Stablecoins are everywhere now. Billions move daily. Exchanges use them. Startups use them. Freelancers get paid in them. Entire treasuries are managed with them.

But there’s something uncomfortable beneath the surface something most people don’t think about until it’s too late.

It’s not fees.

It’s not speed.

It’s not UX.

It’s visibility.

With most public chains, when you send a payment, it doesn’t just “go.” It sits there, visible, waiting to be confirmed. During that time, anyone watching can see what’s about to happen.

If you’re a trader, that can mean getting sandwiched.

If you’re a business, that can mean something bigger: exposure.

This is the quiet problem Plasma ($XPL) is trying to address.

When Payments Feel Like a Live Stream

Imagine if your company’s payroll file appeared publicly before it cleared.

Imagine if your vendor payments were visible in a waiting room before final settlement.

Imagine if your treasury movements were broadcast in real time.

In traditional finance, that would sound absurd.

But in crypto, that’s normal.

Transactions reveal intent before they finalize. Large stablecoin transfers signal liquidity changes. Payment timing reveals operational patterns. Marketplace payouts reveal business scale.

Even if no one acts on that information today, the fact that they can changes the risk profile.

And as stablecoins grow, the incentives to exploit that visibility grow with them.

This Isn’t About Hiding It’s About Protecting

There’s a misconception that privacy equals secrecy.

That’s not what serious businesses want.

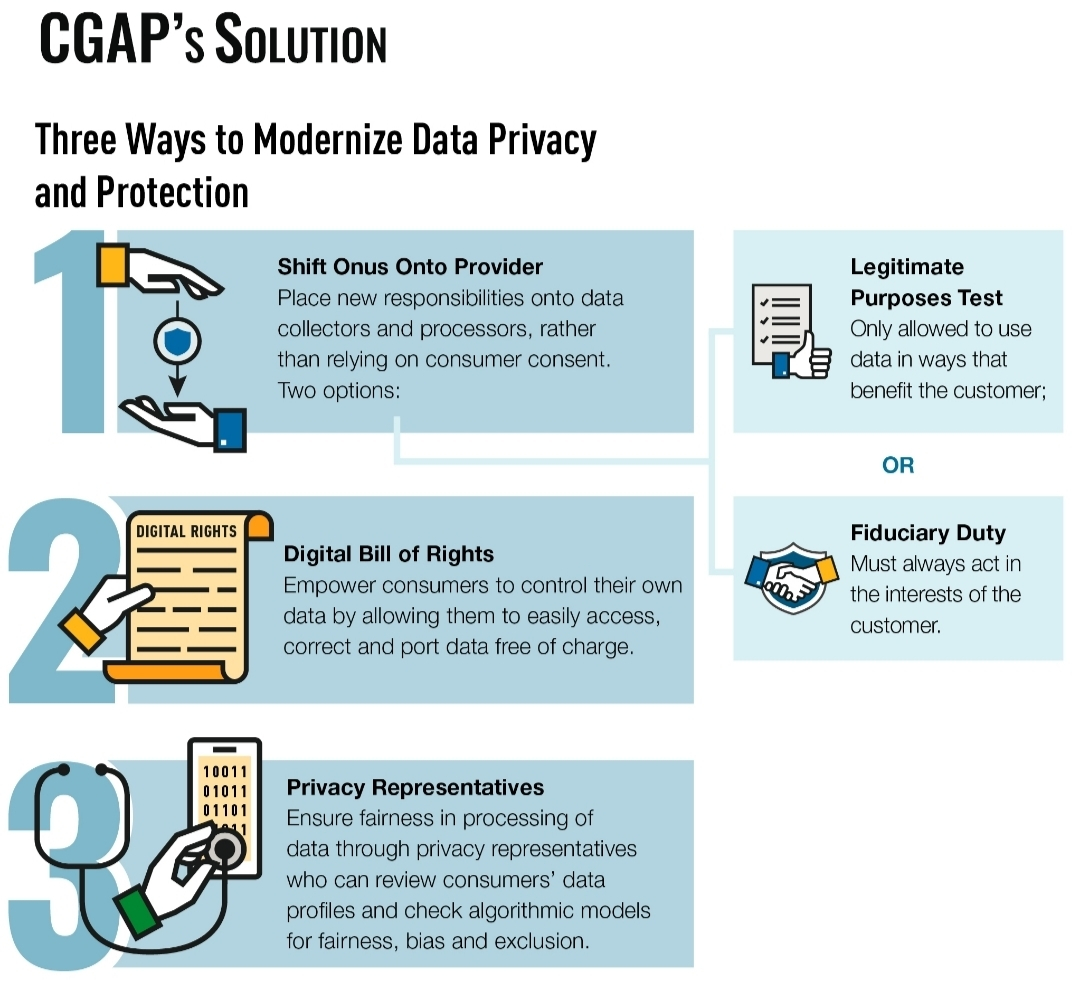

Institutions don’t want to disappear into the shadows. They want compliant systems. They want audits. They want oversight when needed.

