I've watched blockchain projects make bets on market trends that seemed obvious at the time but turned out completely wrong. Plasma made its bet clear from day one - specialized stablecoin infrastructure would win because payments needed purpose-built chains, not general platforms trying to do everything. Six months later with XPL at $0.0815 down 2.98% and RSI at 30.95, markets are voting loudly on whether that bet makes sense.

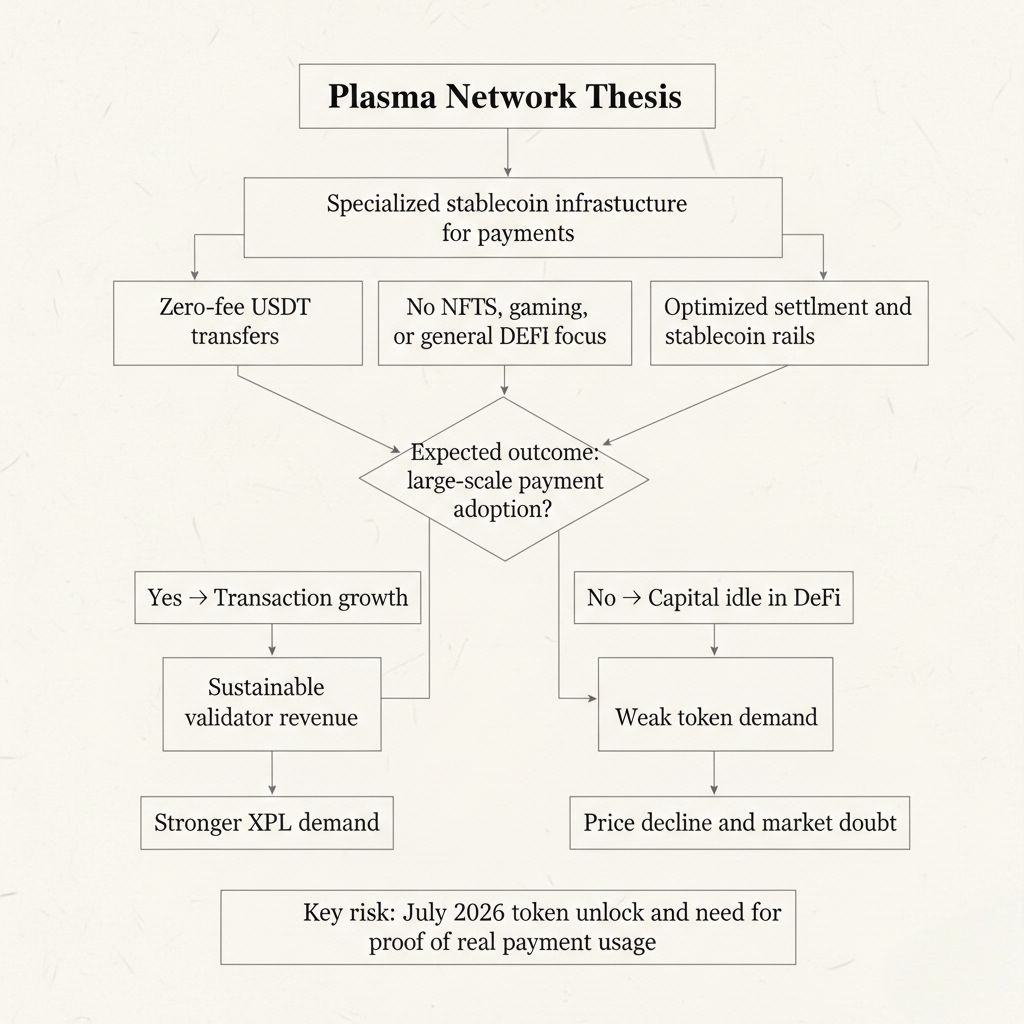

Plasma launched when stablecoin narratives were hot. Every chain wanted stablecoin volume. Plasma went all-in building nothing but stablecoin infrastructure optimized exclusively for USDT transfers and settlement. No NFTs, no gaming, no random DeFi experiments. Just payments and stablecoin operations. That focus was supposed to be Plasma's advantage.

