There has always been a quiet middle state in blockchain transactions.

Not confirmed.

Not failed.

Just… pending.

For years, that state shaped how people interacted with crypto. You would send a transaction, then wait. Refresh a page. Keep a block explorer open longer than necessary. Hesitate before taking the next step because something might still go wrong.

That uncertainty wasn’t just technical. It became behavioral.

Plasma leaves very little room for it.

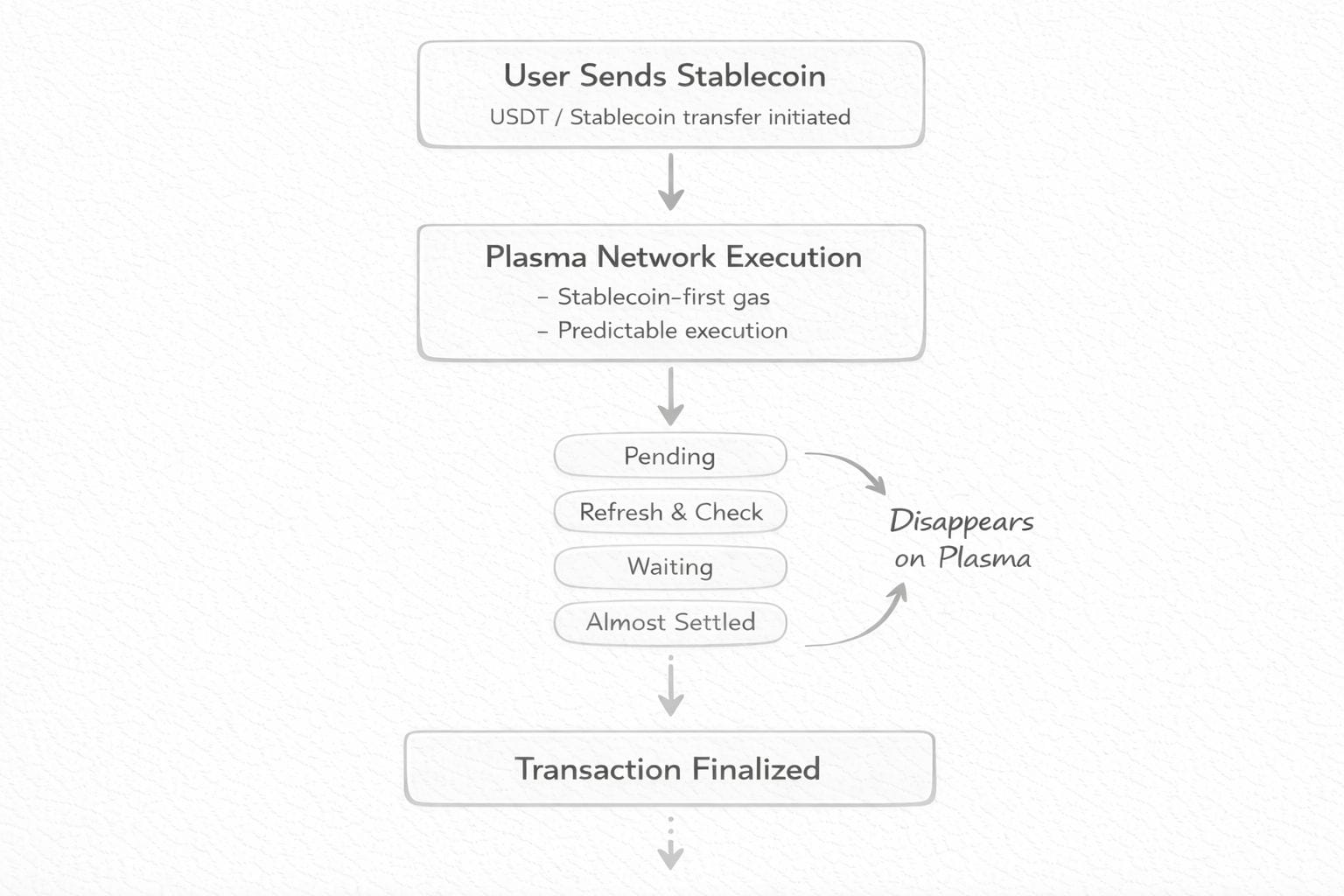

When a stablecoin transfer runs through the Plasma network, it doesn’t hover in limbo for long. Settlement happens quickly enough that the familiar “almost settled” phase barely exists. The transaction resolves, the ledger updates, and the system moves on.

At first, that feels like speed. Over time, it feels like a different relationship with the chain itself.

How Plasma Compresses Uncertainty

Plasma was designed with stablecoin settlement as a first-class concern, not an afterthought. That decision shows up everywhere in how the network behaves.

