When I first looked at Plasma’s zero-fee USD₮ transfers, I expected a familiar trick. Another chain eating the gas cost to juice activity. What I didn’t expect was how quietly opinionated the design is about where stablecoin usage is actually heading, and who should be paying for what underneath. #traderARmalik3520

#traderARmalik3520

On the surface, the promise sounds simple. You send USD₮ on Plasma and the user pays nothing in gas. No ETH, no native token, no “oh wait you need a little balance first.” That surface experience matters because it strips crypto back to something closer to how money already behaves. You don’t think about settlement rails when you send dollars through an app. You just send.#BinanceSquareFamily

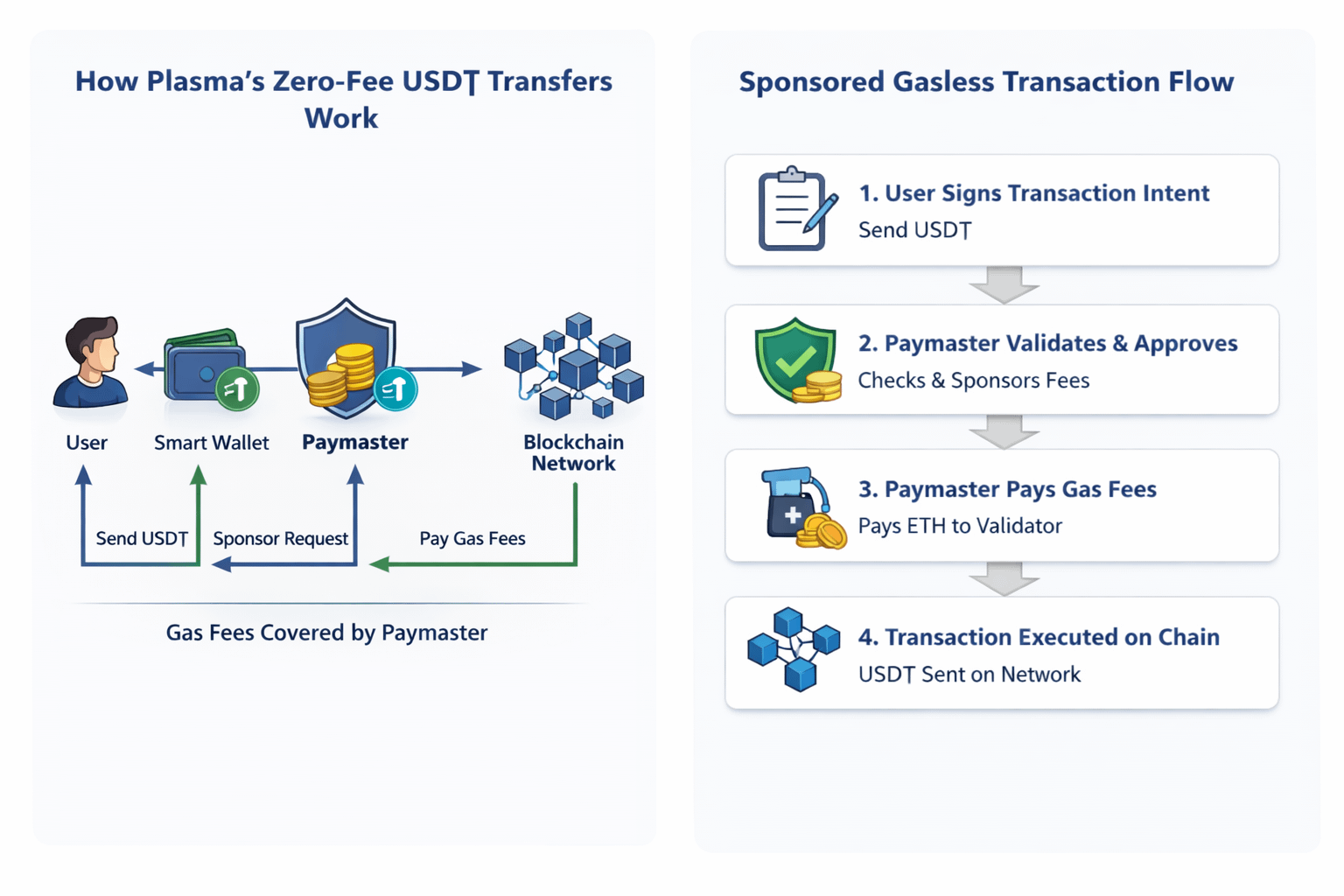

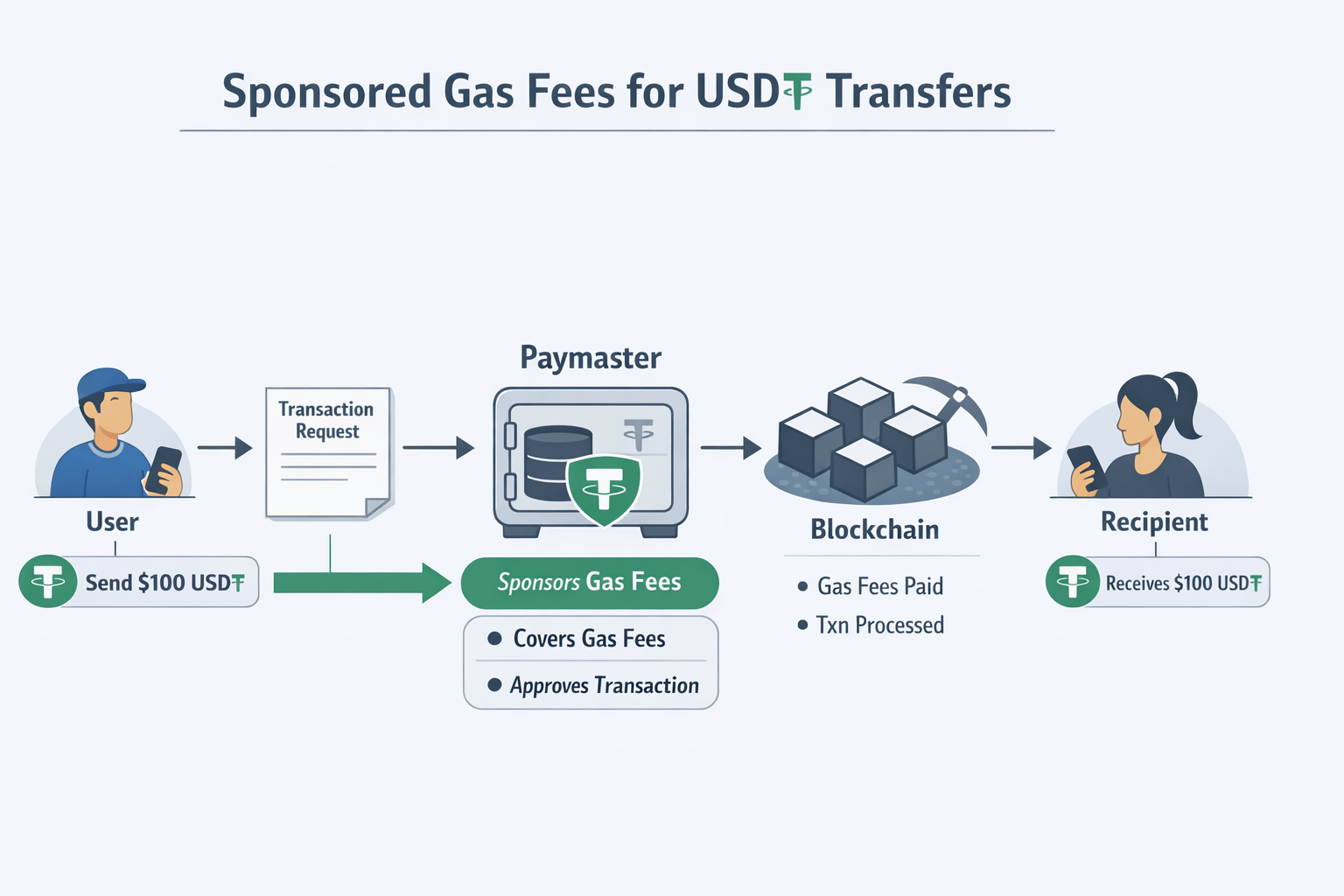

Underneath that simplicity sits the paymaster. Plasma uses an account abstraction style flow where a third party agrees to sponsor transaction fees. In this case, the protocol itself is often the sponsor. Instead of the user attaching gas, the transaction is bundled with a promise that someone else will pay the validator. The user signs intent. The paymaster settles the bill.

