@Dusk Traders don’t fall in love with block space. They fall in love with certainty. The moments that decide whether a venue becomes “where serious flow goes” aren’t the good days with calm prices. It’s the ugly days: sudden volatility, order books thinning out, spreads widening, and everyone rushing to move collateral at the same time. That’s when a network’s limitations stop being theoretical and start showing up as missed fills, stuck withdrawals, or the quiet dread of not knowing whether your transaction will land in time. Dusk’s decision to talk about a “Lightspeed” Layer 2 is really a decision to talk about trader psychology: what it feels like to act under pressure and still trust the rails.

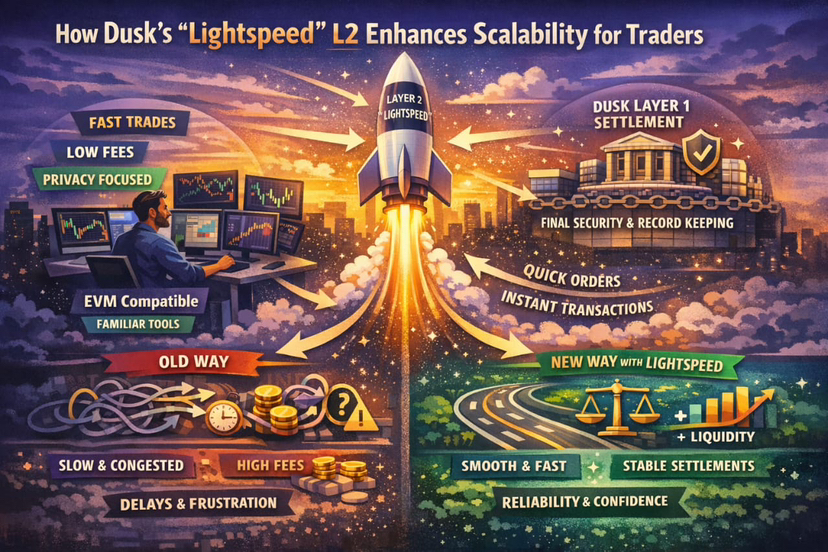

Dusk has been explicit that Lightspeed is an EVM-compatible Layer 2 intended to interoperate with Ethereum while settling back on Dusk’s Layer 1.That single sentence matters because it frames the goal in trader terms. Traders don’t want novelty for its own sake. They want familiar tools, predictable execution, and settlement they can explain to risk teams without hand-waving. “EVM-compatible” speaks to the reality that most trading infrastructure is already built around that execution model, its wallets, its signing flows, its debugging muscle memory. When you lower the cost of switching, you don’t just attract developers. You reduce operational risk for trading desks that have to maintain uptime and answer uncomfortable questions after every incident

Scalability, in this context, isn’t about bragging rights or abstract throughput. It’s about what happens when trade intent becomes trade reality. On a base layer, every interaction competes directly with everything else: transfers, contract calls, administrative actions, bursts of liquidations, arbitrage bots reacting within milliseconds. For traders, congestion isn’t an inconvenience; it’s an execution tax that shows up as slippage and uncertainty. A Layer 2 is a way to separate the “fast loop” from the “final loop.” The fast loop is where traders live: placing orders, rebalancing, moving margin, reacting to price changes. The final loop is where the system proves it all actually happened in the right order, with the right balances, and with the right rules enforced.

That separation changes the emotional texture of trading. When the fast loop is responsive, traders stop overpaying for urgency. They don’t have to spam transactions or inflate fees just to be seen. They can act once, cleanly, and expect the system to respond with something close to real-time feedback. Even if final settlement still has a cadence, the feeling of control comes from the immediacy of acknowledgement and the predictability of inclusion. It’s the difference between driving a car with responsive steering and driving one where the wheel has a half-second delay. Both can eventually turn. Only one feels safe at speed.

For Dusk specifically, Lightspeed is not being positioned as an escape hatch from the Layer 1, but as a layer that still settles on it.That matters for traders because settlement is where arguments get resolved. When a dispute happens—an unexpected liquidation, a contested trade, a margin call that someone claims was unfair—the venue needs a credible “court record.” Settlement on the Layer 1 is the ledger that risk teams, auditors, and counterparties can point to when the story gets messy. Traders don’t always say it out loud, but they trade differently when they believe the record will be clear later. Confidence changes behavior. Fear makes people hoard liquidity and widen spreads

There’s also a quieter point embedded in the way Dusk describes itself: privacy and regulated finance aren’t decorative themes here; they’re core to the network’s identity.Traders understand why that matters even if they never use the word “privacy.” Confidentiality isn’t about hiding wrongdoing; it’s about not broadcasting strategy. It’s about not turning every rebalance into a public signal. In many markets, the moment your intent becomes visible, you pay for it through adverse selection. A scalability layer that’s designed with privacy in mind can reduce the ways traders get punished simply for acting. Dusk Foundation communications have framed Lightspeed as “privacy-friendly” and “fast,” which signals that the team is thinking about throughput and information leakage as one combined problem, not two separate marketing boxes.

Interoperability also has a trader-facing meaning that’s easy to miss. If Lightspeed is meant to interoperate with Ethereum and remain EVM-compatible, the real promise is not “multi-chain” as a slogan. The promise is operational continuity: using known tooling, known signing habits, and known contract patterns while gaining access to Dusk’s settlement environment. For traders, that can translate into faster integration cycles and fewer bespoke pieces that can break at 2 a.m. When markets move, the firms that survive are the ones whose plumbing doesn’t require heroics to maintain.

Why does this feel timely now? Because the market’s expectations have shifted. Traders are no longer impressed by chains that work only when activity is low. The baseline expectation is that the system remains usable during spikes, not after they pass. And in regulated contexts, the pressure is even higher: counterparties and institutions don’t just ask whether the chain can handle volume; they ask whether the chain can handle scrutiny. Dusk has positioned its broader roadmap around making regulated activity feel native on-chain, and Lightspeed sits inside that narrative as the speed layer that doesn’t abandon settlement discipline. It’s also showing up more often in current community discourse and ecosystem commentary, which is why it’s trending as a talking point even before traders can treat it as a finished venue.

The most practical way to judge whether Lightspeed “enhances scalability for traders” is to ignore the word scalability and watch for three things. First, whether transaction experience stays stable when volatility surges: not perfect, just stable enough that strategies don’t need constant fee guessing. Second, whether bridging and settlement feel like a controlled workflow rather than a leap of faith—because traders will accept a slightly slower system if it is predictable, but they won’t accept unpredictability disguised as speed. Third, whether liquidity providers feel safer quoting tighter spreads because they believe execution won’t be interrupted by congestion or uncertainty.

The conclusion is simple and a little unromantic. Lightspeed is Dusk admitting that the Layer 1 can’t be asked to do every job at once, especially if traders are expected to operate in real market conditions. The design intent—EVM familiarity, interoperability, and settlement back to Dusk’s main chain—targets the two things traders care about most: speed in the moment and clarity afterward. If Dusk can translate that intent into a live environment where traders experience fewer stalled actions during stress, fewer surprises in transaction inclusion, and a cleaner settlement story when something goes wrong, then Lightspeed won’t just be a roadmap item. It becomes a behavioral shift: traders stop treating the chain as a risk and start treating it as a place they can actually work.