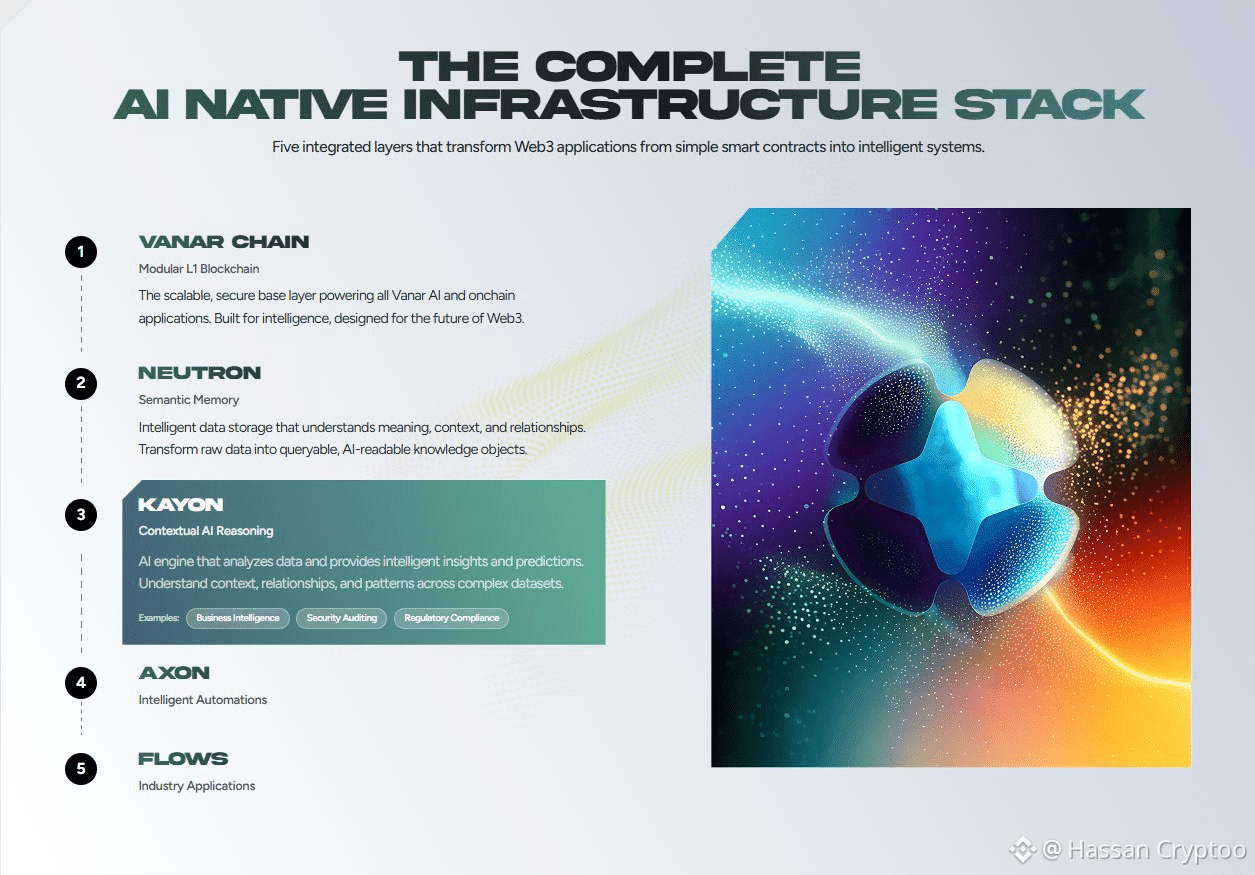

Much of the current conversation around AI and blockchain revolves around grand narratives of Autonomous Agents and Decentralized Superintelligence. This vision often stumbles on a simple, practical reality, today's blockchains are not built for the granular, continuous, and explainable operations AI requires. They are ledgers for finality, not frameworks for process. My review of $VANRY | Vanar's technical approach suggests a shift in focus. Instead of asking how to attach AI to a chain, Vanar's products, Kayon and Flows, demonstrate what it looks like to build chain infrastructure where AI is a native, operational layer. This is not about hosting AI models, it is about creating a blockchain that can reason and act autonomously.

Vanar Chain positions itself as an L1 designed for mainstream adoption, with verticals in gaming, entertainment, and AI. The key differentiator I see is its "AI first" mentality, which the team articulates as moving beyond AI as a feature. This philosophy is crystallized in live products. Take Kayon, which their ecosystem page highlights as an "On chain Reasoning Engine". In a landscape obsessed with inference speed, Kayon addresses a more fundamental, and often overlooked, problem for on chain AI, explainability. When an AI model makes a decision or generates content on chain, how can a user or a smart contract audit the logical steps it took. Kayon's architecture, as implied by its function, seems to provide a verifiable trail of the AI's "thought" process. This transforms AI from a black box oracle into a transparent participant. It is a foundational primitive. Without it, trust in autonomous on chain actions remains brittle, limited to simple, pre defined triggers. Kayon makes complex, logic based AI decisions auditable, which is non negotiable for enterprise or regulated use cases.

