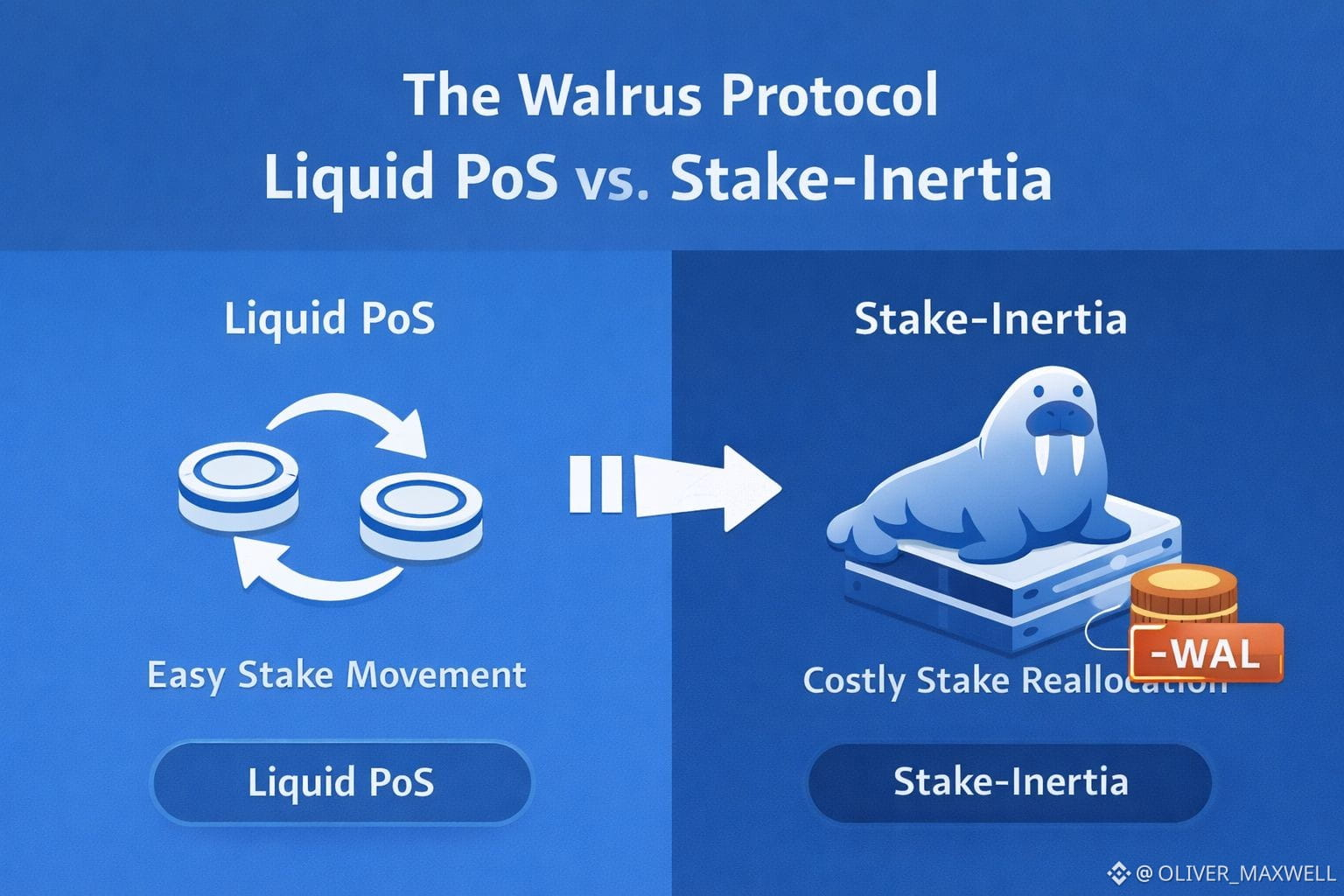

WAL keeps trading like a frictionless PoS beta, like I can swing stake across operators on a whim and the protocol just updates a ledger. That mental model breaks the moment stake is not merely security weight but a handle on who is responsible for which blob slivers. In Walrus, stake rotation is not a clean financial move, it is an attempt to rewrite a placement map. The market wants instant mobility. The system wants continuity.

