I ran into Vanar Chain payment flows through a developer conversation I wasn't expecting to find. $VANRY was sitting at $0.006288, up 2.16% with RSI finally touching 40 after weeks stuck in the 30s. Volume at $732,737 USDT, modest but consistent. The price movement wasn't what caught my attention. It was watching automated payment settlements happening without any human approving transactions.

Not demos. Not testnet activity. Real settlements processing continuously.

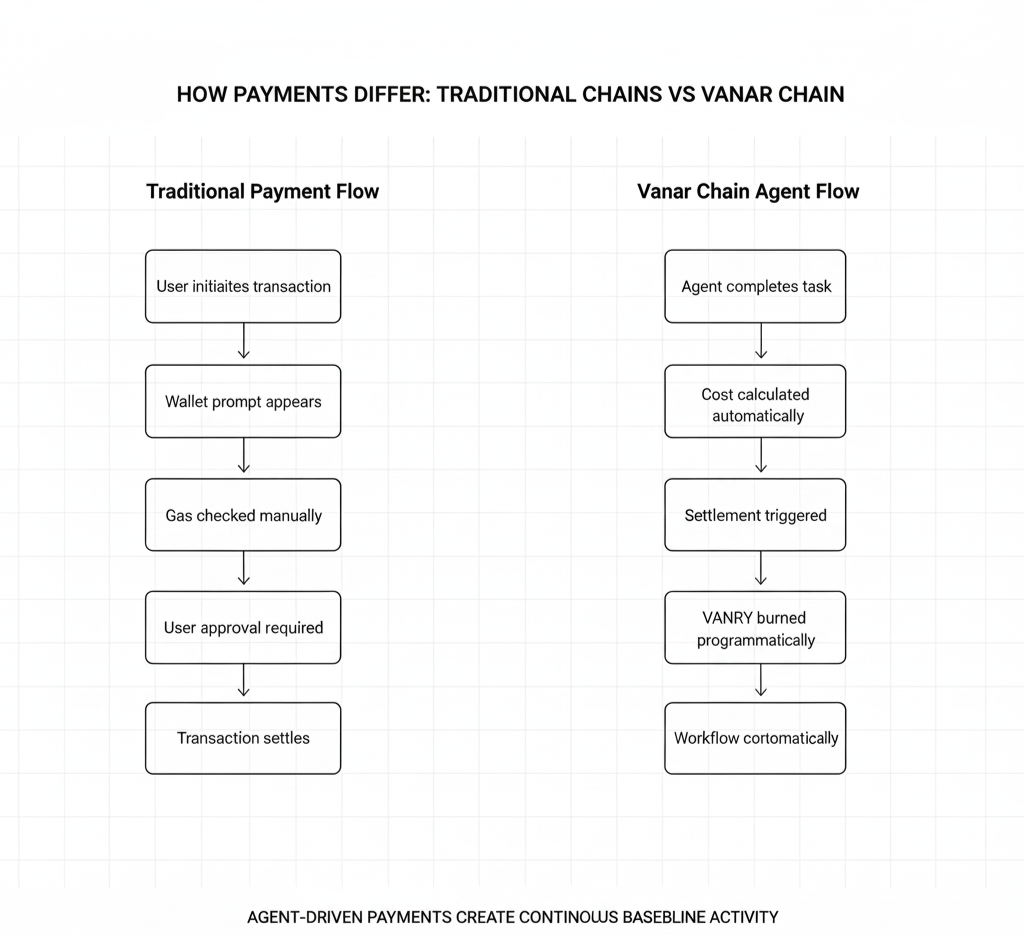

Most blockchain payments assume humans are involved. Wallet pop-ups asking for confirmation. Gas fee estimates you review before proceeding. Manual approval required for every transaction. That UX makes sense when people are moving their own money. It breaks completely when AI agents need to settle thousands of micro-transactions daily.

Vanar Chain developers weren't building around that assumption.

