$BTC Binance CEO CZ Reveals Governments Exploring On-Chain Tokenization of National Assets

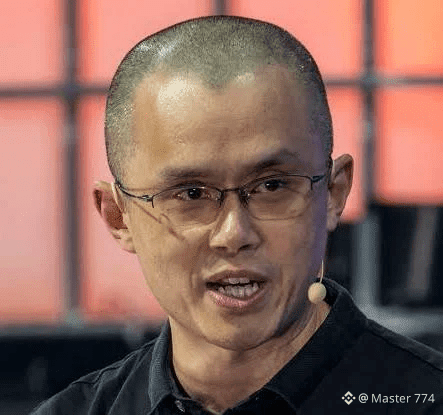

$WLFI At the World Economic Forum in Davos, Changpeng Zhao, the founder and CEO of Binance, confirmed that several governments are actively exploring the tokenization of their state-owned assets on blockchain networks. This, he suggested, could represent the next significant evolution in global cryptocurrency adoption.

Speaking on a panel discussion, Zhao explained that his team $BANK is currently in talks with more than a dozen countries about the potential to bring government-held assets onto blockchain platforms. He framed this initiative as a natural progression following the rise of cryptocurrency exchanges and stablecoins, which he described as the first two major adoption milestones for the industry.

“Exchanges laid the foundation for crypto trading worldwide, and stablecoins brought trust and liquidity to digital finance,” Zhao noted. “Tokenization of national assets is the next frontier—it could fundamentally change how governments manage, track, and leverage public resources.”

While Zhao did not disclose specific countries involved in these discussions, he emphasized that the concept is gaining momentum among both emerging and developed economies. According to him, tokenizing assets on-chain could enhance transparency, reduce inefficiencies, and open new avenues for investment in traditionally illiquid public holdings.

Industry analysts see this as a bold step that could accelerate institutional adoption of blockchain technology. By enabling governments to digitize assets such as real estate, infrastructure projects, or state-owned enterprises, tokenization could make these assets more accessible to global investors while ensuring secure, traceable ownership.

Binance’s CEO believes that just as exchanges and stablecoins proved that crypto can operate at scale globally, tokenization represents a critical opportunity for the sector to further integrate with traditional finance. “This isn’t just about crypto for the sake of crypto,” Zhao said. “It’s about redefining how the world handles value at the national level.”

As governments continue to evaluate regulatory frameworks, technical infrastructure, and potential risks, the coming months may reveal whether national asset tokenization becomes a reality—or remains an ambitious experiment. Regardless, Zhao’s announcement highlights how the boundaries of cryptocurrency adoption continue to expand, moving beyond individual investors and trading platforms toward systemic, government-level applications