We often talk about blockchains being "secured by their token" but that phrase has become a kind of shorthand that glosses over the actual machinery. When I look at a new Layer 1 like plasma, the first question is not just if the token has utility, but how those utilities are engineered to interlock. The design of XPL moves beyond simple staking for security, it is wired into the chain core function as a stablecoin settlement layer. The whitepaper and recent technical communications frame it not as an afterthought, but as the central coordination mechanism for a network built for a specific type of economic activity.

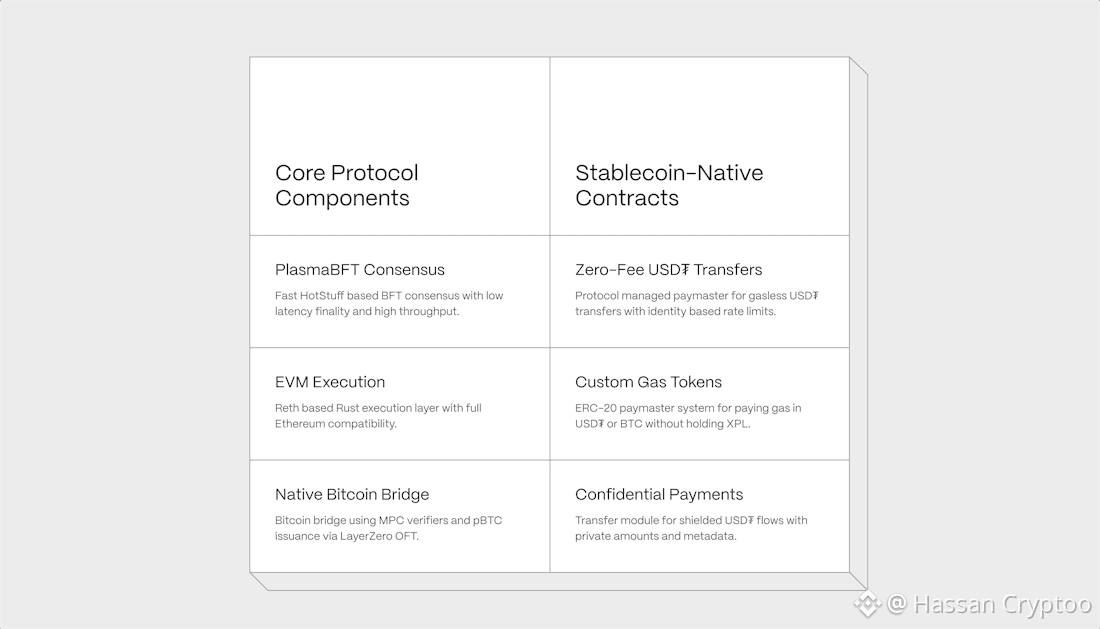

At its foundation, XPL is the staking asset for the network validators. Plasma uses a consensus mechanism called plasmaBFT, a variant of delegated proof of stake. Here, XPL holders delegate their tokens to validators who are responsible for producing and finalizing blocks. The security model is straightforward in principle, validators have economic skin in the game. A malicious actor risks their staked XPL through slashing. But the context matters. This is not just any L1, its stated goal is to attract high value, stablecoin based transaction volume. The security budget, derived from staked $XPL, is what ultimately backs the finality of those USDT or USDC transfers. The staked asset serves a two purposes, it is not just a security buffer but the core collateral that reinforces a specialized transaction network. Currently, the team's communications stress the importance of implementing this security framework to be both neutral by design and resilient against censorship, a key theme in their project's philosophy.

Where $XPL design gets more distinctive is in its integration with the network economic activity. This is the "operating" part of the equation. Plasma introduces a concept called "stablecoin first gas". Users can pay transaction fees in the stablecoin they are transacting with, like USDT. This is a significant user experience play, removing the friction of needing a separate gas token. However, the validator who processes that transaction is ultimately compensated in XPL. The system handles an internal conversion. This creates a direct, automated demand loop, stablecoin transaction volume on the network generates a continuous buy pressure for XPL to pay the validators. It is a clever way to tether the utility token demand to the primary use case the chain is promoting. My review of the mechanism suggests it is designed to align incentives neatly, validators want to process more stablecoin transactions because that is how they earn their XPL fees, and users get a seamless experience. It turns the token into a necessary settlement layer within the settlement layer itself.

