Bitcoin has come a long way since its inception in 2009. From a niche experiment in digital cash to the flagship of the entire cryptocurrency ecosystem, $BTC has continually proven its resilience and ability to capture the attention of investors worldwide. Early adopters saw it as a decentralized alternative to traditional finance, while institutions now recognize it as a legitimate asset class and a hedge against systemic risk.

Historical Price Movement: From Peaks to Pullbacks

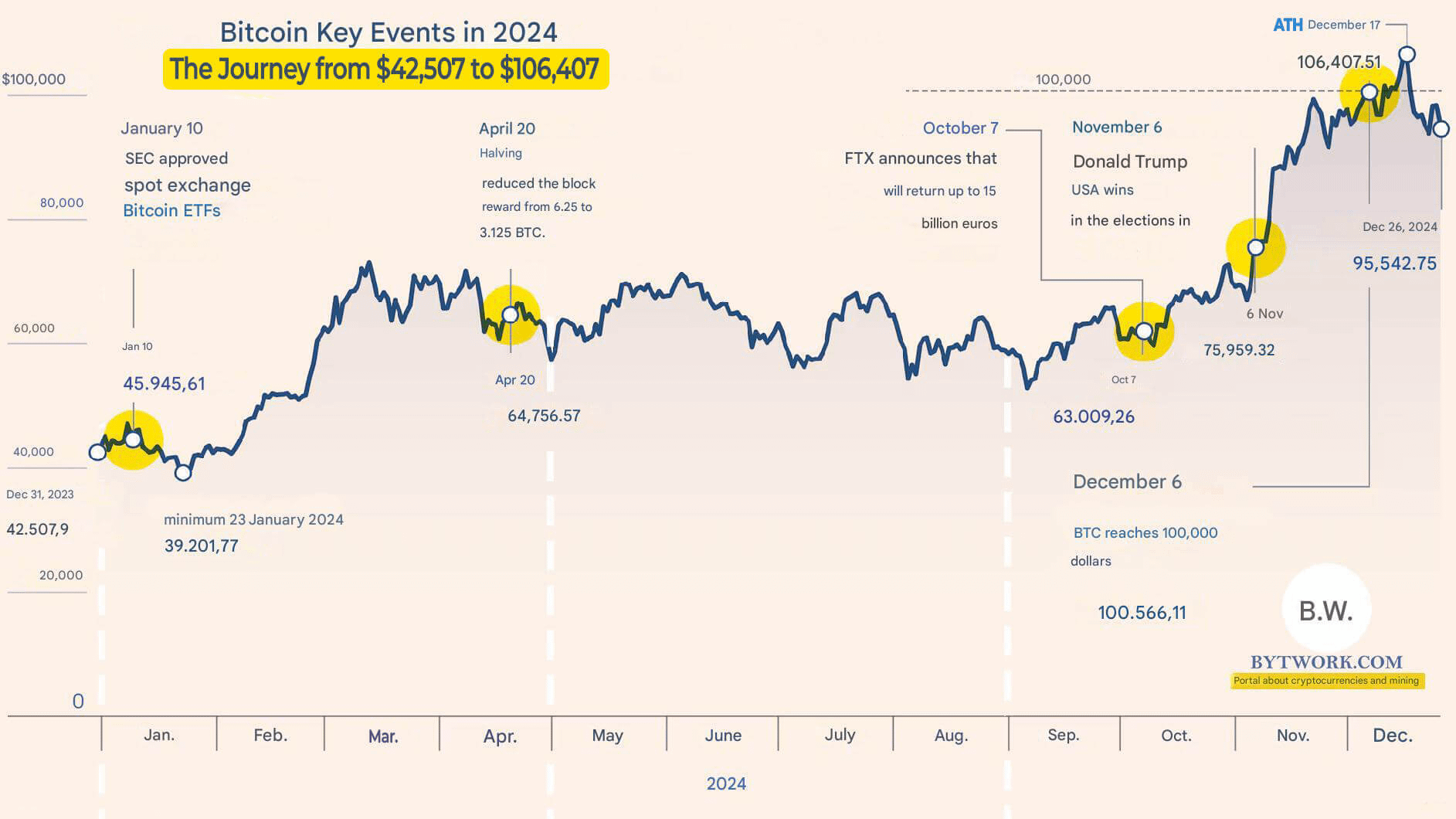

#Bitcoin price journey has been marked by cycles of explosive growth followed by sharp corrections. From its early single-digit dollars to the $1,000 milestone in 2013, then the historic $20,000 surge in late 2017, BTC has repeatedly demonstrated its capacity for rapid appreciation. The 2021 bull run took BTC to an all-time high above $68,000, and while subsequent corrections shook many retail investors, the long-term trend remained intact.

