This isn’t a campaign headline.

This isn’t partisan noise.

This is a direct collision between political power and financial power.

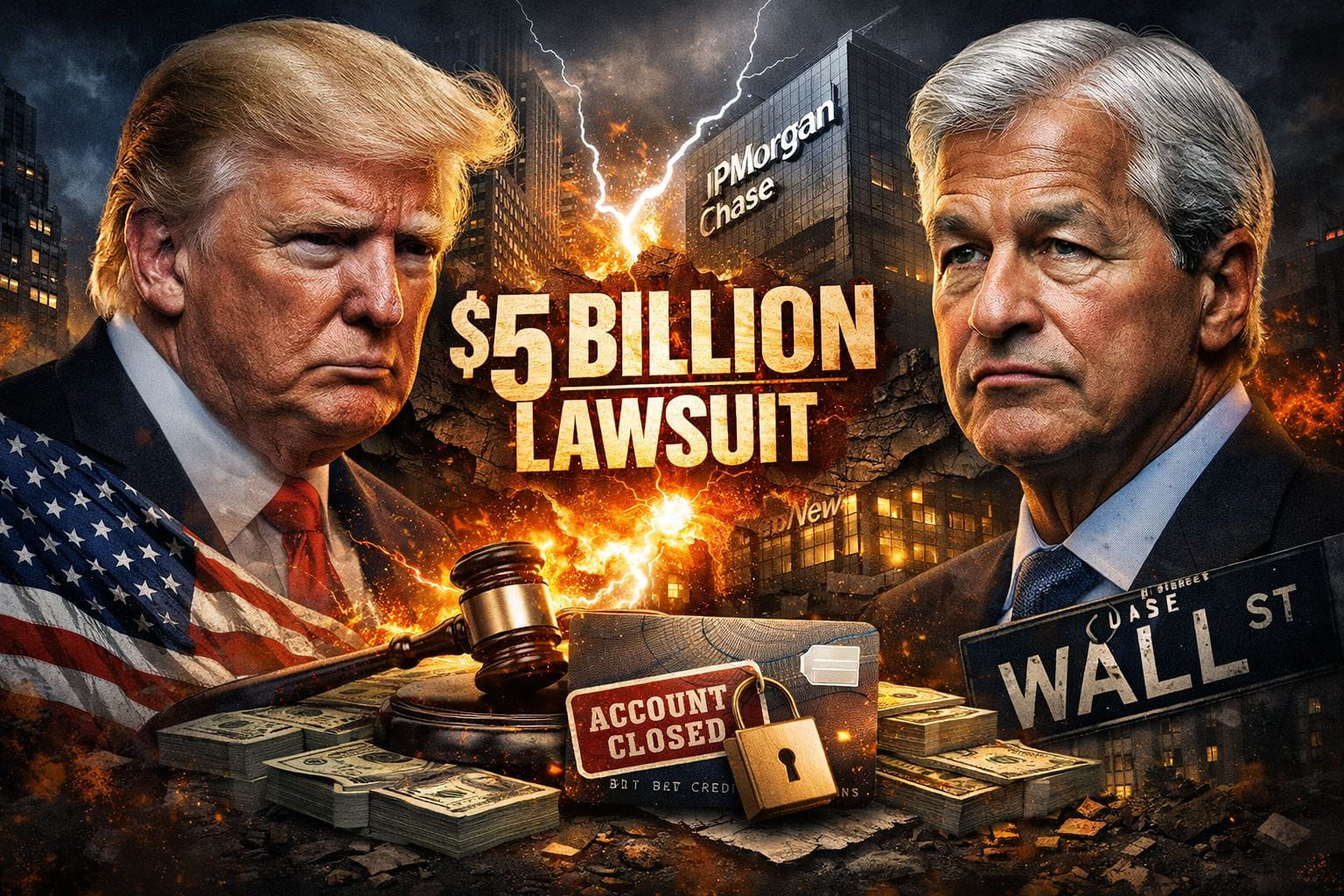

Donald Trump has launched a staggering $5 billion lawsuit against JPMorgan Chase, America’s largest bank, and its CEO Jamie Dimon—accusing them of something far more dangerous than bad service or broken contracts.

The charge is debanking.

According to the lawsuit, Trump claims he was quietly pushed out of the financial system—not by law, not by regulators, but by corporate decision. Once JPMorgan closed its doors, other banks allegedly followed. Not because of risk. Because of fear.

That’s the part that should stop everyone cold.

When the biggest bank moves, the rest don’t ask questions—they fall in line.

JPMorgan denies the allegations. But the argument behind this case cuts deep:

If a mega-bank can cut off access to accounts, transactions, and financial infrastructure, that’s not inconvenience—that’s financial isolation.

No trial.

No vote.

No appeal.

At that point, banks stop being service providers.

They become gatekeepers.

They become power centers.

They become judges—without accountability.

This lawsuit isn’t explosive because it involves Trump.

It’s explosive because it asks a question the system doesn’t want answered:

Who really controls access to money?

If money becomes permission-based, it becomes political.

And once that happens, neutrality dies, trust fractures, and freedom quietly shrinks.

Today it’s Trump.

Tomorrow it could be any business, any movement, any individual that steps out of line.

This isn’t just a legal fight.

It’s a battle over the future of finance—and who holds the keys. 🔥💰#TrumpCancelsEUTariffThreat

#StrategyBTCPurchase #MarketRebound