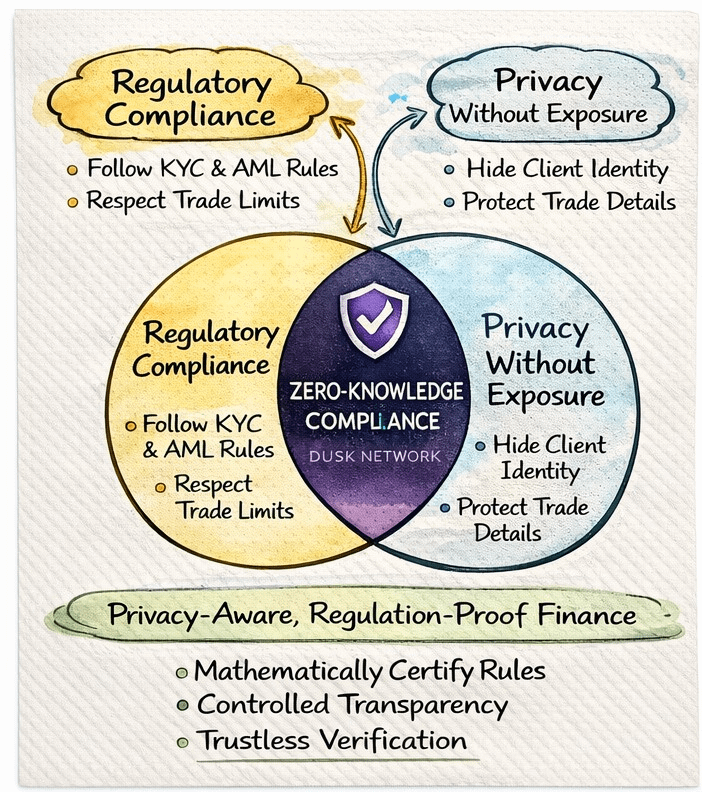

For many years, the finance world has seen privacy and following the rules as opposites. Privacy was seen as hiding things. Following the rules was seen as being open. Blockchain tech made this worse by showing everything openly, which put firms in a tough spot: agree to show everything or stay away.

Because of this, zero-knowledge compliance is becoming a key change in today's finance setup. Dusk Network is a central part of this discussion.

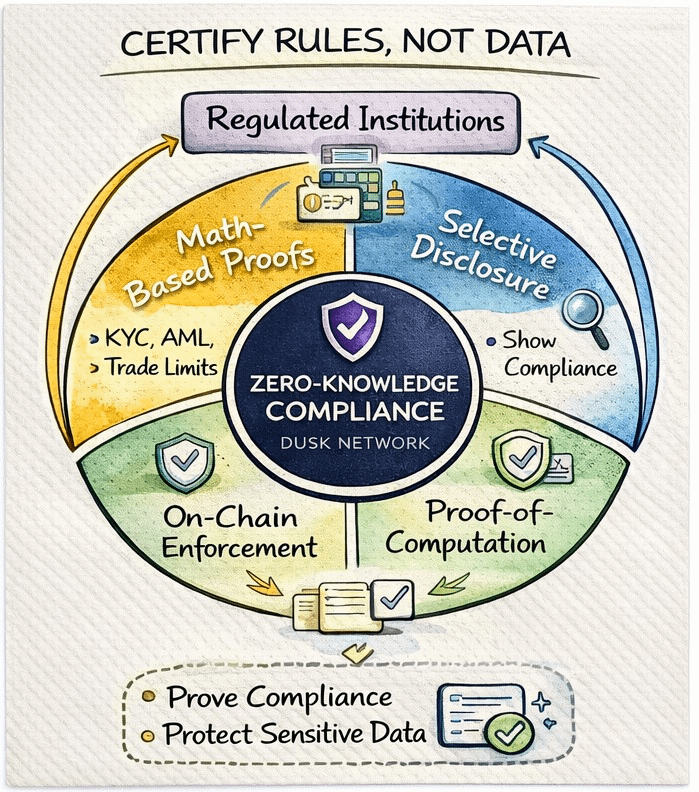

Basically, zero-knowledge compliance changes what is shown and to whom. Instead of showing all details about a trade publicly, zero-knowledge proofs let people confirm they followed the rules without showing the actual data. Following the rules changes from reporting a lot of info to using math to prove it.

This difference is very important

In regular finance, firms don't show their internal records to everyone. They prove they follow the rules through checks, reports, and controlled access. Blockchain changed this, replacing trust with complete openness. This worked for early crypto experiments, but it won't work for real markets where keeping things private is a must.

Zero-knowledge compliance brings back balance

With this, firms can show they meet rules like KYC, AML, solvency, or trade limits without showing client info, positions, or plans. Regulators still get the proof they need. Market players keep their privacy for competition and legal reasons. The system makes sure rules are followed without making finance too public.

Dusk’s plan shows they understand this well. Instead of adding compliance as an extra step outside the system, they put compliance rules right into secret smart contracts. This means rules are followed by the system itself, not by reports or trust.

This change has big results.

First, it lowers risk. When following rules depends on doing things by hand or scattered reports, mistakes are likely. Zero-knowledge systems lower this risk by using math to confirm things are right. Either the rules are met, or the trade doesn’t happen.

Second, it changes how we talk about regulation. Instead of asking regulators to accept unclear systems, zero-knowledge compliance gives them something stronger than openness: proof. Regulators don’t need to see everything if they can use math to confirm nothing illegal happened.

This is very important as finance becomes more digital and automatic. Automatic trading, tokenized items, and on-chain systems move too fast for old oversight methods. Zero-knowledge proofs let regulation grow with automation without losing control.

There’s also a bigger effect on the market. Today’s crypto world favors those okay with being fully public, like regular users or risky traders. Firms are careful, not because they hate decentralization, but because they can’t work under those limits. Zero-knowledge compliance allows a more balanced system where different people can work together without forcing one style on everyone.

Of course, this isn’t a perfect solution. Zero-knowledge systems are hard. They need careful planning, strict checks, and teaching regulators. Things will change slowly, not suddenly. But the direction is clear.

As rules get stricter worldwide and firms want systems that match real-world limits, systems based only on full openness will struggle. The future of finance isn’t hidden, but it’s not fully public either. It’s provable.

Dusk thinks that compliance doesn’t need to show everything to work. It needs to be exact, enforceable, and verifiable. Zero-knowledge compliance does just that.

Eventually, finance will be shaped not by who shows the most data, but by who can prove for sure that the rules were followed