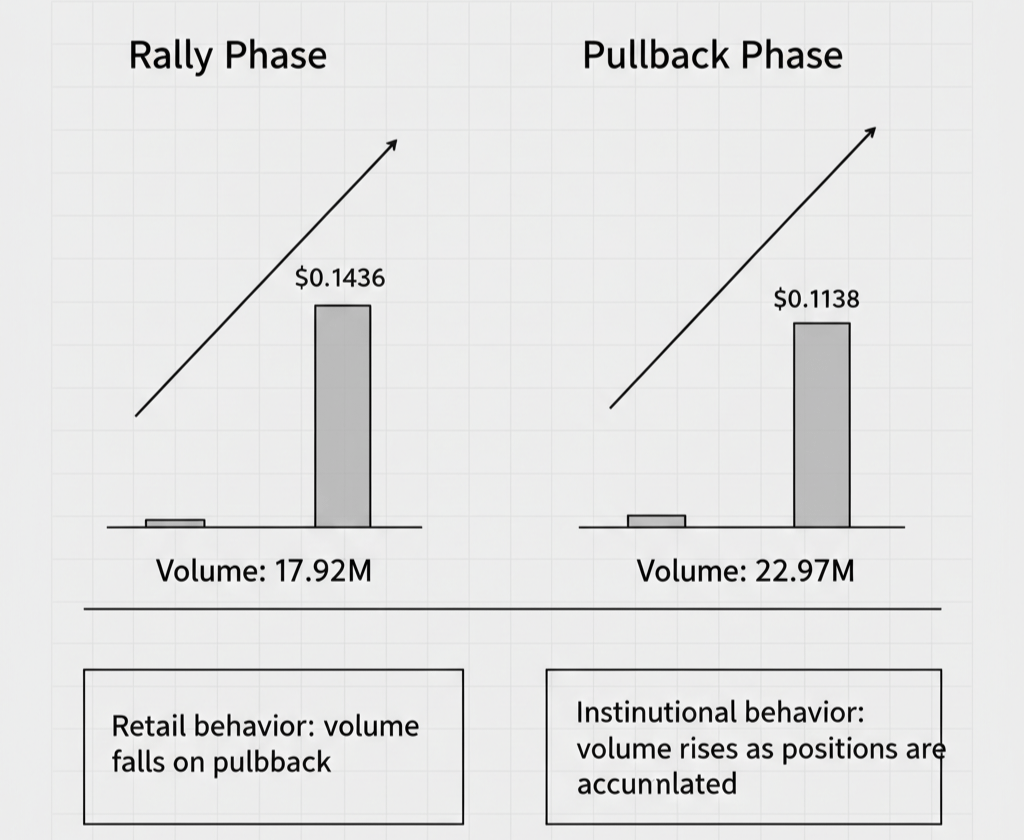

I've watched institutional accumulation enough times to spot the difference between retail panic and smart money building positions. Retail pumps see volume spike during rallies then die when price pulls back—momentum chasers buying strength and fleeing weakness the moment things turn. But when volume stays elevated or actually increases during pullbacks, someone's using the dip to accumulate more. That's institutional behavior, and it only happens when those buyers believe they know something the broader market doesn't.

Dusk pulled back from yesterday's $0.1436 high to $0.1138 today. That's a 21% retracement that normally signals the rally already failed. Except volume didn't collapse—it increased to 22.97 million USDT from yesterday's 17.92 million that drove the 69% pump. RSI cooled to 50.43, neutral after being 57.53 yesterday. The range from $0.1436 down to $0.0926 shows real volatility. But what matters isn't the pullback itself. It's that Dusk is seeing higher volume during consolidation than it did during the actual rally.

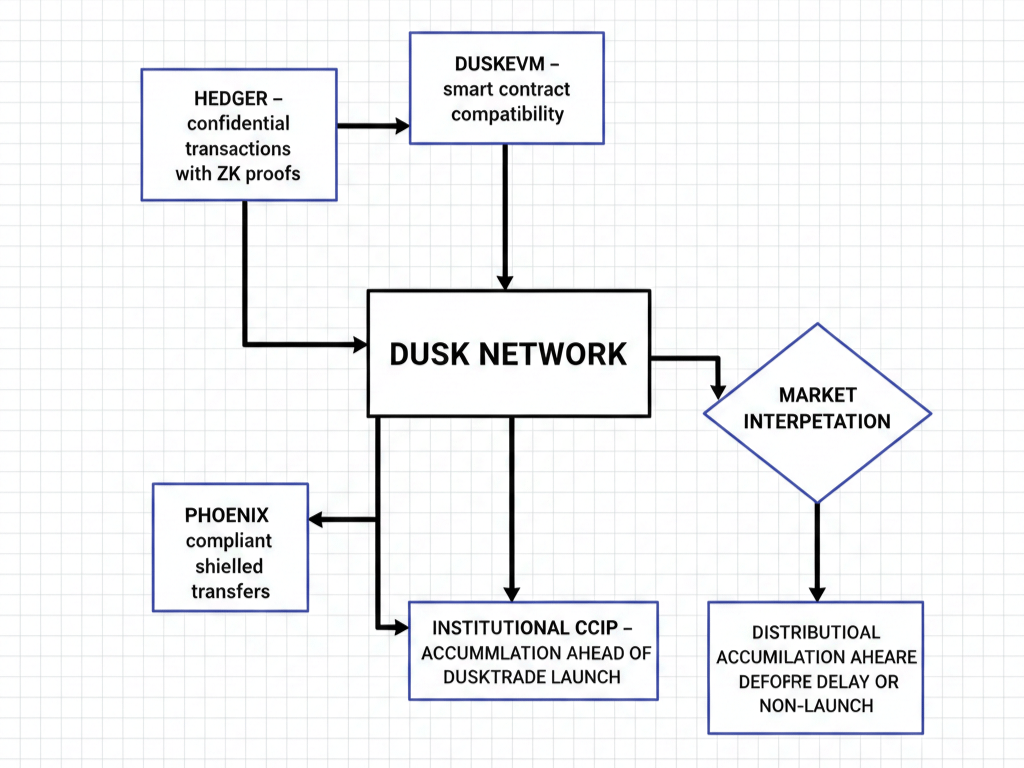

Either this is distribution where yesterday's buyers are exiting into today's liquidity, or someone is aggressively accumulating more Dusk during weakness because they think DuskTrade announcements from NPEX are close enough to justify building even bigger positions after a 69% rally already happened.