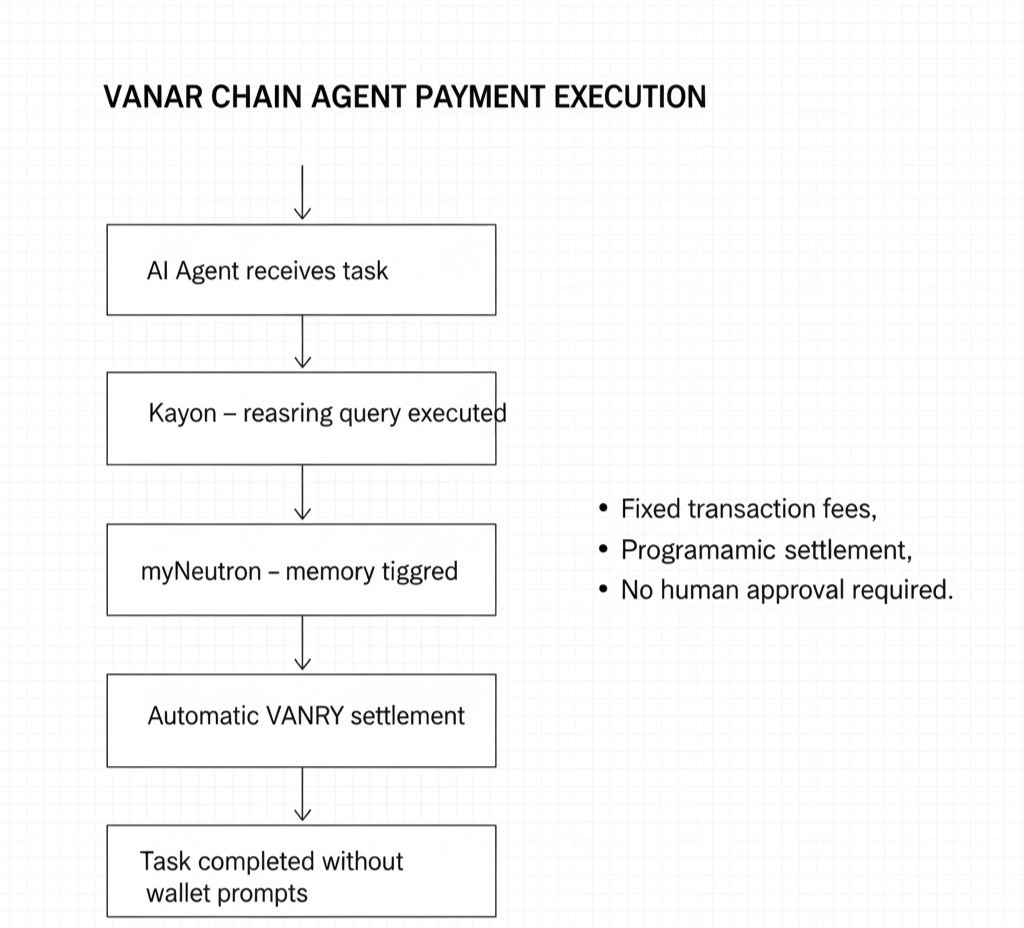

One developer mentioned testing an agent that queries Kayon for reasoning, stores results through myNeutron, then settles payment automatically based on task completion. The entire sequence—query, storage, settlement—happened without human intervention. No wallet prompt. No manual gas approval. The agent executed, confirmed completion, and burned VANRY for the services used.

The fixed fee structure made this possible.

When transaction costs are roughly half a cent regardless of network conditions, agents can operate with predictable economics. An agent managing a workflow doesn't need to check whether gas spiked to $5 or dropped to $0.50. It knows the cost, calculates whether the task generates enough value to justify that cost, and executes or doesn't based purely on logic.

Vanar Chain treating payments as infrastructure rather than features is what enables this.

I kept reading through transaction logs developers were sharing. Agents settling micro-payments for data access. Another paying for automated reasoning queries. A third compensating for memory storage across sessions. Each settlement happened programmatically, triggered by task completion rather than human decision.

VANRY movement during these periods reflected actual economic activity, not speculation.

When 117.72 million VANRY tokens moved in 24 hours, part of that volume came from these automated settlements. Not all—trading activity still exists. But enough came from agents operating continuously that you could see a baseline of payment activity decoupled from whether humans were actively trading the token.

That creates different dynamics than typical blockchain economics.

Most networks see payment activity correlate tightly with user activity. When people aren't actively using applications, payment volume drops. When interest fades, settlement activity disappears. Vanar Chain's agent-driven settlement baseline operates regardless of whether humans are paying attention.

The Worldpay integration adds another layer to this. Traditional payment rails connecting to blockchain settlement means agents can operate in environments requiring fiat convertibility and regulatory compliance. An agent settling a task denominated in dollars but executing on Vanar Chain can bridge between systems without manual intervention.

Developers testing this mentioned settlement delays occasionally when fiat conversion was involved. Not failures, just latency. The agent would complete a task, trigger settlement, wait for Worldpay confirmation, then proceed. That wait time—usually under 30 seconds—was acceptable for most workflows but broke time-sensitive operations.

Vanar Chain operators were documenting these edge cases publicly, same pattern as the cross-chain debugging.

What stood out was how payment settlement wasn't treated as a separate feature to add later. It was infrastructure, built into how Vanar operates from the beginning. Every Neutron seed creation requires VANRY settlement. Every Kayon query burns VANRY upon completion. Every Flow execution settles automatically when conditions are met.

Agents don't open wallets. They don't approve transactions manually. They execute tasks, confirm completion, and settlement happens programmatically as part of the workflow.

That's fundamentally different from how most blockchains handle payments.

I still don't know if this approach scales beyond early adopters. Most applications won't need autonomous payment settlement. Centralized solutions work fine when humans are in the loop. But for the subset building truly autonomous agents—systems that need to operate continuously, settle micro-payments automatically, and function without constant supervision—Vanar Chain's payment infrastructure starts making concrete sense.

For now, agents keep settling. VANRY keeps getting burned for real economic activity. And Vanar Chain keeps processing payments as infrastructure whether markets care about the token price or not.