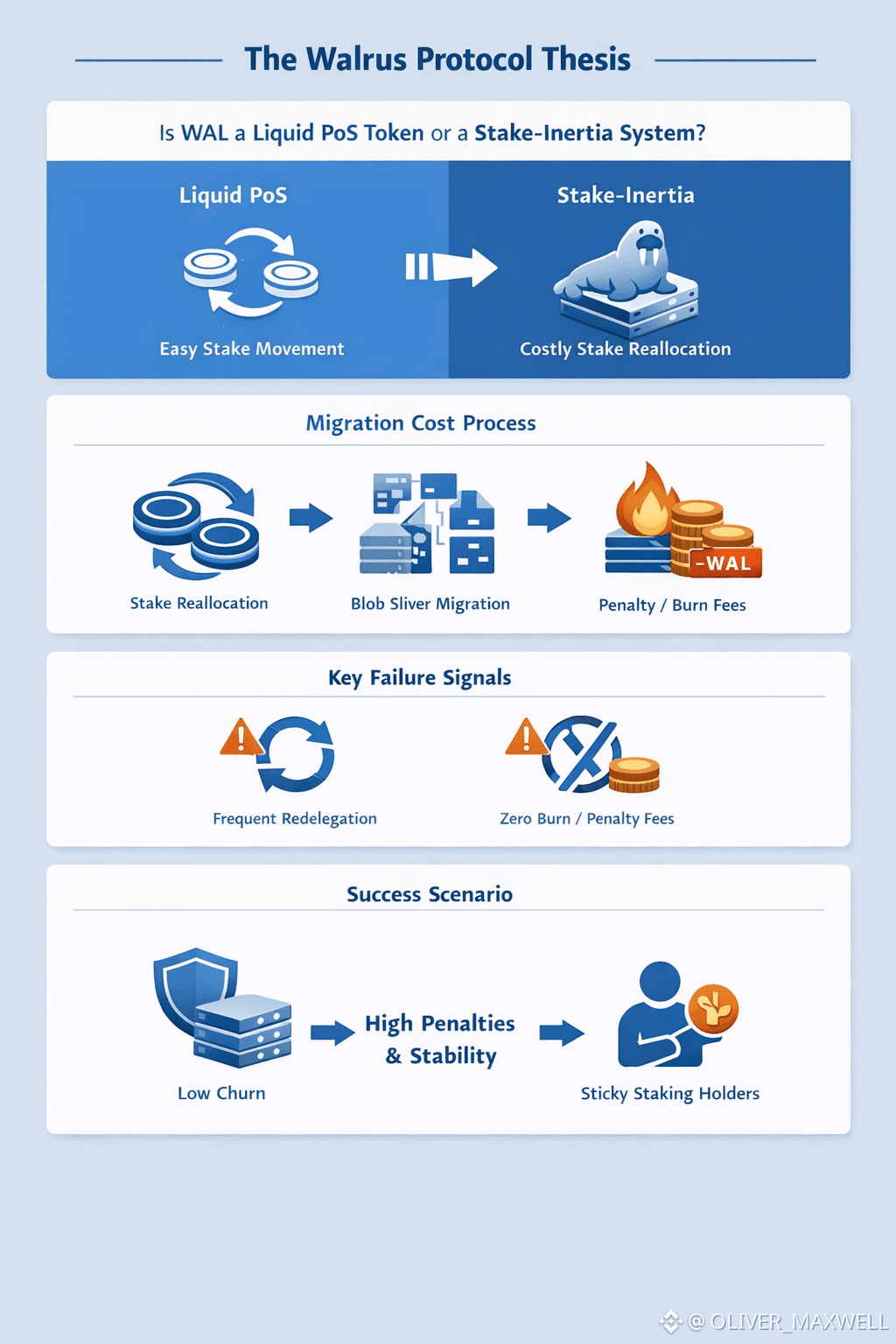

When I model Walrus, I stop treating “staking” as yield selection and start treating it as a time-bound commitment to carry slivers. Erasure coding and blob splitting are not window dressing, they are what makes responsibility granular and distributed. Each blob becomes many slivers spread across a set of storage nodes, and availability only means something if those slivers stay where the protocol expects them to be, with repair behavior that stays predictable when things go wrong. If stake moves freely, the assignment has to move too, or the guarantees quietly rot. Making it move is migration work.

