In the rapidly evolving world of cryptocurrencies, stablecoins have emerged as the bridge between traditional finance and decentralized networks. Yet, despite their widespread adoption, mainstream blockchain networks often struggle to deliver fast, secure, and low-cost stablecoin transactions. Enter Plasma, a Layer 1 blockchain purpose-built to solve these challenges, and its Bitcoin-anchored architecture is turning heads in the crypto space.

Purpose-Built Architecture: Stablecoins First

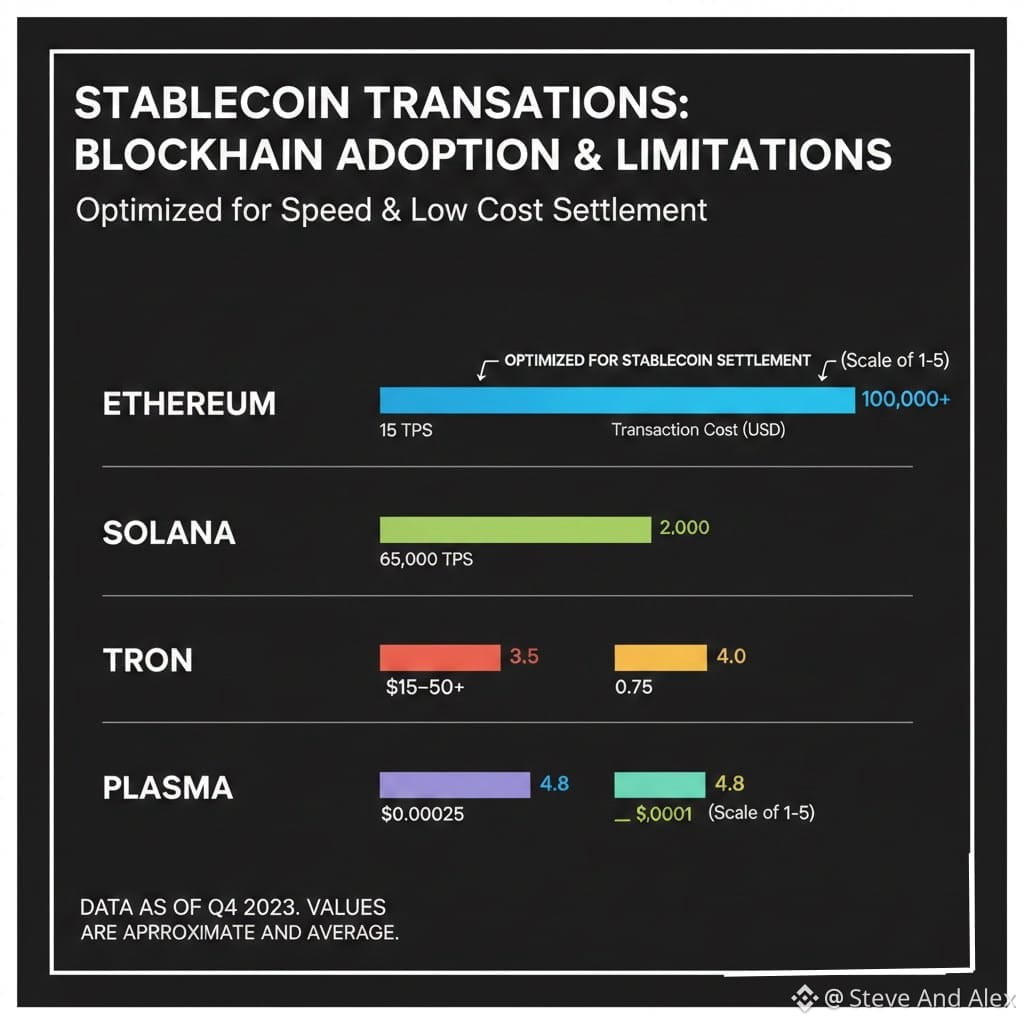

Unlike general-purpose blockchains like Ethereum or Solana, Plasma isn’t trying to do everything. Its primary focus is stablecoin settlement and payments, making it a specialized infrastructure rather than a “one-size-fits-all” network. This distinction is crucial because many existing chains impose high transaction fees, slow finality, or complex gas models that hinder mass adoption of stablecoins, especially in regions with heavy remittance traffic.

