At the time of writing, Bitcoin is trading near $68,166, positioned at a technically and psychologically decisive range. The market is not trending — it is compressing. And compression precedes expansion.

The question is not whether volatility is coming.

The question is direction.

After studying multi-cycle structure, liquidity positioning, macro correlations, and sentiment data, two dominant scenarios emerge.

📉 The Bear Thesis: The $50K Liquidity Sweep

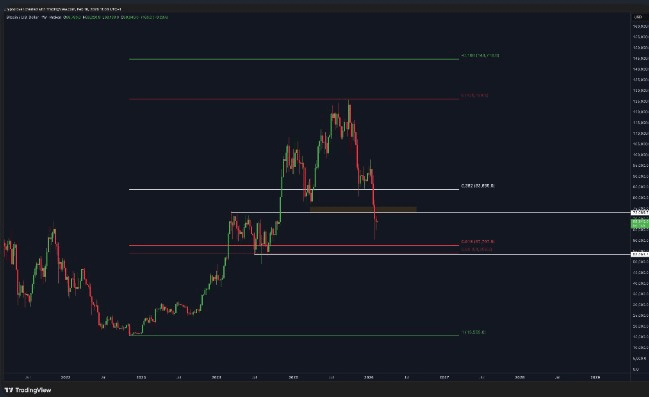

1. Structural Resistance at $72K

Bitcoin continues to stall below the $72,000–$73,000 supply zone — a region that previously acted as distribution during the prior all-time high formation.

Repeated rejections at this level suggest:

Aggressive overhead supply

Unwilling breakout buyers

Large players distributing into strength

Until this level is reclaimed on high volume, the market remains technically vulnerable.

2. The Psychological $60K Pivot

The $60K level is not just horizontal support — it is a liquidity magnet.

If price decisively loses $60K:

Stop losses cascade

Late longs unwind

Perpetual funding flips negative

Below that, the $50K–$53K zone becomes the next high-probability liquidity pool.

Why that region?

0.618 Fibonacci retracement of the current cycle

Previous consolidation base

Significant on-chain accumulation cluster

CME gap confluence (historical behavior)

Markets often engineer one final flush before structural reversals. A sweep into $50K would reset funding, sentiment, and leverage — preparing the ground for sustainable upside.

3. Momentum Divergence

On the higher timeframes:

Price made higher highs

RSI failed to confirm

This bearish divergence historically precedes:

Distribution phases

Final shakeouts

Deep corrective pullbacks

Momentum exhaustion at resistance is not random — it reflects declining marginal demand.

4. Macro Headwinds

Bitcoin does not trade in isolation.

Current macro backdrop:

Elevated bond yields

Tight global liquidity

Strong dollar conditions

Risk asset hesitation

Until liquidity conditions improve, explosive upside may remain capped.

📈 The Bull Thesis: Post-Halving Expansion Cycle

While short-term structure looks fragile, longer-term context tells a different story.

1. Multi-Cycle Ascending Structure (2018–Present)

Since the 2018 bear market low, Bitcoin has maintained a higher-timeframe ascending trajectory.

Each cycle includes:

Blow-off top

70–80% correction

Base formation

Mid-cycle retracement

Expansion phase

If this is a mid-cycle retracement rather than a macro top, current price action resembles prior accumulation phases.

2. Sentiment Reset

The Crypto Fear & Greed Index is hovering near extreme fear.

Historically:

Retail sells fear

Long-term capital accumulates fear

Markets bottom when participants feel maximum discomfort — not maximum optimism.

3. Post-Halving Supply Dynamics

Following each halving event:

Supply issuance drops

Miner sell pressure reduces

Scarcity narrative strengthens

Previous cycles show delayed expansion — not immediate rallies. Price often consolidates for months before accelerating.

4. Institutional Structural Demand

Unlike 2018:

Spot ETFs now exist

Institutional capital participates

Dips attract structured inflows

This creates demand layers beneath price — particularly during volatility spikes.

🔑 The Decisive Levels

Bearish Continuation Trigger:

Loss of $60K on strong volume → opens path to $50K liquidity sweep.

Bullish Confirmation Trigger:

Daily close above $72K–$73K → invalidates short-term bearish structure.

If reclaimed with conviction, next expansion targets align toward:

→ $80K

→ $100K+ continuation

📊 Probability Framework

Markets rarely move in straight lines.

Short term:

Expect volatility compression between $60K–$70K.

Medium term:

A liquidity event (either flush or breakout) is increasingly likely.

Long term:

Structural trend remains intact unless $50K fails decisively on weekly timeframe.

💡 Strategic Perspective

Prediction is ego. Positioning is edge.

I’m monitoring:

• $60K for structural failure

• $72K for breakout confirmation

• Funding + open interest for leverage imbalance

• Liquidity shifts in global markets

Sentiment is washed out. Structure is compressing. Liquidity is coiling.

When Bitcoin resolves from this range, it won’t move quietly.

It will expand.

The only question is from which level.