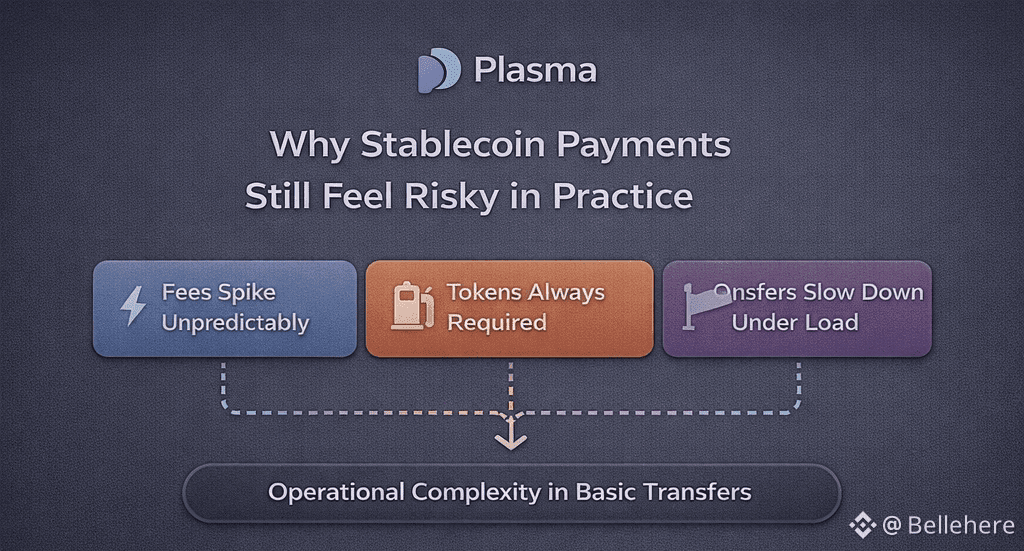

The initial attempt to use stablecoins to do something normal, it becomes obvious that it does not fit. It has a stable asset but not a stable experience. On-chain dollar transfer still appears fragile in both senses that do not matter to trading and matter a lot to payments. Fees vary when the network is congested. Users require a second token to transfer money. A simple transfer may act vastly in response to the congestion.

There is nothing wrong with stablecoins. It is something wrong with the tracks they are running on.

It is the gap that Plasma is attempting to fill. Not through the addition of more functionality, but through the shrinking of the problem. Rather than considering stablecoins as an additional type of token on a general-purpose chain, Plasma considers stablecoin settlement to be the main work. All other things are secondary.

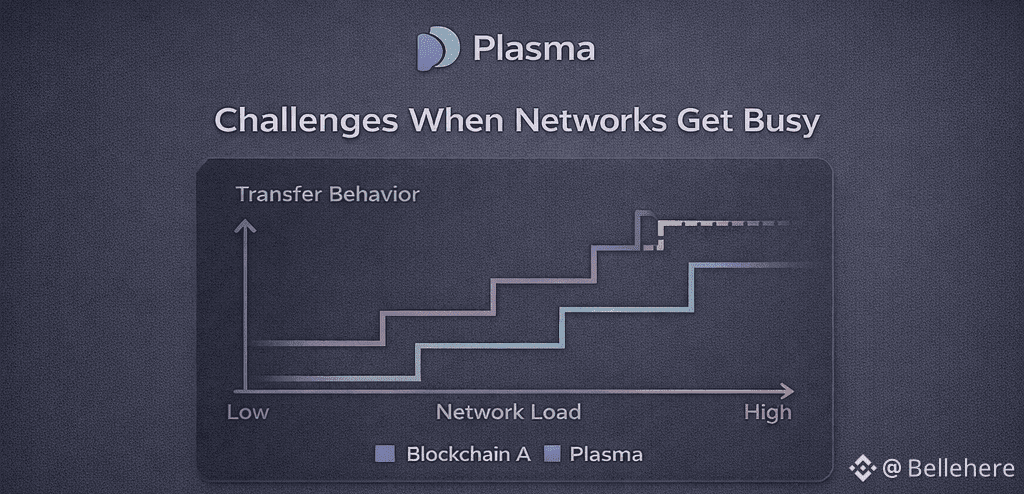

The difference is important as the payments are not made at the convenient time. Payroll, treasury flows, payment of suppliers - this flow occurs throughout the course of the day, can often be load-bearing, and can often have predictability of greater significance than theoretical performance. A chain that will perform well when it is quiet but will go bad at any moment when it gets busy is acceptable to test. It's not fine for money.

