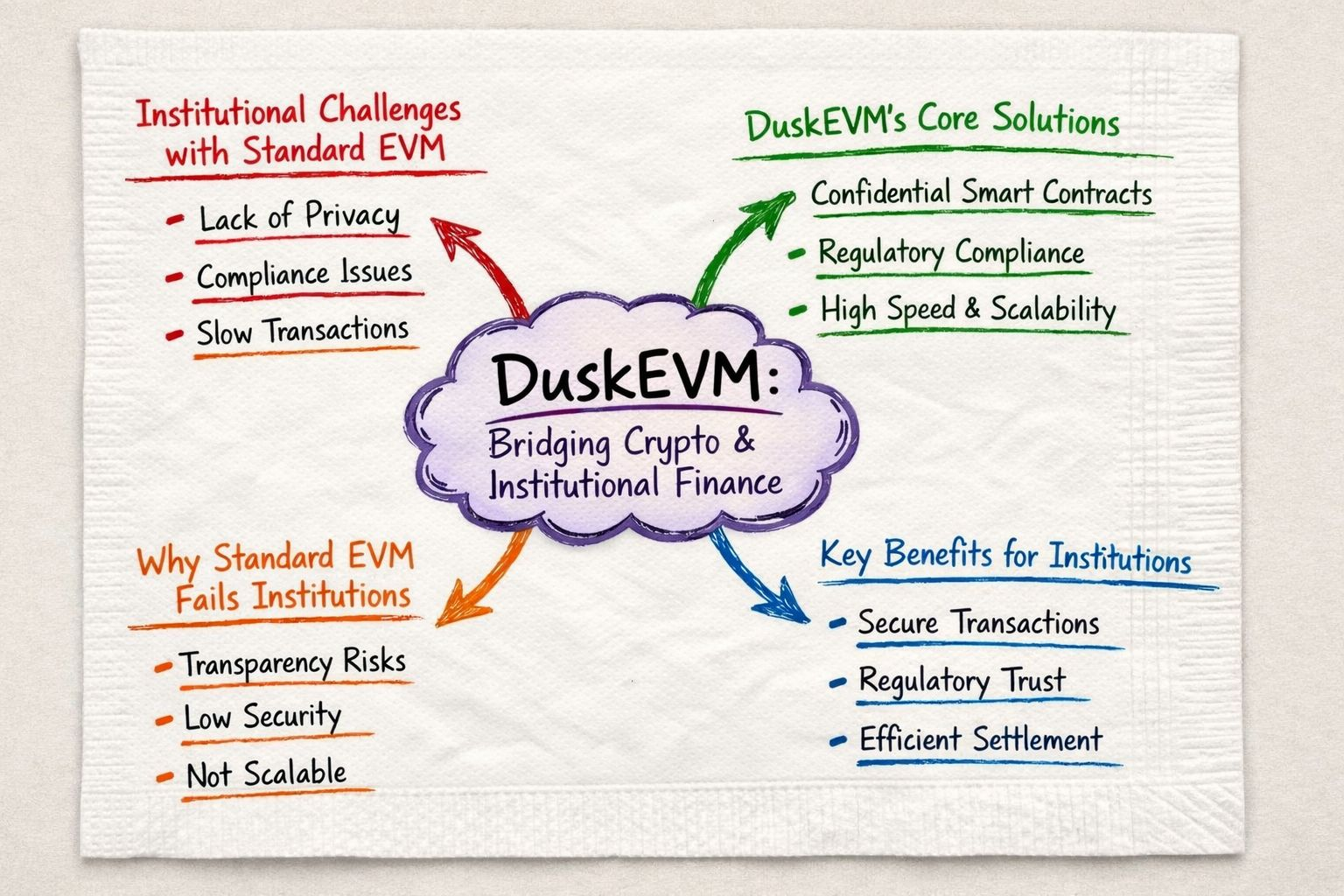

For years, “EVM compatibility” in crypto has been seen as the key to success. The idea is that if a blockchain supports Ethereum smart contracts, developers will join, money will follow, and big institutions will eventually feel safe to participate. But this idea falls apart when we think about what institutions need compared to what standard EVM chains offer.