That distinction sounds technical, but it’s the foundation. A normal blockchain transaction assumes the sender pays for execution. Plasma flips that assumption. The question becomes not “can the user afford gas” but “does this transaction meet the sponsor’s rules.”#Plasma $XPL

Those rules are where things get interesting. USD₮ transfers are sponsored because Plasma wants stablecoin velocity more than fee revenue right now. That’s not charity. It’s a calculated trade. Stablecoins already dominate onchain activity. In 2024, stablecoins represented roughly 65 percent of all crypto transaction volume by dollar value, even though they accounted for far fewer transactions. The money is already there. What’s missing is frictionless movement.

If you’ve ever sent USD₮ on Ethereum mainnet, you know the pain. A simple ERC-20 transfer can cost anywhere from $1 to $8 depending on congestion. That doesn’t sound like much until you realize it’s a fixed cost. Sending $20 and paying $3 in gas is not a serious payment system. Plasma’s zero-fee layer removes that fixed tax.

Here’s how a real transfer flows. A user initiates a USD₮ send. Their wallet constructs a user operation instead of a raw transaction. This bundle includes the transfer details and a request for gas sponsorship. The paymaster checks conditions. Is it USD₮. Is it within rate limits. Is the account behaving normally. If approved, the paymaster attaches the gas payment and forwards the operation to the network.

From the validator’s point of view, nothing magical happened. Gas was paid. Blocks were produced. Fees were earned. The only difference is who footed the bill.

Understanding that helps explain why this isn’t just a marketing subsidy. Plasma is shaping behavior. Sponsored gas encourages small, frequent transfers. It makes micro-payments viable. It lowers the psychological cost of moving funds. Early signs suggest this matters. On networks that introduced sponsored stablecoin transfers, average transfer sizes dropped by 30 to 40 percent within weeks, while total transfer counts rose sharply. Less hoarding. More flow.

What struck me is how this changes wallet design incentives. When gas disappears for core actions, wallets stop educating users about fees and start competing on speed, reliability, and trust. That’s a different texture than most crypto UX today, which still assumes users must be partially protocol engineers.

Meanwhile, the protocol layer gains leverage. Because the paymaster is discretionary, Plasma can enforce guardrails. Rate limits protect against abuse. Whitelisting ensures sponsorship applies only to assets that serve the network’s goals. If someone tries to spam, the subsidy shuts off. That creates a soft permissioning layer without turning the chain into a closed system.

There are risks here. Sponsored gas is not free. Someone pays eventually. If usage scales faster than expected, subsidy budgets can get stressed. We’ve seen this movie before with incentives that worked until they didn’t. There’s also a centralization pressure. Whoever controls the paymaster controls access to zero-fee lanes. If policies tighten, users feel it instantly.

There’s a quieter risk too. When users don’t see fees, they may not internalize resource constraints. That can lead to congestion if safeguards fail. Plasma’s bet is that stablecoin transfers are predictable enough to model and price in aggregate, even if they’re free at the edge.

That bet lines up with broader market patterns. Stablecoin supply crossed $130 billion recently, but growth has been uneven. Issuance is strong. Usage is fragmented. Payments still feel experimental. What’s missing isn’t liquidity. It’s boring reliability. Zero-fee transfers are not flashy, but they are earned. They require someone to believe the long-term value of activity outweighs short-term costs.

If this holds, we may see protocols competing less on yield gimmicks and more on who can quietly underwrite real usage. Sponsored gas becomes infrastructure, not a promo. The protocol becomes a toll payer on behalf of users, recouping value elsewhere through volume, integrations, or institutional flows.

That’s the larger pattern Plasma points to. Crypto is learning that abstraction is not about hiding complexity for fun. It’s about deciding, explicitly, where complexity belongs. In Plasma’s design, complexity sits with the protocol and the sponsor, not the user sending $50 in USD₮.

The sharp observation that stays with me is this. When gas disappears, what’s left is intent. And protocols that can afford to sponsor intent are the ones quietly positioning themselves as payment rails, not just chains.@Plasma