During periods of global crisis, markets clearly show how investors react under pressure. Fear pushes capital away from experimental or volatile assets and toward safer options. This is why gold often rises when uncertainty increases. Bitcoin, despite its innovation, still reacts like a risk asset. The divergence reflects investor psychology rather than technology.

Why Gold Is Moving Up

Gold has maintained value for thousands of years across wars, recessions, and inflation. It is physical, scarce, and does not depend on digital systems. Central banks and governments trust gold as a reserve asset. When confidence in financial systems weakens, gold becomes the first choice. Stability and familiarity make it attractive in crises.

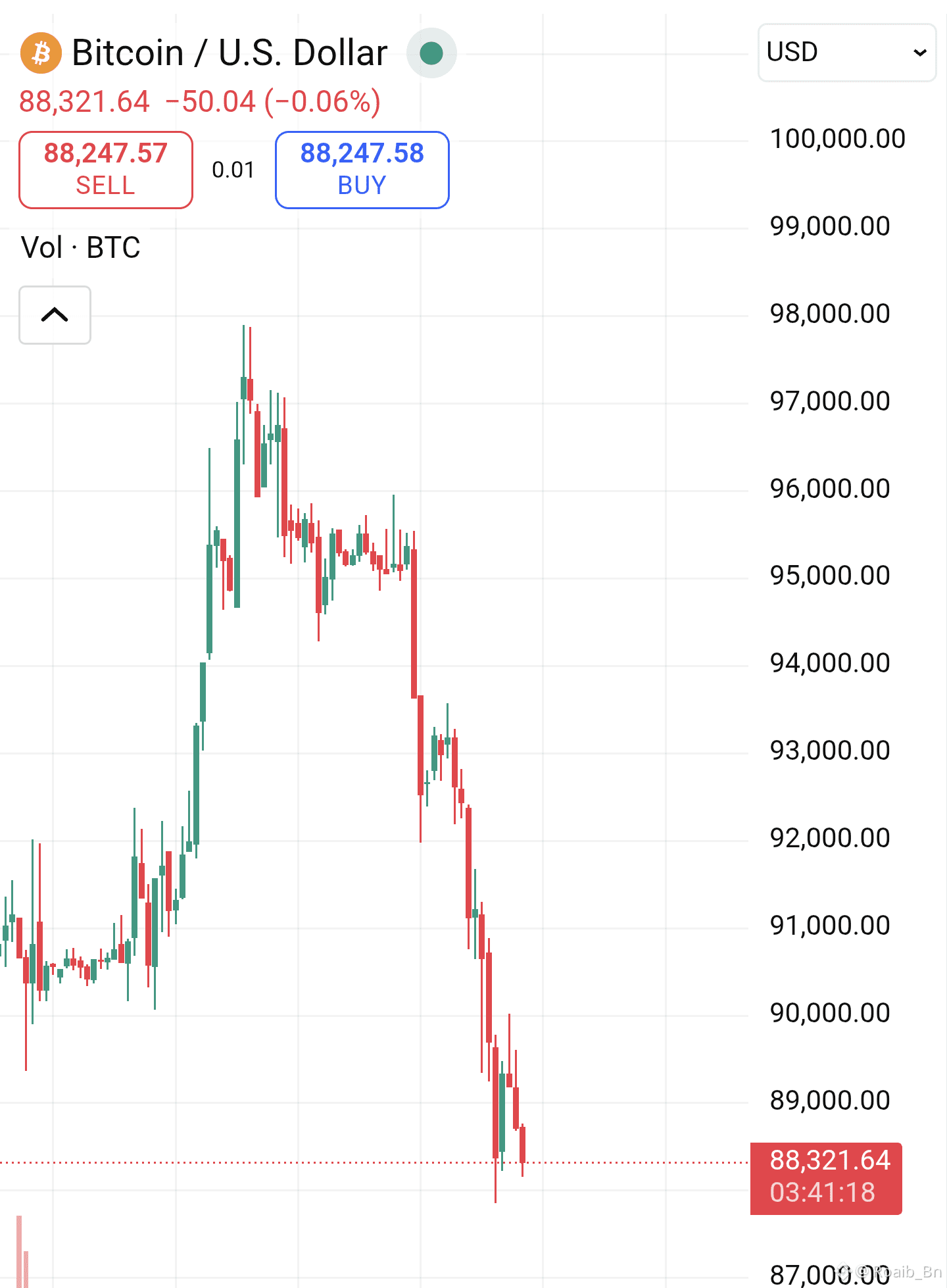

Why Bitcoin Is Falling

Bitcoin is still considered a high volatility asset by most investors. During uncertainty, traders reduce risk exposure and exit positions quickly. Heavy leverage and speculation increase selling pressure. Bitcoin also tends to move with stocks during market stress. This behavior causes sharp drops when fear dominates.

Liquidity and Market Pressure

In financial stress, investors often sell liquid assets to raise cash. Bitcoin is easy to sell instantly, which increases downward pressure. Gold benefits as funds rotate into traditional safe havens. Institutions prioritize capital preservation over growth during crises. This shift strengthens gold and weakens Bitcoin temporarily.

Regulation and Confidence Issues

Regulatory uncertainty adds pressure to the crypto market during crises. Governments often tighten control when instability rises. This creates fear and hesitation among investors. Gold does not face sudden regulatory shocks. Its role in the global system is already established and trusted.

Long Term Perspective

This divergence does not mean Bitcoin has lost its future value. It highlights different roles in different economic phases. Gold protects wealth during fear driven markets. Bitcoin performs best when confidence and risk appetite return. Understanding this helps investors avoid emotional decisions.

#TrumpTariffsOnEurope #GoldSilverAtRecordHighs #BTCVSGOLD #MarketRebound #CPIWatch