The problem is focus cuts both ways. Plasma can't capture random growth from whatever gets hot next. When meme coins pump elsewhere, Plasma gets nothing because the architecture wasn't built for that. When gaming takes off on other chains, Plasma misses entirely. The network lives or dies purely on whether stablecoin payment volume grows enough to justify specialized infrastructure.

Current XPL price at $0.0815 with volume at 9.08M USDT suggests markets think Plasma focused on the wrong thing. Stablecoin volume exists but it's flowing through Tron and Ethereum, not migrating to specialized infrastructure that Plasma spent millions building. The infrastructure works perfectly but nobody's switching because existing solutions are good enough.

Plasma tested $0.0700 just days ago before recovering to current levels. That's an 89% collapse from September launch around $0.73. The bleeding hasn't stopped despite Plasma shipping integrations, maintaining uptime, processing billions in DeFi volume through Aave. Technical execution is fine. Market fit is the question.

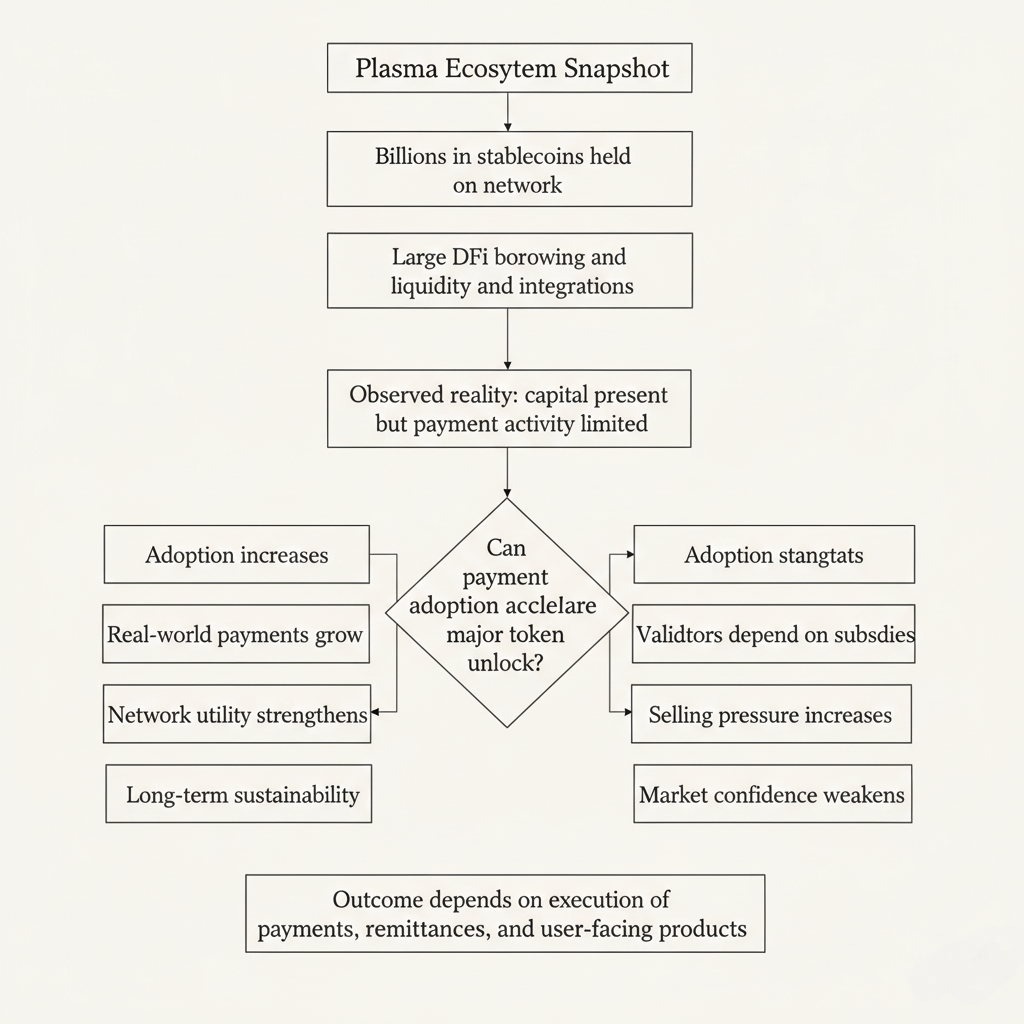

What's fascinating about Plasma's situation is the disconnect between ecosystem metrics and token price. Plasma holds $7 billion in USDT through LayerZero OFT standard, fourth largest by that measure. Over $600 million in weETH sits on Plasma, biggest deployment anywhere. Aave on Plasma processes over $1.5 billion in active borrowing with 84%+ utilization rates. Real institutional capital chose Plasma for deployment.

