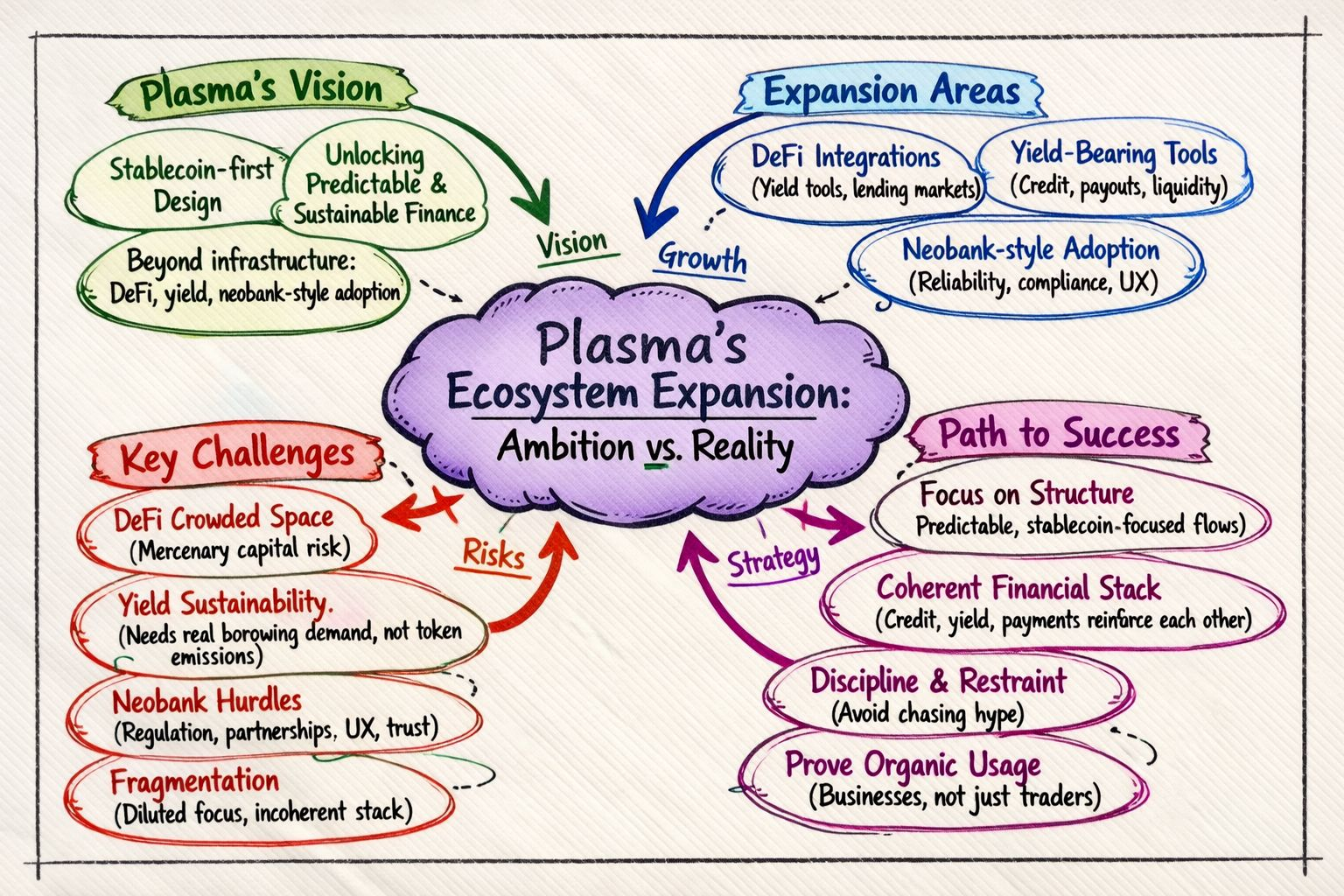

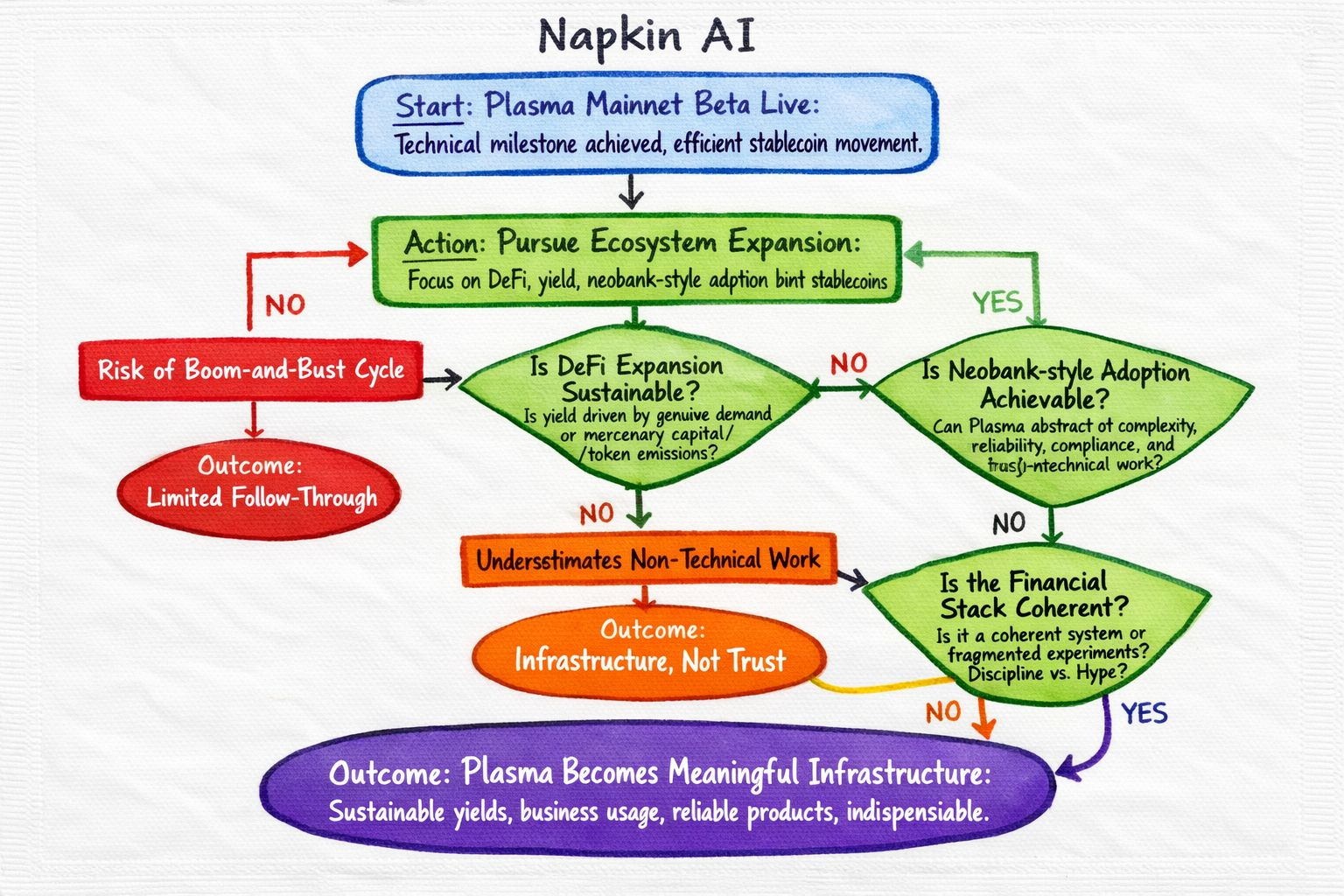

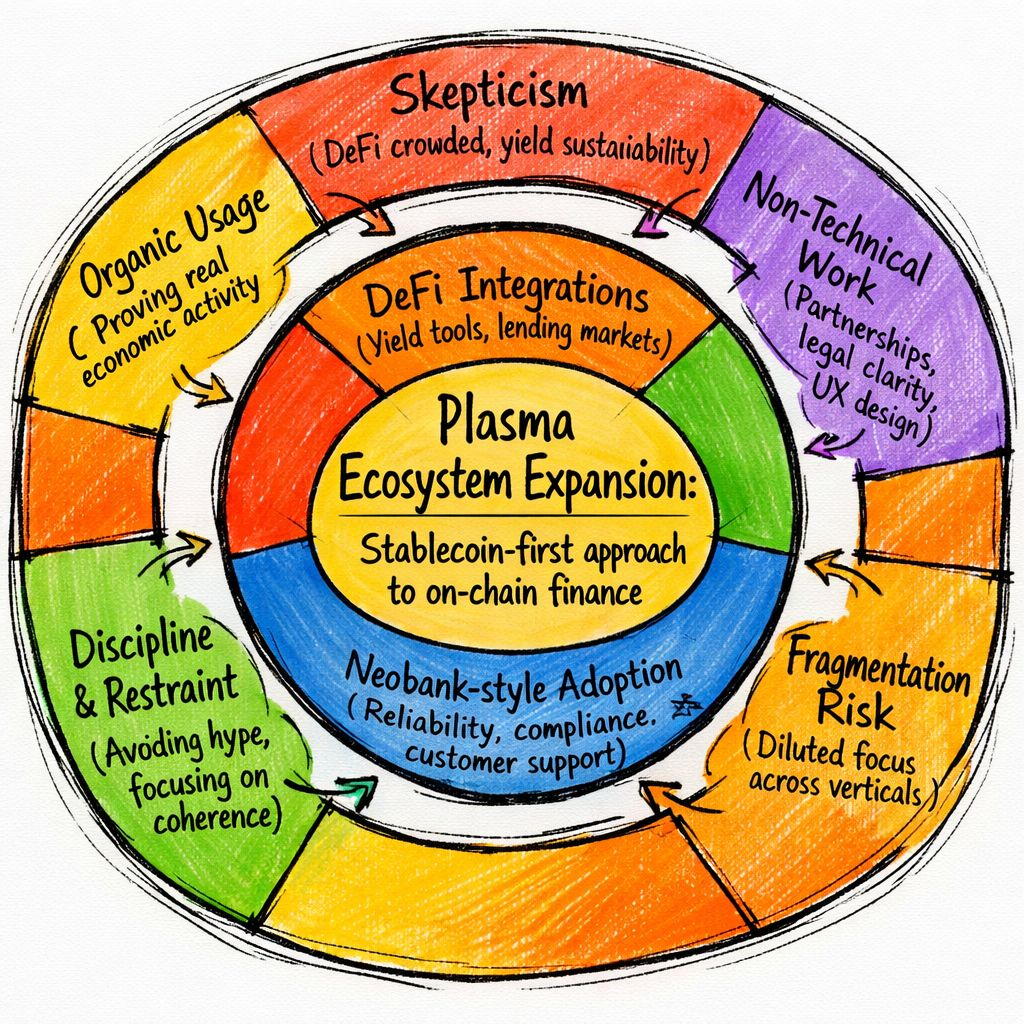

In the crypto space, the idea of ecosystem expansion gets thrown around a lot, but it's rarely examined closely. Almost every project says they're moving beyond just the basics to include things like decentralized finance (DeFi), ways to earn yield, and real-world applications. Plasma is now at this stage, talking more and more about DeFi tie-ins, tools for earning yield, and even adoption similar to online banks using stablecoins. It's an ambitious idea, but is it possible?

Looking at Plasma's plan, it seems logical at first. Stablecoins aren't just for trading anymore; they're becoming the foundation of online finance. Payments, payouts, credit, managing finances stablecoins are already popular in these areas. Plasma is betting that if you build an ecosystem focusing on stablecoins, instead of treating them as an afterthought, you can have more predictable and long-lasting financial activity.

But it's good to be doubtful

Expanding into DeFi sounds nice, but DeFi isn't new anymore. Yield tools, lending platforms, and incentives for providing liquidity are common. Many chains have learned that yield without real demand quickly falls apart as people chase the best deals. If Plasma's DeFi part is mainly based on incentives instead of real use, it could repeat the same boom-and-bust cycle seen in other ecosystems.