This capability connects directly to Flows. If Kayon handles the "why" Flows handles the "how" and "then" Described by the project as a platform for "safe, automated execution" Flows appears to be the workflow layer. Think of it as the connective tissue that allows an auditable decision from Kayon to automatically initiate a series of on chain or off chain actions. A user could, for example, set up a Flow where an AI agent monitored a marketplace, identified a specific asset trait via Kayon's reasoning, and then automatically executed a purchase, all within a secured, pre defined parameters. This moves beyond speculative trading bots. The practical applications are in dynamic NFTs, responsive game economies, or automated compliance checks where the logic and the outcome are both transparent and trustless. It turns static smart contracts into dynamic, intelligent workflows.

The technical promise of these tools is underscored by their integration within a broader, product driven ecosystem. Vanar is not just a chain with developer tools, it houses end user applications like the Virtua Metaverse and the VGN games network. These provide immediate, real world testing grounds. An AI driven character in a Virtua experience could use Kayon for in world decision making that players can verify, with Flows managing its subsequent interactions with items or other players. This creates a closed loop of utility for the VANRY token. Token utility is not speculative, it is fueled by the computational resources, transactions, and governance actions generated by these functioning products. The token powers the infrastructure that makes the applications run.

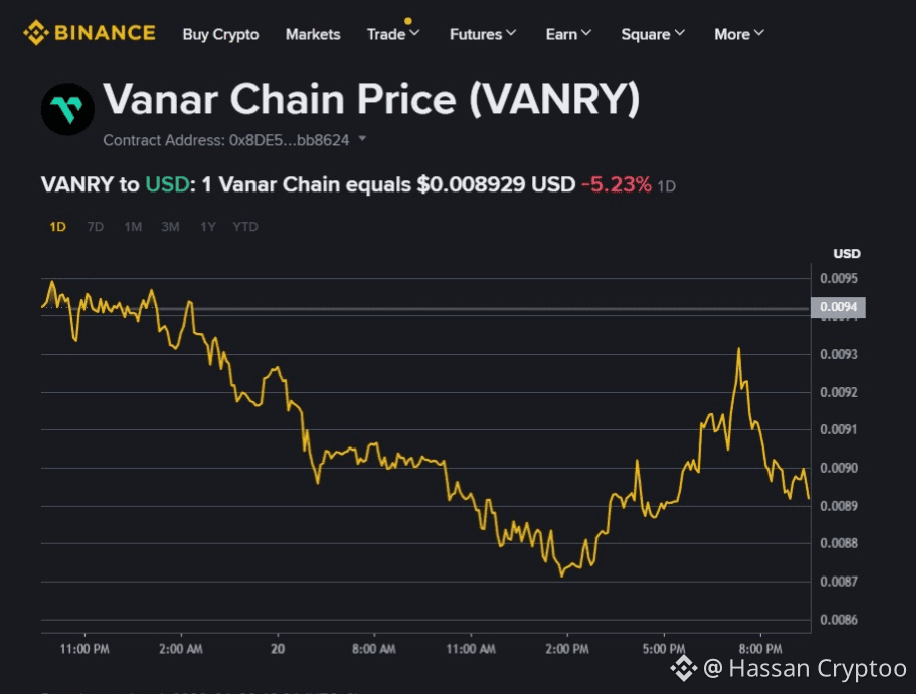

A look at the VANRY token's provides me insight into its ecosystem's momentum. Currently trading at $0.0084 on Binance Spot, its marketcap stands near to $18.8 million. The daily trading volume shows consistent liquidity, absent the wild volatility common to hype-driven coins. On Binance, the chart creates a consolidation pattern in weekly time frame, recently it was highly volatile as well. It is trading below its all time high, which is not uncommon for projects building through a bear market phase. What stands out to me is the correlation, or current lack of a strong one, with broad AI token hype. This relative stability might reflect the market's slower digestion of infrastructure level value versus application level hype. The token's value proposition is tied to the sustained usage of Vanar's suite, a compound effect that differs from the spike and fade cycles of narrative coins.

This brings us to the core of Vanar's proposition with Kayon and Flows. The real competition for these products is not other L1s, it is the inertia of tradition and the inadequacy of retrofitted solutions. Most chains approach AI by trying to be a good host for models, offering high TPS or cheap storage. Vanar's products suggest a belief that AI needs a different home environment entirely, one with native memory for context, a reasoning engine for audit trails, and an automation hub for action. This is a bet on a future where the most valuable on chain activity is not just value transfer, but intelligent, verifiable process execution. For developers and enterprises looking at blockchain for more than Finance, this shift from a settlement only layer to an operational intelligence layer is the pivotal change. Kayon and Flows are early, concrete steps in that direction, making the vision of a practical, usable on chain AI environment less theoretical. Their continued development and adoption will be a tangible measure of whether an AI native blockchain can carve out a necessary and durable niche.

by Hassan Cryptoo

@Vanarchain | #vanar | $VANRY