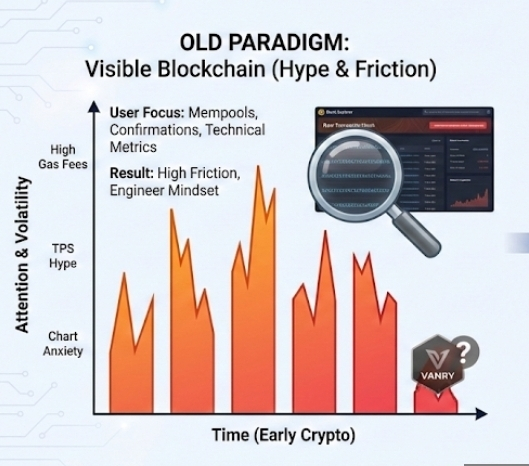

Most people don’t think about electricity when they switch on a light. They only notice it when it fails. I’ve started to think blockchain might be heading in the same direction. For years, the chain itself was the headline. TPS numbers. Gas fees. Token charts. Everything loud, measurable, constantly compared. But lately I find myself caring less about the chain and more about what I can actually do with it.

That shift changes how I look at the so-called “invisible blockchain” idea. The point isn’t to make blockchain disappear in a literal sense. It’s to make it stop demanding attention. Early crypto culture trained users to watch mempools, track confirmations, calculate fees. It almost felt like being your own network engineer. That might have been necessary at the beginning. It’s not sustainable if the goal is normal people using normal apps.

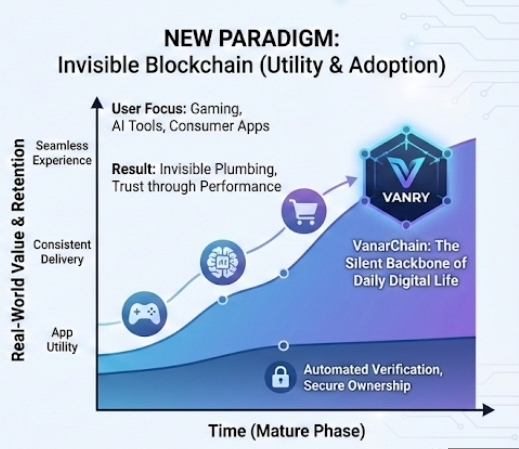

Vanar’s positioning makes more sense through that lens. Instead of pushing the chain as the product, it leans into gaming, AI tools, consumer-facing experiences. In simple terms, the blockchain becomes the back-end record keeper. Ownership, transfers, verification.These are just ways of saying the system quietly tracks who owns what, moves assets securely, and confirms that transactions are real. The user doesn’t need to stare at a block explorer to feel confident.

I’ll be honest though. There’s a tension here. Crypto built its identity around transparency. Public ledgers meant anyone could verify activity. When infrastructure fades into the background, trust shifts from visible data to performance. Does it work smoothly? Does it break under pressure? Those become the new signals.

On Binance Square, visibility works differently. Posts rise because of engagement. Dashboards highlight trending chains. AI recommendation systems reward what keeps attention. That environment nudges projects toward spectacle. Big announcements travel faster than steady execution. An invisible approach can look quiet, maybe even boring. But over time, consistent delivery builds a different kind of credibility. Fewer spikes. More retention. This algorithms eventually notices that too.

Technically, invisibility requires real substance. Throughput to meaning how many transactions a network can process per second to matters because lag ruins immersion. Finality, how quickly a transaction becomes irreversible that matters because waiting five seconds in a fast game feels like forever. These aren’t abstract metrics. They shape whether an app feels modern or clumsy.

Vanar seems to be betting that if the infrastructure is fast and stable enough, developers will build experiences where blockchain simply feels like part of the environment. Not a feature. Just plumbing. And plumbing is only impressive when it fails.

There are risks. Abstraction hides complexity, but it doesn’t eliminate it. Someone still manages validators, security, and decentralization, which basically means ensuring no single party controls the network. If convenience wins too much, decentralization can quietly erode. That would defeat the point. Invisible should not mean opaque.

I also think the invisible thesis changes how we measure success. Instead of asking which chain has the highest daily transactions, maybe we ask which applications people return to without thinking about the tech underneath. That’s harder to capture in a single metric. It’s not as screenshot-friendly. But it feels closer to real adoption.

Maybe the future of blockchain isn’t louder dashboards or more aggressive narratives. Maybe it’s a player buying an in-game asset without realizing a distributed network validated the trade. Maybe it’s an AI app verifying data ownership quietly in the background. No applause. No trending hashtag.

If that future unfolds, the strongest networks won’t be the ones constantly proving themselves. They’ll be the ones quietly embedded in daily digital life, steady enough that nobody feels the need to check how they work. And in a strange way, disappearing like that might be the clearest sign the technology finally matured.

Статья

The “Invisible Blockchain” Thesis and How Vanar Fits It

Отказ от ответственности: на платформе опубликованы материалы и мнения третьих лиц. Не является финансовой рекомендацией. Может содержать спонсируемый контент. См. Правила и условия.

0

2

73

Последние новости криптовалют

⚡️ Участвуйте в последних обсуждениях в криптомире

💬 Общайтесь с любимыми авторами

👍 Изучайте темы, которые вам интересны

Эл. почта/номер телефона