The promise of decentralized finance has always been hindered by a fundamental limitation: blockchain networks cannot process transactions fast enough or cheaply enough to serve billions of users. While countless projects have attempted to solve this problem, most solutions involve uncomfortable trade-offs between security, decentralization, and performance. Plasma emerges from years of theoretical research and practical experimentation, representing an approach to scaling that preserves the security guarantees people expect from blockchain systems while delivering the performance characteristics necessary for mainstream financial applications. Understanding where Plasma fits in the broader blockchain landscape requires examining not just its current implementation but the evolution of scaling thought that led to its creation.

The Intellectual Origins of Plasma Technology

The concept of Plasma didn’t originate with the current XPL project but traces back to foundational research by Ethereum developers seeking solutions to the network’s obvious scalability constraints. As early as 2017, researchers proposed frameworks where child chains could process transactions independently while periodically committing their state to Ethereum’s main chain for security. This theoretical foundation established principles that would influence scaling solutions for years to come, even though early implementations faced challenges that prevented widespread adoption.

The core insight driving Plasma research was that most transactions don’t need to be immediately visible to the entire network. If two people are trading tokens back and forth, the global Ethereum network doesn’t need to process and validate every individual swap. Instead, those transactions can happen in a separate environment with only periodic checkpoints posted to the main chain. This approach dramatically reduces the load on Ethereum while maintaining the ability to prove transaction validity and recover funds if something goes wrong.

Early Plasma implementations struggled with data availability problems and complex exit mechanisms that made them impractical for real applications. Users needed to monitor the child chain constantly to ensure operators weren’t behaving maliciously, and withdrawing funds required waiting periods measured in weeks. These friction points meant that despite sound theoretical foundations, first-generation Plasma designs never achieved significant adoption. The vision was correct, but the execution needed refinement.

The current Plasma project builds on this theoretical heritage while incorporating lessons from years of Layer 2 experimentation. The team recognized that pure Plasma designs carried trade-offs that limited usability, so they integrated concepts from optimistic rollups and other scaling approaches. This hybrid architecture combines the security model of Plasma with practical improvements that address the usability issues that plagued earlier implementations. The result is infrastructure that feels familiar to users and developers while delivering the performance and cost characteristics that make Layer 2 solutions valuable.

