In the rapidly evolving Layer-1 landscape, performance is no longer a luxury it is a necessity. As decentralized finance, on-chain trading, and real-time applications continue to grow, the demand for ultra-fast and deterministic blockchain infrastructure has intensified. Fogo has entered this arena with a focused mission: build a purpose-engineered blockchain optimized for high-frequency, low-latency execution.

Rather than competing broadly as a general-purpose chain, Fogo is positioning itself as a specialized high-performance settlement layer. Its architecture reflects this intent through several distinctive technical features that differentiate it from traditional Layer-1 networks.

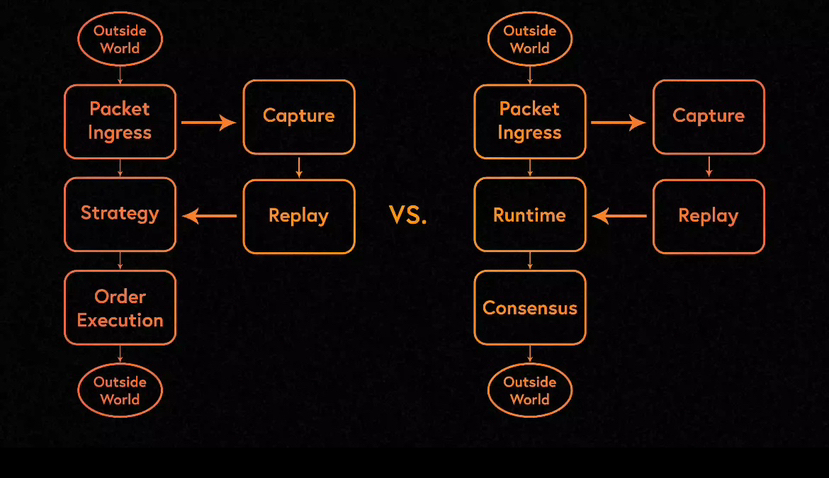

Firedancer-Powered Validator Architecture

One of Fogo’s most important technological pillars is its reliance on the Firedancer validator client architecture. Firedancer was originally designed to dramatically improve transaction processing throughput and reduce latency bottlenecks common in conventional validator implementations.

Why this matters:

Why this matters:

• Traditional validator clients often become CPU-bound under heavy load

• Network congestion typically increases confirmation delays

• High-frequency trading environments require deterministic performance

Fogo’s adoption of a Firedancer-style architecture aims to address these issues by:

• Increasing parallel transaction processing

• Reducing validator overhead

• Improving network efficiency under stress

This design choice signals that Fogo is targeting serious performance use cases rather than casual retail throughout.

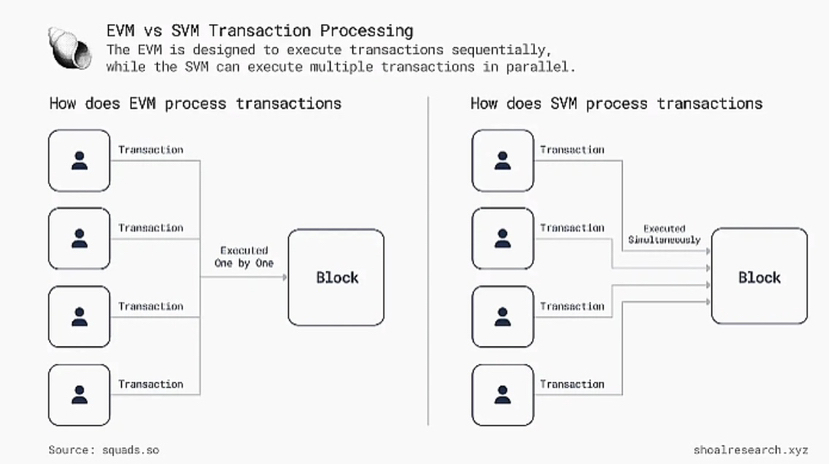

Solana Virtual Machine (SVM) Compatibility

Another strategic decision behind Fogo is its compatibility with the Solana Virtual Machine (SVM). Instead of building a completely new execution environment, Fogo leverages the proven high-performance runtime model pioneered by Solana.

Key advantages of SVM compatibility:

Developer portability

Projects familiar with SVM environments can migrate or deploy with lower friction.

High throughput execution

SVM is optimized for parallel transaction execution, enabling significantly higher TPS compared to many EVM chains.

Battle-tested runtime model

By building on an established execution paradigm, Fogo reduces early-stage technical risk.

This approach reflects a broader trend in crypto infrastructure: modular innovation rather than reinventing every layer of the stack.