Governance is the third pillar. Holding XPL confers the right to participate in on chain governance votes that steer the protocol future. This includes decisions on parameter adjustments, treasury allocations, and technical upgrades. In a chain focused on serving institutional payment and finance use cases, as noted in its project description, predictable and orderly governance is critical. The token becomes the key to that process. While many projects offer governance, for plasma its importance is amplified. Decisions about fee market mechanics, the integration of new stablecoin assets, or adjustments to the staking model directly impact the chain attractiveness as a financial utility. Token holders are not just voting on features, they are potentially steering the financial plumbing.

Then there are the more targeted utility features. Plasma promotes "gasless" USDT transfers for specific applications or user onboarding flows. In these models, a developer or dApp can sponsor transactions so the end user pays nothing. Who covers the cost, The sponsor pays in XPL. This positions the token as the backend fuel for business development and user acquisition strategies on the network. The token functions as a B2B utility, capable of fueling substantial, bulk usage should these frameworks achieve widespread adoption. Looking ahead, Plasma's roadmap envisions employing XPL to provide security services spanning numerous blockchain networks According to the project's technical documents, the "bitcoin anchored security" framework would involve staking $XPL to back verifiable commitments recorded on the Bitcoin blockchain, seeking to harness Bitcoin's immutable characteristics. Successful execution of this model would add a major and distinctive security aspect to the token's utility.

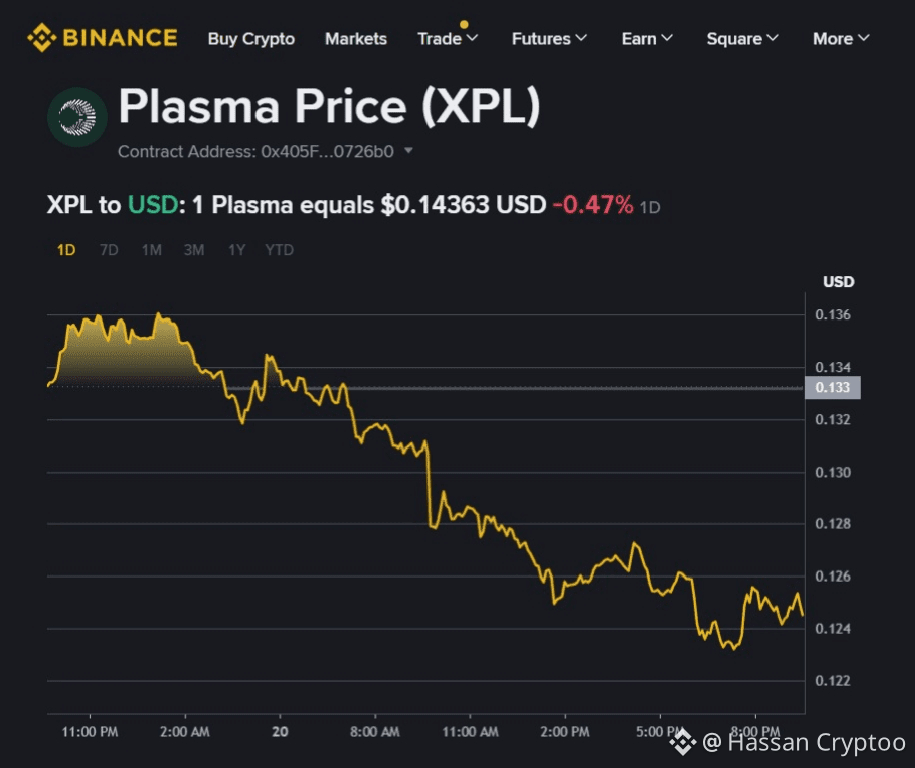

$XPL is currently available for trading on Binance Spot. Chart analysis shows the price is now in a stabilization phase inside a specific range following its debut. Visible spikes in the volume profile align with developments on the network and shifts across the wider Layer 1 sector. On a fundamental level, data from CoinMarketCap places it alongside other new Layer 1 blockchain platforms. Key considerations for any analyst include its Fully Diluted Valuation and circulating supply figures, which must be evaluated against its technical distinctiveness and the actual expansion of its stablecoin settlement activity the central performance indicator.

The architecture of $XPL utility feels deliberately layered. It is not a single use asset. It secures the chain through staking, operates its fee economy through a conversion engine, governs its parameters, and could one day anchor its security to bitcoin. Each function supports the main goal, making plasma the most efficient and secure home for stablecoins. The success of this model hinges entirely on adoption. If stablecoin volume flows onto the chain, the engineered demand loops for $XPL begin to spin. If not, the sophisticated design remains theoretical. What stands out to me after examining the documentation is how the token roles are not just listed but are logically derived from the chain singular focus. It is a purpose built economic instrument for a purpose built blockchain.

by Hassan Cryptoo