Bitcoin derivatives markets indicate that professional traders are bracing for near-term volatility and potential downside, while simultaneously positioning to accumulate around current levels. Options and futures data point to caution on leverage rather than outright bearish conviction.

Bitcoin has remained capped below $91,000, and the annualized funding rate for perpetual futures stands near 7%, close to the lower bound of the neutral range. This suggests limited appetite for aggressive bullish leverage, even after a modest rebound from earlier lows.

In the options market, demand for downside hedges has not surged. The most active strategies over the past 48 hours have been long straddles and long iron condors, both volatility-focused structures. This positioning implies expectations of consolidation or range trading rather than a sharp continuation lower.

Positioning among top traders reinforces a neutral-to-bullish bias. Long-to-short ratios at major exchanges ticked higher, indicating gradual accumulation without reliance on high leverage. The behavior aligns with a strategy of building exposure during price compression phases.

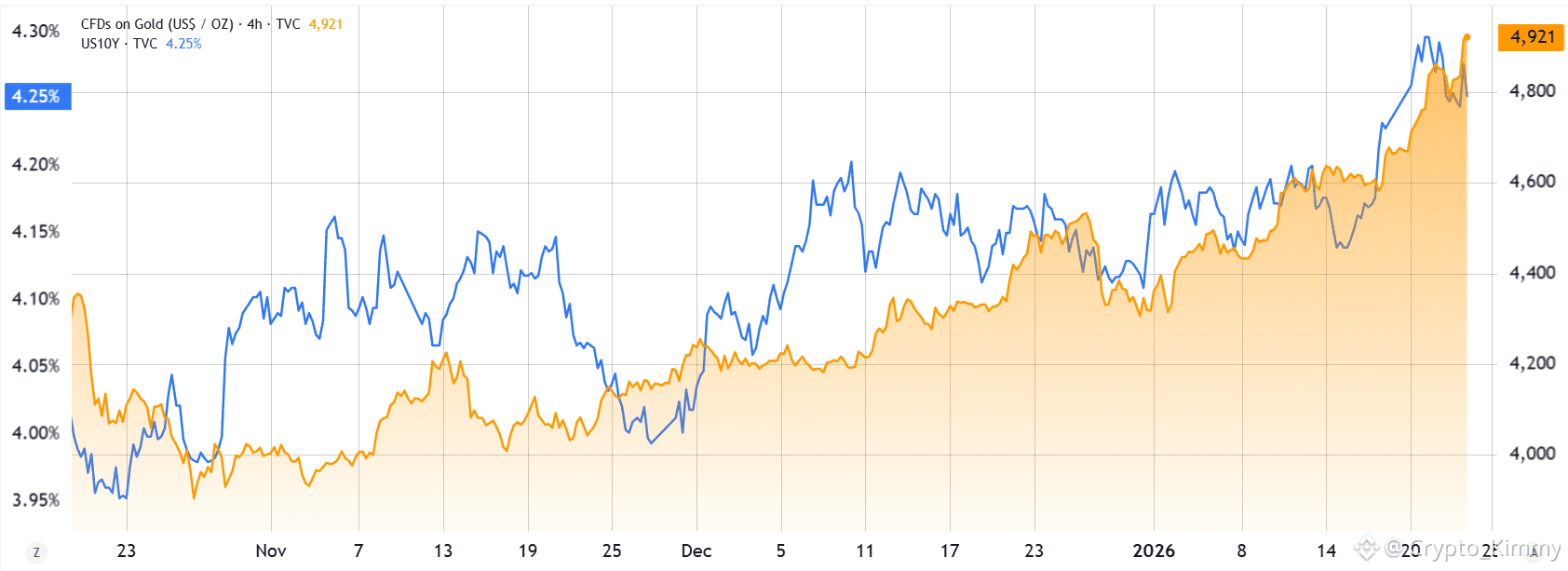

Macro signals remain mixed. Gold prices reached record highs as US Treasury yields climbed to around 4.25%, reflecting renewed safe-haven demand and fiscal concerns. At the same time, Bitcoin spot ETFs recorded roughly $1.58 billion in net outflows over two days, delaying the return of institutional inflows.

Attention now turns to upcoming corporate earnings, with Microsoft, Tesla, Apple, and Visa set to report. Broader risk sentiment may hinge on these results.

Overall, derivatives data suggest resilience after the $88,000 retest, but a move back toward $95,000 likely depends on the resumption of institutional inflows, which have yet to materialize.

#weeklyblockchain #cryptonews #blockchain #latestnews #bitcoin #derivatives #optionsmarket #institutionalflows #etfs