The last twenty four hours in crypto did not feel like a correction.

They felt like the opening phase of a global conflict.

Bitcoin collapsed through levels that traders trusted for months.

Ethereum followed without hesitation.

Altcoins were not spared. They were overrun.

This was not random volatility.

This was a systemic breakdown driven by structure leverage and fear.

To understand why the market is bleeding like World War 3 we need to step away from headlines and look directly at what the charts are telling us.

Bitcoin Was the First Front to Collapse

Bitcoin always sets the tone.

When Bitcoin breaks structure the rest of the market follows.

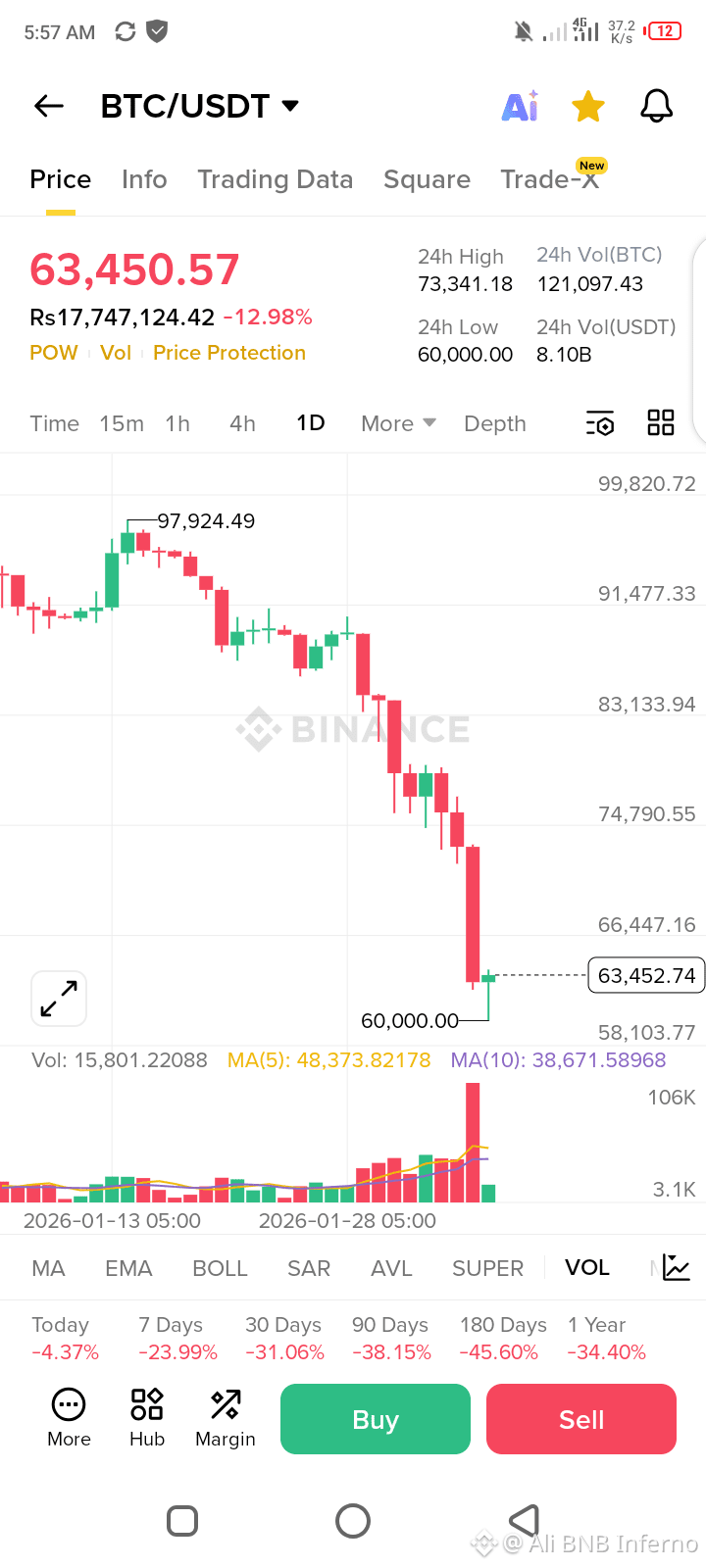

On the daily chart Bitcoin topped near 97,900 and then began forming a clear sequence of lower highs. That was the first warning. The second warning came when price failed to reclaim the 83,000 region. From that point momentum shifted fully to sellers.