But that capital isn't using Plasma for payments. It's earning yield on Aave or providing liquidity for trading. The stablecoin volumes sitting on Plasma aren't flowing through payment channels driving the transaction fees that would make economics sustainable. Plasma has the capital but not the activity it was designed to facilitate.

The zero-fee USDT transfer model that defines Plasma creates this weird dynamic. Users can access everything Plasma offers without holding XPL or generating fee revenue for validators. Brilliant for user experience, catastrophic for creating organic token demand. When XPL crashes, there's no usage floor because nobody needs the token to use the network.

Plasma validators stake capital and run infrastructure securing billions in deposits while earning minimal fees because the main product is subsidized. That works temporarily while treasury funds the subsidy. Long-term it only works if volume scales enough that non-USDT transactions generate fees exceeding the subsidy cost. Six months in, that scaling hasn't materialized.

Staking launching in 2026 creates XPL utility beyond transaction fees. Validators will compete for delegated stake, and holders can earn yields by delegating instead of selling. Whether that absorbs selling pressure depends entirely on what yields look like. At $0.0815 with unclear growth, why lock capital in Plasma staking versus earning safe yields elsewhere?

The July 2026 unlock looms as existential test for Plasma. That's 2.5 billion XPL from US participant lockups, roughly 138% of current circulating supply. If Plasma hasn't demonstrated meaningful payment adoption by then, that unlock floods markets without organic demand to absorb it. Current price action with RSI at 30.95 suggests markets expect exactly that scenario.

Plasma's competitive position keeps getting harder. Tron dominates USDT transfers with network effects and user base built over years. Plasma offering zero fees versus Tron's near-zero fees isn't enough differentiation to overcome switching costs for most users. Ethereum has deepest liquidity despite high gas. Solana attracts developers with speed and actual ecosystem activity.

What would Plasma need to change the trajectory? Real payment adoption metrics showing thousands of daily transactions for goods and services not DeFi speculation. Plasma One neobank launching and gaining hundreds of thousands of users. Remittance corridors processing meaningful volume through partnerships with Yellow Card and BiLira. Concrete proof that specialized stablecoin infrastructure drives behavior change.

Those catalysts are possible but increasingly unlikely as time passes without evidence. Plasma has had six months to demonstrate product-market fit. The longer it takes to show real payment adoption, the more markets conclude the thesis was wrong and capital moves elsewhere. Current volume of 9.08M USDT is lowest in weeks, suggesting even traders stopped caring about potential bounces.

The infrastructure Plasma built is genuinely excellent for its purpose. PlasmaBFT consensus delivers sub-second finality. Protocol Paymaster handles gas invisibly. EVM compatibility means easy developer onboarding. Cross-chain integrations connect everywhere. None of that matters if the market doesn't need specialized stablecoin infrastructure badly enough to use it.

Plasma is stuck in painful middle ground. Not dead enough to capitulate completely and bounce hard from zero. Not alive enough to show growth justifying current price. Just grinding lower on declining interest while infrastructure processes minimal payment activity relative to capacity. That's how most failed projects spend their final year before everyone stops pretending it matters.

Maybe Plasma proves markets wrong. Maybe payment adoption inflects in 2026 when products ship and use cases emerge that need exactly what Plasma built. Or maybe this is well-designed infrastructure solving problems markets don't care about, and XPL continues bleeding until July unlock finishes whatever's left. Next few months shipping Plasma One and pBTC probably decide which outcome we get.

For now Plasma sits at $0.0815 with RSI 30.95 showing oversold conditions without conviction buying. Markets gave Plasma six months to prove the specialized stablecoin infrastructure thesis. The price chart says they're not convinced. Whether Plasma changes that judgment or becomes another cautionary tale about building technology nobody needs depends entirely on execution over coming months.