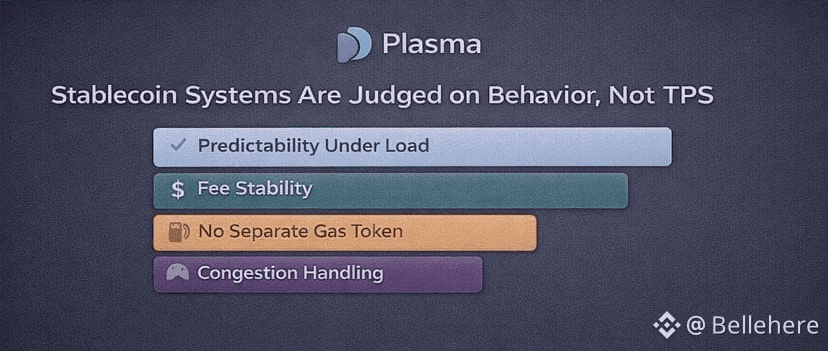

The main bet of plasma is that the transfer of stablecoins is not to act as a blockchain transaction but rather as a payment. This may seem blatantly self-evident, yet the vast majority of systems do not maximize it. They are flexible, composable, or peak optimized. Plasma is repeatable: it settles quickly, fees are predictable, and user decisions during transfers are minimal.

The more visible manifestation of this bet is the way Plasma charges transfers of USDT. A protocol-level paymaster records the sponsorship of the gas by relevant USDT transfer and transferFrom calls. On the part of the user, this eliminates the necessity of carrying out a separate gas token to transfer dollars. Computation is not made free it is just that the cost is borne elsewhere, so the action taken by the user remains clean.

It is not a unique crypto trend. Users do not have to deal directly with routing charges or settlement expenses in payments. That complication gets absorbed by someone else so that the transaction appears simple. Plasma is in effect attempting to take that split of labor on-chain when transferring stablecoins.

It is also at this point that the real tradeoffs become evident. Attack surfaces are created by subsidized actions. Free verse fee sponsorship does not stand up to adversarial use. The documentation of plasma is clear with regard to guardrails: sponsorship is scoped, rate-limited and subject to eligibility logic. That brings in policy and governance issues, who decides which rules to follow, how these rules change, how to deal with exceptions, but those are standard issues in payment infrastructure. The most common way of avoiding them is simply transferring the risk to a less noticeable location.

Performance is included in the story, but not in the manner that crypto tends to present it. Plasma is a work based on Fast HotStuff consensus design and is oriented on short block times and high throughput. The reason why those numbers are important is not as a source of bragging and rather as a source of reliability. Finally, payments do not require extreme high peaks of TPS but rather steady finality during system busy periods. When throughput fails or the latency is high at the point of increase in demand, it fails the simplest test of the system.

The same logic can be applied to Plasma making its decision to be entirely EVM-compatible. It is not the most interesting avenue, but it mitigates the risk of integration. Existing tooling, audits, and mental models can be used by the builders instead of them learning a new environment of execution. In the case of a chain with a payments orientation, reducing novelty is not a weakness.

And there is a more question of trust in the long run. Plasma posits itself as a Bitcoin-based system, with the mechanisms to grant durability and censorship resistance of Bitcoin through time. It does not matter that they agree on the ideologies; it is a question of settlement assurance. The payment systems are not only considered on their speediness but also on its ability to have records that will stand a test tomorrow. One of the ways to deal with that is anchoring to a battle-tested base layer, although with a set of assumptions and dependencies of its own.

All this does not assure adoption. Settlement of stablecoins is already in the competition. Ethernet has credibility and fluidity. In other networks, there is scale in particular areas. Plasma must demonstrate that a stablecoin-first design would in fact result in easier behavior in reality - not only in benchmark, but in volatility, congestion and stress.

That is what is worth watching. Not what the marketing says, but the behavior of the system when it is being used on boring chores on an around-the-clock basis. Is the behavior of fees predictable? Do transfers remain boring? Is operational complexity kept off the user?

In the case of the success of Plasma, it will not be dramatic. It will be as though the stablecoins began acting like money. And when it comes to payments, the most important systems tend to remain silent. They just keep working.