I’ve been watching blockchain projects evolve over the years. @Plasma caught my eye a while back. It positions itself as a layer one network focused on stablecoins. What draws me in is how it tackles performance without the usual tradeoffs. Think about the bottlenecks in many chains. High throughput often means sacrificing security or decentralization. Plasma seems to navigate this differently. Its design choices reflect a thoughtful blend of existing ideas pushed further.

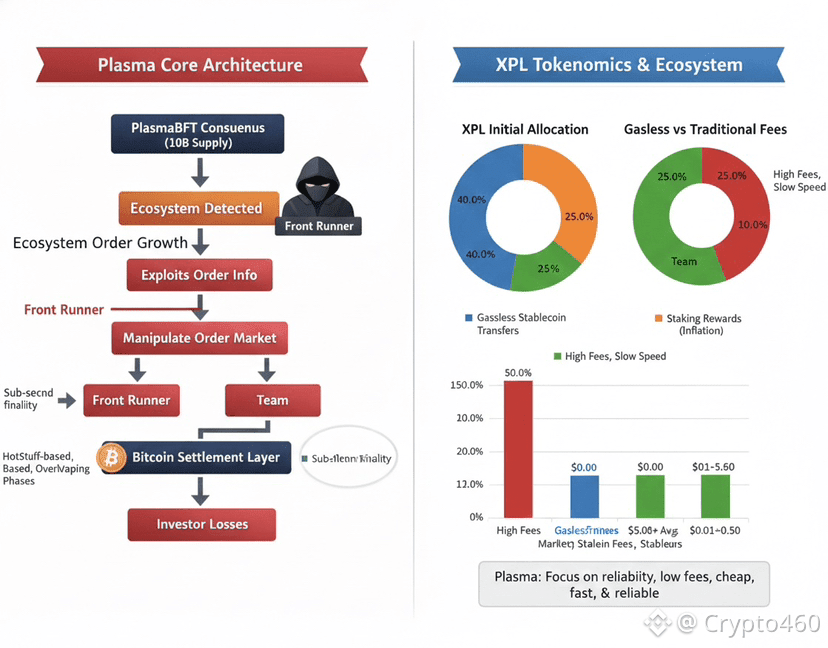

Consider the consensus mechanism at its heart. Plasma uses something called PlasmaBFT. This draws from HotStuff protocols. I’ve seen HotStuff in other systems. It aims for quick agreement among nodes. In Plasma the setup allows blocks to finalize in under a second. Imagine a network where transactions confirm almost instantly. This isn’t just theory. From what I’ve observed in testnets validators propose and confirm in overlapping phases. That overlap cuts down latency. Nodes don’t wait idly. They process in parallel. The result feels like a smoother flow. High performance emerges from this rhythm. Not forced but natural.

Security ties into this closely. Plasma anchors to Bitcoin. It acts as a sidechain in a way. This means it leverages Bitcoin’s proof of work for added protection. I’ve pondered why this matters. Stablecoins handle real value. A breach could be disastrous. By bridging to Bitcoin Plasma adds a layer of trust minimization. Think of it as borrowing strength from a proven giant. The bridge itself pBTC lets Bitcoin liquidity flow in without central custodians. Users move assets across. No single point of failure looms large. This hybrid approach intrigues me. It combines Bitcoin’s UTXO model for transfers with Ethereum style smart contracts. UTXO handles value efficiently. I’ve noticed in Bitcoin how it tracks unspent outputs cleanly. Plasma adapts this for stablecoins. Transfers become straightforward. Less overhead.

Now about fees. Many chains charge gas in native tokens. This can deter everyday use. Plasma flips that. It offers gasless transfers for stablecoins like USDT. How does this work. A built in paymaster system covers costs. Users pay in the stablecoin itself if needed. Or sometimes nothing at all for basic sends. I’ve seen this encourage microtransactions. Picture sending a dollar instantly without a cut. The network sustains through staking rewards. Validators stake XPL the native token. They earn from inflation starting higher then tapering. This incentivizes security without burdening users. Performance stays high because fees don’t clog the system. Transactions fly through.

EVM compatibility stands out too. Developers build on Ethereum tools. They deploy here seamlessly. But Plasma optimizes for stablecoins. Not general apps. This focus sharpens efficiency. I’ve wondered if broad purpose chains dilute their strengths. Plasma narrows in. It supports over a thousand transactions per second. That’s not hype from whitepapers. Early mainnet data shows it holding up. The architecture stacks layers wisely. Execution runs on Reth a Rust based client. Rust brings speed and safety. Fewer bugs mean steadier performance. The consensus layer PlasmaBFT handles agreement. Settlement ties back to Bitcoin for finality.

Let’s think through an example. Suppose a merchant accepts payments globally. Traditional wires take days with fees. On Plasma a stablecoin transfer hits in seconds. Zero cost to the sender. The merchant receives full amount. This scales because the chain processes in batches efficiently. Validators communicate in optimized ways. No wasteful broadcasts. Targeted messages speed things up. I’ve observed similar in other BFT systems. But Plasma tunes it for low latency. Uncertainty creeps in here. Will real world load test this fully. Early signs point yes. Yet networks evolve under pressure.

Another piece is the tokenomics woven in. XPL secures the chain. Stakers validate. But it doesn’t dominate transactions. Stablecoins take center stage. This separation feels smart. Native tokens often volatile. Stablecoins steady. Performance benefits from this stability. Users engage without price swings affecting costs. I’ve seen volatility scare off adoption in other projects. Plasma sidesteps that.

Reflecting on the bridge mechanics. The trust minimized design uses cryptographic proofs. Assets lock on Bitcoin. Mint on Plasma. Reverse to unlock. This reduces counterparty risk. I’ve mulled over past bridge hacks. Central points fail. Plasma spreads the load. Validators monitor collectively. Adds resilience. High performance isn’t just speed. It’s reliability under stress.

The overall structure three layers in some descriptions execution consensus settlement. Each handles its role cleanly. Execution processes smart contracts. Consensus agrees on order. Settlement finalizes on Bitcoin. This modularity allows tweaks without overhauling everything. Innovation here lies in integration. Not isolation.

I’ve spent time comparing to other layer ones. Some prioritize speed but centralize. Plasma balances. PoS with Bitcoin backing decentralizes further. Throughput high without massive hardware demands. Nodes run efficiently. This could lower barriers for validators. More participants stronger network.

Curious about future tweaks. Plasma plans confidential payments. Hide amounts perhaps. For privacy in stablecoin world. That could boost adoption in sensitive areas. Also deeper Bitcoin ties. More liquidity flowing in.

Watching Plasma unfold offers insights into where blockchains head. Its innovations push performance for specific use stablecoins. Adoption might grow as users seek fast cheap transfers. Understanding these tech choices helps grasp broader shifts. Markets observe quietly. Systems like this could quietly reshape payments. Time will reveal how far it goes.