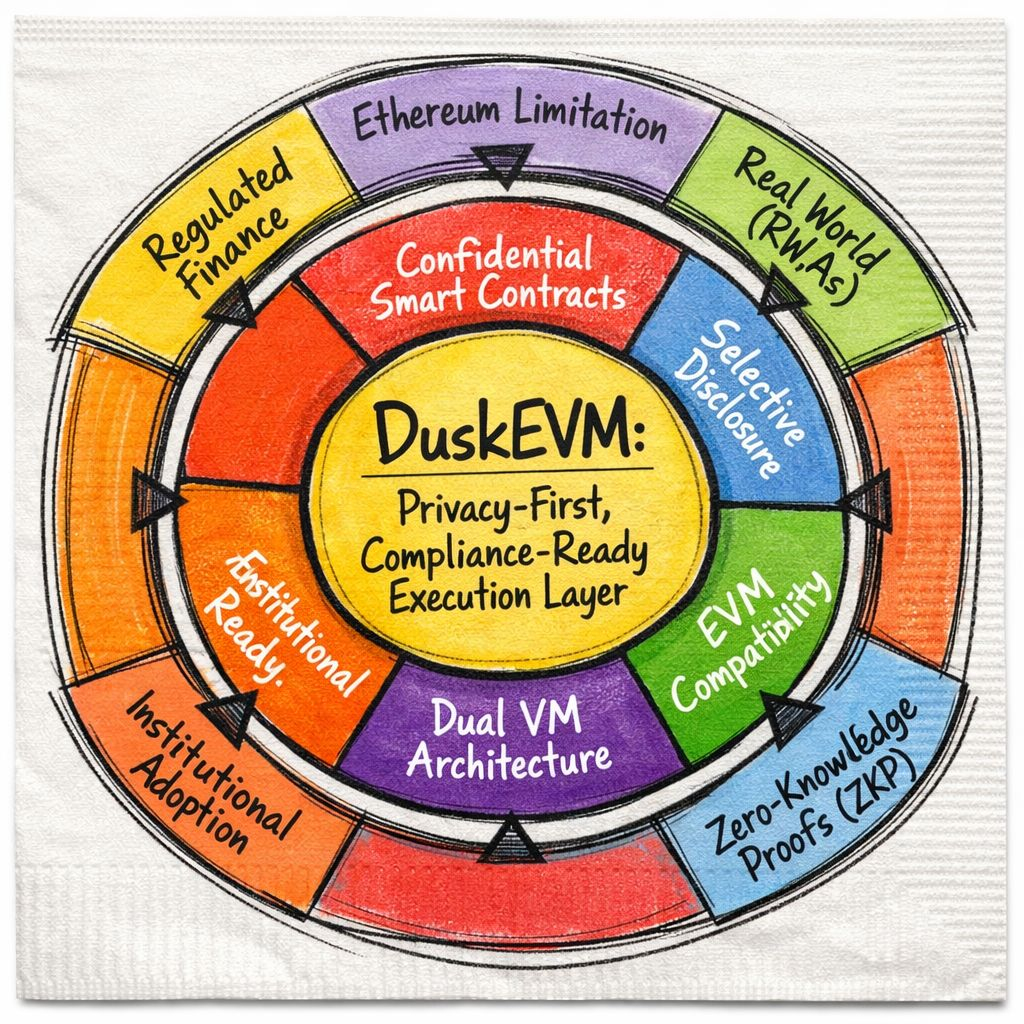

That's where Dusk Network comes in. It's not just another EVM copy, but a subtle argument against the idea that compatibility alone makes a system ready for real-world finance.