The hidden cost is not a fee line item. It is the operational load of moving responsibility without breaking read behavior. Push sliver reshuffles too hard and you create a fragile interval where things still “work” but repairs spike, coordination overhead rises, and performance starts living closer to the edge. A storage protocol cannot pretend that is free. So the rational design response is to make short-horizon stake churn expensive, because liquidity is not neutral here. It fights the placement logic.

Once I accept that, the market framing looks off by category. Traders price WAL staking like portable yield. In a stake-inertia system, the portability is the mirage. You can sell spot whenever you want, but turning “I redelegate” into “the sliver map actually changes” should drag bandwidth, repair traffic, and operator coordination behind it. If it does not, then Walrus is not binding stake to data responsibility in the way people assume.

The sloppy comeback is always the same: “All PoS has unbonding, so what’s special?” What is special is what the friction is protecting. Normal PoS friction is about not letting security evaporate instantly. Walrus friction has to protect continuity of stored data. The sacrifice is stake mobility, not as a philosophical stance, but because constant re-assignment of slivers is how a storage network quietly degrades under stress.

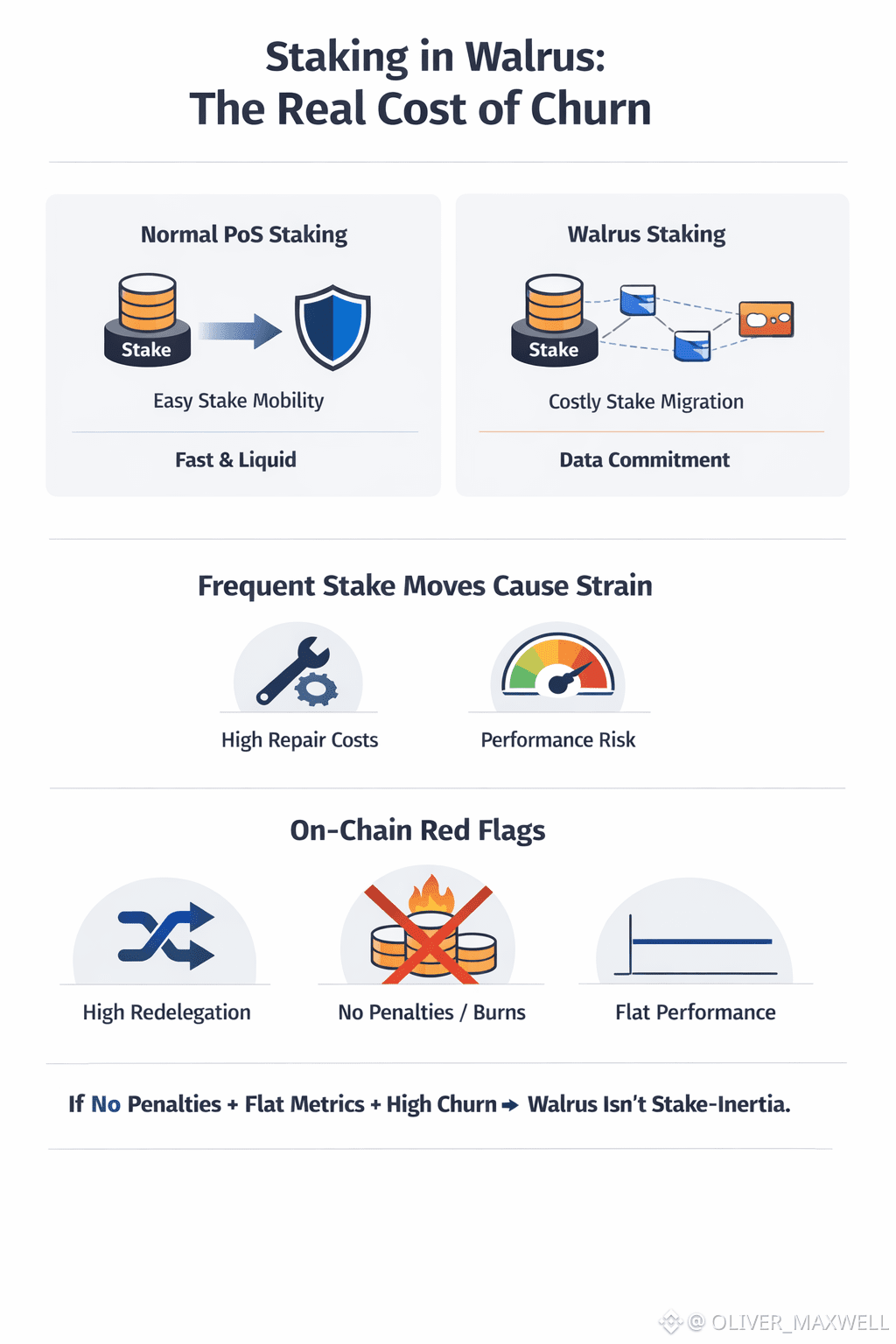

That is why I do not buy a design that tolerates churn as a lifestyle. For Walrus to behave the way the market currently prices it, redelegation would need to be cheap and frequent with no visible scars. For Walrus to behave like a stake-inertia asset, churn needs a visible price that shows up on-chain in penalties or burn, and it needs to be high enough that most stakers do not treat operator selection like a weekly trade. If that price is not there, my thesis is wrong.

If the thesis holds, WAL stops being owned by the marginal yield tourist. The marginal holder becomes someone who accepts that staking is not a liquid instrument, it is a commitment that earns more when you do not constantly test the escape hatch. That matters most in the exact market regime people keep bringing to WAL: fast rotations, liquid staking reflexes, and narrative-chasing allocations. Those instincts collide with a system that wants sticky stake.