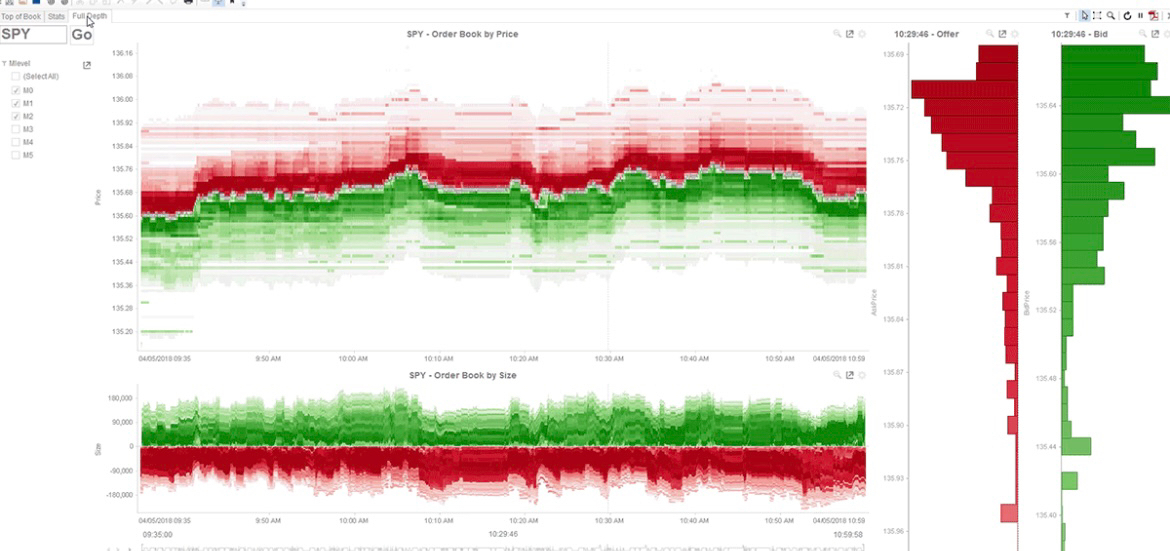

Ultra-Low Latency Block Design

Fogo’s architecture is explicitly optimized for near-instant transaction confirmation. The network design prioritizes minimal latency between transaction submission and finality, a critical requirement for:

• On-chain order books

• Perpetual futures trading

• Market-making strategies

• Real-time DeFi applications

In modern crypto markets, milliseconds can translate directly into financial edge. By engineering the chain around low-latency principles, Fogo is attempting to capture a niche that many general-purpose Layer-1s struggle to serve effectively.

Performance philosophy

Instead of maximizing raw TPS numbers for marketing, Fogo appears focused on:

• deterministic execution

• predictable confirmation times

• low jitter under load

This is particularly important for institutional-grade trading infrastructure.

Multi-Local Consensus Optimization

One of the more technically interesting aspects of Fogo is its emphasis on localized consensus efficiency. While details continue to evolve, the network design suggests an attempt to minimize global coordination overhead one of the biggest hidden bottlenecks in blockchain scalability.

The problem with traditional consensus

Most Layer-1 networks suffer from:

• global message propagation delays

• validator synchronization overhead

• network-wide latency amplification

Fogo’s approach aims to streamline consensus pathways so that the network can maintain speed even as activity increases.

Potential benefits include:

• faster block propagation

• improved scalability ceiling

• reduced congestion during peak usage

If executed properly, this could be one of Fogo’s most meaningful long-term differentiators.

Token Utility and Economic Alignment

The FOGO token is designed to serve multiple roles within the ecosystem, aligning network usage with economic incentives.

Core utilities

Gas fees

FOGO is used to pay for transaction execution, directly tying demand to network activity.

Staking and security

Validators and delegators use the token to secure the network, reinforcing decentralization incentives.

Governance potential

As the ecosystem matures, token holders may participate in protocol-level decision making.

A well-structured token economy is critical for long-term Layer-1 sustainability. Fogo’s multi-utility design follows the emerging best practice of tightly coupling token demand with real network usage.

Purpose-Built for On-Chain Trading

Perhaps the most important strategic insight behind Fogo is its vertical focus. Instead of attempting to be everything for everyone, the project appears heavily optimized for:

• high-frequency DeFi

• on-chain derivatives

• order-book-based exchange

• institutional trading rails

This specialization could become a major advantage.

Why specialization matters

The Layer-1 space is increasingly crowded. General-purpose chains compete on broad ecosystems, but specialized chains can win by dominating a high-value niche.

If on-chain trading continues to grow particularly with the rise of fully on-chain order books infrastructure like Fogo could see disproportionate demand.

Early-Stage Positioning and Ecosystem Potential

Fogo is still in the early phases of ecosystem development, which presents both opportunity and risk.

Opportunity

• Early infrastructure advantage

• Potential for rapid ecosystem growth

• Strong narrative around performance

Risk

• Execution risk remains

• Ecosystem depth still developing

• Competition from established high-performance chains

However, historically, networks that successfully capture the speed + trading narrative have often attracted significant developer and liquidity attention.

Final Thoughts

Fogo represents a new generation of Layer-1 thinking one that prioritizes latency, determinism, and specialized performance over generic scalability claims. Its combination of Firedancer-inspired architecture, SVM compatibility, and low-latency design suggests a clear strategic focus: become the infrastructure layer for real-time on-chain markets.

Whether Fogo ultimately achieves mass adoption will depend on execution, ecosystem growth, and sustained technical performance under real-world load. But from a design perspective, the project is aligned with one of the most important emerging trends in crypto infrastructure: purpose-built high-speed blockchains.

If the future of DeFi truly moves toward fully on-chain, high-frequency financial systems, Fogo is positioning itself to be part of that foundation.