Plasma (XPL) Explained — An Educational Overview (Early 2026)

In blockchain discussions, the name “Plasma” often causes confusion. Originally, Plasma was a theoretical Ethereum Layer 2 framework proposed in 2017, designed to improve scalability. That early idea struggled with security and usability issues and was largely abandoned.

Modern Plasma (ticker: XPL) is not a revival of that old design. It is a new, independent blockchain that has launched its own mainnet and is purpose-built for one specific use case: stablecoin payments.

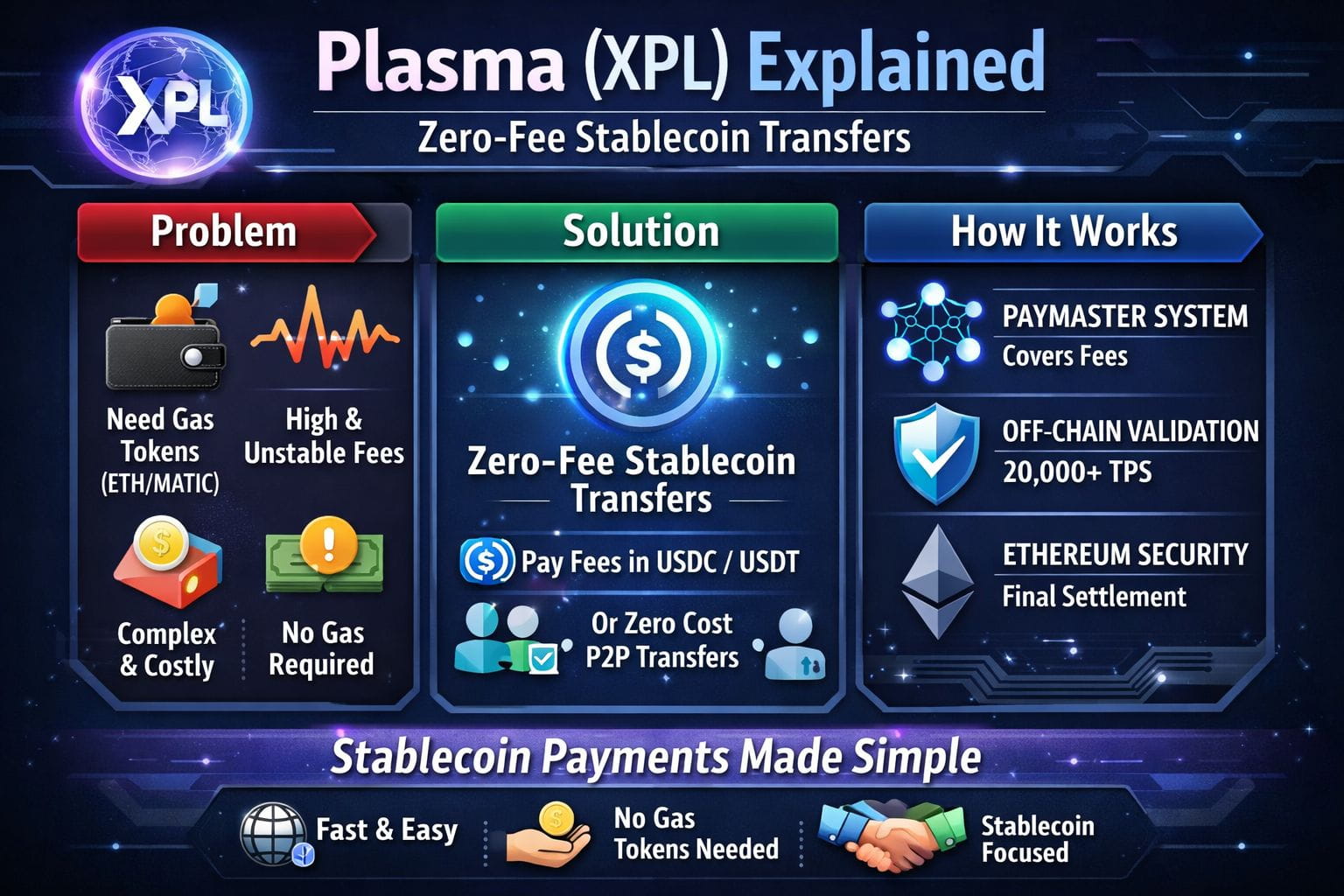

1. The Core Problem: Stablecoin Friction

Even on advanced blockchains today, stablecoins face practical obstacles:

Users must hold a separate gas token (ETH, MATIC, etc.)