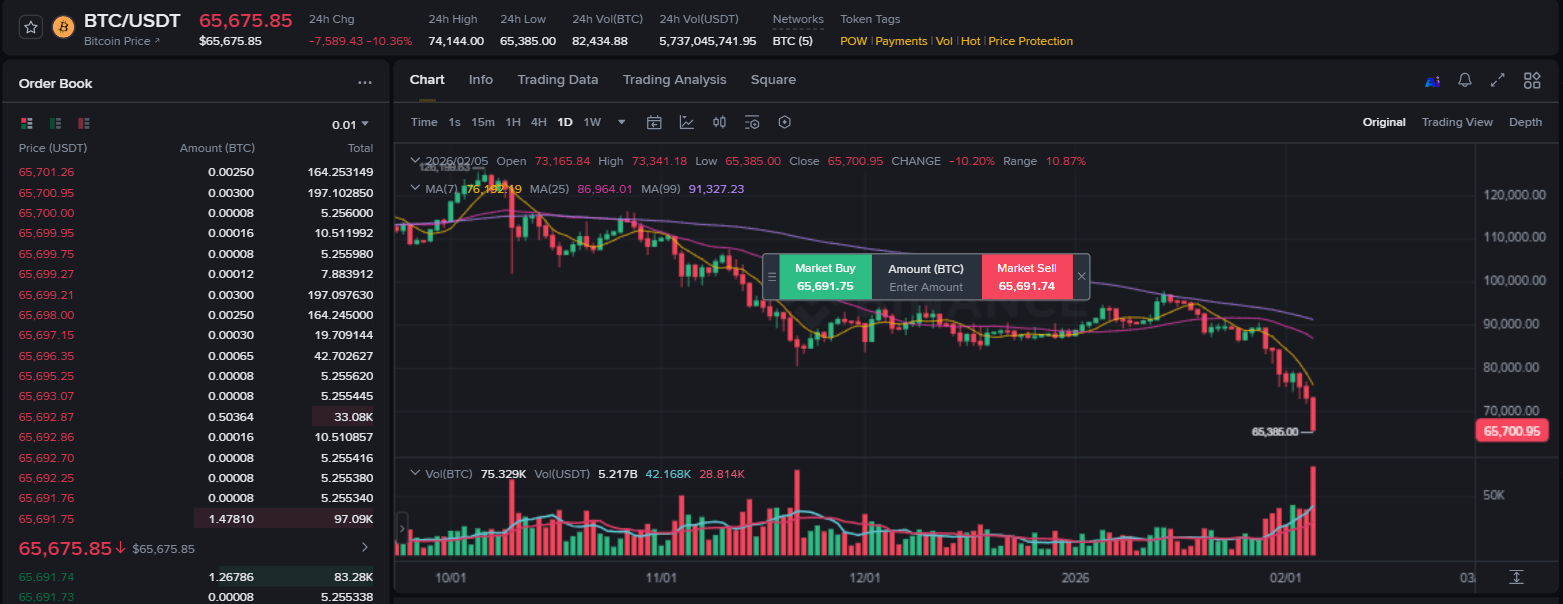

currently, BTC has retraced back to the $65,000 level, a price that signals both market strength and consolidation. Historically, Bitcoin has used these pullbacks as springboards for its next leg up. Looking at previous cycles, these retracements are often followed by renewed institutional interest, increased adoption, and technological upgrades that reinforce confidence in the network.

Analytical Perspective: Why BTC Could Bounce Back Stronger

Several factors suggest that BTC is well-positioned to regain momentum:

Market Cycles: Bitcoin’s four-year halving cycle has historically coincided with bull runs. The current macroeconomic environment, combined with renewed investor interest, sets the stage for the next potential upward phase.

Institutional Adoption: More companies, funds, and even governments are exploring BTC exposure. With growing acceptance in the financial system, demand dynamics remain strong.

Network Strength: Bitcoin’s fundamentals—hash rate growth, active addresses, and transaction volumes—remain robust. A healthy network supports long-term price appreciation.

Macro Tailwinds: Geopolitical uncertainty, inflation concerns, and digital gold narratives continue to position BTC as a preferred store of value for a new generation of investors.

Looking Ahead: Key Levels to Watch

While $65,000 serves as a critical support level, the market will be closely watching whether BTC can reclaim previous highs and break past resistance zones. A sustained move above $68,000 could signal the start of a new bullish cycle, while consolidation around $60,000–$65,000 would indicate healthy accumulation before the next surge.

Conclusion

Bitcoin’s journey from a niche experiment to a mainstream financial asset has been nothing short of extraordinary. Historical patterns and current market dynamics suggest that BTC’s retracement to $65,000 may not be a setback but a strategic pause. For traders and investors, understanding these cycles, monitoring adoption trends, and analyzing network fundamentals can provide clarity in anticipating BTC next move.