The more interesting claim isn't about yield, it's about structure. Plasma is aiming for predictable, stablecoin-focused financial activity instead of risky speculation. This should create a more stable environment for businesses and institutions. But it needs careful risk management, realistic plans, and self-control – qualities that aren't always rewarded in crypto.

Yield tools linked to stablecoins can be useful, but only if there's real demand to borrow. Artificially high yield that's paid for by creating new tokens is easy to start but hard to keep going. The challenge for Plasma in 2026 will be showing that its yield comes from real economic activity: credit use, managing finances, or liquidity related to payments – not just recycled incentives.

Then there's the online bank idea

Crypto has been toying with online banking for years. Some projects focused too much on the branding, only to learn that banks are regulated for a reason. Becoming like an online bank means being reliable, following the rules, having customer support, and being clear about regulations things many blockchain ecosystems struggle with.

Plasma's focus on stablecoins gives it a better chance than most. Stablecoins already act like digital dollars, and businesses are getting more comfortable using them. But building something that feels like an online bank means hiding the complicated stuff, not showing it. Users don't want to worry about gas fees, bridges, or wallet security when handling payroll or managing funds.

This is where the doubt gets stronger. Chains built on infrastructure often don't realize how much non-technical work is needed for adoption. Partnerships, legal clarity, user experience, and long-term promises are more important than fast transaction times. Plasma can allow online bank-like products, but it may not control whether people trust those products.

Another concern is spreading focus too thin. Trying to expand into DeFi, yield, and online bank use cases at the same time can weaken focus. Each area has different users, risks, and ways to measure success. Doing all of them well enough is harder than doing one of them very well. The question is: is Plasma building a financial system that fits together, or just a bunch of separate experiments?

To Plasma's benefit, its focus on stablecoin economics suggests it wants things to fit together. Credit, yield, and payments can support each other if they're designed as part of the same system. But this doesn't happen automatically. It needs discipline – especially when things are going well and there's pressure to follow the latest trends.

In the end, Plasma's expansion plans for 2026 should be judged less by what they announce and more by what they do. Is the yield sustainable without constant incentives? Are the DeFi tools used by businesses, not just traders? Are the online bank-like products simple, reliable, and quietly useful?

If the answer is yes, Plasma could find a meaningful place in stablecoin finance. If not, it could become just another chain with good ideas and limited results. In crypto, ambition is common. Doing things well – and knowing when to hold back – is rare.