That volume pattern—22.97 million during pullback versus 17.92 million during rally—is the key signal about whether yesterday's move was genuine institutional positioning or just another pump before final capitulation.

Dusk sits at $0.1138 after touching $0.0926, stabilizing in this range now. RSI at 50.43 is perfectly neutral, could go either direction with equal probability. Volume at 22.97 million is 28% higher than yesterday despite price pulling back 21%. That volume increase during pullback is what catches attention. More capital participated today than yesterday, but instead of pushing price higher, it absorbed selling and held support above $0.10.

When institutions accumulate, they don't chase rallies. They let retail push price up, wait for profit-takers to sell, then buy the pullback aggressively. That creates exactly the pattern Dusk is showing—big rally on strong volume, pullback on even stronger volume as institutions add positions. Retail does opposite—FOMO buys rallies, panic sells pullbacks. The volume at 22.97 million during Dusk's pullback looks like institutional behavior.

But that only makes sense if those institutions know something about DuskTrade that public doesn't. Otherwise why commit 23 million USDT during a pullback after already committing 18 million during the rally? Combined that's over 40 million in volume across two days for Dusk that was trading 2-4 million daily last week.

That's not coincidence. That's coordinated accumulation by participants who believe NPEX is actually launching securities settlement on Dusk and want positions before public announcement.

The NPEX partnership justifies this accumulation if it's real. They manage €300 million in assets with actual regulatory licenses from AFM. When licensed financial entities partner with blockchain protocols for securities tokenization, it's operational evaluation, not marketing. NPEX wouldn't maintain partnership with Dusk through price crashing to $0.0851 unless they genuinely intended using the infrastructure for real securities settlement.

What makes institutional accumulation plausible is Dusk has everything NPEX needs already operational. Hedger provides confidential transactions using zero-knowledge proofs specifically for securities trading where order privacy matters operationally. DuskEVM offers EVM compatibility so NPEX deploys standard Solidity contracts. Phoenix enables shielded transfers with receiver verification meeting regulatory requirements. Chainlink CCIP integration allows tokenized securities moving across chains while maintaining compliance.

All that infrastructure exists and works at $0.1138 just like it would at $0.30. If NPEX wanted launching DuskTrade tomorrow, technology is ready. The question is whether NPEX wants to launch it. And the volume pattern at 22.97 million during pullback suggests someone believes they do.

Those 270+ validators still running Dusk nodes through the rally to $0.1436 and pullback to $0.1138 provides supporting evidence institutional adoption might be real. Those operators maintained infrastructure through crash to $0.0851, operating at losses for weeks. They stayed operational during yesterday's rally and today's pullback. Their thesis isn't based on trading price—it's operational conviction that securities settlement launches regardless of short-term volatility.

If validators thought DuskTrade was vaporware, they would've quit during crash to $0.0851. Instead they maintained infrastructure. Now market is rallying toward their conviction with volume patterns suggesting institutional accumulation. Either validators were right about securities settlement timeline and market is finally catching up, or they're trapped in sunk costs and today's volume just creates exit liquidity.

What I keep coming back to is timing. We're in 2026, supposedly DuskTrade launch year. Volume spiked from 2-4 million to 18 million yesterday, now 23 million today. That's 5-10x normal participation happening precisely when launch should be approaching. Either that's coincidence, or someone knows regulatory approvals came through and NPEX is ready migrating securities onto Dusk.

The pullback from $0.1436 to $0.1138 on higher volume creates healthy technical setup if this is real accumulation. Institutions don't want chasing price vertical—they want consolidation letting them build larger positions without moving markets too much. Today's pullback on 22.97 million accomplishes exactly that, allowing whoever drove yesterday's rally to add more at better prices.

But this pattern only works if announcements come soon. If weeks pass without DuskTrade details from NPEX, today's volume becomes distribution rather than accumulation. Buyers at $0.11-$0.14 become trapped holders rather than smart money positioning ahead of news.

What confirms this is institutional positioning rather than bull trap? NPEX announcing concrete DuskTrade launch details—specific date, regulatory approvals confirmed initial securities lined up for tokenization on Dusk infrastructure. Not vague progress updates. Actual operational details proving €300 million in securities migrating on-chain.

Without that announcement, the volume pattern at 22.97 million during pullback just creates uncertainty. Could be institutions accumulating ahead of news they know is coming. Could be sophisticated traders creating liquidity for final distribution before thesis proves false.

For anyone deciding whether holding Dusk through this pullback, the volume pattern is key signal. Pullbacks on declining volume mean rally failed. Pullbacks on increasing volume like today's 22.97 million mean someone's still accumulating aggressively despite price being 21% off highs. That behavior only makes sense if those buyers know something justifying continued capital commitment.

Either they know DuskTrade launches soon, or they're speculating it does. Won't be clear until NPEX either announces or silence confirms delays. For now, Dusk at $0.1138 with volume at 22.97 million during pullback is testing whether yesterday's rally was institutional positioning for securities settlement or just volatility that doesn't mean anything fundamental changed.