Technical Architecture and Design Decisions

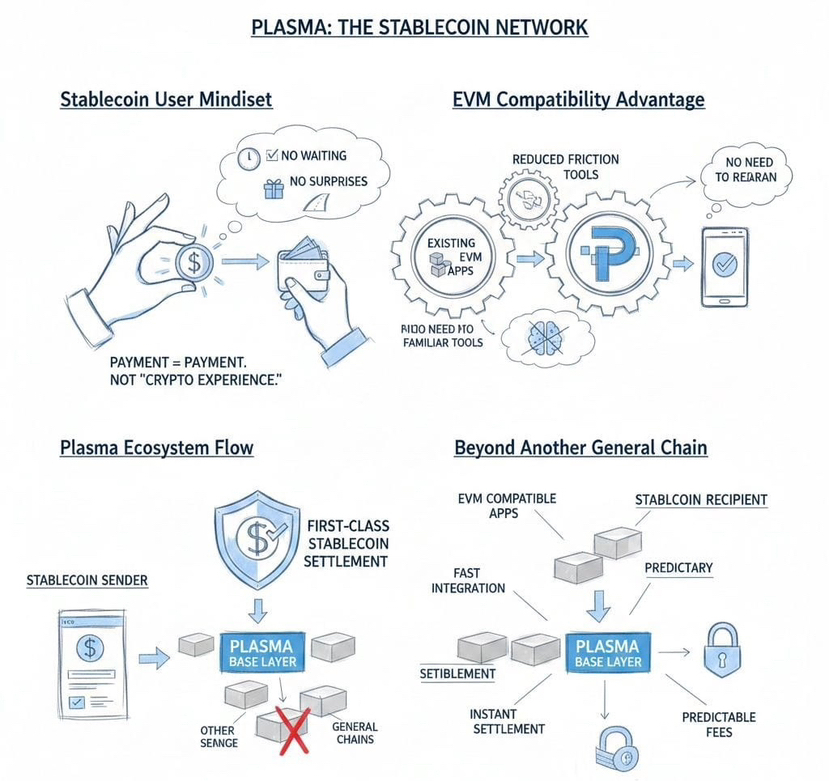

Plasma operates as a Layer 2 scaling solution that processes transactions off the Ethereum main chain while inheriting security from Ethereum’s consensus mechanism. The architecture relies on validators who collect transactions, execute smart contracts, and periodically submit compressed state commitments to Ethereum. These commitments act as checkpoints, allowing anyone to verify that the Layer 2 chain is operating correctly without processing every individual transaction.

The consensus mechanism among validators uses a proof-of-stake model where validators must lock XPL tokens as collateral. This economic security ensures that validators who attempt fraudulent behavior lose their stake, creating strong incentives for honest operation. The validator set rotates periodically, preventing any single group from maintaining long-term control over transaction processing. This decentralization of validation responsibilities distributes trust across multiple independent parties rather than relying on a single operator.

Transaction finality on Plasma happens within seconds, allowing users to see confirmation of their actions almost immediately. This responsiveness matters enormously for applications where users expect instant feedback, whether trading tokens, claiming rewards, or interacting with games. The speed comes from consensus among validators rather than waiting for Ethereum block confirmation, with security ultimately backed by the ability to challenge invalid state transitions on the main chain.

The fraud proof system represents a critical security component, allowing anyone to challenge state commitments that include invalid transactions. If validators attempt to process transactions that violate protocol rules, whether stealing funds or executing contracts incorrectly, observers can submit proof of the fraud to Ethereum. The main chain can then verify this proof and penalize the responsible validators while reverting the invalid state. This mechanism creates a safety net where the system remains secure as long as at least one honest observer monitors validator behavior.

Smart contract execution on Plasma uses an Ethereum Virtual Machine compatible environment, meaning developers can deploy existing Solidity code without modification. This compatibility eliminates one of the biggest barriers to Layer 2 adoption, allowing projects to migrate from Ethereum mainnet or deploy simultaneously on both networks using the same codebase. The development tools, testing frameworks, and deployment processes all work identically, reducing the learning curve for developers exploring Plasma.

Data availability solutions ensure that even if Plasma validators disappeared entirely, users could recover their assets and reconstruct the chain’s state. Transaction data gets published in a format that allows independent verification, either on Ethereum itself or through alternative data availability layers. This guarantee means users don’t need to trust validators with custody of their funds beyond short time windows, maintaining the self-custody principles that make blockchain technology valuable for financial applications.

Building an Ecosystem From Foundation to Functionality

The early days of Plasma’s ecosystem involved attracting pioneering projects willing to experiment with new infrastructure despite limited network effects and unproven performance at scale. These initial applications served as crucial test cases, revealing optimization opportunities and edge cases that theoretical analysis couldn’t anticipate. The feedback from these early builders shaped protocol improvements and helped establish best practices for developing on Plasma.

Decentralized exchanges naturally gravitated toward Plasma because they benefit most directly from reduced transaction costs and increased throughput. Automated market makers could operate with tighter spreads when gas costs didn’t dominate small trades. Liquidity providers enjoyed better capital efficiency as they could rebalance positions more frequently without prohibitive fees. These DEXs weren’t necessarily innovative in their mechanisms, but they demonstrated that familiar DeFi primitives worked smoothly on Plasma’s infrastructure.

Yield farming protocols and lending markets followed, recognizing that lower transaction costs made previously uneconomical strategies viable. Small holders could participate in complex yield strategies that required multiple transactions without fees eroding their profits. Borrowers could manage collateral positions more actively, adjusting to market conditions without excessive costs. The result was a lending ecosystem that felt more responsive and accessible than equivalent applications on Ethereum mainnet.

