When I first looked at VANRY touching fractions of a cent, the $1 question felt almost naïve, the kind of number people throw around late in bull markets. But the longer I sat with it, the more interesting it became, not as a prediction, but as a way to understand what actually drives value underneath a token like this. #traderARmalik3520

#traderARmalik3520

At the surface level, the math is blunt. VANRY trades around the low single-cent or sub-cent range depending on the day, with roughly 2.2 to 2.4 billion tokens either circulating or close to it. That puts the network’s market value somewhere between about $15 million and $60 million recently, depending on price swings. Those numbers matter because price is just market cap divided by supply. A $1 VANRY is not a vibe or a narrative. It is roughly a $2.4 billion valuation. That is a forty to one hundred times expansion from where the market has been sitting.@Vanarchain $VANRY

Understanding that helps explain why the debate often gets messy. People talk past each other. One side points at charts and says “it already did a 5x once,” while the other side points at the supply and laughs. Both are right in their own narrow frame. A 5x from $20 million is still small. A jump from $50 million to $2.4 billion is not.#vanar

What struck me is how often the supply number is quoted without context. Two point four billion sounds huge until you remember that Polygon sits north of $7 billion in market cap with a similar order of magnitude in tokens, and that Solana crossed $100 billion at its peak with far more inflation risk baked in early. The difference was not supply discipline alone. It was demand showing up steadily, then all at once.

