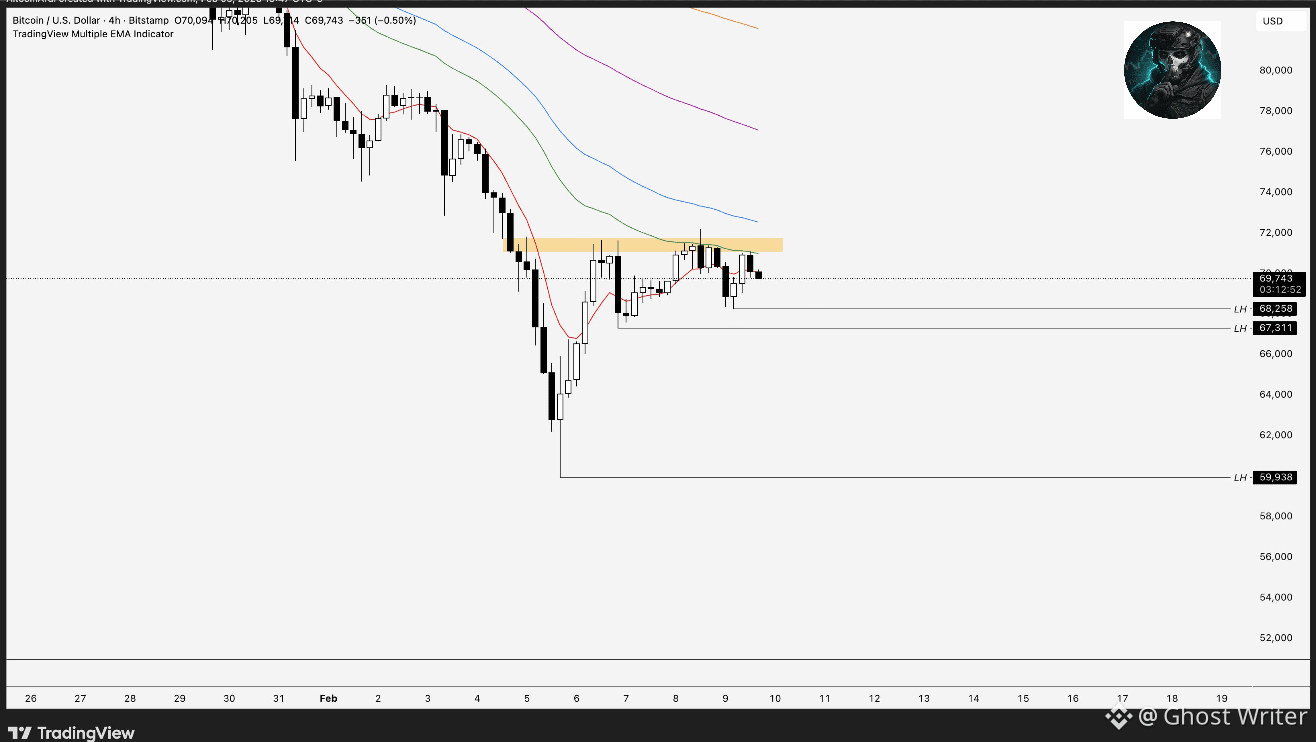

$BTC is currently consolidating after a sharp sell-off, forming lower highs on the 4H timeframe, confirming that short-term structure is still bearish.

Price has now rejected from the highlighted supply zone around $71K–$72K, showing sellers are defending this area aggressively. This zone aligns closely with the EMAs overhead, adding extra resistance pressure.

Right now, BTC is hovering near $69.7K, trapped between resistance above and liquidity below.

⚡ Market has only two clean paths from here:

🔹 Bullish Case:

A strong 4H close above $72K would invalidate the lower-high structure and open the door for a move toward $74K–$76K.

This would offer short-term long scalp opportunities if momentum confirms.

🔹 Bearish Case:

Failure to hold $68.2K–$67.3K support risks another liquidity sweep toward $60K, where the next major demand sits.

📌 Key Levels to Watch:

• Supply: $71K–$72K

• Support: $68.2K – $67.3K

• Major downside liquidity: ~$60K

📌 Final Thoughts:

Market already flushed weak hands.

Now it’s playing patience.

No FOMO.

No prediction.

Just reaction to levels.

Smart money waits for confirmation.

Crowd chases candles.

Trade the structure — not the noise.

#BTC #Bitcoin #Crypto #MarketStructure #4HChart #BinanceSquare #PriceAction 🚀