The decisive moment arrived when $BTC lost 75,000 and then 70,000 without meaningful defense. Those were not slow breakdowns. They were fast aggressive candles accompanied by expanding volume. This is critical. High volume during downside moves confirms forced selling not profit taking.

The final capitulation candle drove price into 60,000 before a reaction bounce. That wick is important. It signals a liquidity sweep where stops were cleared and leveraged positions were liquidated.

Technically speaking Bitcoin has now broken its medium term bullish structure.

Key observations on BTC:

Daily trend has flipped bearish

Price is far below short term moving averages

Volume confirms panic liquidation

Previous support levels have turned into resistance

At the current price near 63,000, Bitcoin is sitting in a fragile zone. There is no confirmed base yet. Any bounce from here must be treated as a relief rally until price reclaims 75,000. Below 60,000, the next visible demand zone lies closer to 55,000.

This is why the market feels unstable. Bitcoin is not trending. It is searching for a floor under pressure.

Ethereum Is Taking Heavier Casualties

If Bitcoin is the battlefield commander then Ethereum is the frontline infantry.

Ethereum has significantly underperformed Bitcoin during this crash. That is a red flag for overall market health.

ETH peaked near 3,400 and then entered a persistent downtrend marked by weak bounces and heavy sell pressure. The most important technical failure occurred when Ethereum lost 3,000. That level had acted as psychological and structural support for months. Once it broke sellers accelerated.

Ethereum then fell into a liquidity vacuum. There was little historical support between 2,600 and 2,000. This explains the speed of the decline.

The current price near 1,870 is sitting just above the recent low at 1,747. While the bounce from that level shows short term reaction it does not yet signal accumulation.

Key ETH technical signals:

Strong bearish structure on daily timeframe

No higher low formed yet

Volume confirms distribution not absorption

Moving averages are sharply downward sloping

Ethereum remains vulnerable below 2,100. A reclaim of 2,400 would be required to shift momentum back toward neutrality. Until then ETH weakness continues to pressure altcoins.

Why This Feels Like a Global Conflict

This crash feels different because it is broad and synchronized.

Bitcoin broke structure.

Ethereum collapsed harder.

Altcoins experienced deeper percentage losses.

That pattern is not normal during healthy markets.

This type of move usually happens when leverage has built up over time and confidence becomes complacency. Once key levels break liquidations cascade automatically. Algorithms sell. Stops trigger. Fear compounds.

The market does not pause to ask why. It simply reacts.

This is why the comparison to World War 3 resonates. Not because of chaos alone but because of scale. Every sector is affected. Every risk asset feels the pressure.

Liquidity Was the Real Trigger

There does not need to be catastrophic news for a crash like this to occur. Structure alone is enough.

When price trades above major supports for too long leverage accumulates. Once those supports fail liquidity disappears. Buyers step away. Sellers dominate.

Bitcoin losing 75,000 removed confidence.

Ethereum losing 3,000 removed hope.

Altcoins had no defense left.

The market did not crash because of one event. It crashed because it was fragile.

What Happens Next

Markets rarely reverse immediately after capitulation. They need time.

Possible scenarios:

Bitcoin ranges between 60,000 and 68,000 while volatility cools

Ethereum attempts to stabilize above 1,750

Altcoins remain weak until $ETH shows strength

A sustained recovery requires confirmation. That means higher lows stronger volume on green candles and reclaiming broken resistance levels.

Until then caution remains necessary.

Final Thoughts

This market bleed was not an accident.

It was the result of broken structure excessive leverage and fear meeting thin liquidity.

Bitcoin is wounded but not dead.

Ethereum is bleeding more heavily.

Altcoins are paying the highest price.

World War 3 has not started.

But on the charts it certainly feels like the opening battles have already been fought.

Do you believe Bitcoin holding the 60,000 zone can prevent further damage or does Ethereum weakness suggest the market still has unfinished business to the downside?