Sub-second finality under PlasmaBFT means transactions don’t sit around waiting for probabilistic confirmation. Gas abstraction and stablecoin-denominated fees mean users aren’t juggling multiple assets just to move one. The execution layer is optimized around predictable outcomes rather than variable delays.

Together, these choices collapse the gray zone that most chains leave behind.

On Plasma, there is far less time to wonder whether a transaction is “probably fine.” The network resolves that question quickly. The ledger settles. Any ambiguity that remains exists outside the chain.

That changes how people act.

The Hidden Role of “Pending” in Crypto Workflows

Pending states do more than signal technical progress. They buy time.

On slower or noisier networks, that time becomes part of the workflow. Businesses delay fulfillment. Operators wait before releasing funds. Users postpone closing wallets. Support teams are trained to tell customers to “give it a few more minutes.”

Over time, entire processes form around that uncertainty.

Plasma quietly removes the conditions that make those processes necessary.

When settlement is deterministic and fast, there’s less incentive to hover. Less reason to batch actions. Less value in waiting “just in case.” The network doesn’t reward hesitation, but it doesn’t punish it either. It simply doesn’t absorb it.

That distinction matters.

Speed Is Not the Point Predictability Is

It’s easy to frame Plasma as a fast chain. That’s accurate, but incomplete.

What actually changes user behavior is predictability.

On Plasma, stablecoin transfers behave the same way repeatedly. Fees don’t spike unexpectedly for basic usage. Confirmation times don’t stretch without warning. Finality arrives when expected.

That consistency reduces cognitive overhead.

People stop treating transactions as fragile events that need supervision. They don’t schedule their attention around confirmations. They don’t mentally keep actions “open” while waiting for closure.

Money starts behaving like money, not like a process.

Stablecoins That Feel Ordinary Again

Stablecoins are meant to be boring. In practice, moving them on most blockchains still feels technical. You need gas. You need to understand fee dynamics. You need to worry about timing.

Plasma removes much of that friction by design.

Gasless stablecoin transfers and stablecoin-first fee mechanisms mean users don’t have to think about native tokens just to move value. The transaction experience becomes simpler, closer to what people expect when sending money.

That ordinariness is important.

Real-world usage depends less on innovation and more on reliability. People don’t want to feel clever every time they pay or transfer funds. They want it to work, quietly and consistently.

Plasma’s focus on stablecoins makes that possible without layering complexity on top.

Behavioral Shifts That Don’t Show Up in Metrics

No dashboard captures how much time people spend hovering over block explorers. No metric measures how often teams delay actions because a transaction is still pending.

But those behaviors are real.

As Plasma removes uncertainty, those habits start to fade. Users check less. Teams wait less. Decisions move earlier in the process.

Documentation gets written before execution instead of after. Approval flows shift forward. Checks happen upstream rather than downstream.

This isn’t because Plasma enforces discipline.

It’s because Plasma doesn’t accommodate indecision.

The chain resolves state quickly and cleanly. Anything unresolved belongs to the human side of the system.