The consequence is mechanical. When redelegation is costly, “rotate into whoever pays more this week” stops working as a strategy. Operator competition shifts away from short-term incentive bidding and toward long-lived reliability, because stability itself is being priced and rewarded. Short-horizon stakers lose their edge because their edge was mobility. Governance also skews toward persistence, because exiting and re-entering is no longer cheap.

The part I think the market really underestimates is the attack surface created by churn at the wrong time. In Walrus, an epoch boundary that triggers mass reshuffling is not just political noise, it can translate into migration and repair load when the network can least afford it. An adversary does not need to crack cryptography to cause pain. They just need to make churn economically attractive and push the system into self-inflicted logistics strain. A credible Walrus design makes that game expensive, and pays the stable set for absorbing it.

This leaves me with an uncomfortable but useful framing: WAL can be liquid on exchanges while staking remains sticky by design. That changes how I think about drawdowns. In a plain PoS trade, drawdowns often trigger stake flight that can weaken the system and accelerate the narrative spiral. In a stake-inertia system, stake flight hits friction. That can dampen spirals, but it can also delay repricing because pressure builds behind the constraint and then releases in chunks at epoch cadence.

The falsification is not vague, and I want it that way. If on-chain data shows high redelegation and high operator-set turnover across epochs while churn penalties and burn stay near zero, the inertia story collapses. If those same epochs show PoA issuance and read performance staying flat despite heavy reshuffling, then migration is not binding cost and stake is not meaningfully welded to sliver responsibility. In that world, WAL really is closer to a liquid PoS beta.

If instead the chain shows low churn, visible penalties or burn tied to movement, and stability that tracks stake persistence, then the market is pricing the wrong driver. WAL is not a weekly rotation chip. It is a token that prices the cost of reshuffling erasure-coded responsibility. The bet is simple: either Walrus can tolerate liquid stake without paying an operational price, or it cannot. I am betting it cannot, because in Walrus the expensive thing is not validating blocks, it is moving data responsibility without weakening the promise that the data stays there.