NFT marketplaces discovered that Plasma’s cost structure enabled new categories of digital collectibles. Projects could mint large collections affordably, making generative art and gaming assets economically viable where they weren’t on expensive Layer 1 networks. Trading volumes increased as collectors could buy and sell items impulsively without calculating whether transaction fees justified the purchase. This accessibility expanded the NFT market beyond high-value art into everyday digital items and in-game assets.

Gaming applications pushed Plasma’s infrastructure in unique ways, with players potentially triggering hundreds of transactions during a single session. Traditional blockchain networks make this impossible due to costs and confirmation times, but Plasma’s performance characteristics enabled genuinely interactive blockchain games. Whether battling other players, trading items, or claiming rewards, gamers could interact with on-chain systems as naturally as they would with traditional game servers.

The diversity of applications building on Plasma revealed that developers viewed it as general-purpose infrastructure rather than specialized for particular use cases. This versatility stems from the EVM compatibility decision and the focus on developer experience. When the barriers to deployment are low and the tools are familiar, developers experiment more freely with bringing their projects to new platforms.

Tokenomics and Network Incentives

XPL functions as the economic engine driving Plasma’s security and operation. Users pay transaction fees in XPL, creating organic demand that scales with network usage. This direct relationship between platform activity and token utility provides clearer value accrual than many crypto projects where token economics feel disconnected from actual usage. As more applications deploy and attract users, XPL consumption increases correspondingly.

Validators stake XPL to participate in consensus, earning rewards from transaction fees and inflationary emissions. This staking mechanism aligns validator incentives with network health and security. Validators profit from honest operation and increased network usage while risking their stake through malicious behavior. The economic penalties for fraud need to exceed potential gains from attacks, ensuring that rational validators choose honest participation over attempting exploits.

The token distribution involved allocations to the development team, early investors, strategic partners, and community incentives. Vesting schedules for team and investor tokens extend across multiple years, reducing supply pressure from early participants liquidating positions. These vesting commitments signal long-term alignment with the project’s success rather than short-term extraction of value.

Governance rights accompany XPL ownership, allowing token holders to vote on protocol parameters and upgrade proposals. This decentralized governance structure theoretically distributes control across the community rather than concentrating it with the development team. In practice, governance participation remains limited to active community members, with most holders never voting on proposals. The mechanism exists for stakeholders who want influence over protocol evolution, even if the majority choose passive holding.

Liquidity mining programs incentivized early adoption by rewarding users who provided liquidity to DEXs or participated in ecosystem applications. These rewards helped bootstrap network effects during the critical early period when limited liquidity and few applications might otherwise have prevented organic growth. The programs have gradually reduced as organic usage increased, transitioning from artificial incentives to genuine utility-driven demand.

Navigating Challenges and Competition

Network congestion during periods of peak demand revealed that even high-performance Layer 2 networks face scalability limits. When multiple popular applications simultaneously experience usage spikes, transaction throughput becomes a constraint. Plasma responded with infrastructure upgrades and optimization, but these episodes demonstrated that scaling is an ongoing process rather than a solved problem. Each capacity increase eventually gets absorbed by growing usage, requiring continuous attention to performance.

Security audits uncovered vulnerabilities that required immediate attention, temporarily disrupting development roadmaps as the team prioritized fixes. While no exploits occurred in production, the discovery of potential attack vectors highlighted the complexity of blockchain security. Every protocol upgrade, every new feature, every integration point creates surfaces that must be examined for vulnerabilities. The team’s response demonstrated commitment to security over feature velocity, but it also revealed how resource-intensive maintaining secure blockchain infrastructure truly is.

The competitive landscape intensified as established Layer 2 networks gained traction and new solutions launched with aggressive ecosystem development strategies. Arbitrum and Optimism attracted major protocols through grants and technical support. Alternative approaches like zkSync promised superior technology through zero-knowledge proofs. Plasma needed to differentiate not just through technical specifications but through community building, developer relations, and strategic partnerships. Standing out requires more than good technology when multiple competent teams are building similar solutions.