But they don’t want to leak sensitive information mid-transfer.

There’s a difference between anonymity and confidentiality.

Anonymity hides who you are.

Confidentiality protects what needs protection while still allowing the right parties to verify.

Plasma’s thesis is simple: stablecoin rails need confidentiality by default, with auditability when required.

That’s not anti-regulation. That’s how mature financial systems work.

The MEV Mindset Goes Beyond Trading

We often talk about MEV as a trading issue. But the underlying idea is broader: when your future action is visible, someone can position around it.

In DeFi, that’s front-running.

In payments, it can be targeting.

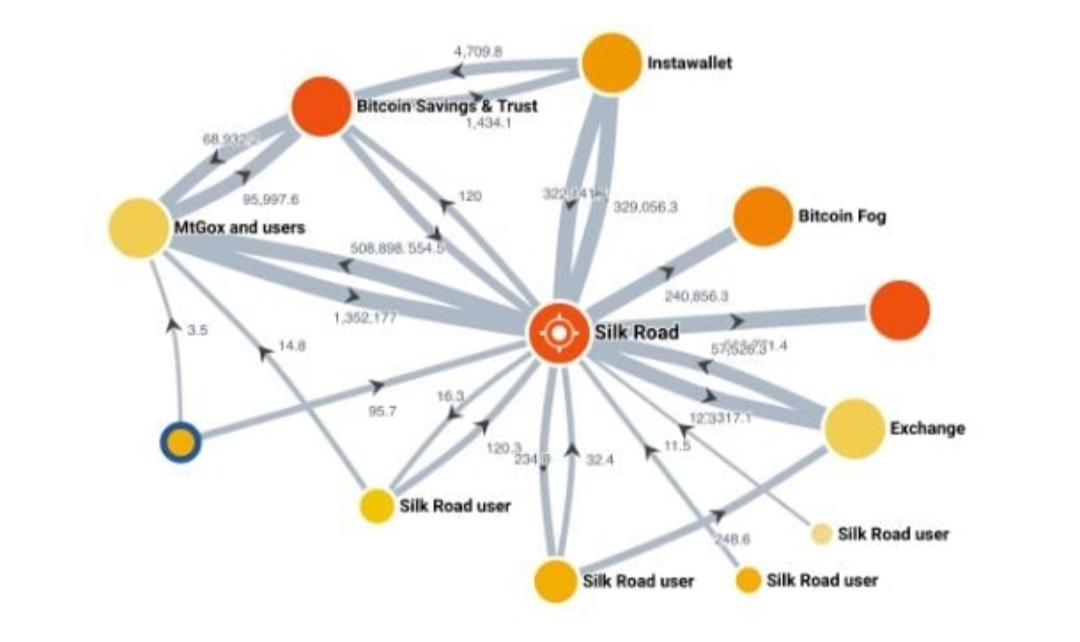

Large transfers attract attention. Attackers can monitor wallets. Competitors can infer volume. Observers can map relationships between businesses.

An aid organization sending funds publicly could unintentionally expose recipients. A fintech moving liquidity might signal internal stress or growth cycles.

These aren’t dramatic, cinematic hacks. They’re slow leaks of information that compound over time.

Infrastructure doesn’t usually fail in one big explosion. It erodes quietly.

Plasma’s Middle Ground

The future probably isn’t fully public rails.

And it’s probably not fully private black boxes either.

Real finance requires selective disclosure.

That means:

Sensitive details are protected by default.

Auditors can verify correctness when necessary.

Regulators can see what they’re allowed to see.

Composability isn’t sacrificed.

Plasma appears to be building toward that middle ground where stablecoin payments feel normal again.

Not hidden.

Not opaque.

Just not broadcast to the entire internet.

That subtle shift changes who can comfortably use stablecoins.

Operators.

Institutions.

Payroll systems.

Treasury managers.

Serious builders.

Making Stablecoins Feel Like Money Again

Most people don’t want their salary history mapped publicly.

They don’t want their suppliers traceable by strangers.

They don’t want their treasury movements turning into signals.

When stablecoins feel like a live feed of your financial life, they stop feeling like money.

In the traditional world, payments are confidential by default. Access is controlled. Oversight exists but it’s structured.

If stablecoins aim to become everyday rails, they need to reflect that expectation.

Plasma’s positioning isn’t flashy. It’s not built around hype or maximalist narratives. It’s built around something quieter:

Financial normalcy.

And sometimes, the most important upgrades in infrastructure are the ones that make everything feel less dramatic and more secure.

The next phase of stablecoin growth won’t be won by the fastest chain. It will be won by the rail people trust with real operations.