Plasma’s architecture starts by considering how stablecoins are actually used in real-world transactions, rather than forcing users to adapt to the blockchain’s limitations. By building the network around the flow of stablecoins, Plasma ensures that sending, receiving, and settling digital dollars is fast, seamless, and cost-effective. This approach positions Plasma as a potential backbone for future global payment systems.

PlasmaBFT: Sub-Second Finality for Real-Time Transactions

At the core of Plasma’s design is its PlasmaBFT consensus protocol, a modern Byzantine Fault Tolerant system optimized for speed, reliability, and scalability. Traditional blockchain networks often take minutes or even hours for transactions to finalize, which is impractical for everyday payments. PlasmaBFT achieves sub-second finality, meaning transactions are confirmed almost instantly, enabling real-time settlement for users and businesses alike.

This consensus mechanism also supports high throughput, allowing thousands of transactions per second. In practice, this translates to a blockchain that can handle heavy payment traffic, from retail microtransactions to institutional transfers, without the delays or congestion that plague older networks.

Bitcoin-Anchored Security: Trust Meets Innovation

One of Plasma’s most innovative features is its Bitcoin-anchored security model. While many Layer 1 blockchains rely solely on their native security mechanisms, Plasma periodically publishes state checkpoints to the Bitcoin blockchain. This creates a trust-minimized link between Plasma and Bitcoin, leveraging Bitcoin’s unparalleled security and decentralization as a foundation.

The implications of this are significant:

Censorship Resistance: Anchoring to Bitcoin makes it exceedingly difficult for any single entity to alter historical transaction data or block payments, increasing trust in the network.

Neutrality: By tying its security to Bitcoin, Plasma avoids dependence on any one validator set or governance structure, appealing to users and institutions who value fairness and transparency.

Enhanced Security: Rewriting Plasma’s historical state would require compromising Bitcoin itself, which is practically infeasible, giving users and institutions confidence in the integrity of the network.

This approach is particularly attractive for institutional users, who require both speed and high security for cross-border settlements, treasury operations, and stablecoin-based financial products.

EVM Compatibility: Bridging Innovation with Familiarity

Plasma achieves its innovative architecture without sacrificing developer accessibility. Through a Rust-based execution client called Reth, Plasma is fully compatible with the Ethereum Virtual Machine (EVM). This means developers can deploy Solidity smart contracts, integrate familiar tooling like MetaMask or Hardhat, and experiment with DeFi applications on a network optimized for stablecoins.

By combining state-of-the-art security and stablecoin-first design with EVM compatibility, Plasma creates a unique ecosystem where both developers and users can operate efficiently without facing steep learning curves or high costs.

Mainnet Adoption and Real-World Impact

Plasma’s mainnet beta has already attracted over $2 billion in stablecoin liquidity, demonstrating confidence from both retail users and institutional players. Wallets like Trust Wallet and exchanges such as Busha now support Plasma, enabling near-zero fee stablecoin transfers and real-time settlement. Users can now experience the speed and efficiency of blockchain payments without worrying about gas tokens or delays.

These developments signal that Plasma’s architecture isn’t just theoretical—it’s actively shaping a new reality for fast, secure, and user-friendly stablecoin payments.

Why Plasma Matters

Stablecoins are increasingly central to global finance, from remittances in developing countries to programmable finance for institutions. Yet their adoption is hindered by high fees, slow confirmation times, and complex user experiences. Plasma addresses these pain points with a purpose-built, Bitcoin-secured Layer 1, combining speed, security, and usability.

As the crypto industry matures, networks like Plasma may define the next generation of financial infrastructure, enabling stablecoins to function as a true bridge between traditional money and decentralized systems. For users, developers, and institutions, Plasma represents a powerful example of how blockchain architecture can be reimagined to solve real-world financial challenges.