Liquidity fragmentation poses a persistent challenge as similar applications exist across multiple chains. A lending protocol on Plasma might offer better technology than its Ethereum equivalent, but if the Ethereum version holds ten times the liquidity, most rational users will choose the more liquid market despite higher fees. Overcoming this fragmentation requires either building substantially superior applications or convincing major protocols to migrate significant portions of their operations. Neither happens quickly in decentralized systems where users and liquidity move gradually rather than all at once.

Regulatory uncertainty casts shadows over all DeFi infrastructure, with the legal status of various protocols and tokens remaining unclear in many jurisdictions. While Plasma itself is neutral infrastructure, the applications building on it often involve financial services that may face regulatory scrutiny. The team cannot control how regulators interpret and apply laws to blockchain systems, creating uncertainty that could impact ecosystem development regardless of technical merit.

Developer Experience and Community Growth

Plasma invested heavily in developer tools and documentation, recognizing that ecosystem growth depends on making the platform approachable for builders. Comprehensive guides explain how to deploy contracts, interact with bridges, and optimize for Plasma’s specific characteristics. Code examples demonstrate common patterns for everything from token launches to complex DeFi protocols. Testing frameworks help developers catch issues before deploying to production, reducing the risk of costly mistakes on live networks.

Developer grants provided funding for teams building ecosystem-expanding applications. These grants targeted projects that would fill gaps in available functionality, demonstrate innovative use cases, or attract users from other ecosystems. The selection process balanced technical merit with strategic value, prioritizing projects likely to succeed and contribute meaningfully to Plasma’s growth. Grant recipients often became community champions, sharing their experiences and helping subsequent builders navigate platform-specific considerations.

Hackathons created concentrated periods of building activity where developers could experiment with Plasma while competing for prizes and recognition. These events generated new projects while building social connections among community members. The most successful applications often emerged from teams that formed at hackathons, combining complementary skills and perspectives. Beyond just producing new projects, hackathons created content showcasing Plasma’s capabilities and provided direct feedback channels for the core team to understand developer pain points.

Educational initiatives targeted developers new to blockchain technology, recognizing that ecosystem growth required expanding the talent pool rather than just competing for existing Ethereum developers. Tutorial series walked newcomers through smart contract fundamentals, explaining concepts from first principles rather than assuming prior blockchain knowledge. Mentorship programs paired experienced developers with those beginning their blockchain journey, creating relationships that accelerated learning and increased retention of new community members.

Integration Within the Multi-Chain Landscape

Plasma’s relationship with the broader cryptocurrency ecosystem evolved from an isolated Layer 2 into an interconnected component of multi-chain DeFi. Cross-chain bridges enabled assets to flow between Plasma and other networks, creating liquidity connections that users increasingly demanded. These bridges carried inherent risks, as numerous high-profile exploits across the industry demonstrated, but they also provided essential functionality for users managing assets across multiple chains.

Major DeFi protocols deployed on Plasma as part of multi-chain strategies that became standard practice for successful applications. Rather than committing exclusively to one blockchain, projects maintained presences across multiple networks, allowing users to choose their preferred environment. When established protocols deployed on Plasma, they brought not just technology but brands and user bases, providing instant credibility and attracting liquidity that might otherwise have taken years to accumulate organically.

Aggregators incorporated Plasma into their routing algorithms, enabling users to access Plasma liquidity without directly interacting with the chain. If the best price for a token swap existed on Plasma, the aggregator would automatically route through there, abstracting away the complexity of managing multiple chains. This integration made Plasma’s liquidity accessible to the broader DeFi market regardless of where users held their assets or which interfaces they preferred.

