Bitcoin has cooled off sharply after topping near 126K and is now hovering around the 90K–92K support zone. This isn’t just another random level on the chart — it’s a key area that has held before, and if the broader bull trend is still alive, this zone needs to defend once again.

The current price action feels deliberate. After an aggressive rally, BTC is now compressing, signaling that the market is pausing for direction rather than drifting aimlessly. This kind of tight structure often leads to a strong expansion move.

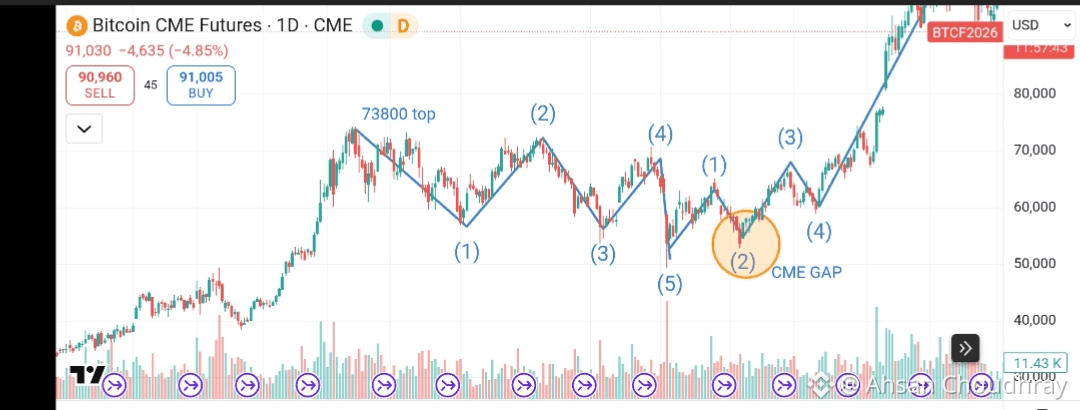

How the structure looks right now

As long as 90K remains intact, bullish control is still valid, and another push higher remains a realistic scenario.

A decisive reclaim and hold above 103K would likely confirm strength and reopen the path toward continuation.

However, if Bitcoin loses 90K on a weekly close, that would be a meaningful shift. In that case, downside momentum could accelerate, targeting the 80K–85K region as the next major support band.

At the moment, BTC is stuck in a tight range and showing indecision. Historically, these phases don’t last long — they usually resolve with volatility. That’s why the weekly close matters far more than intraday moves. The reaction around 90K will give the clearest signal of what comes next.

The forgotten CME gap that still matters

There’s also an important detail many traders have overlooked: a CME gap formed in September 2024. Why does this matter? Because its structure closely resembles the setup seen during the last major dip that preceded the 126,200 ATH.

Back then, price dipped, a CME gap formed, and the larger-timeframe trend eventually resumed higher. Seeing a similar pattern appear again doesn’t guarantee repetition — but it does raise the probability that this pullback could be part of a bigger bullish continuation, not the end of the cycle.

Should you short here?

Shorting at this stage is high risk. A sharp relief bounce before any deeper drop could easily wipe out early shorts. There’s also a small CME gap near the 100K area, which price may want to revisit first.

A more patient approach would be to:

Wait for price to move above 100K,

Then watch for weakness or rejection, which could form a potential head-and-shoulders structure if the market truly wants to roll over.

Final thought

This is not a market for guessing. Bitcoin is sitting at a level that will define the next major move. Let price confirm direction first — patience here can be far more profitable than rushing into a trade.

The 90K zone isn’t just support.

It’s the decision point.