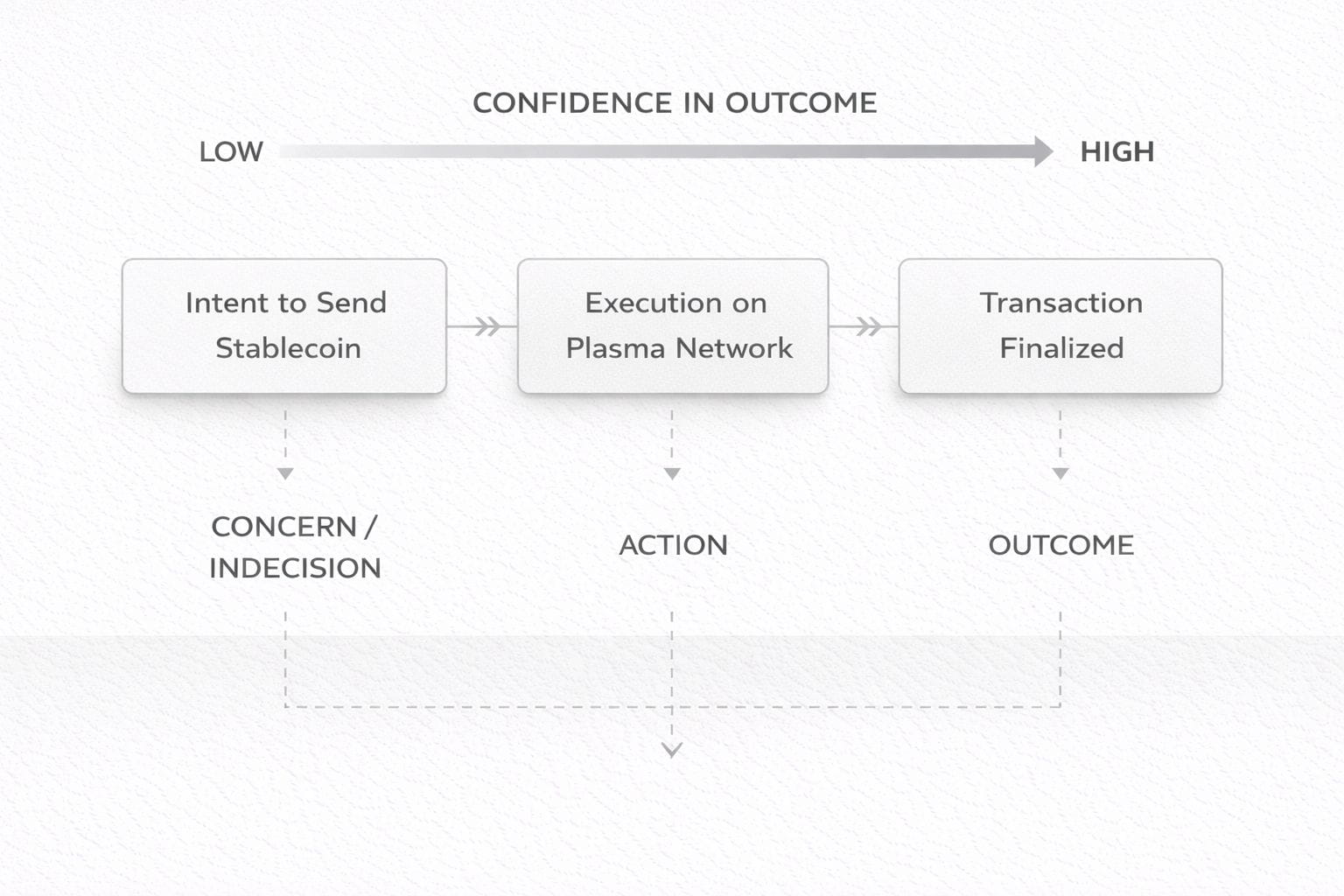

When Intent and Outcome Move Closer Together

One consequence of fast, predictable settlement is that intent and outcome sit closer together.

On slower systems, mistakes can hide in delay. There’s time to reinterpret what was meant to happen. On Plasma, that buffer is smaller. By the time a question is raised, the transaction may already be final.

That doesn’t make the network unforgiving. It makes it honest.

Responsibility sharpens when outcomes arrive quickly. Actions feel heavier not because they’re riskier, but because they resolve faster than explanations do.

Plasma doesn’t force better decisions.

It simply makes unclear ones harder to postpone.

Infrastructure That Refuses to Be the Center of Attention

One of Plasma’s more understated qualities is that it doesn’t demand to be noticed.

It doesn’t constantly remind users of its architecture. It doesn’t require them to manage complexity just to participate. It doesn’t interrupt workflows with unnecessary steps.

In many blockchain ecosystems, the chain becomes the focus. Users adapt their behavior to it. Plasma flips that relationship. The network adapts to how people already expect money to behave.

That design philosophy is visible in everything from fee handling to finality to execution predictability.

Instead of adding features, Plasma removes friction. Instead of chasing spectacle, it prioritizes reliability.

These choices don’t generate hype cycles. They generate trust through repetition.

The Risk of Quiet Infrastructure

There is a trade-off to this approach.

Infrastructure that “just works” doesn’t always attract attention. It doesn’t create dramatic narratives. It doesn’t produce viral moments.

But for payments and settlement, the absence of drama is often the goal.

Plasma’s success won’t be measured by how loud its community becomes or how flashy its features look. It will be measured by whether people continue to move real stablecoin value through the network simply because it’s easier to do so.

That’s a slower test. A quieter one.

When “Almost Settled” Is Gone

Over time, the most noticeable thing about Plasma may be what users stop noticing.

No more hovering over explorers.

No more waiting “just in case.”

No more mental notes to check back later.

The transaction finishes.

The ledger settles.

The user moves on.

That’s not a revolutionary promise. It’s a practical one.

Plasma doesn’t try to redefine what money is. It doesn’t ask users to change their behavior dramatically. It simply removes the uncertainty that made everyday actions feel fragile.

And when “almost settled” disappears, what remains is something crypto has struggled to deliver consistently:

A network where stablecoin settlement feels finished when it happens not minutes or blocks later.

In that sense, Plasma isn’t about doing more.

It’s about getting out of the way.