Let's be real

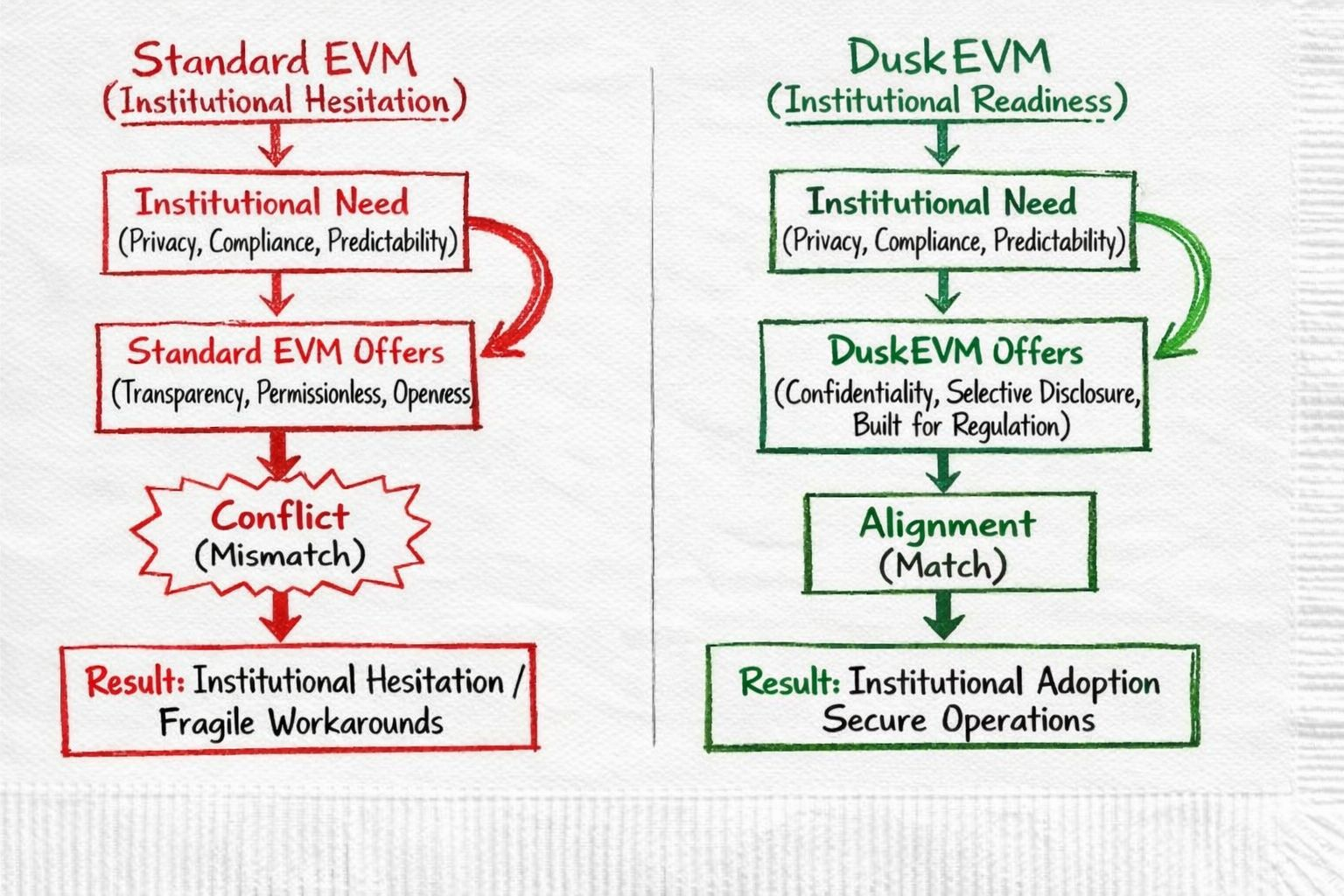

Institutions don't adopt technology just because it's trending. They adopt it because it lowers risk, fits with regulations, and works with their current setups. Most EVM chains, even the fast and cheap ones, were not created with these things in mind. They were made for openness and innovation without permission. These qualities are strengths but also weaknesses for use by institutions.

The first problem is transparency. On a standard EVM chain, everything is public by default: balances, who's involved, how transactions work, and contract details. Regular users and DeFi projects might be okay with this, but it's a deal-breaker for institutions. Financial companies cannot show their sensitive positions, trading methods, or customer data on a public record. Privacy is essential.

Many EVM chains try to fix this with outside solutions or tricks. However, these are just temporary fixes. Institutions want assurances, not clever hacks. If privacy isn't built into the system, it's unstable and risky.

The second issue is compliance. Institutions must follow strict rules. They must prove who can transact, under what conditions, and how much they reveal. Standard EVM chains are intentionally neutral and open. That's a strong idea, but it clashes with regulated settings.

