Let's talk about what's really moving markets this week. Forget the noise—the big picture is coming into focus, and it's creating a fascinating landscape for crypto. Here's the lowdown from the trading desk.

💰 Where's the Institutional Money Going?

The institutional story for crypto isn't just about waiting for new money; it's about a structural shift in the type of money already flowing in. ETF inflows are now just one part of the story. Analysts highlight that institutions like JPMorgan are gearing up to offer crypto services, signaling a massive wave of mature capital from pension funds and 401(k) plans is imminent. When these funds start adding crypto to their model portfolios, the buying pressure could be systematic and sustained, not just speculative.

Our Take: This changes the game entirely. Crypto is becoming a core, regulated asset class. The era of "hype cycles" is giving way to a story of institutional "maturity and integration".

⚙️ Hot Under the Hood: Tech, Policy, and Security

Beneath the price action, three critical developments are shaping the future of the space:

🚀 The Clarity Act is in Motion: The landmark US regulatory framework has entered a pivotal Senate committee mark-up. This could finally end the dreaded "regulation by enforcement" and provide the legal certainty needed for builders and institutions to go all-in.

🛡️ Quantum Threats Get Real: A staggering $2 trillion worth of $BTC is vulnerable to future quantum computing attacks. The launch of the "Bitcoin Quantum" testnet is a direct, proactive response to this existential risk. This is not hype; it's essential long-term security work.

🔒 Tether Steps Up: In a clear nod to regulators, Tether froze $182 million in USDT tied to illicit activity. This shows major players are aligning with government pressure to clean up the ecosystem, a necessary step for mainstream acceptance.

📈 Quick Tech Check: Key Levels to Watch

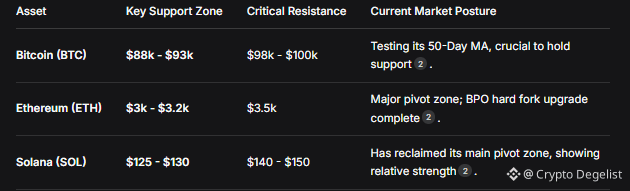

While fundamentals set the stage, technicals give us the map. Here's where the majors are consolidating:

🌍 The Macro Backdrop: Why Crypto's Story Resonates

This is the crucial context. Look at the headlines beyond our bubble:

Global trade is fragmenting under "mounting pressure" from geopolitics and protectionism. This leads to policy uncertainty and supply chain disruptions.

"Slow growth" is the new global norm, with major economies like the U.S. and China losing momentum.

Here’s the connection: In a world of fragmented, politicized traditional finance and low-growth expectations, crypto's borderless, predictable (capped supply), and innovation-driven model becomes exponentially more attractive. It offers an alternative network.

💡 Bottom Line: We are witnessing crypto's evolution from a speculative bet into a legitimate pillar of the future financial system. The combination of institutional onboarding, serious tech upgrades, and a shaky macro environment for traditional assets is creating a uoniquely bullish long-term setup.

Stay sharp, and manage your risk. The trend is your friend, but the stops are your lifeline.

What do you think is the most powerful crypto narrative right now? Is it institutional adoption, real-world utility, or something else? Let me know your take in the comments!

BTC89,146.03+0.90%