Vanar Chain moves into 2026 with a level of execution that feels rare in Web3. Instead of chasing headlines, the network is rolling out core systems that directly translate into usage, revenue, and retention. With the full Kayon reasoning layer live, AI subscriptions activated, and the VGN gaming network expanding by 12 new cooperative titles, Vanar has shifted clearly from proving infrastructure to scaling real demand. While $VANRY trades near the $0.006 to $0.008 range with a steady market cap around $13 to $18 million, what stands out to me is not price action but how consistently the ecosystem is converting development into measurable activity. This is starting to look less like an experiment and more like an operating system for AI driven Web3.

Kayon Reasoning Brings Intelligence On Chain

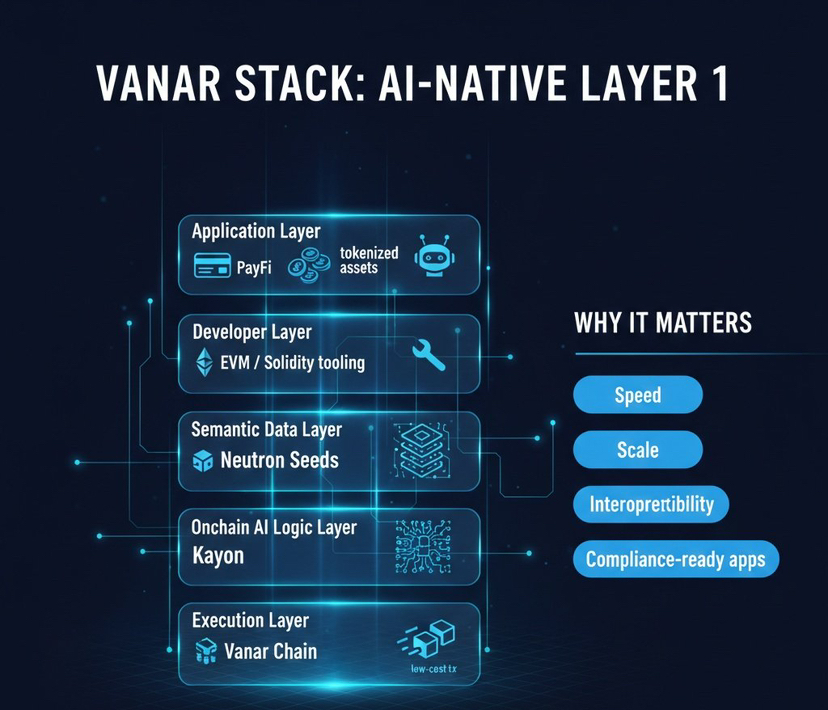

Kayon is the most meaningful leap Vanar has made so far. It turns smart contracts from static rule sets into systems that can evaluate context, apply logic, and act automatically. Instead of hard coding endless conditions, developers can now describe intent in natural language. When I see examples like validating a multi million dollar invoice against regional tax rules and settling it instantly, it becomes obvious how far this goes beyond traditional DeFi automation.

Kayon works by querying Neutron Seeds, checking live blockchain state, and applying rule sets that span dozens of jurisdictions. The output is produced in seconds, fully auditable, and executed on chain for a fixed fee equivalent to $0.0005. That predictability matters. Enterprises do not want surprise costs when volumes rise, and Vanar’s flat pricing removes that uncertainty completely. Unlike off chain AI services, every decision Kayon makes can be traced and verified, which is why regulated businesses are paying attention.

The introduction of AI subscription tiers in early 2026 is just as important. Enterprises pay in $VANRY for higher reasoning capacity, advanced compliance checks, and more complex workflows. Part of that spend is burned, part rewards stakers, and part funds development. As I look at this structure, it feels sustainable because demand for reasoning grows alongside usage. The more companies automate trust, the tighter the token dynamics become.

VGN Network Turns Gaming Into a Growth Engine

Gaming continues to be Vanar’s fastest adoption channel, and 2026 made that very clear. The addition of 12 cooperative titles pushed developer participation up by nearly ninety percent compared to the previous year. Games like Jetpack Hyperleague show what happens when blockchain disappears into the background. Players sign in with familiar accounts, pay with cards through Worldpay, and interact with on chain assets without ever thinking about gas or wallets.

What makes this work is performance consistency. Sub three second finality and a thirty million gas limit per block allow tournaments, live events, and in game economies to run smoothly even during traffic spikes. Fixed fees mean hundreds of in game actions cost only cents in total. Compared to chains where congestion turns play sessions into expensive experiments, Vanar’s approach feels designed for scale.

Interoperability inside the VGN ecosystem adds another layer. Items carry Neutron Seeds that store history, rarity, and provenance. A reward earned in one game can move into another or into a metaverse environment without losing context. Kayon monitors these economies in real time, adjusting drop rates and balancing incentives to prevent abuse. To me, this looks like the first real example of AI actively managing digital economies rather than just analyzing them after the fact.

Security and Compliance Catch Up With Ambition

As usage grows, Vanar is also strengthening its security posture. The rollout of post quantum cryptography in mid 2026 is a signal that the team is thinking well beyond short term cycles. Enterprises that tokenize assets or store sensitive records need confidence that their data will remain secure for decades, not just years.

Neutron Seeds combined with quantum resistant encryption make on chain records durable in a way few networks can currently claim. Kayon then turns those records into compliance tools, generating reports and validation trails that regulators can inspect in real time. I find this particularly compelling because it removes a huge operational burden from companies. Instead of assembling reports manually, compliance becomes a continuous process embedded in transactions themselves.

Proof of Reputation validators play a key role here. By prioritizing known, accountable operators rather than anonymous capital, Vanar reduces institutional risk without centralizing control. It is a middle ground that many enterprises have been asking for.

Brands and Metaverses Bring the Physical World On Chain

The launch of brand driven environments like Shelbyverse shows how Vanar bridges physical and digital value. In this case, real vehicle data becomes part of the on chain experience through compressed Seeds. Ownership, licensing, and royalties are enforced automatically, and transactions settle instantly in $VANRY.

What stands out to me is how accessible this is to non crypto users. Fans buy digital assets with standard payment methods, participate in immersive experiences, and gradually become part of the on chain economy without friction. This model scales far beyond gaming. Any brand with loyal communities can replicate it, turning engagement into programmable ownership.

Governance Evolves With Usage

Governance on Vanar is no longer abstract. With Governance 2.0, stakers actively influence how AI behaves, how incentives are distributed, and which initiatives receive funding. Voting power reflects commitment, not just balance, which encourages long term participation.

Recent decisions funding infrastructure upgrades and security research show that governance is already shaping the roadmap in tangible ways. As the holder base grows beyond eleven thousand addresses, influence spreads more evenly, and the network becomes more resilient.

Market Signals and What Comes Next

Despite broader market uncertainty, vanry has held its range with consistent volume. Indicators suggest neutral sentiment, but adoption metrics continue to rise. That disconnect tells me the market has not fully priced in what is being built.

Upcoming catalysts include expanded Kayon subscriptions, more VGN titles, additional brand metaverses, and deeper enterprise integrations. Each of these adds recurring demand rather than one off hype. Fixed fees, predictable costs, and native intelligence form a combination that is difficult for competitors to replicate quickly.

Vanar Chain’s progress through 2026 feels deliberate and quietly confident. AI is no longer a feature layered on top of blockchain here. It is becoming the mechanism that coordinates value, rules, and experiences across the network. As reasoning becomes native and automation becomes the norm, the real question is not whether Vanar can scale, but how much of Web3’s future activity will choose an infrastructure that already knows how to think.