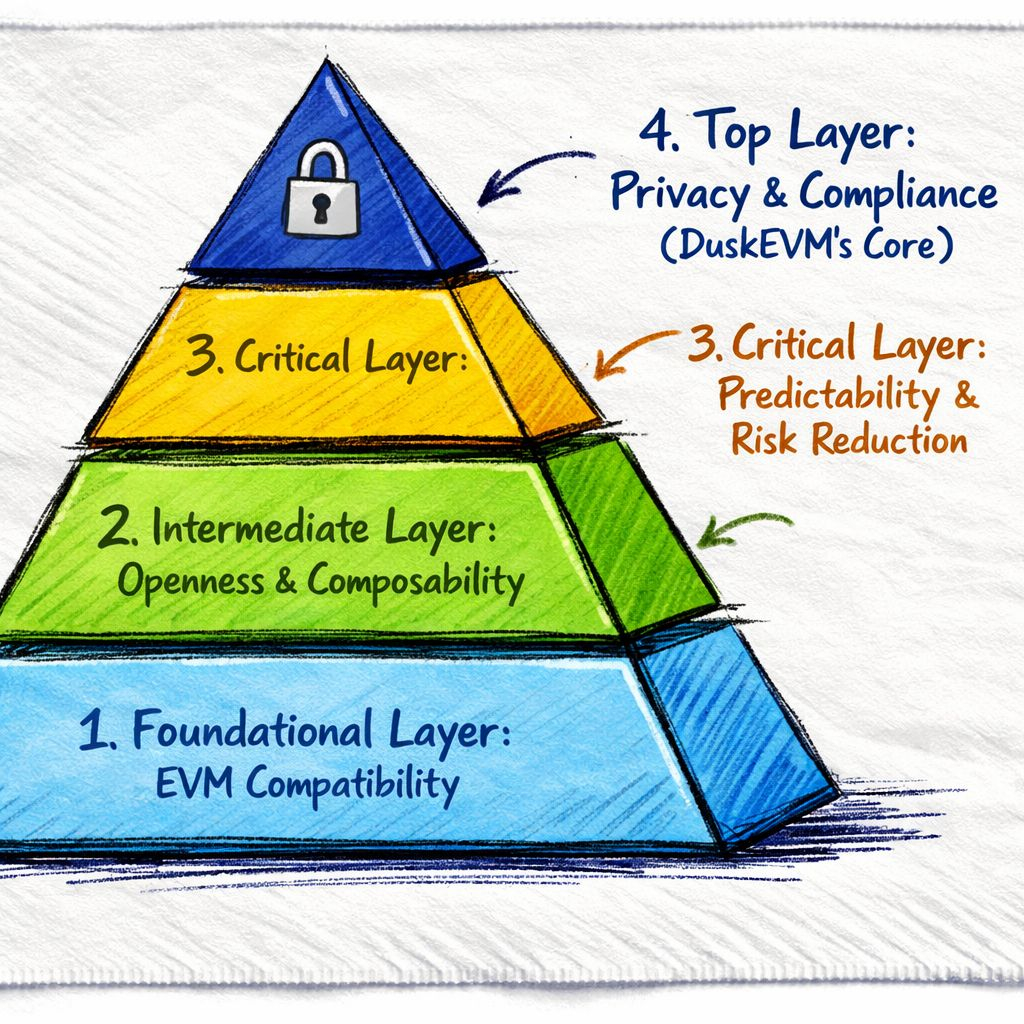

EVM compatibility makes it simple to use existing smart contracts, but it doesn't address following rules at the basic level. You still need ways to enforce rules, limit access, and selectively share info with regulators without making everything public. Most EVM chains just weren’t designed for this balancing act.

Then, there's what can be expected

Institutions don't care as much about hype. They care more about understanding risk. They need predictable execution, costs, and results. Gas costs that change a lot, MEV issues, and unclear validator actions might be okay for crypto users, but they create too much uncertainty for institutions. EVM compatibility doesn't solve these problems; it often includes them.

Dusk's point is that institutions need more than just Ethereum-style tools. They need a system that assumes regulation, privacy, and accountability from the start. That's why ideas like private smart contracts and selective information sharing are important. They allow institutions to use blockchain tech without ignoring the rules they follow in the real world.

It’s worth noting that this doesn't mean institutions want fully private systems either. Regulators still need to see things. Auditors still need access. The challenge is being able to show the right information to the right people at the right time. Standard EVM chains are all or nothing when it comes to transparency. That's too simple for how institutional finance works.

So, when people say, “Institutions will come once everything is EVM-compatible,” it's important to challenge that. Compatibility helps developers, not institutions' fears. It lowers the cost to start, not the risk.

Dusk’s thinking points to a harder truth: if a blockchain isn’t designed with institutional needs in mind from the start, EVM compatibility won't make it suitable. For institutions, the question isn’t “Can we use our contracts here?” It’s “Can we operate here without breaking the rules?”

And on most EVM chains, the answer is still no.