As the prospect of Kevin Warsh taking the helm of the Federal Reserve in May 2026 becomes a central theme for the markets, investors are grappling with a profound shift in monetary philosophy. While markets generally dislike uncertainty, they are even more wary of "structural ruptures." Warsh does not represent a status quo transition; he signals a doctrinal revolution at the world’s most powerful central bank.

1. The Warsh Doctrine: Moving Beyond "Data Dependency"

Kevin Warsh’s primary critique of the current Federal Reserve is that it has become an overly bureaucratic institution, too predictable, and dangerously tethered to backward-looking indicators.

Against "Rearview Mirror" Policy: Warsh criticizes Jerome Powell’s tendency to wait for every tenth of a percentage point of inflation to be confirmed before acting. In Warsh’s view, the Fed should be proactive and anticipatory rather than reactive.

The AI-Driven Productivity Thesis: Unlike traditional models that fear growth inherently fuels inflation, Warsh argues that Artificial Intelligence is driving a massive productivity boom. He believes this allows for aggressive rate cuts without reigniting price spirals.

Balance Sheet Normalization: This is the most contentious point for Wall Street. Warsh advocates for a drastic reduction of the Fed's balance sheet (Quantitative Tightening). He believes the central bank should no longer act as the "buyer of last resort" for U.S. debt.

2. Why This Week’s Correction is Directly Linked to Him

The recent market turmoil—marked by a sharp sell-off in precious metals and bonds—is the result of the market attempting to "price in" the Warsh enigma.

The Commodities Shock: Silver recently suffered its worst trading session in decades. This is largely because Warsh is perceived as a "Strong Dollar" advocate. A resurgent USD mechanically exerts downward pressure on dollar-denominated commodities.

The Long-End Rate Paradox: While he may favor lower policy rates to satisfy pro-growth mandates, his desire to shrink the Fed’s balance sheet pushes long-term bond yields higher. This creates a volatile environment: lower short-term rates but surging long-term borrowing costs.

The End of the "Fed Put": Investors fear that Warsh will abandon the practice of bailing out the market at the first sign of a 5% dip. He represents a move away from the systematic "support doctrine" of the Powell era.

3. Why the Downward Pressure May Persist

The market has entered a "repricing" phase that is unlikely to resolve quickly for three key reasons:

The Hawk-Dove Hybrid: Warsh is difficult to categorize. Historically an inflation hawk, he now advocates for rate cuts to stimulate the "supply side." This ambiguity creates extreme volatility as the market struggles to forecast his true policy path.

Institutional Overhaul: Warsh supports a fundamental review of Fed governance. The prospect of reduced institutional independence—or at least a shift in its relationship with the Treasury—is prompting institutional investors to reduce risk exposure.

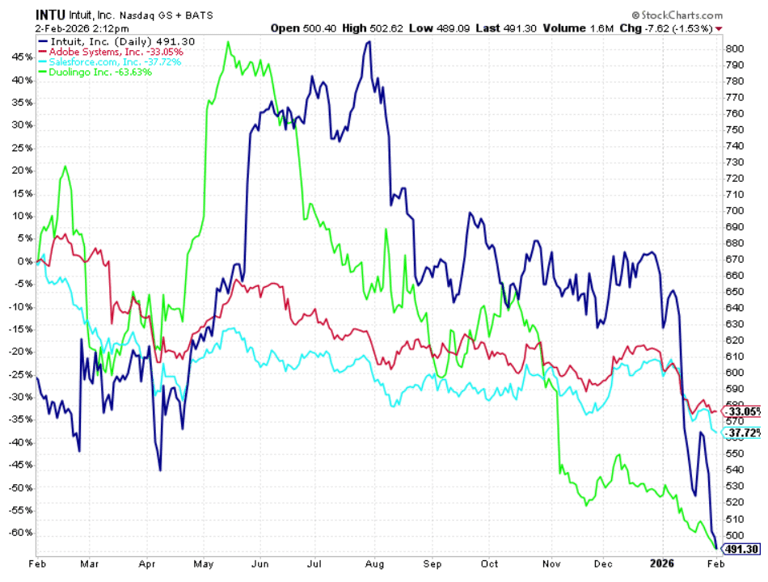

Liquidity Extraction: If Warsh follows through on reducing the Fed's liquidity injections, sectors that flourished under "easy money"—specifically Big Tech and Cryptocurrencies—will have to adjust their valuations to a much leaner economic reality.

The Bottom Line: This week's correction is more than just profit-taking; it is the financial world adjusting to the end of an era. Kevin Warsh represents the transition from a "Protective Fed" to a "Reformist Fed."