#Plasma isn’t trying to be loud.

It’s trying to be useful. And in crypto, that difference matters more than hype.

Most Layer-1 chains chase narratives — faster TPS, bigger ecosystems, louder marketing. Plasma quietly focuses on something far more practical: stablecoin settlement. Real payments. Real movement of value. Not just speculation candles on a chart.

The idea is simple but powerful.

If stablecoins are already the backbone of crypto transactions, then a blockchain designed specifically for stablecoins makes sense. Plasma leans into that reality instead of pretending every chain must do everything.

Speed is where it becomes interesting.

Sub-second finality changes the feeling of a transaction. You don’t wait. You don’t wonder. The payment is just… done. That psychological shift is small on paper but massive in real usage — especially for retail payments and merchant adoption.

Then comes compatibility.

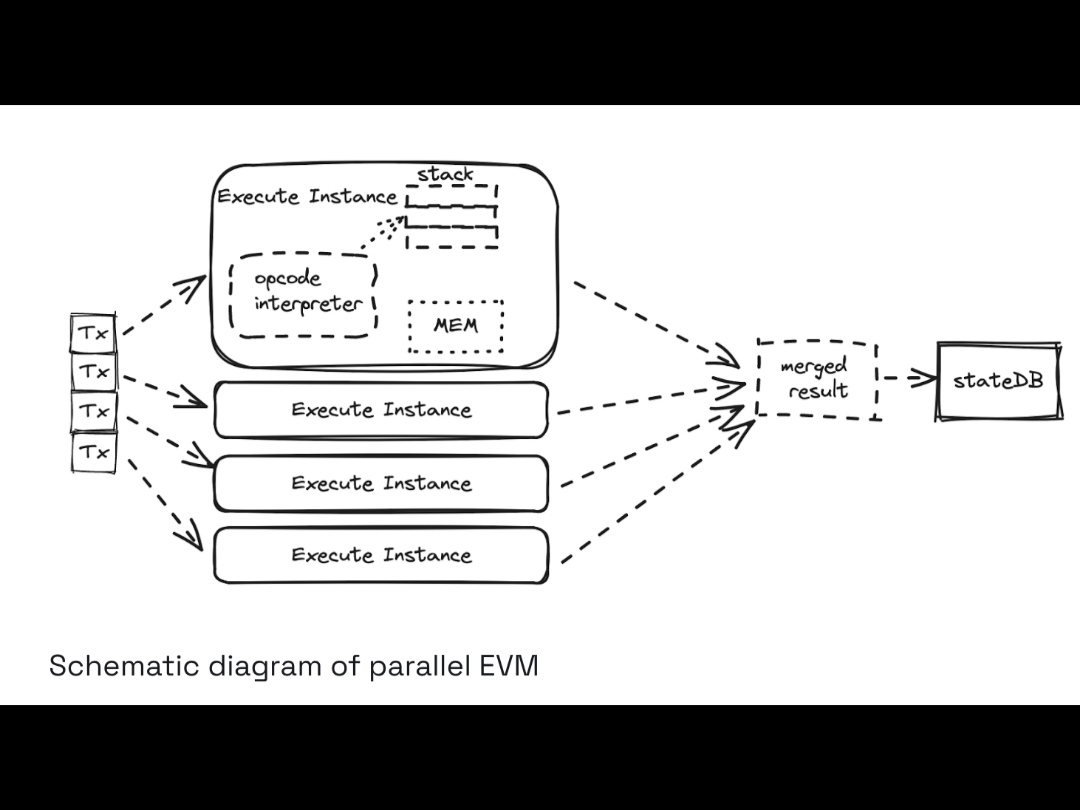