The foundational relationship with Ethereum remained critical despite these multi-chain connections. Every security guarantee ultimately traced back to Ethereum’s consensus layer. Every withdrawal from Plasma posted proof to Ethereum contracts that could be verified by anyone. This dependence represented both strength and constraint. Plasma inherited Ethereum’s security and legitimacy but also its limitations and upgrade timeline. When Ethereum implemented major changes, Plasma had to adapt accordingly, maintaining compatibility while preserving its own technical roadmap.

The Long View on Plasma’s Future

Looking ahead, Plasma’s trajectory depends on several interconnected factors in the rapidly evolving blockchain industry. Ethereum’s continued development directly influences Layer 2 viability through changes in data availability, gas costs, and security assumptions. Upcoming upgrades might reduce Layer 2 operating costs or increase their throughput. Conversely, if Ethereum mainnet becomes significantly more scalable through sharding or other improvements, the value proposition for Layer 2 solutions could shift in ways that require strategic adaptation.

The technical roadmap includes enhancements focused on further reducing costs and increasing capacity. Zero-knowledge technology might eventually augment or replace optimistic rollup mechanisms, offering faster finality and better capital efficiency. Such transitions require extraordinary care since they cannot disrupt existing applications while introducing new capabilities. The balance between innovation and stability becomes more delicate as ecosystems mature and more projects depend on infrastructure remaining reliable and predictable.

Institutional adoption represents a potential inflection point that could dramatically increase usage. If traditional financial institutions experiment with tokenized assets or blockchain-based settlement systems, they will need infrastructure combining performance with security and regulatory compliance. Plasma positions itself as capable of supporting these requirements, though converting potential into actual adoption requires more than just technical capability. It demands relationships, compliance frameworks, and user experiences that meet institutional standards.

The governance system may evolve as the community matures and stakeholder interests diversify. Early governance focuses primarily on technical parameters, but mature protocols eventually face political and economic decisions involving trade-offs between competing interests. How Plasma’s governance handles these complex decisions will reveal whether decentralized decision-making can scale beyond technical committees to something approaching genuine democratic governance of critical infrastructure.

Competition will intensify rather than diminish as the blockchain industry matures. The Layer 2 landscape will likely consolidate around a few dominant networks while niche solutions serve specialized use cases. Plasma’s position in this future hierarchy depends on execution quality, ecosystem development, and perhaps factors outside anyone’s control like market timing or viral adoption of particular applications. The team’s focus on building regardless of market conditions suggests understanding that infrastructure projects measure success across years rather than quarters.

Building for Tomorrow’s Users

Plasma isn’t attempting to revolutionize blockchain technology or replace existing financial systems overnight. It’s infrastructure designed to make decentralized applications work better, serving as practical tooling for developers who want to build without constantly optimizing for gas costs or worrying about network congestion. This pragmatic approach lacks the dramatic narrative that drives speculative frenzies, but pragmatism often proves more durable than hype when measured over years rather than months.

The cryptocurrency industry cycles through waves of excitement and disappointment as ambitious visions collide with technical reality. Projects surviving these cycles typically do so by delivering tangible value that persists regardless of token price or market sentiment. Plasma’s focus on developer experience and application performance suggests understanding that long-term success comes from people actually using the technology rather than just trading tokens or discussing potential.

Years from now, if Plasma succeeds, most users won’t know they’re interacting with it. They’ll simply use applications that happen to run on Plasma infrastructure, enjoying low fees and fast transactions without understanding or caring about the technical architecture enabling those benefits. That invisibility would represent ultimate validation of the project’s vision: building infrastructure so reliable and efficient that it fades into the background, allowing applications to shine rather than the underlying platform.

The blockchain industry needs more projects willing to do unglamorous work of building robust infrastructure that functions consistently under diverse conditions. Flashy features and ambitious promises attract attention, but sustainable ecosystems rest on foundations of reliable technology. Plasma appears to understand this truth, channeling energy into engineering rather than marketing. Whether that approach ultimately succeeds remains uncertain, but it represents the kind of serious technical development that actually moves the industry forward rather than just generating headlines and speculation.