Fees fluctuate, making small payments inefficient

User experience is confusing for non-crypto users

This friction limits stablecoins’ real-world adoption, especially for remittances, salaries, and everyday payments.

2. Plasma’s Solution: A Zero-Fee Stablecoin Rail

Plasma addresses this problem directly by redesigning how transaction fees work.

Plasma allows users to pay fees in the same stablecoin they are sending

In many peer-to-peer transfers, fees are eliminated entirely

Users can operate without holding any native gas token

This is enabled through a Paymaster mechanism, inspired by Ethereum’s account abstraction model. The result is a system where stablecoins behave like digital cash, not like complex crypto assets.

3. How Plasma Differs from Rollups

To understand Plasma, it is important to compare it with standard Ethereum rollups such as Optimism or Arbitrum.

a) Consensus: PlasmaBFT

Plasma uses a custom consensus system called PlasmaBFT, inspired by Fast HotStuff, a Byzantine Fault Tolerant protocol.

Transactions finalize in under one second

Designed for high throughput and low latency

Ideal for payment use cases where speed matters

Rollups, by contrast, rely on Ethereum Layer 1 for ordering or assume transactions are valid unless challenged, which introduces delays.

b) Data Availability Model

Plasma takes a different approach to data storage:

Most transaction data is kept off-chain

Ethereum Layer 1 only stores compressed state roots and proofs

This design enables:

20,000+ transactions per second

Extremely low operational costs

However, it also means Plasma sacrifices some composability and transparency compared to rollups that post full data on-chain.

4. Plasma Nova and zk-Proofs

Early Plasma designs suffered from the Mass Exit Problem, where users had to withdraw funds simultaneously if the operator became malicious.

Modern Plasma (often referred to as Plasma Nova) addresses this with:

Zero-knowledge proofs

Cryptographic verification of state correctness

Strong protection against operator fraud

While Plasma is not as trust-minimized as Ethereum Layer 1, it is significantly more secure than traditional sidechains.

5. EVM Compatibility and Execution Layer

Plasma is fully EVM-compatible, using the Reth execution engine.

This means:

Ethereum smart contracts can be deployed with minimal or no changes

Developers do not need to learn a new programming model

Existing tooling works out of the box

This lowers the barrier for adoption and development.

6. Real-World Progress (2025–2026)

Key milestones show Plasma’s practical focus:

Mainnet Beta launched: September 25, 2025

Optimism bridge: Enables asset movement in under 2 seconds

Institutional partnerships:

BiLira (Turkey)

Yellow Card (Africa)

These partnerships highlight Plasma’s role in cross-border payments and inflation-resistant finance, rather than speculative DeFi.

7. Strengths and Weaknesses (Balanced Analysis)

Strengths

Extremely low-cost stablecoin transfers

Excellent user experience for non-crypto users

Anchored to Ethereum for final settlement and security

Weaknesses

Limited DeFi composability

Requires monitoring (watchers) to ensure operator honesty

Smaller validator set raises centralization concerns

8. Conclusion

Plasma (XPL) should not be viewed as a competitor to Ethereum or rollups.

Instead, it is best understood as:

> A specialized, high-speed payment rail within the Ethereum ecosystem

If rollups are general-purpose platforms, Plasma is a dedicated financial highway optimized for stablecoins.

From an educational perspective, Plasma demonstrates a key lesson in blockchain design:

Specialization, not universality, is often the key to real-world adoption.

That principle is at the core of Plasma’s architecture and long-term vision.

#GrayscaleBNBETFFiling #USIranMarketImpact #ETHMarketWatch #modifiedAi