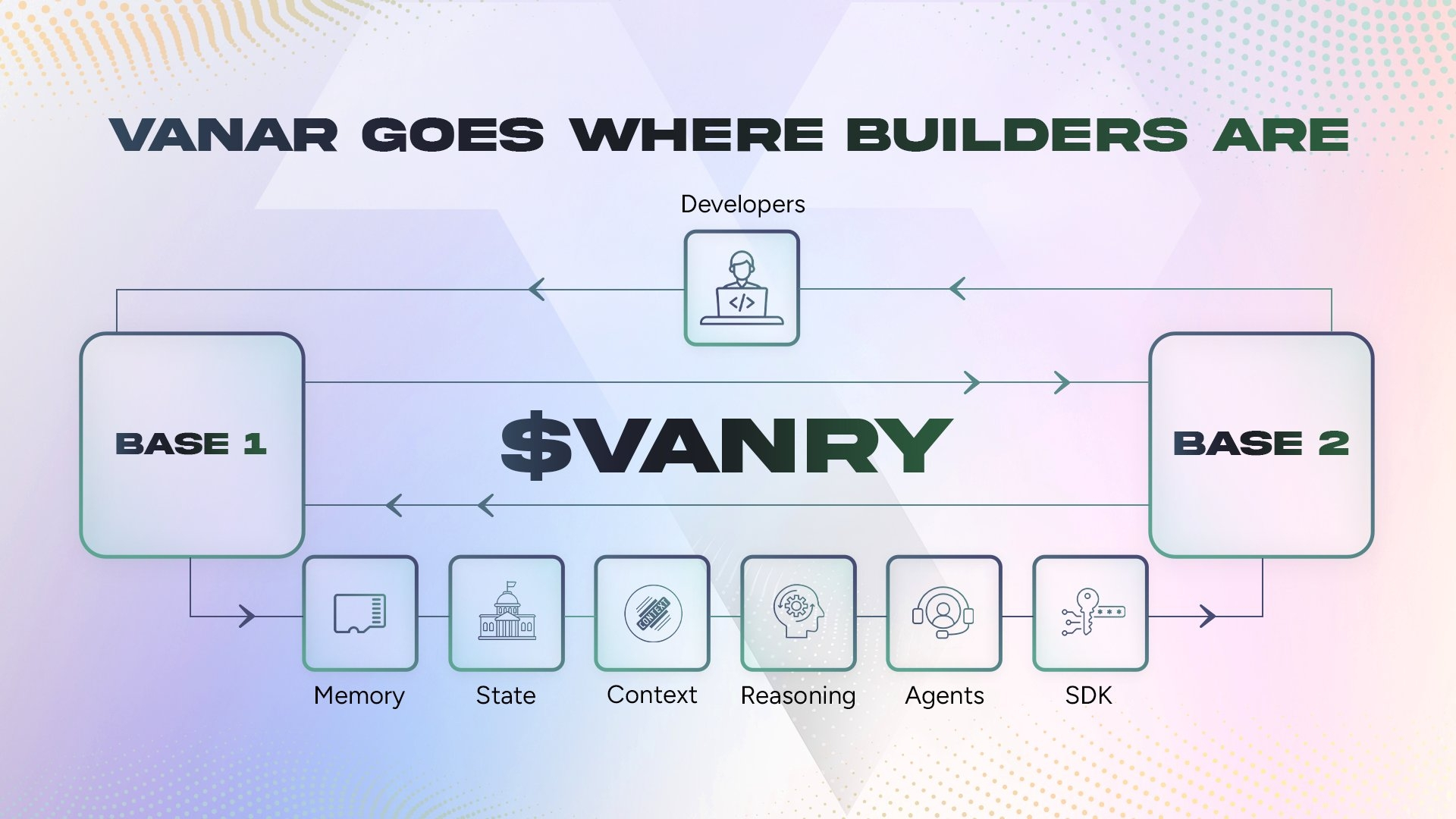

On the surface, demand for VANRY today looks thin. Daily trading volumes often sit in the low millions or below, which means price moves quickly when money enters and exits. Underneath that, though, is a quieter layer. Vanar is positioning itself around gaming, AI-linked workloads, and asset ownership, areas where blockchains either become invisible infrastructure or get ignored entirely. The token’s role is to secure and pay for that activity. That is the foundation story. It does not move price by itself, but it creates the conditions where price can move without collapsing.

Here is where the math becomes more interesting. To go from roughly $0.006 to $1 over, say, ten years, VANRY would need a compound annual growth rate of about 58 percent. That sounds extreme until you realize many mid-cycle altcoins did far more than that between 2020 and 2021. The difference is that those gains were compressed into eighteen months and then partially given back. Sustaining even half that pace over a decade requires something different. It requires usage that keeps showing up even when the market goes quiet.

Right now, the market is not euphoric. Bitcoin dominance is high. Liquidity is selective. Capital rotates into things that show real traction, not just whitepapers. That context matters. If VANRY were already seeing tens of thousands of daily transactions tied to real applications, the $1 conversation would feel less hypothetical. Early signs exist, but they are early. Remains to be seen is the honest phrase here.

A common counterargument is that $2.4 billion market caps are rare and reserved for top fifty assets. That is true, but it also misses how fast the rankings reshuffle each cycle. In 2019, a $2 billion asset was elite. In 2021, it barely cracked the top hundred. If total crypto market capitalization grows from roughly $1.7 trillion today to $4 or $5 trillion in a future cycle, a $2.4 billion VANRY is not a moonshot. It is a question of whether it earns a seat.

Underneath that question sits another layer of risk. High supply means that even modest sell pressure can cap rallies. Early holders taking profit at ten or twenty cents would create real resistance. That does not kill the $1 scenario, but it stretches the timeline. It means price would need to grind, not spike. Steady adoption matters more than viral attention.

There is also the dilution story. With most of the supply already known and largely circulating, VANRY avoids one common trap where future unlocks crush late buyers. That does not guarantee upside, but it removes one structural headwind. What it enables is a clearer signal. If price moves meaningfully, it is because demand is arriving, not because supply mechanics are temporarily favorable.

Meanwhile, the broader market is quietly changing how it values infrastructure chains. Hype alone is not enough anymore. Tokens that survive multiple cycles tend to anchor themselves in a specific type of usage. Ethereum did it with settlement. Solana did it with speed and cost. The question for VANRY is whether gaming and AI workloads become sticky enough to justify long-term capital. If that holds, valuation conversations shift from “can it pump” to “what share of activity does it capture.”

Probability is where honesty matters. A move from today’s levels to ten cents is plausible within a strong cycle. That implies a market cap around $240 million, which many projects reach briefly without becoming household names. A move to fifty cents implies $1.2 billion and sustained relevance. A move to $1 implies not just relevance, but recognition. Each step up the ladder narrows the odds.

If I had to translate that into human terms, the chance of VANRY touching $1 in the next few years is low. Single digits low. Over a decade, if the network keeps building quietly while the market grows around it, the probability is no longer absurd. It is just hard. Earned, not gifted.

What this whole exercise reveals is less about VANRY and more about how crypto pricing actually works. Big numbers scare people because they feel disconnected from daily charts. But underneath, it is always the same equation. Supply times belief times usage. When one of those is missing, price floats. When all three line up, even conservative math starts to look generous.

The sharp thing worth remembering is this. A $1 token price is not a milestone. It is a mirror. It reflects how much real weight the market thinks a network can carry. Whether VANRY ever gets there will say less about speculation, and more about whether its foundation quietly held while everyone was watching something louder.@Vanarchain