility and liquidity.

Aggregators incorporated Plasma into their routing algorithms, enabling users to access Plasma liquidity without directly interacting with the chain. If someone wanted to swap tokens and the best price happened to exist on Plasma, the aggregator would automatically route through there, abstracting away the complexity of managing multiple chains. This integration made Plasma’s liquidity accessible to the broader DeFi market regardless of where users actually held their assets.

The relationship between Plasma and Ethereum remained foundational despite these multi-chain connections. Every security guarantee ultimately traced back to Ethereum’s consensus layer. Every bridge withdrawal posted proof to Ethereum contracts. This dependence on Ethereum represented both a strength and a constraint. Plasma inherited Ethereum’s security and legitimacy but also its limitations and upgrade timeline. When Ethereum implemented major changes, Plasma had to adapt accordingly.

The Road Ahead and Long-Term Vision

Looking forward, Plasma’s trajectory depends on several evolving factors in the blockchain industry. Ethereum’s continued development influences Layer 2 viability directly. Upcoming upgrades might change how Layer 2 networks post data, potentially reducing their costs or increasing their throughput. Conversely, if Ethereum mainnet becomes more scalable through sharding or other improvements, the value proposition for Layer 2 solutions could shift.

The team’s roadmap includes technical enhancements focused on further reducing costs and increasing capacity. Zero-knowledge technology might eventually augment or replace the current optimistic rollup approach, offering faster finality and better capital efficiency. Such transitions require careful planning since they can’t disrupt existing applications while introducing new capabilities. The balance between innovation and stability becomes more delicate as the ecosystem matures.

Institutional adoption represents a potential inflection point that could dramatically increase Plasma’s usage. If traditional financial institutions begin experimenting with tokenized assets or blockchain-based settlement systems, they’ll need infrastructure that combines performance with security and regulatory compliance. Plasma positions itself as infrastructure capable of supporting these requirements, though converting that potential into actual adoption requires more than just technical capability.

The governance system may evolve as the community matures and stakeholder interests diversify. Early governance focuses primarily on technical parameters, but mature protocols eventually face political and economic decisions that involve trade-offs between competing interests. How Plasma’s governance handles these more complex decisions will reveal whether decentralized decision-making can scale beyond technical committees to something resembling actual democratic governance.

Competition will intensify rather than diminish. The Layer 2 landscape will likely consolidate around a few dominant networks, while niche solutions serve specialized use cases. Plasma’s position in this future hierarchy depends on execution, ecosystem development, and perhaps factors outside anyone’s control like market timing or viral adoption of particular applications. The team appears focused on building regardless of market conditions, a necessary mindset for infrastructure projects that measure success across years rather than quarters.

The Quiet Revolution

Plasma isn’t trying to replace Ethereum or Bitcoin or revolutionize money overnight. It’s infrastructure designed to make existing blockchain applications work better, serving as a practical tool for developers who want to build without worrying constantly about gas optimization. This pragmatic approach lacks the dramatic narrative that drives speculative frenzies, but it might prove more durable than projects built on hype.

The cryptocurrency industry cycles through waves of excitement and disappointment as ambitious visions repeatedly collide with technical reality. Projects that survive these cycles typically do so by delivering tangible value that persists regardless of token price or market sentiment. Plasma’s focus on developer experience and application performance suggests an understanding that long-term success comes from people actually using the technology rather than just talking about its potential.

Years from now, if Plasma succeeds, most users won’t know they’re interacting with it. They’ll simply use applications that happen to run on Plasma infrastructure, enjoying low fees and fast transactions without understanding the technical architecture enabling those benefits. That invisibility would represent the ultimate validation of the project’s original vision: building infrastructure so reliable and efficient that it fades into the background, allowing applications to shine.

The blockchain industry needs more projects willing to do the unglamorous work of building robust infrastructure. Flashy features and ambitious promises attract attention, but sustainable ecosystems rest on foundations of reliable technology that works consistently under diverse conditions. Plasma appears to understand this truth, focusing its energy on engineering rather than marketing. Whether that approach ultimately succeeds remains uncertain, but it represents the kind of serious technical development that actually moves the industry forward.