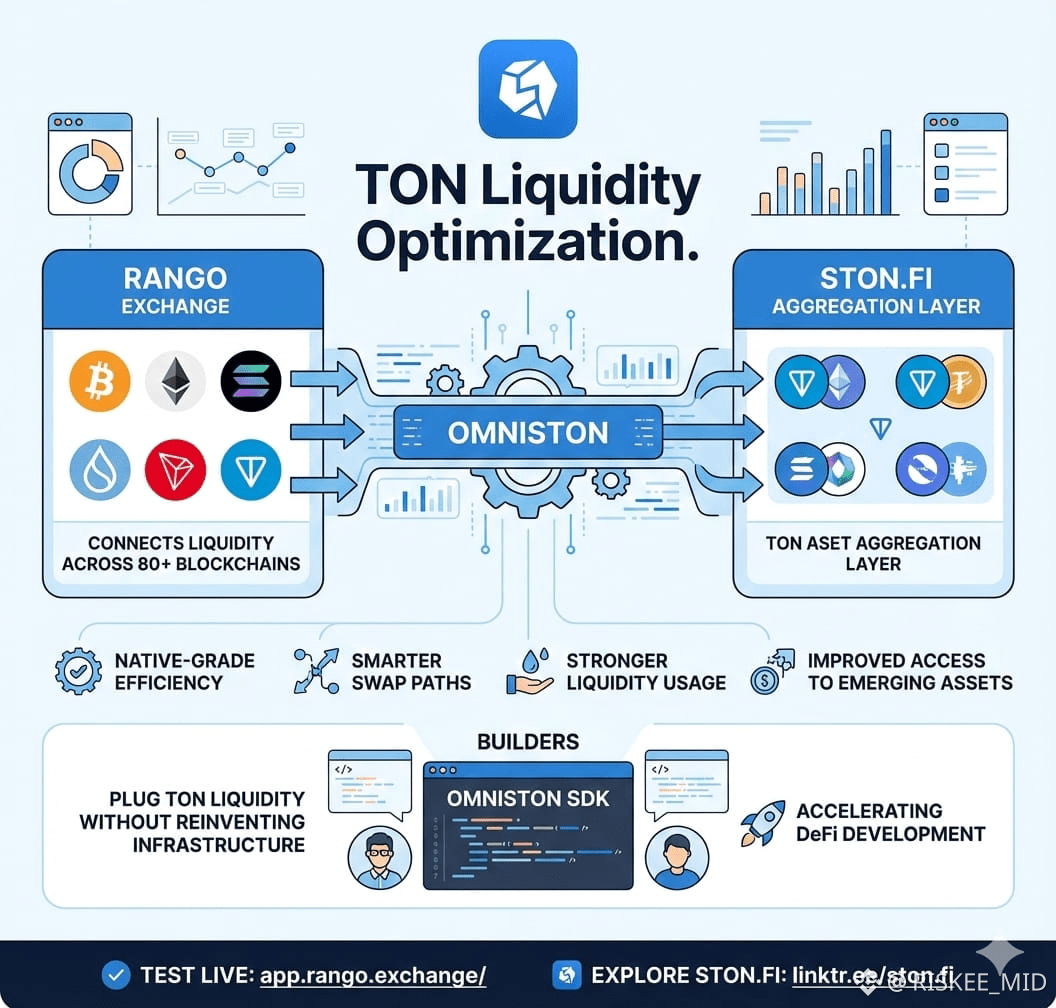

TON liquidity is finally getting the treatment it deserves — why the Omniston → Rango integration matters

The quiet stuff often makes the loudest difference. TON’s connectivity just took a big step forward: Omniston is now powering TON swaps inside Rango Exchange. That may sound like backend plumbing, but it changes how real people and builders interact with TON liquidity — for the better. Here’s a clear, practical breakdown of what happened, why it matters, and what it means for traders, developers, and the TON ecosystem.

What actually changed

Rango Exchange connects liquidity across 80+ blockchains (Bitcoin, Ethereum, Solana, Sui, Tron, and more). Before this update, TON swaps on Rango were routed through generic, cross-chain paths that often used wrapped or indirect assets. Now, Rango routes TON trades through Omniston, which uses STONfi’s aggregation layer to execute TON swaps with native-grade liquidity and protocol-level execution.

In short: TON trades on Rango are no longer treated as an afterthought or routed through clumsy intermediaries. They’re executed using real TON liquidity directly — which makes swaps smarter, deeper, and more efficient.

Under the hood: native aggregation vs generic routing

A few technical points — straightforward and important:

Generic routing: Older cross-chain routing often relied on wrapped assets or multi-hop bridges. That creates fragmentation (liquidity split across many wrapped versions), higher slippage, and more failure points.

Native aggregation: Omniston pulls liquidity directly from STONfi sources (the DEX/aggregator on TON). Trades settle with protocol-level execution on TON instead of relying on wrapped tokens or external bridges.

Result: fewer hops, lower fragmentation, and more reliable execution — particularly for long-tail or newly listed TON tokens that are often hard to reach via generic cross-chain paths.

Why users (traders) benefit

Better prices and lower slippage. Native aggregation finds deeper liquidity pools and avoids unnecessary hops, which usually improves execution price and reduces slippage — especially on larger trades or illiquid tokens.

Access to long-tail tokens. Assets that lived mostly on TON or only had thin cross-chain presence become easier to trade from other ecosystems via Rango.

Faster, cleaner settlements. Less wrapping/unwrapping and fewer cross-chain steps mean trades are simpler and less error-prone.

A more consistent UX. Instead of encountering strange route failures or wildly different quoted prices, users should see more predictable behavior when swapping TON assets.

Why builders should care

This integration is more than convenience — it’s an infrastructure signal:

Plug-and-play liquidity via the Omniston SDK. Teams building wallets, cross-chain dApps, or aggregators can now integrate TON liquidity without reinventing routing logic or building custom bridges for TON.

Faster product iteration. If developers can rely on native-grade TON liquidity being available through Rango + Omniston, they can ship features faster (token lists, buy/swap flows, on-ramps).

Easier discovery for new tokens. Projects launching on TON get a clearer path to liquidity and discoverability across Rango’s multi-chain audience.

What this means for TON’s ecosystem

Less fragmentation, more depth. As more multi-chain aggregators adopt native TON routes, liquidity that used to be split across wrapped versions and isolated pools can coalesce into deeper, healthier markets.

Network effects. Better access improves trading volume, which attracts more makers, which attracts more integrations — a positive feedback loop for TON DeFi.

Signals to infrastructure teams. When major aggregators treat TON as “first-class” rather than tacked-on, other projects and protocols take notice and prioritize TON support.

Important caveats (be smart)

This is a helpful upgrade, but it’s not magic. Keep these in mind:

Smart-contract & protocol risk. Any new integration or SDK introduces code risk. Use caution and do basic checks before routing large amounts through unfamiliar flows.

Slippage and liquidity still vary. Native aggregation improves the situation, but very small markets or newly minted tokens can still exhibit high slippage or low depth.

Not financial advice. This explains the technical and product impact — it’s not investment advice. Always do your own research (DYOR).

How to try it

If you want to see it in action, TON swaps are already live on Rango: 👉 app.rango.exchange/

Learn more about the liquidity source powering these routes: linktr.ee/ston.fi

Quick takeaway

Integrating Omniston into Rango is a technical move with practical consequences: smoother execution, better access to $TON tokens, and a lower barrier for developers to build with TON liquidity. For users it means better swaps; for builders it means less plumbing to worry about. For TON, it’s another step toward being treated like a first-class chain in the multi-chain world.