Bitcoin falls to multi-month lows, triggering heavy losses across mining stocks and crypto-linked equities

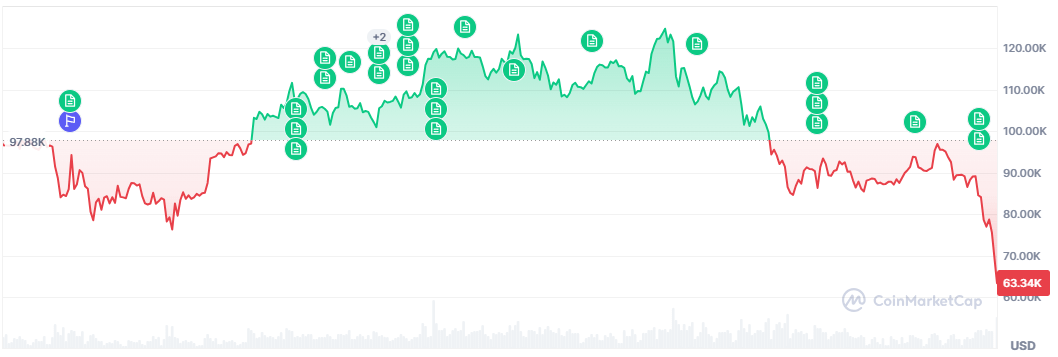

The crypto market faced intense pressure as $BTC Bitcoin dropped to its lowest level since November 2024, sparking a broad sell-off across digital assets and crypto-related stocks. Bitcoin mining companies were hit the hardest, with investors rushing to de-risk amid rising macroeconomic uncertainty.

Major mining stocks posted double-digit losses in a single session, reflecting growing concerns over balance sheets heavily exposed to digital assets. The sell-off accelerated after Bitcoin fell below key psychological and institutional cost levels, amplifying downside momentum across the sector.

The downturn comes as markets reassess risk assets, weighed down by uncertainty around Federal Reserve interest rate cuts and stretched AI-related equity valuations. These factors have driven capital away from speculative assets, including cryptocurrencies and publicly traded companies holding large $BTC Bitcoin reserves.

With volatility back in focus, traders and investors are closely watching macro signals and on-chain data to gauge whether this move marks a temporary correction or a deeper shift in market sentiment.