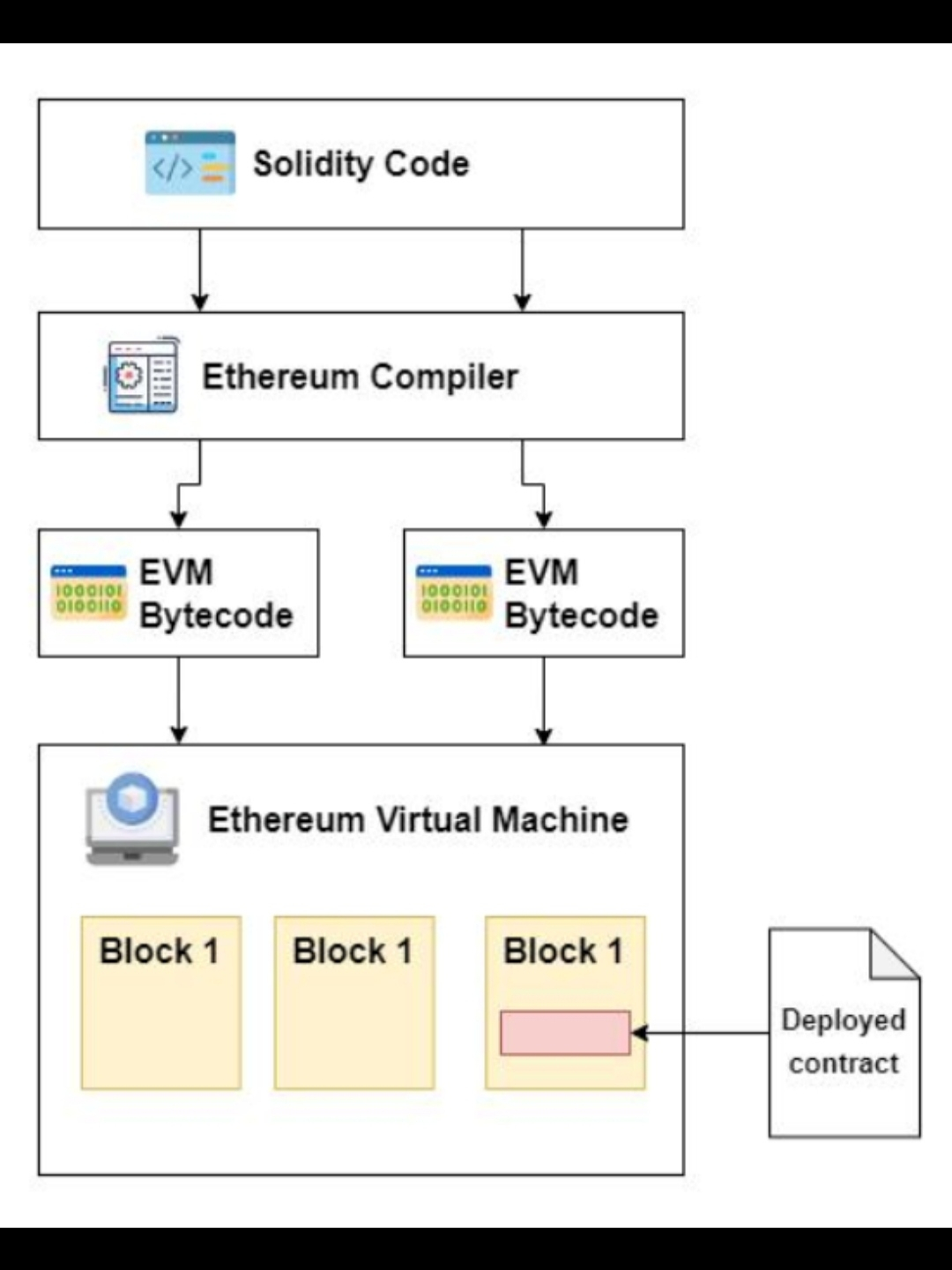

@Plasma keeps EVM support, which quietly removes friction. Developers don’t need to relearn everything. Existing tools, smart contracts, and workflows can move over without drama. That lowers the barrier, and lower barriers usually mean faster growth.

But the real signal is in the design philosophy.

Gasless USDT transfers.

Stablecoin-first fee structure.

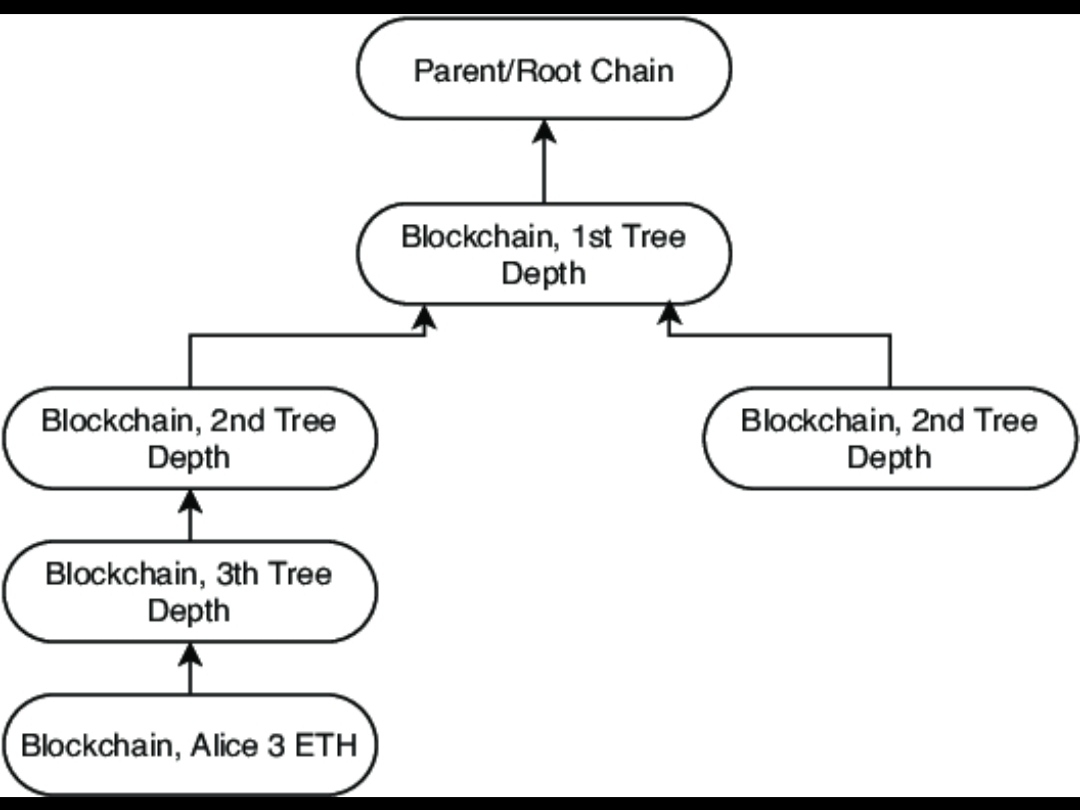

Bitcoin-anchored security.

These aren’t random features. They all point in one direction: making crypto behave like money instead of an experiment.

And that’s where Plasma stands out.

Not as the loudest chain.

Not as the trendiest narrative.

But as infrastructure built for the part of crypto people actually use every day.

If adoption in the next cycle is driven by payments, remittances, and real settlement, Plasma could quietly move from “unknown project” to something much harder to ignore.